Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need all only OH (WN 1) 39,537.50 category (Direct Materials) and three Indirect-Cost categories - e 1 3. 33,287.5 Cost Gap between Forecast Total Cost

need all only

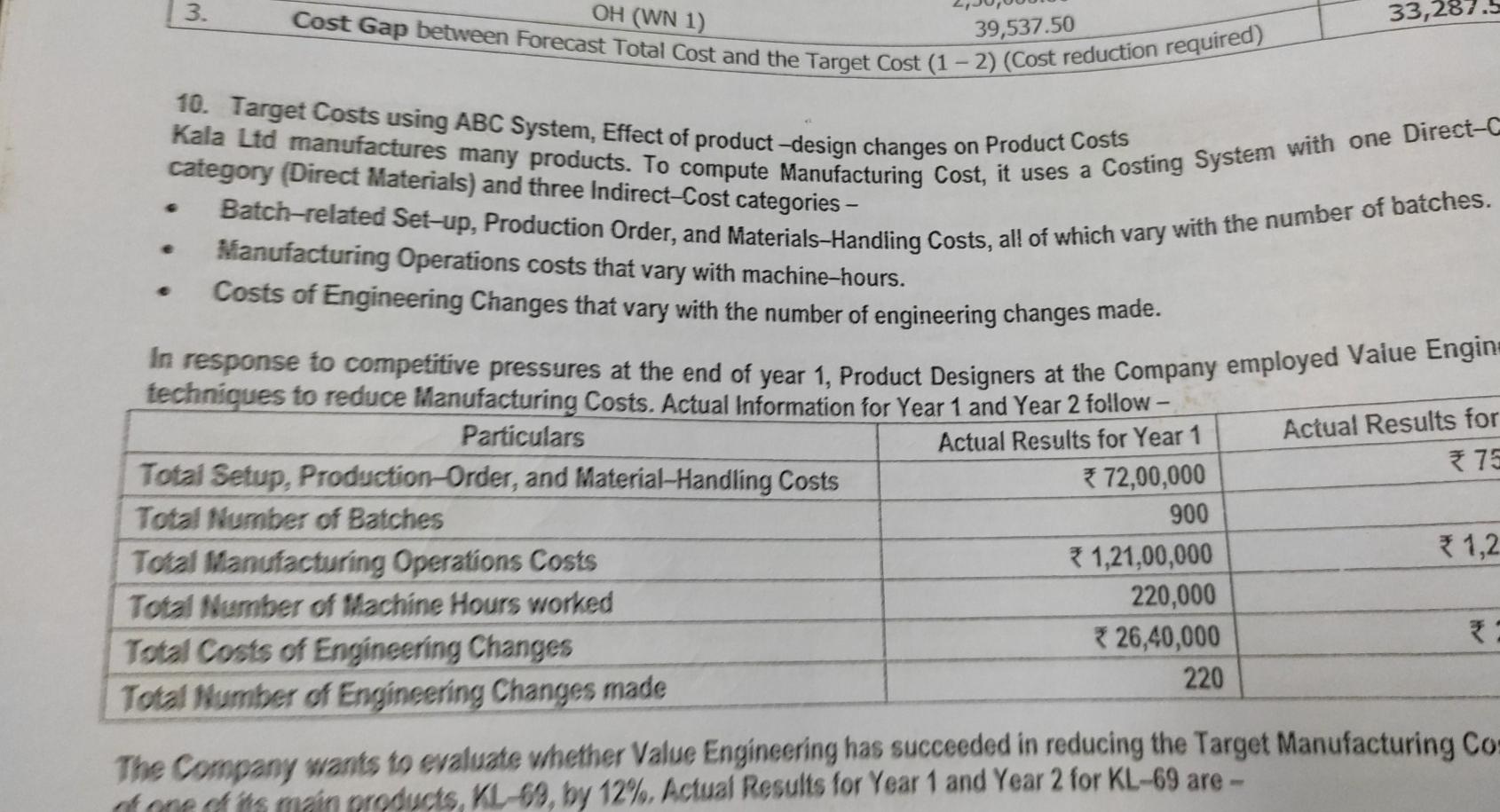

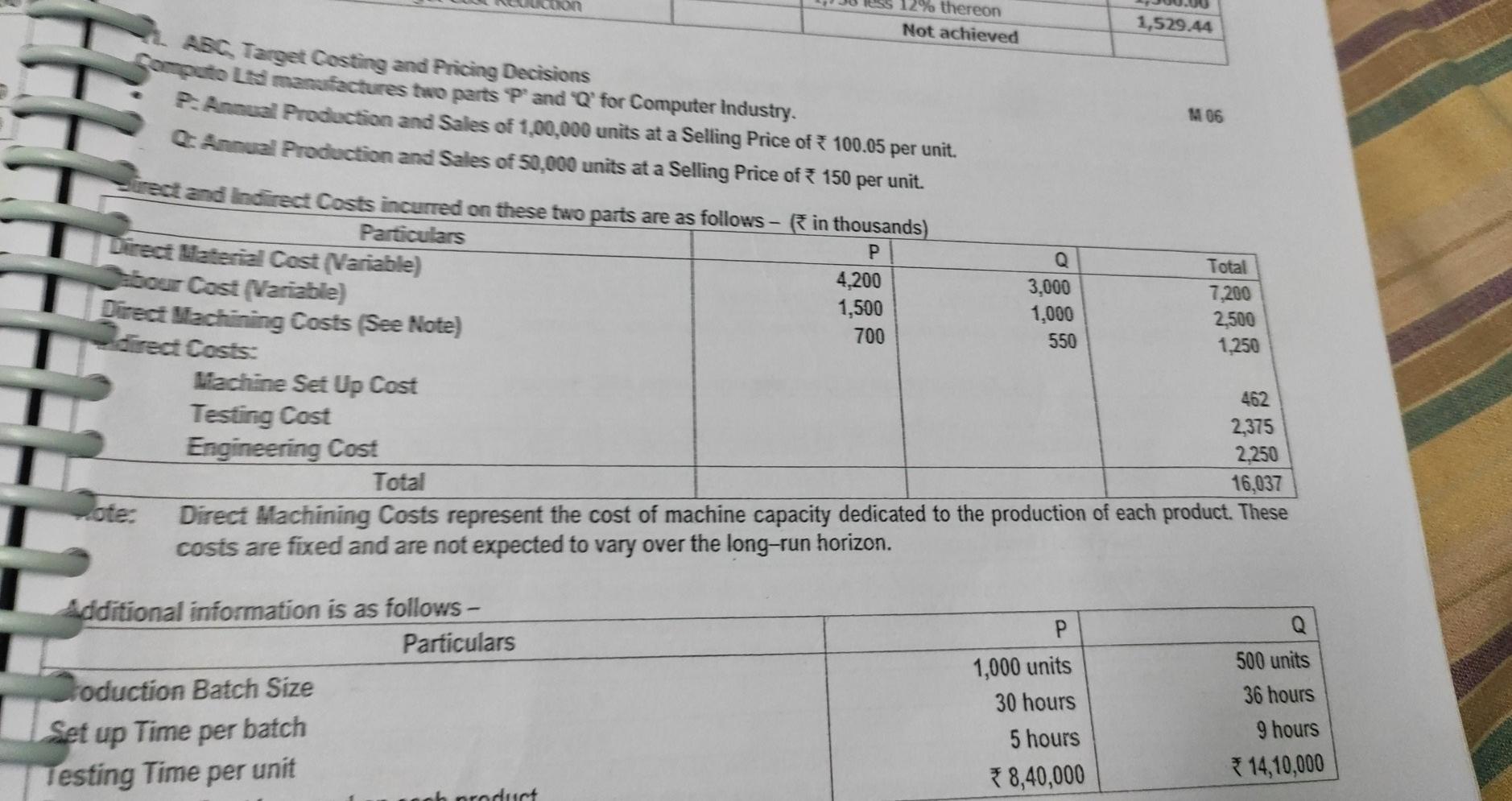

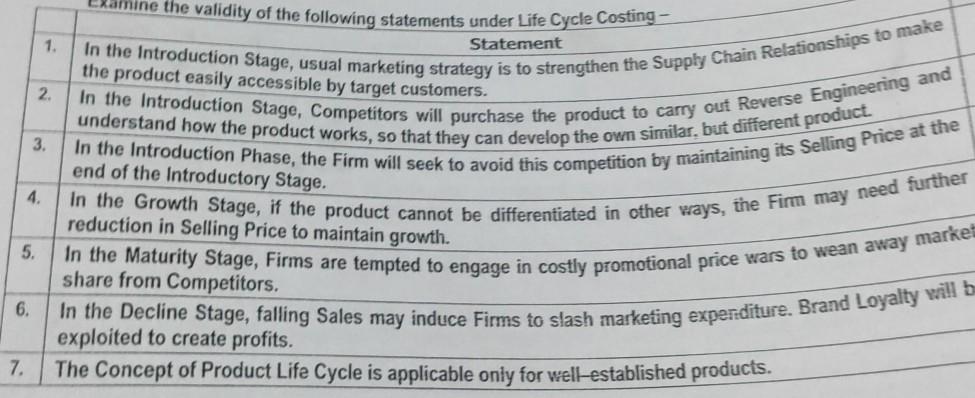

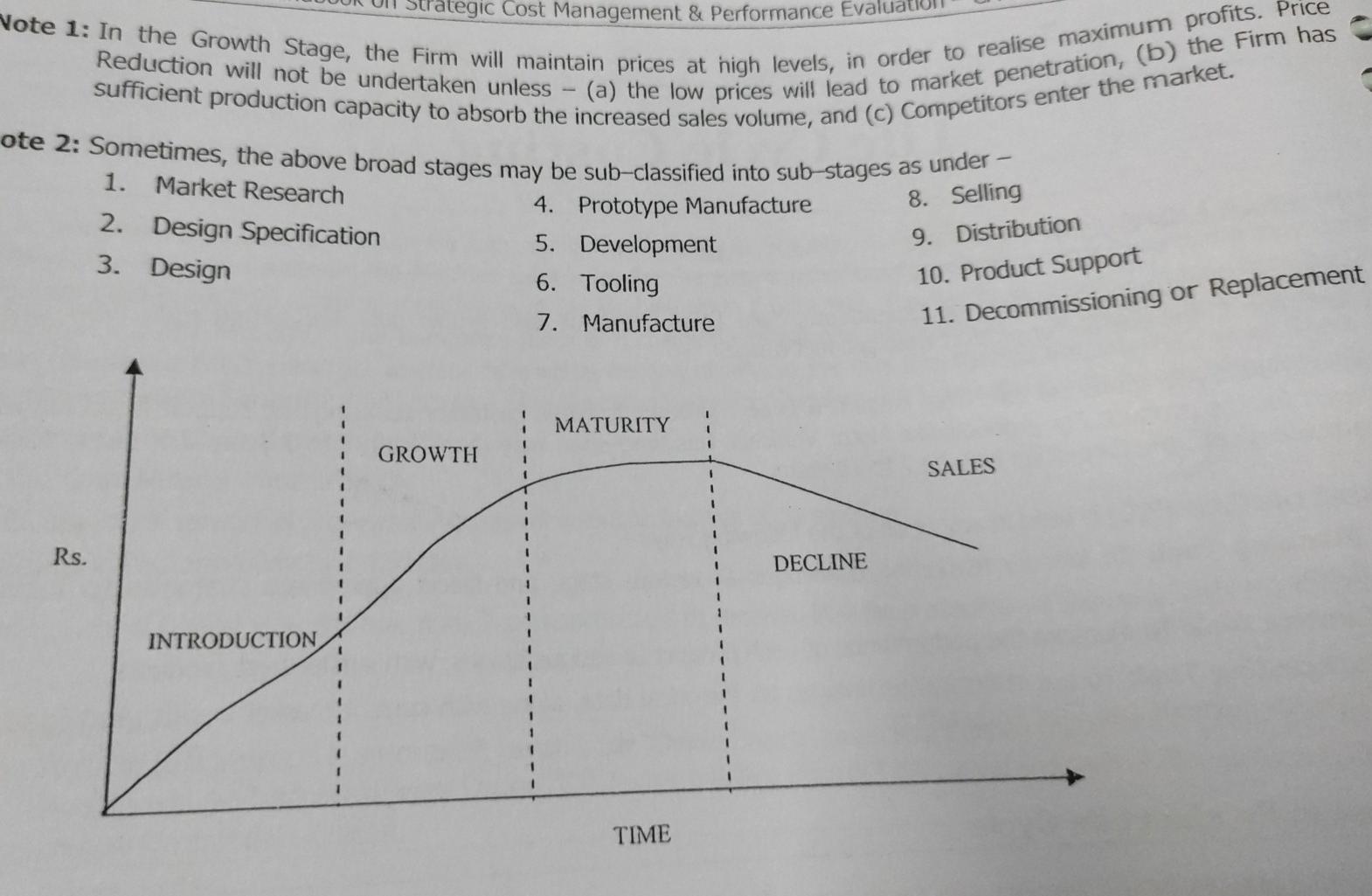

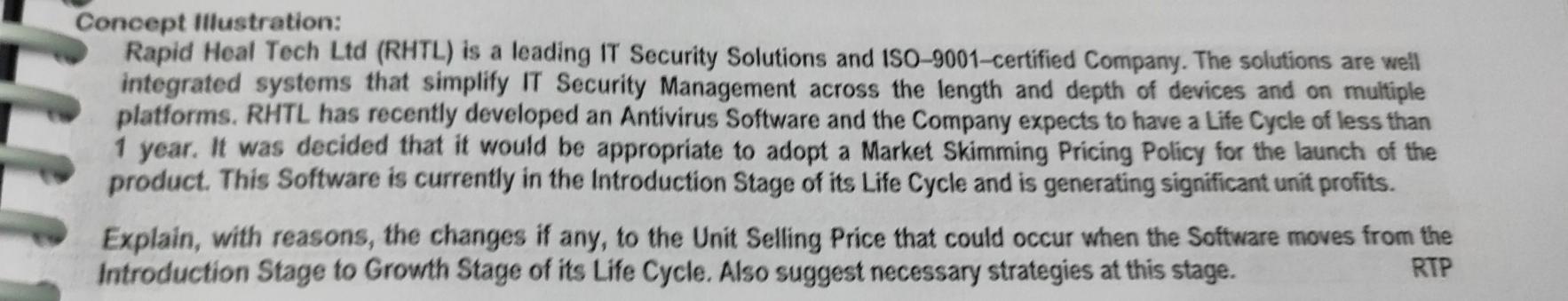

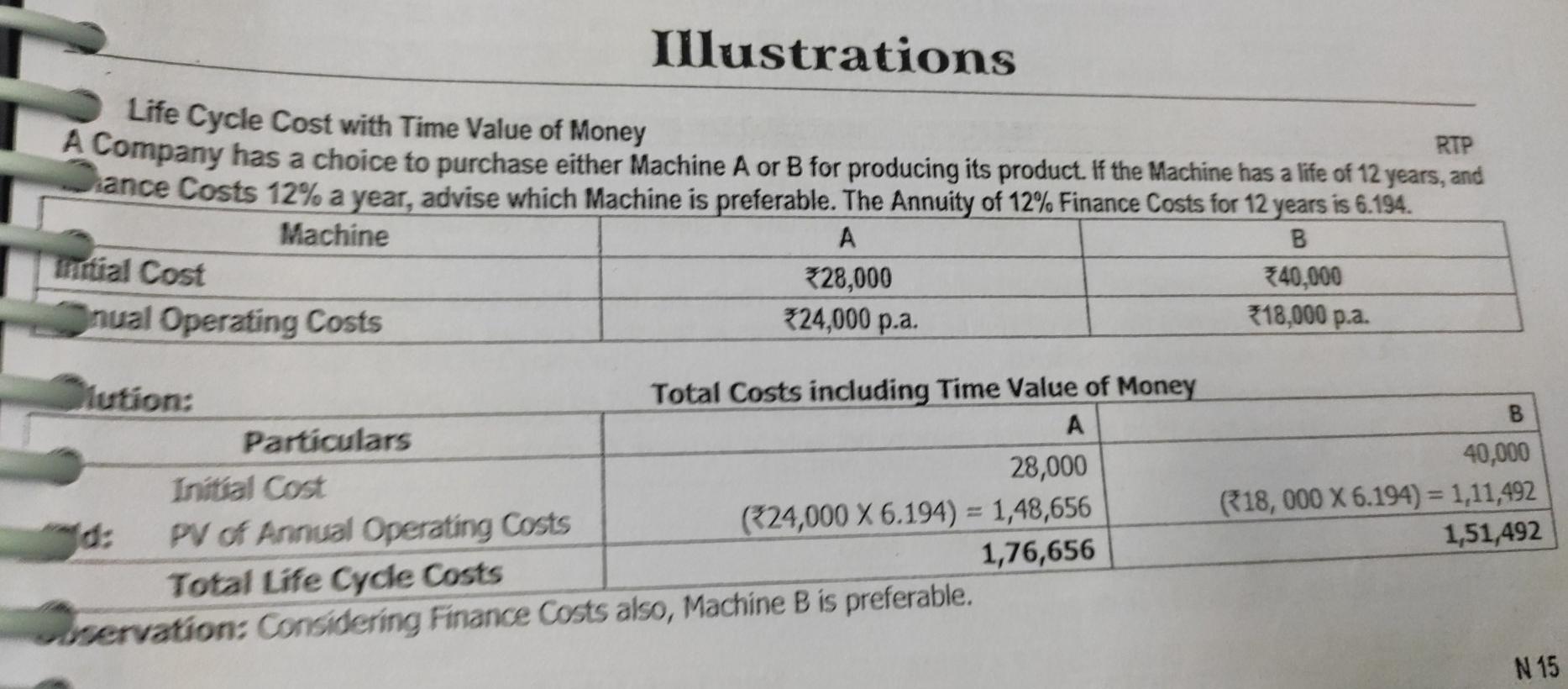

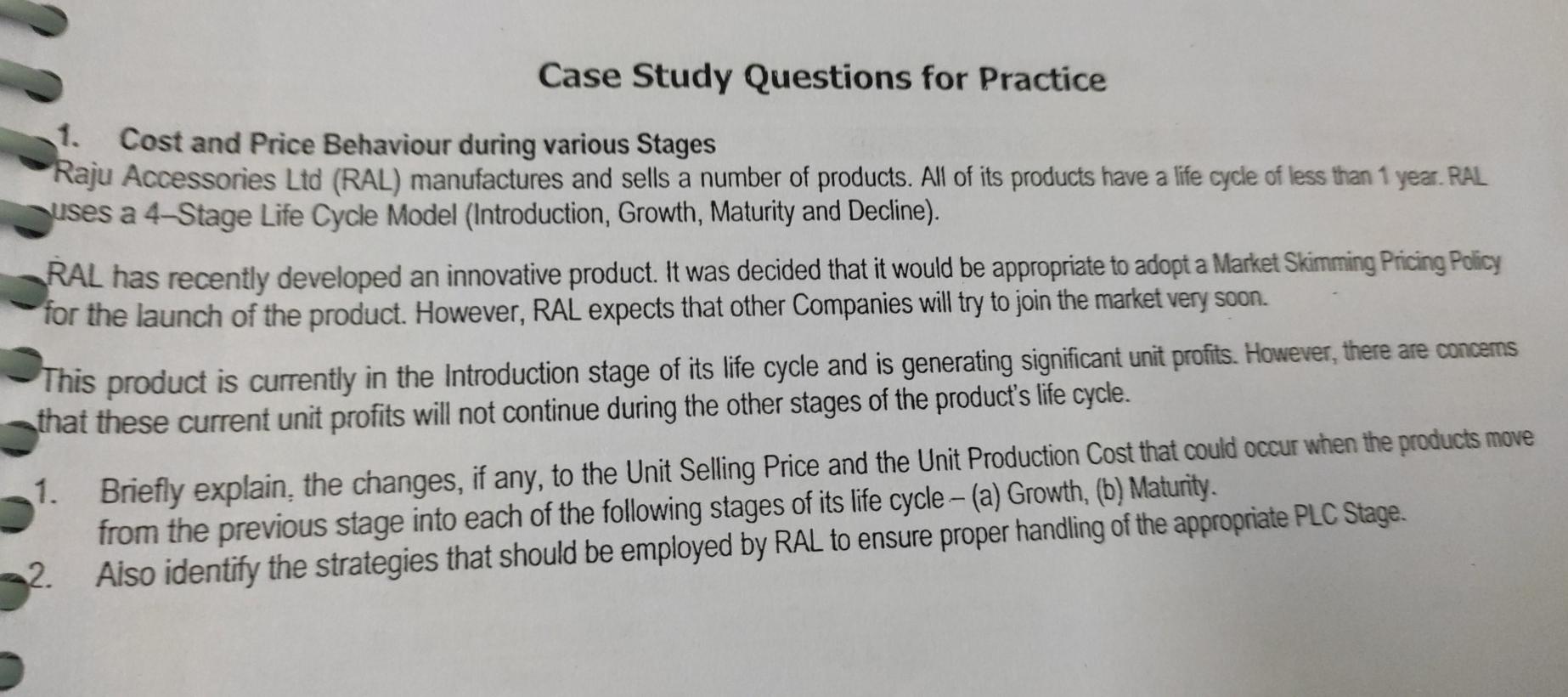

OH (WN 1) 39,537.50 category (Direct Materials) and three Indirect-Cost categories - e 1 3. 33,287.5 Cost Gap between Forecast Total Cost and the Target Cost (1 - 2) (Cost reduction required) 10. Target Costs using ABC System, Effect of product -design changes on Product Costs Kala Ltd manufactures many products. To compute Manufacturing Cost, it uses a Costing System with one Direct- Batch-related Set-up, Production Order, and Materials-Handling Costs, all of which vary with the number of batches. Manufacturing Operations costs that vary with machine-hours. Costs of Engineering Changes that vary with the number of engineering changes made. In response to competitive pressures at the end of year 1, Product Designers at the Company employed Value Engin= techniques to reduce Manufacturing Costs. Actual Information for Year 1 and Year 2 follow - Particulars Actual Results for Year 1 Total Setup, Production-Order, and Material Handling Costs 70 72,00,000 Total Number of Batches 900 Total Manufacturing Operations Costs 1,21,00,000 * 1,2 Total Number of Machine Hours worked 220,000 Total Costs of Engineering Changes 26,40,000 220 Total Number of Engineering Changes made Actual Results for The Company wants to evaluate whether Value Engineering has succeeded in reducing the Target Manufacturing Co of one of the main products, KL-69, by 12%. Actual Results for Year 1 and Year 2 for KL-69 are - M 06 20% thereon 1,529.44 Not achieved ABC Target Costing and Pricing Decisions Computo Lis manufactures two parts P and Q* for Computer industry. PAnnual Production and Sales of 1,00,000 units at a Selling Price of * 100.05 per unit. QAnnual Production and Sales of 50,000 units at a Selling Price of 150 per unit. Srect and indirect Costs incurred on these two parts are as follows - in thousands) Particulars Q Total Direct Material Cosi (Variable) 4,200 3,000 7,200 abour Cosi (Variable) 1,500 1,000 2,500 Direct Machining Costs (See Note) 700 550 1,250 direct Costs: 462 Machine Set Up Cost 2,375 Testing Cost 2,250 Engineering Cost 16,037 Total Jote: Direct Machining Costs represent the cost of machine capacity dedicated to the production of each product. These costs are fixed and are not expected to vary over the long-run horizon. Additional information is as follows - Particulars Foduction Batch Size Set up Time per batch Testing Time per unit 1,000 units 30 hours 5 hours 8,40,000 500 units 36 hours 9 hours * 14,10,000 horoduct the product easily accessible by target customers. end of the Introductory Stage. Lamine the validity of the following statements under Life Cycle Costing - 1. Statement In the Introduction Stage, usual marketing strategy is to strengthen the Supply Chain Relationships to make 2. understand how the product works, so that they can develop the own similar, but different product. In the Introduction Stage, Competitors will purchase the product to carry out Reverse Engineering and 3. In the Introduction Phase, the Firm will seek to avoid this competition by maintaining its Selling Price at the 4. reduction in Selling Price to maintain growth. In the Growth Stage, if the product cannot be differentiated in other ways, the Firm may need further 5. share from Competitors. In the Maturity Stage, Firms are tempted to engage in costly promotional price wars to wean away market 6. In the Decline Stage, falling Sales may induce Firms to slash marketing exper:diture. Brand Loyalty will b exploited to create profits. 7 The Concept of Product Life Cycle is applicable only for well-established products. Reduction will not be undertaken unless rategic Cost Management & Performance Evalu Vote 1: In the Growth Stage, the Firm will maintain prices at high levels, in order to realise maximum profits. Price sufficient production capacity to absorb the increased sales volume, and (C) Competitors enter the market. (a) the low prices will lead to market penetration, (b) the Firm has ote 2: Sometimes, the above broad stages may be sub-classified into sub-stages as under - 4. Prototype Manufacture 8. Selling 5. Development 6. Tooling 7. Manufacture 1. Market Research 2. Design Specification 3. Design 9. Distribution 10. Product Support 11. Decommissioning or Replacement MATURITY GROWTH SALES Rs. DECLINE INTRODUCTION 1 TIME Concept Illustration: Rapid Heal Tech Ltd (RHTL) is a leading IT Security Solutions and ISO-9001-certified Company. The solutions are well integrated systems that simplify IT Security Management across the length and depth of devices and on multiple platforms. RHTL has recently developed an Antivirus Software and the Company expects to have a Life Cycle of less than 1 year. It was decided that it would be appropriate to adopt a Market Skimming Pricing Policy for the launch of the product. This Software is currently in the Introduction Stage of its Life Cycle and is generating significant unit profits. Explain, with reasons, the changes if any, to the Unit Selling Price that could occur when the Software moves from the Introduction Stage to Growth Stage of its Life Cycle. Also suggest necessary strategies at this stage. RTP RTP Illustrations Life Cycle Cost with Time Value of Money A Company has a choice to purchase either Machine A or B for producing its product . If the Machine has a life of 12 years, and Jance Costs 12% a year, advise which Machine is preferable. The Annuity of 12% Finance Costs for 12 years is 6.194. B Machine littal Cost *28,000 340,000 nual Operating Costs 224,000 p.a. 18,000 p.a. A Stution: Total Costs including Time Value of Money Particulars A Initial Cost 28,000 d: PV of Annual Operating Costs (*24,000 X 6.194) = 1,48,656 Total Life Cyde Costs 1,76,656 ervation: Considering Finance Costs also, Machine B is preferable. 40,000 18,000 X 6.194) = 1,11,492 1,51,492 N 15 Case Study Questions for Practice 1. Cost and Price Behaviour during various Stages Raju Accessories Ltd (RAL) manufactures and sells a number of products. All of its products have a life cycle of less than 1 yea RAL uses a 4-Stage Life Cycle Model (Introduction, Growth, Maturity and Decline). RAL has recently developed an innovative product. It was decided that it would be appropriate to adopt a Market Skimming Pricing Policy for the launch of the product. However, RAL expects that other Companies will try to join the market very soon. This product is currently in the Introduction stage of its life cycle and is generating significant unit profits. However, there are concerms that these current unit profits will not continue during the other stages of the product's life cycle. 1. Briefly explain the changes, if any, to the Unit Selling Price and the Unit Production Cost that could occur when the products move from the previous stage into each of the following stages of its life cycle - (a) Growth, (b) Maturity. Aiso identify the strategies that should be employed by RAL to ensure proper handling of the appropriate PLC Stage. 2. OH (WN 1) 39,537.50 category (Direct Materials) and three Indirect-Cost categories - e 1 3. 33,287.5 Cost Gap between Forecast Total Cost and the Target Cost (1 - 2) (Cost reduction required) 10. Target Costs using ABC System, Effect of product -design changes on Product Costs Kala Ltd manufactures many products. To compute Manufacturing Cost, it uses a Costing System with one Direct- Batch-related Set-up, Production Order, and Materials-Handling Costs, all of which vary with the number of batches. Manufacturing Operations costs that vary with machine-hours. Costs of Engineering Changes that vary with the number of engineering changes made. In response to competitive pressures at the end of year 1, Product Designers at the Company employed Value Engin= techniques to reduce Manufacturing Costs. Actual Information for Year 1 and Year 2 follow - Particulars Actual Results for Year 1 Total Setup, Production-Order, and Material Handling Costs 70 72,00,000 Total Number of Batches 900 Total Manufacturing Operations Costs 1,21,00,000 * 1,2 Total Number of Machine Hours worked 220,000 Total Costs of Engineering Changes 26,40,000 220 Total Number of Engineering Changes made Actual Results for The Company wants to evaluate whether Value Engineering has succeeded in reducing the Target Manufacturing Co of one of the main products, KL-69, by 12%. Actual Results for Year 1 and Year 2 for KL-69 are - M 06 20% thereon 1,529.44 Not achieved ABC Target Costing and Pricing Decisions Computo Lis manufactures two parts P and Q* for Computer industry. PAnnual Production and Sales of 1,00,000 units at a Selling Price of * 100.05 per unit. QAnnual Production and Sales of 50,000 units at a Selling Price of 150 per unit. Srect and indirect Costs incurred on these two parts are as follows - in thousands) Particulars Q Total Direct Material Cosi (Variable) 4,200 3,000 7,200 abour Cosi (Variable) 1,500 1,000 2,500 Direct Machining Costs (See Note) 700 550 1,250 direct Costs: 462 Machine Set Up Cost 2,375 Testing Cost 2,250 Engineering Cost 16,037 Total Jote: Direct Machining Costs represent the cost of machine capacity dedicated to the production of each product. These costs are fixed and are not expected to vary over the long-run horizon. Additional information is as follows - Particulars Foduction Batch Size Set up Time per batch Testing Time per unit 1,000 units 30 hours 5 hours 8,40,000 500 units 36 hours 9 hours * 14,10,000 horoduct the product easily accessible by target customers. end of the Introductory Stage. Lamine the validity of the following statements under Life Cycle Costing - 1. Statement In the Introduction Stage, usual marketing strategy is to strengthen the Supply Chain Relationships to make 2. understand how the product works, so that they can develop the own similar, but different product. In the Introduction Stage, Competitors will purchase the product to carry out Reverse Engineering and 3. In the Introduction Phase, the Firm will seek to avoid this competition by maintaining its Selling Price at the 4. reduction in Selling Price to maintain growth. In the Growth Stage, if the product cannot be differentiated in other ways, the Firm may need further 5. share from Competitors. In the Maturity Stage, Firms are tempted to engage in costly promotional price wars to wean away market 6. In the Decline Stage, falling Sales may induce Firms to slash marketing exper:diture. Brand Loyalty will b exploited to create profits. 7 The Concept of Product Life Cycle is applicable only for well-established products. Reduction will not be undertaken unless rategic Cost Management & Performance Evalu Vote 1: In the Growth Stage, the Firm will maintain prices at high levels, in order to realise maximum profits. Price sufficient production capacity to absorb the increased sales volume, and (C) Competitors enter the market. (a) the low prices will lead to market penetration, (b) the Firm has ote 2: Sometimes, the above broad stages may be sub-classified into sub-stages as under - 4. Prototype Manufacture 8. Selling 5. Development 6. Tooling 7. Manufacture 1. Market Research 2. Design Specification 3. Design 9. Distribution 10. Product Support 11. Decommissioning or Replacement MATURITY GROWTH SALES Rs. DECLINE INTRODUCTION 1 TIME Concept Illustration: Rapid Heal Tech Ltd (RHTL) is a leading IT Security Solutions and ISO-9001-certified Company. The solutions are well integrated systems that simplify IT Security Management across the length and depth of devices and on multiple platforms. RHTL has recently developed an Antivirus Software and the Company expects to have a Life Cycle of less than 1 year. It was decided that it would be appropriate to adopt a Market Skimming Pricing Policy for the launch of the product. This Software is currently in the Introduction Stage of its Life Cycle and is generating significant unit profits. Explain, with reasons, the changes if any, to the Unit Selling Price that could occur when the Software moves from the Introduction Stage to Growth Stage of its Life Cycle. Also suggest necessary strategies at this stage. RTP RTP Illustrations Life Cycle Cost with Time Value of Money A Company has a choice to purchase either Machine A or B for producing its product . If the Machine has a life of 12 years, and Jance Costs 12% a year, advise which Machine is preferable. The Annuity of 12% Finance Costs for 12 years is 6.194. B Machine littal Cost *28,000 340,000 nual Operating Costs 224,000 p.a. 18,000 p.a. A Stution: Total Costs including Time Value of Money Particulars A Initial Cost 28,000 d: PV of Annual Operating Costs (*24,000 X 6.194) = 1,48,656 Total Life Cyde Costs 1,76,656 ervation: Considering Finance Costs also, Machine B is preferable. 40,000 18,000 X 6.194) = 1,11,492 1,51,492 N 15 Case Study Questions for Practice 1. Cost and Price Behaviour during various Stages Raju Accessories Ltd (RAL) manufactures and sells a number of products. All of its products have a life cycle of less than 1 yea RAL uses a 4-Stage Life Cycle Model (Introduction, Growth, Maturity and Decline). RAL has recently developed an innovative product. It was decided that it would be appropriate to adopt a Market Skimming Pricing Policy for the launch of the product. However, RAL expects that other Companies will try to join the market very soon. This product is currently in the Introduction stage of its life cycle and is generating significant unit profits. However, there are concerms that these current unit profits will not continue during the other stages of the product's life cycle. 1. Briefly explain the changes, if any, to the Unit Selling Price and the Unit Production Cost that could occur when the products move from the previous stage into each of the following stages of its life cycle - (a) Growth, (b) Maturity. Aiso identify the strategies that should be employed by RAL to ensure proper handling of the appropriate PLC Stage. 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started