Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need 58b and 59 answered 55 A info: 55 b info: 58 a info: spreadsheet: unlevered proforma spreadsheed: levered proforma $161,851/ 7.9%-$2,048,745 Assume (a) an

need 58b and 59 answered

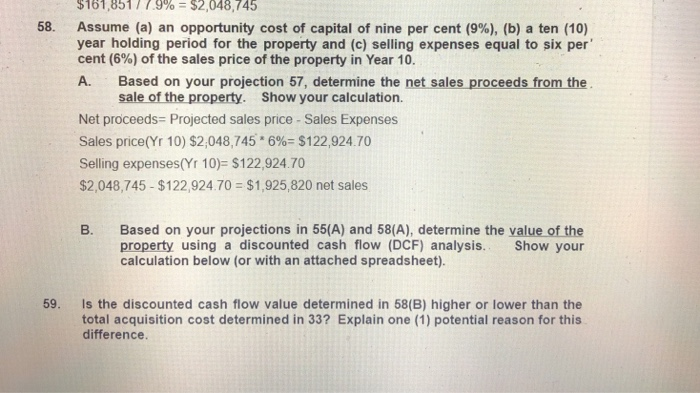

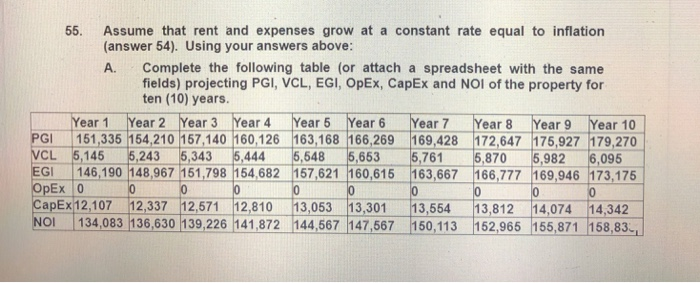

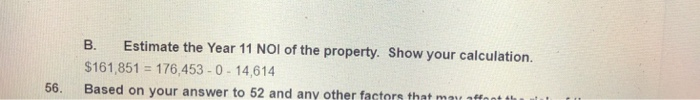

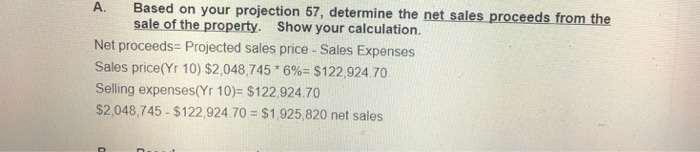

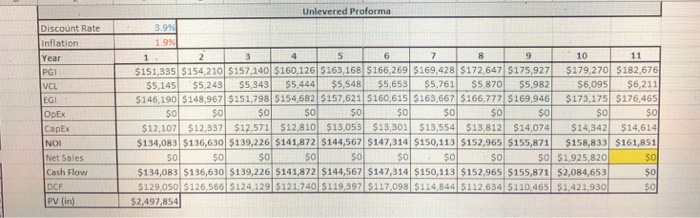

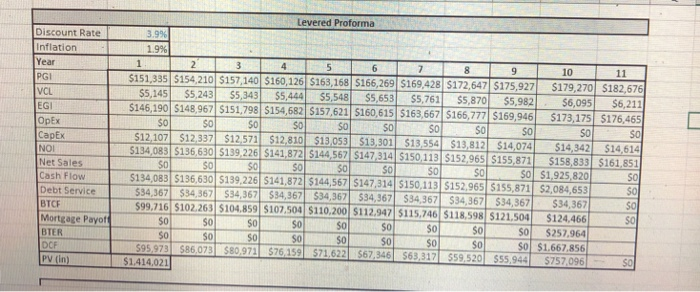

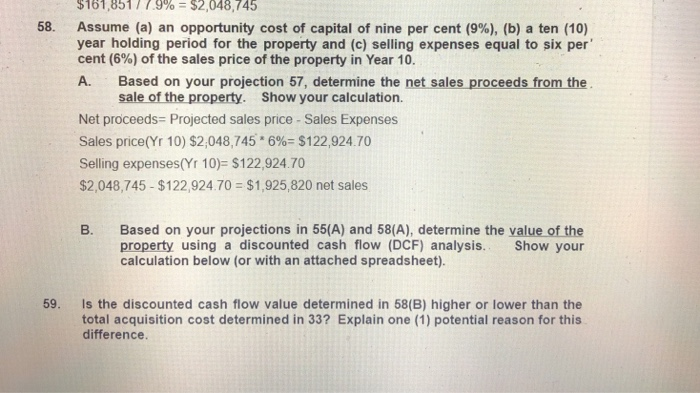

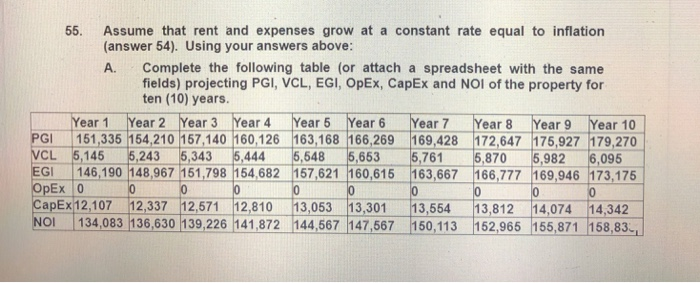

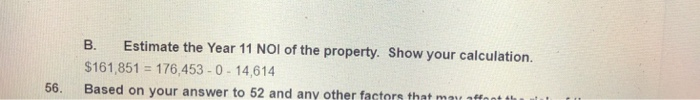

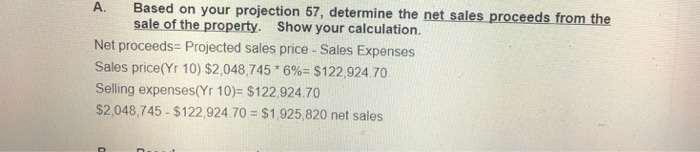

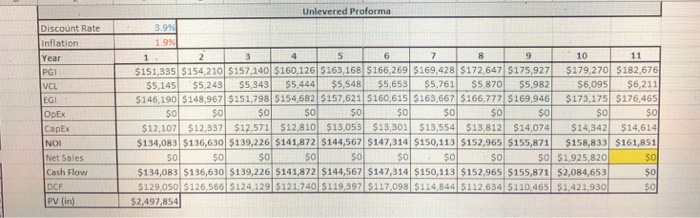

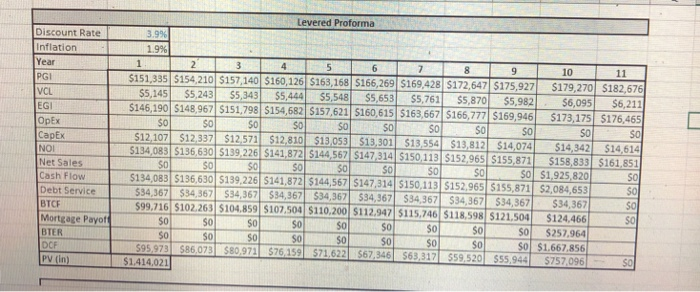

$161,851/ 7.9%-$2,048,745 Assume (a) an opportunity cost of capital of nine per cent (9%), (b) a ten (10) year holding period for the property and (c) selling expenses equal to six per cent (6%) of the sales price of the property in Year 10. A. Based on your projection 57, determine the net sales proceeds from the 58. sale of the property. Show your calculation. Net proceeds Projected sales price- Sales Expenses Sales price(Yr 10) $2,048, 745-6%-$122,924 70 Selling expenses(Yr 10)- $122,924.70 $2,048,745-$122,924.70 $1,925,820 net sales B. Based on your projections in 55(A) and 58(A), determine the value of the property using a discounted cash flow (DCF) analysis. calculation below (or with an attached spreadsheet). Show your 59. Is the discounted cash flow value determined in 58(B) higher or lower than the total acquisition cost determined in 33? Explain one (1) potential reason for this difference 55. Assume that rent and expenses grow at a constant rate equal to inflation (answer 54). Using your answers above: Complete the following table (or attach a spreadsheet with the same fields) projecting PGI, VCL, EGI, OpEx, CapEx and NOI of the property for ten (10) years. A. ear 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 9 Year 7 Year 8 Year 10 GI 151,335 154,210 157 140 160,126 163,168 166,269 169,428 172,647 175,927 179,270 CL 5 14516,243 5343 5,44416,64816,653 5,761.-16,870-16,982. 6,095 GI 146,190 148,967 151,798 154682 157,621 160,615 163,667 166,777 169,946 173,175 Ex 0 apEx 12107 12337 12,671 12,810 13,053 13,301 13,55 13,812 14,074 14,342 O 134,083 136,630 139,226 141,872 144,567 147,567 150,113 152,965 155,871 158,83-1 B. Estimate the Year 11 NOI of the property. Show your calculation. $161,851 176,453-0- 14,614 Based on your answer to 52 and any other factors that mat ffnnt tl 56. A. Based on your projection 57, determine the net sales proceeds from the sale of the property. Show your calculation. Net proceeds Projected sales price - Sales Expenses Sales price(Yr 1 0) $2,048,745 * 6%:S 1 22,924 70 Selling expenses(Yr 10)= $122924.70 $2,048,745 $122,924.70 $1,925,820 net sales Unlevered Proforma Discount Rate 1.9% 10 ear PGI VCL $151335| $154,210| $157,140|S160.126|S163.168S166.2 69|S169.428|S172647|S17592 S17a270.-S182616 S5,145 $5,243 $5,343 $5,444 $5,548 $5,653 $5,761 $5,870 $5,982 $6,095 $6,211 $146,190 $148,967 $151,798 $154,682 $157,621 $160,615 $163,667 $166,777 $169,946 $173,175 $176,465 oo o $o $12,107 $12,337 $12.571 $12,810 $13,053 $13,301 $13,554 $13,812 $14,074 $14,342 $14,614 $134,083| $136,630| $139,226|$141,872|$144,567| $147,3 14|S150,113|S152,965|S155,8 71| $158,8 3 3|S161.851 s0 s0 s0 $o $0 OpEx CapEx s0 $0 50 $O $1,925,820 Net Sales Cash Flow DCF PV 134,083 $136,630 $139,226 $141,872 $144,567 $147,314 $150,113 $152,965 $155,871 $2,084,653$o $126,566 5124,1 2,634 $110,465 $1.421,9 $2,497,854 Levered Proforma Discount Rate Inflation Year 19% 10 151.335 154 210 5157,140 $160,126 5163,168 5166,269 $169 428 5172,647 $175,927 $146190 $48 $179,270 S182,676 5,761 55,870 5,98256,095 $6,211 967 $151,798 5154.582 157,621 5160 615 5163 667 $166,777 $169 946 $173,175 $176,465 PGI $5,243 $5,343 $5,444 $5,548 $5,653 $5,76 $5,870 $5,982 EGI OpEx CapEx NOI Net Sales Cash Flow 50 S0 S0 so So S0 S0 $12571 $12,810 $13 053 513,501 $13,554 $13,812 $14,074 $14342 $14,614 136 630 $139,226 s141,872 si 4,567 $17,314 sis 113 si 2.965 $155 871 SS8,833 sio,si SD S0 s0 147,314 $150,113 $152,965 $155,871 $2,084,653 $34,367 $34,367 $34,36734,367 $34,367 534,367 $34.367 $34,367 $34,367 $34,367 99.716 $102.263 5104.859 107 504 5110,200 $112.947 5115,740 5118598 121 504 $124.466 O $257,964 O $1.667.856 567 5 $134,083 S136,6 Debt Service BTCF Mortgage Payof SO S0 $0 s0 50 S0 S0 BTER S0 S0 595973 86.073 80.97 $76159 $71.622 567.346 563,317 $59.520 $55.944 $757.096 $1,414,021 $161,851/ 7.9%-$2,048,745 Assume (a) an opportunity cost of capital of nine per cent (9%), (b) a ten (10) year holding period for the property and (c) selling expenses equal to six per cent (6%) of the sales price of the property in Year 10. A. Based on your projection 57, determine the net sales proceeds from the 58. sale of the property. Show your calculation. Net proceeds Projected sales price- Sales Expenses Sales price(Yr 10) $2,048, 745-6%-$122,924 70 Selling expenses(Yr 10)- $122,924.70 $2,048,745-$122,924.70 $1,925,820 net sales B. Based on your projections in 55(A) and 58(A), determine the value of the property using a discounted cash flow (DCF) analysis. calculation below (or with an attached spreadsheet). Show your 59. Is the discounted cash flow value determined in 58(B) higher or lower than the total acquisition cost determined in 33? Explain one (1) potential reason for this difference 55. Assume that rent and expenses grow at a constant rate equal to inflation (answer 54). Using your answers above: Complete the following table (or attach a spreadsheet with the same fields) projecting PGI, VCL, EGI, OpEx, CapEx and NOI of the property for ten (10) years. A. ear 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 9 Year 7 Year 8 Year 10 GI 151,335 154,210 157 140 160,126 163,168 166,269 169,428 172,647 175,927 179,270 CL 5 14516,243 5343 5,44416,64816,653 5,761.-16,870-16,982. 6,095 GI 146,190 148,967 151,798 154682 157,621 160,615 163,667 166,777 169,946 173,175 Ex 0 apEx 12107 12337 12,671 12,810 13,053 13,301 13,55 13,812 14,074 14,342 O 134,083 136,630 139,226 141,872 144,567 147,567 150,113 152,965 155,871 158,83-1 B. Estimate the Year 11 NOI of the property. Show your calculation. $161,851 176,453-0- 14,614 Based on your answer to 52 and any other factors that mat ffnnt tl 56. A. Based on your projection 57, determine the net sales proceeds from the sale of the property. Show your calculation. Net proceeds Projected sales price - Sales Expenses Sales price(Yr 1 0) $2,048,745 * 6%:S 1 22,924 70 Selling expenses(Yr 10)= $122924.70 $2,048,745 $122,924.70 $1,925,820 net sales Unlevered Proforma Discount Rate 1.9% 10 ear PGI VCL $151335| $154,210| $157,140|S160.126|S163.168S166.2 69|S169.428|S172647|S17592 S17a270.-S182616 S5,145 $5,243 $5,343 $5,444 $5,548 $5,653 $5,761 $5,870 $5,982 $6,095 $6,211 $146,190 $148,967 $151,798 $154,682 $157,621 $160,615 $163,667 $166,777 $169,946 $173,175 $176,465 oo o $o $12,107 $12,337 $12.571 $12,810 $13,053 $13,301 $13,554 $13,812 $14,074 $14,342 $14,614 $134,083| $136,630| $139,226|$141,872|$144,567| $147,3 14|S150,113|S152,965|S155,8 71| $158,8 3 3|S161.851 s0 s0 s0 $o $0 OpEx CapEx s0 $0 50 $O $1,925,820 Net Sales Cash Flow DCF PV 134,083 $136,630 $139,226 $141,872 $144,567 $147,314 $150,113 $152,965 $155,871 $2,084,653$o $126,566 5124,1 2,634 $110,465 $1.421,9 $2,497,854 Levered Proforma Discount Rate Inflation Year 19% 10 151.335 154 210 5157,140 $160,126 5163,168 5166,269 $169 428 5172,647 $175,927 $146190 $48 $179,270 S182,676 5,761 55,870 5,98256,095 $6,211 967 $151,798 5154.582 157,621 5160 615 5163 667 $166,777 $169 946 $173,175 $176,465 PGI $5,243 $5,343 $5,444 $5,548 $5,653 $5,76 $5,870 $5,982 EGI OpEx CapEx NOI Net Sales Cash Flow 50 S0 S0 so So S0 S0 $12571 $12,810 $13 053 513,501 $13,554 $13,812 $14,074 $14342 $14,614 136 630 $139,226 s141,872 si 4,567 $17,314 sis 113 si 2.965 $155 871 SS8,833 sio,si SD S0 s0 147,314 $150,113 $152,965 $155,871 $2,084,653 $34,367 $34,367 $34,36734,367 $34,367 534,367 $34.367 $34,367 $34,367 $34,367 99.716 $102.263 5104.859 107 504 5110,200 $112.947 5115,740 5118598 121 504 $124.466 O $257,964 O $1.667.856 567 5 $134,083 S136,6 Debt Service BTCF Mortgage Payof SO S0 $0 s0 50 S0 S0 BTER S0 S0 595973 86.073 80.97 $76159 $71.622 567.346 563,317 $59.520 $55.944 $757.096 $1,414,021

55 A info:

55 b info:

58 a info:

spreadsheet: unlevered proforma

spreadsheed: levered proforma

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started