Answered step by step

Verified Expert Solution

Question

1 Approved Answer

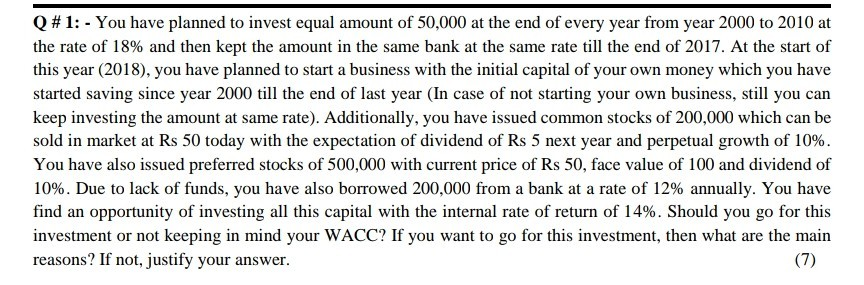

need a quick ans please Q #1: - You have planned to invest equal amount of 50,000 at the end of every year from year

need a quick ans please

Q #1: - You have planned to invest equal amount of 50,000 at the end of every year from year 2000 to 2010 at the rate of 18% and then kept the amount in the same bank at the same rate till the end of 2017. At the start of this year (2018), you have planned to start a business with the initial capital of your own money which you have started saving since year 2000 till the end of last year (In case of not starting your own business, still you can keep investing the amount at same rate). Additionally, you have issued common stocks of 200,000 which can be sold in market at Rs 50 today with the expectation of dividend of Rs 5 next year and perpetual growth of 10%. You have also issued preferred stocks of 500,000 with current price of Rs 50, face value of 100 and dividend of 10%. Due to lack of funds, you have also borrowed 200,000 from a bank at a rate of 12% annually. You have find an opportunity of investing all this capital with the internal rate of return of 14%. Should you go for this investment or not keeping in mind your WACC? If you want to go for this investment, then what are the main reasons? If not, justify your answer. (7)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started