Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need a great answer please Assignment 4 - Chapter 6 COM204 -Fall 2020 Question 1 Ivan Manufacturing purchased equipment and a delivery van on January

need a great answer please

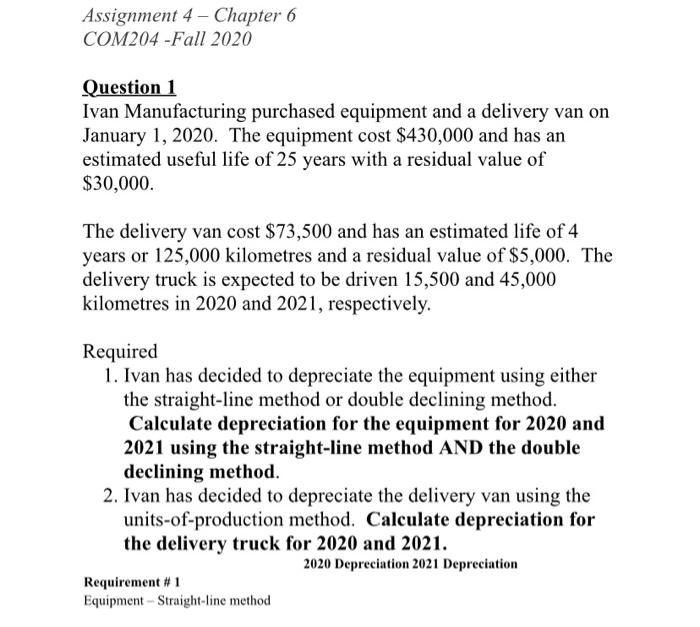

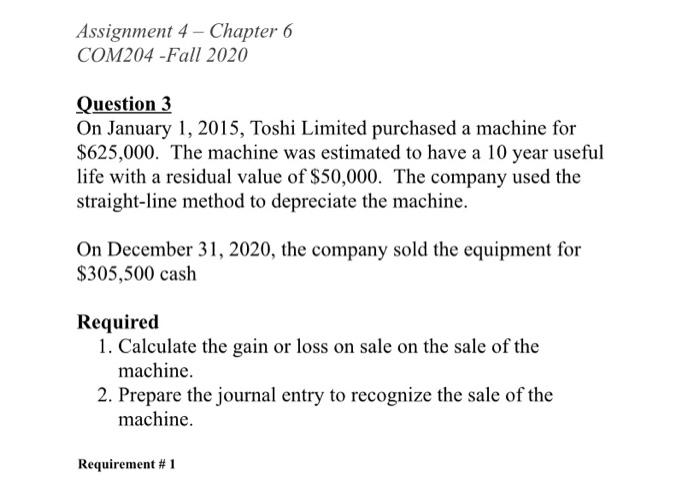

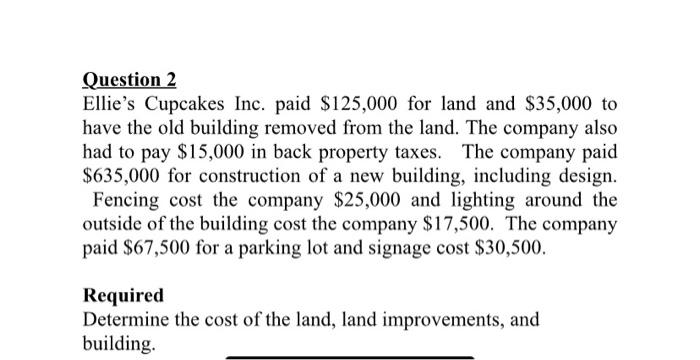

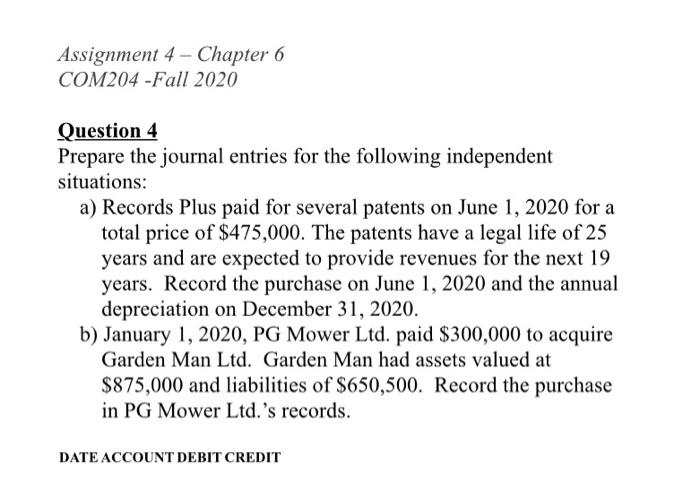

Assignment 4 - Chapter 6 COM204 -Fall 2020 Question 1 Ivan Manufacturing purchased equipment and a delivery van on January 1, 2020. The equipment cost $430,000 and has an estimated useful life of 25 years with a residual value of $30,000. The delivery van cost $73,500 and has an estimated life of 4 years or 125,000 kilometres and a residual value of $5,000. The delivery truck is expected to be driven 15,500 and 45,000 kilometres in 2020 and 2021, respectively. Required 1. Ivan has decided to depreciate the equipment using either the straight-line method or double declining method. Calculate depreciation for the equipment for 2020 and 2021 using the straight-line method AND the double declining method. 2. Ivan has decided to depreciate the delivery van using the units-of-production method. Calculate depreciation for the delivery truck for 2020 and 2021. 2020 Depreciation 2021 Depreciation Requirement #1 Equipment - Straight-line method Assignment 4 - Chapter 6 COM204 -Fall 2020 Question 3 On January 1, 2015, Toshi Limited purchased a machine for $625,000. The machine was estimated to have a 10 year useful life with a residual value of $50,000. The company used the straight-line method to depreciate the machine. On December 31, 2020, the company sold the equipment for $305,500 cash Required 1. Calculate the gain or loss on sale on the sale of the machine. . 2. Prepare the journal entry to recognize the sale of the machine. Requirement # 1 Question 2 Ellie's Cupcakes Inc. paid $125,000 for land and $35,000 to have the old building removed from the land. The company also had to pay $15,000 in back property taxes. The company paid $635,000 for construction of a new building, including design. Fencing cost the company $25,000 and lighting around the outside of the building cost the company $17,500. The company paid $67,500 for a parking lot and signage cost $30,500. Required Determine the cost of the land, land improvements, and building Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started