Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need all parts for both 1-1 & 1-2 in image Problem 1-1 Everyone in the class invested $50.00 each in Darby's Dapples, Inc. For your

Need all parts for both 1-1 & 1-2 in image

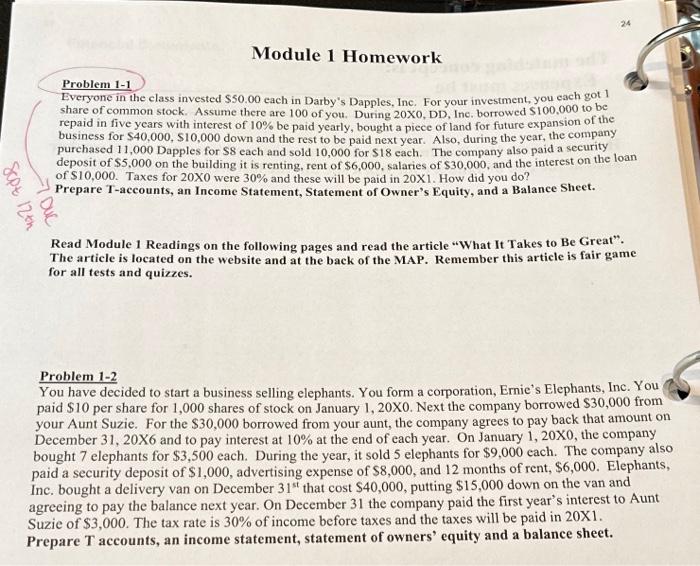

Problem 1-1 Everyone in the class invested $50.00 each in Darby's Dapples, Inc. For your investment, you each got 1 share of common stock. Assume there are 100 of you. During 20X0, DD, Ine, borrowed \$100,000 to be repaid in five years with interest of 10% be paid yearly, bought a piece of land for future expansion of the business for $40,000,$10,000 down and the rest to be paid next year. Also, during the year, the company purchased 11,000 Dapples for $8 each and sold 10,000 for $18 each. The company also paid a security deposit of $5,000 on the building it is renting, rent of $6,000, salaries of $30,000, and the interest on the loan of $10,000. Taxes for 200 were 30% and these will be paid in 201. How did you do? Prepare T-accounts, an Income Statement, Statement of Owner's Equity, and a Balance Sheet. Read Module 1 Readings on the following pages and read the article "What It Takes to Be Great". The article is located on the website and at the back of the MAP. Remember this article is fair game for all tests and quizzes. Problem 1-2 You have decided to start a business selling elephants. You form a corporation, Ernie's Elephants, Inc. You paid $10 per share for 1,000 shares of stock on January 1,20X0. Next the company borrowed $30,000 from your Aunt Suzie. For the $30,000 borrowed from your aunt, the company agrees to pay back that amount on December 31,206 and to pay interest at 10% at the end of each year. On January 1,200, the company bought 7 elephants for $3,500 each. During the year, it sold 5 elephants for $9,000 each. The company also paid a security deposit of $1,000, advertising expense of $8,000, and 12 months of rent, $6,000. Elephants, Inc. bought a delivery van on December 31st that cost $40,000, putting $15,000 down on the van and agreeing to pay the balance next year. On December 31 the company paid the first year's interest to Aunt Suzie of $3,000. The tax rate is 30% of income before taxes and the taxes will be paid in 20X1. Prepare T accounts, an income statement, statement of owners' equity and a balance sheet. Problem 1-1 Everyone in the class invested $50.00 each in Darby's Dapples, Inc. For your investment, you each got 1 share of common stock. Assume there are 100 of you. During 20X0, DD, Ine, borrowed \$100,000 to be repaid in five years with interest of 10% be paid yearly, bought a piece of land for future expansion of the business for $40,000,$10,000 down and the rest to be paid next year. Also, during the year, the company purchased 11,000 Dapples for $8 each and sold 10,000 for $18 each. The company also paid a security deposit of $5,000 on the building it is renting, rent of $6,000, salaries of $30,000, and the interest on the loan of $10,000. Taxes for 200 were 30% and these will be paid in 201. How did you do? Prepare T-accounts, an Income Statement, Statement of Owner's Equity, and a Balance Sheet. Read Module 1 Readings on the following pages and read the article "What It Takes to Be Great". The article is located on the website and at the back of the MAP. Remember this article is fair game for all tests and quizzes. Problem 1-2 You have decided to start a business selling elephants. You form a corporation, Ernie's Elephants, Inc. You paid $10 per share for 1,000 shares of stock on January 1,20X0. Next the company borrowed $30,000 from your Aunt Suzie. For the $30,000 borrowed from your aunt, the company agrees to pay back that amount on December 31,206 and to pay interest at 10% at the end of each year. On January 1,200, the company bought 7 elephants for $3,500 each. During the year, it sold 5 elephants for $9,000 each. The company also paid a security deposit of $1,000, advertising expense of $8,000, and 12 months of rent, $6,000. Elephants, Inc. bought a delivery van on December 31st that cost $40,000, putting $15,000 down on the van and agreeing to pay the balance next year. On December 31 the company paid the first year's interest to Aunt Suzie of $3,000. The tax rate is 30% of income before taxes and the taxes will be paid in 20X1. Prepare T accounts, an income statement, statement of owners' equity and a balance sheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started