Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need 7a-7d answered. Required Information Flexible Budgeting and Financial Statement Analysis in Tableau 9-1 (Static) [The following information applies to the questions displayed below.] Williams

need 7a-7d answered.

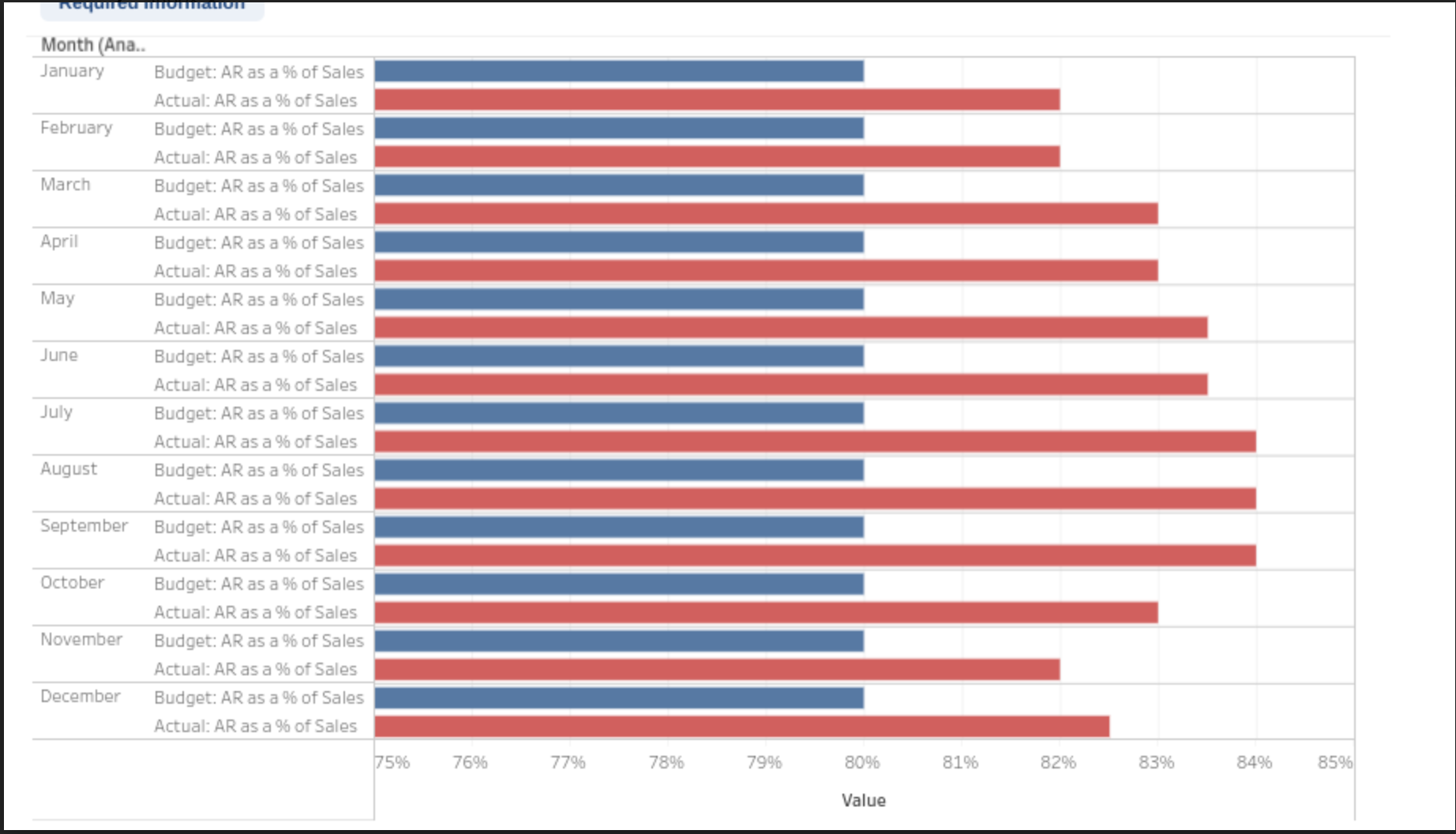

Required Information Flexible Budgeting and Financial Statement Analysis in Tableau 9-1 (Static) [The following information applies to the questions displayed below.] Williams Company is a merchandiser and its accounting department has finished preparing a flexible budget to better understand the differences between its actual results and the master budget. The chief financial officer (CFO) would like your assistance in interpreting some data visualizations that she will use to explain why the company's actual results differed from its master budget. Required: Review the Tableau dashboards that the CFO has given you and answer the questions that follow. Tableau Dashboard Activity 9-1 (Static) Part 7 Month (Ana.. (For each question you may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) 7a. Which of the following statements are true with respect to the Accounts Receivable Analysis visualization? ? The blue bars show the percentage of each molnth's sales that should be collected in the month of sale according the company's budgeting assumptions ? The Blue bars show each month's ending accounts receivable balance as a percent of current assets according to the flexibie budget. ? The red bars show each month's actual ending accounts receivable balance as a percent of current assets. The red bars show the percentage of each month's sales that were actually collected in the month of sale. 7b. Which of the following statements are true with respect to the Accounts Receivable Analysis visualization? Each month's actual accounts receivable as a percent of sales is less than the budgeted accounts receivable as a percent of sales. Each month's actual accounts receivable as a percent of sales is greater than the budgeted accounts receivable as a percent of sales. Some of the month's actual accounts receivable as a percent of sales are less than the budgeted accounts receivable as a pqrcent of sales, whereas in other months the opposite is true. Some of the month's actual accounts receivable as a percent of sales are greater than the budgeted accounts recelvable as a percent of sales, whereas in other months the opposite is true. 7c. Which of the following statements are true with respect to the Accounts Receivable Analysis visualization? The cash collections in each month that are related to that month's sales are always less than the expectations according to the budget. The cash collections in each month that are related to that month's sales are always greater than the expectations according to the budget. The budget suggests that 80% of each month's sales should be collected in the month of sale. The actual results indicate that more than 80% of each month's sales are being collected in the month of sale 7d. Which of the following insights are revealed by the Accounts Receivable Analysis visualization? The company's actual cash collection pattern is having an adverse effect on its operating cash flows: The company's actual cash collection pattern is having a positive effect on its operating cash flows. The company's actual cash collection pattern is having an adverse effect on its operating cash flows in most months, but a positive effect in a few months. The company's actual cash collection pattem is having an adverse effect on its operating cash flows in a few inonths, but a positive effect in most months. Required Information Flexible Budgeting and Financial Statement Analysis in Tableau 9-1 (Static) [The following information applies to the questions displayed below.] Williams Company is a merchandiser and its accounting department has finished preparing a flexible budget to better understand the differences between its actual results and the master budget. The chief financial officer (CFO) would like your assistance in interpreting some data visualizations that she will use to explain why the company's actual results differed from its master budget. Required: Review the Tableau dashboards that the CFO has given you and answer the questions that follow. Tableau Dashboard Activity 9-1 (Static) Part 7 Month (Ana.. (For each question you may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) 7a. Which of the following statements are true with respect to the Accounts Receivable Analysis visualization? ? The blue bars show the percentage of each molnth's sales that should be collected in the month of sale according the company's budgeting assumptions ? The Blue bars show each month's ending accounts receivable balance as a percent of current assets according to the flexibie budget. ? The red bars show each month's actual ending accounts receivable balance as a percent of current assets. The red bars show the percentage of each month's sales that were actually collected in the month of sale. 7b. Which of the following statements are true with respect to the Accounts Receivable Analysis visualization? Each month's actual accounts receivable as a percent of sales is less than the budgeted accounts receivable as a percent of sales. Each month's actual accounts receivable as a percent of sales is greater than the budgeted accounts receivable as a percent of sales. Some of the month's actual accounts receivable as a percent of sales are less than the budgeted accounts receivable as a pqrcent of sales, whereas in other months the opposite is true. Some of the month's actual accounts receivable as a percent of sales are greater than the budgeted accounts recelvable as a percent of sales, whereas in other months the opposite is true. 7c. Which of the following statements are true with respect to the Accounts Receivable Analysis visualization? The cash collections in each month that are related to that month's sales are always less than the expectations according to the budget. The cash collections in each month that are related to that month's sales are always greater than the expectations according to the budget. The budget suggests that 80% of each month's sales should be collected in the month of sale. The actual results indicate that more than 80% of each month's sales are being collected in the month of sale 7d. Which of the following insights are revealed by the Accounts Receivable Analysis visualization? The company's actual cash collection pattern is having an adverse effect on its operating cash flows: The company's actual cash collection pattern is having a positive effect on its operating cash flows. The company's actual cash collection pattern is having an adverse effect on its operating cash flows in most months, but a positive effect in a few months. The company's actual cash collection pattem is having an adverse effect on its operating cash flows in a few inonths, but a positive effect in most monthsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started