Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need 100 % old was Correct This is Finance Question RTP O Present Value of Benefit / Conclusion: Hence, Proposal 3 may be accepted, i.e.

Need 100 % old was Correct

Need 100 % old was Correct

This is Finance Question

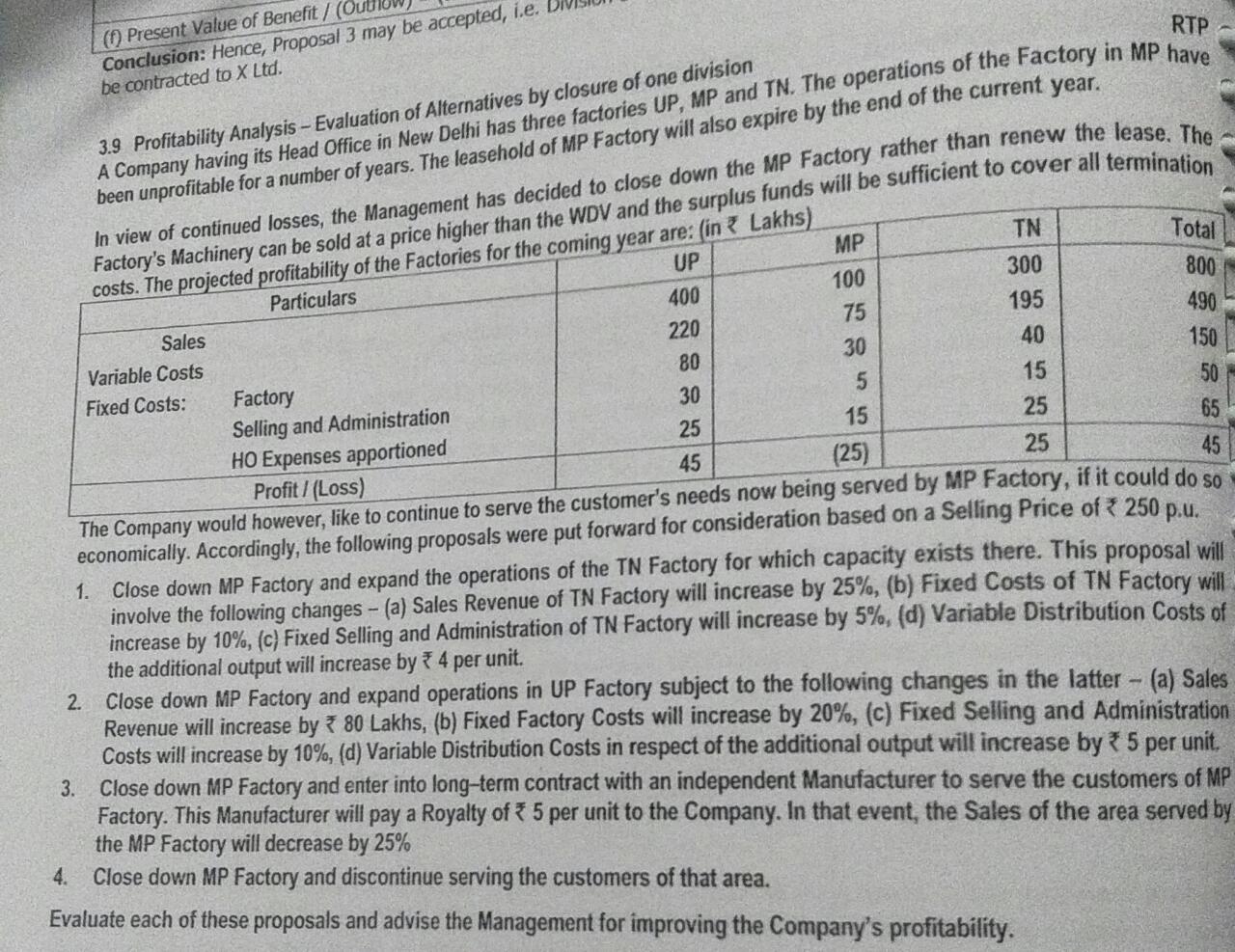

RTP O Present Value of Benefit / Conclusion: Hence, Proposal 3 may be accepted, i.e. be contracted to X Ltd. A Company having its Head Office in New Delhi has three factories UP, MP and TN. The operations of the Factory in MP have 3.9 Profitability Analysis - Evaluation of Alternatives by closure of one division been unprofitable for a number of years. The leasehold of MP Factory will also expire by the end of the current year. costs. The projected profitability of the Factories for the coming year are: (in Lakhs) Factory's Machinery can be sold at a price higher than the WDV and the surplus funds will be sufficient to cover all termination Total 800 490 150 Particulars 40 Sales Variable Costs Fixed Costs: TN MP UP 100 300 400 75 195 220 30 80 Factory 5 15 30 50 Selling and Administration 25 15 25 65 HO Expenses apportioned 25 45 (25) 45 Profit / (Loss) The Company would however, like to continue to serve the customer's needs now being served by MP Factory, if it could do so economically . Accordingly, the following proposals were put forward for consideration based on a Selling Price of 3 250 p.u. Close down MP Factory and expand the operations of the TN Factory for which capacity exists there. This proposal will involve the following changes - (a) Sales Revenue of TN Factory will increase by 25%, (b) Fixed Costs of TN Factory will increase by 10%, (c) Fixed Selling and Administration of TN Factory will increase by 5%, (d) Variable Distribution Costs of the additional output will increase by * 4 per unit. 2. Close down MP Factory and expand operations in UP Factory subject to the following changes in the latter - (a) Sales Revenue will increase by 80 Lakhs, (b) Fixed Factory Costs will increase by 20%, (c) Fixed Selling and Administration Costs will increase by 10%, (d) Variable Distribution Costs in respect of the additional output will increase by 5 per unit. 3. Close down MP Factory and enter into long-term contract with an independent Manufacturer to serve the customers of MP Factory. This Manufacturer will pay a Royalty of 5 per unit to the Company. In that event, the Sales of the area served by the MP Factory will decrease by 25% 4. Close down MP Factory and discontinue serving the customers of that area. 1. Evaluate each of these proposals and advise the Management for improving the Company's profitabilityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started