Answered step by step

Verified Expert Solution

Question

1 Approved Answer

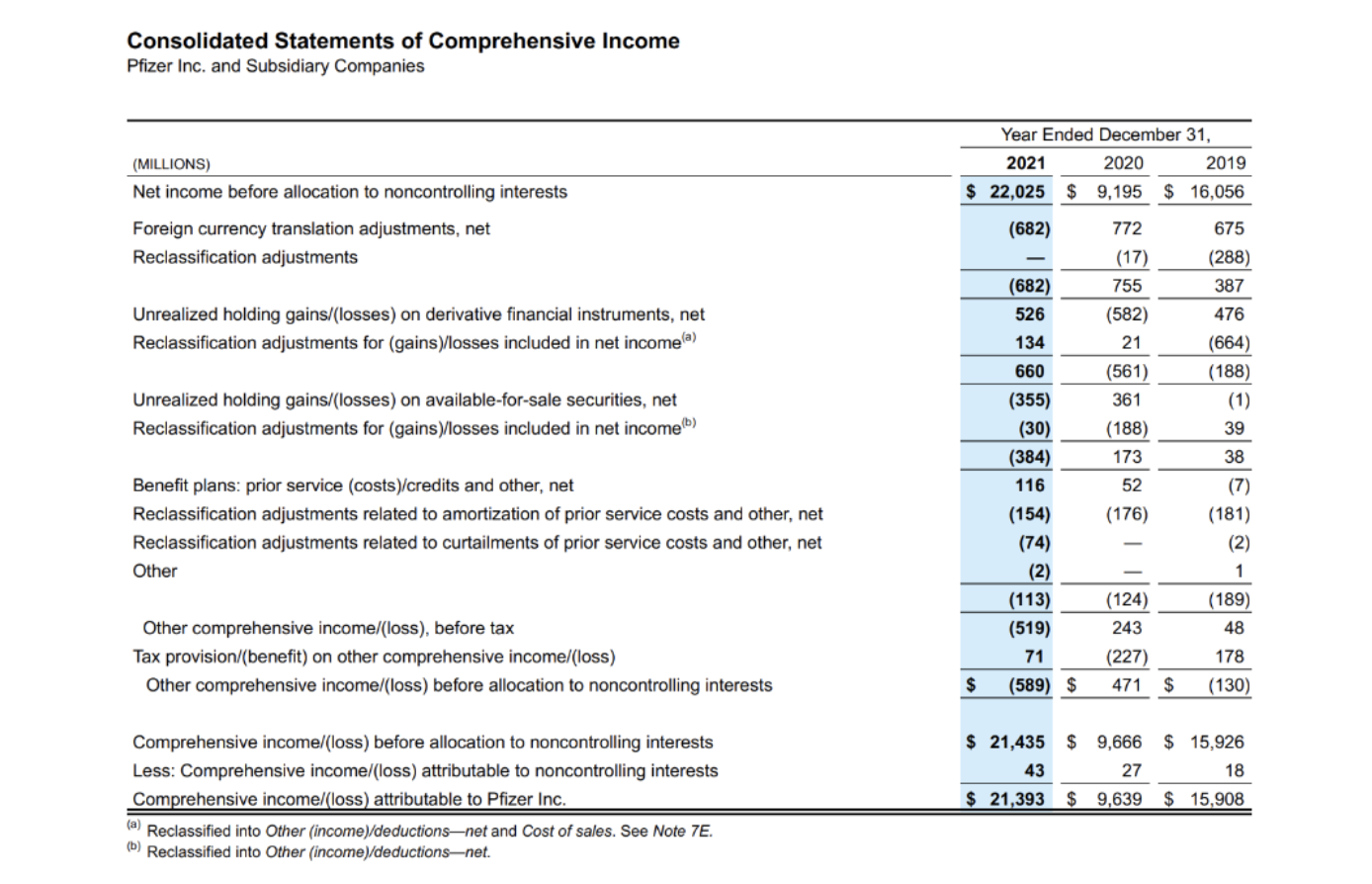

need a financial analysis statement for Plizer company. -consolidated statement of income -comprehensive income Consolidated Statements of Comprehensive Income Pfizer Inc. and Subsidiary Companies Year

need a financial analysis statement for Plizer company.

-consolidated statement of income

-comprehensive income

Consolidated Statements of Comprehensive Income Pfizer Inc. and Subsidiary Companies Year Ended December 31, 2021 2020 2019 $ 22,025 $ 9,195 $ 16,056 (MILLIONS) Net income before allocation to noncontrolling interests Foreign currency translation adjustments, net Reclassification adjustments (682) 772 675 (682) 526 Unrealized holding gains/(losses) on derivative financial instruments, net Reclassification adjustments for (gains)/losses included in net income) 134 (17) 755 (582) 21 (561) 361 (188) 173 52 (176) Unrealized holding gains/losses) on available-for-sale securities, net Reclassification adjustments for (gains)losses included in net income) (288) 387 476 (664) (188) (1) 39 38 (7) (181) (2) 660 (355) (30) (384) 116 (154) (74) (2) (113) (519) 71 (589) $ Benefit plans: prior service (costs)/credits and other, net Reclassification adjustments related to amortization of prior service costs and other, net Reclassification adjustments related to curtailments of prior service costs and other, net Other 1 (189) (124) 243 48 Other comprehensive income (loss), before tax Tax provision/(benefit) on other comprehensive income (loss) Other comprehensive income/(loss) before allocation to noncontrolling interests 178 (227) 471 $ $ (130) Comprehensive income/(loss) before allocation to noncontrolling interests Less: Comprehensive income (loss) attributable to noncontrolling interests Comprehensive income (loss) attributable to Pfizer Inc. Reclassified into Other (income)/deductionsnet and Cost of sales. See Note 7E. (b) Reclassified into Other (income)/deductions-net. $ 21,435 $ 9,666 $ 15,926 43 27 18 $ 21,393 $ 9,639 $ 15,908 (a)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started