Answered step by step

Verified Expert Solution

Question

1 Approved Answer

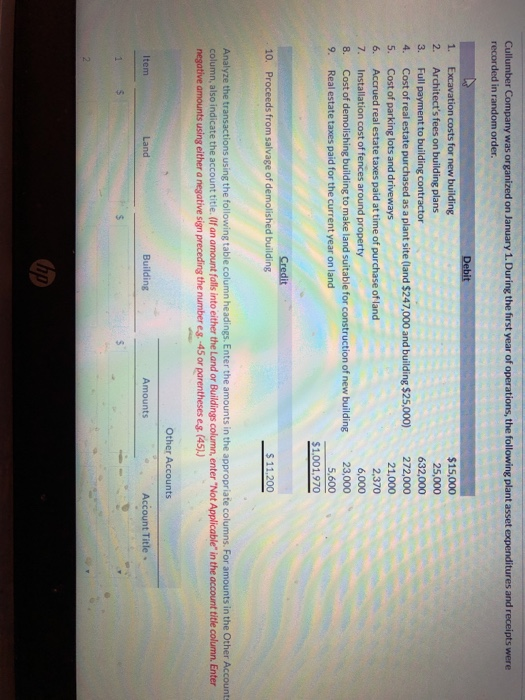

need all questions answered, thanks! Cullumber Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts

need all questions answered, thanks!

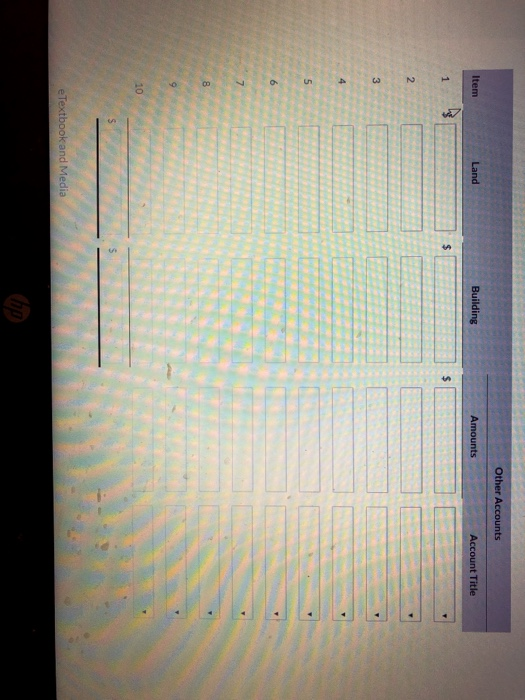

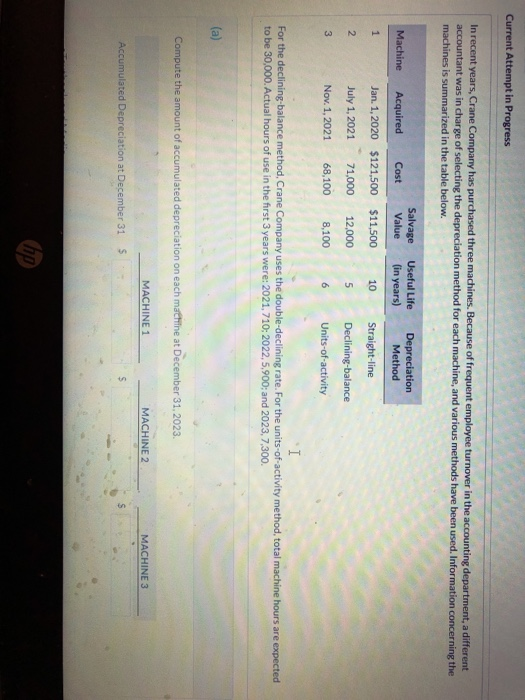

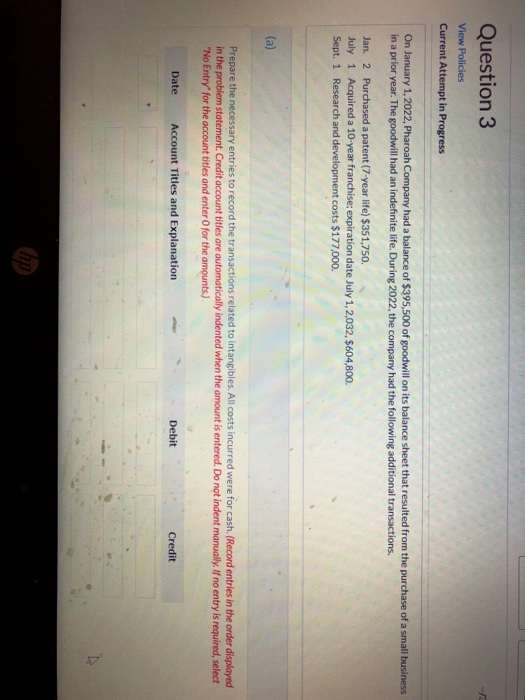

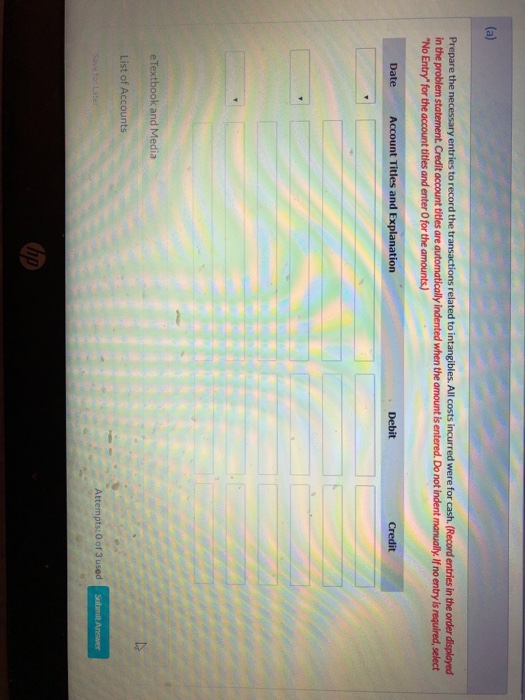

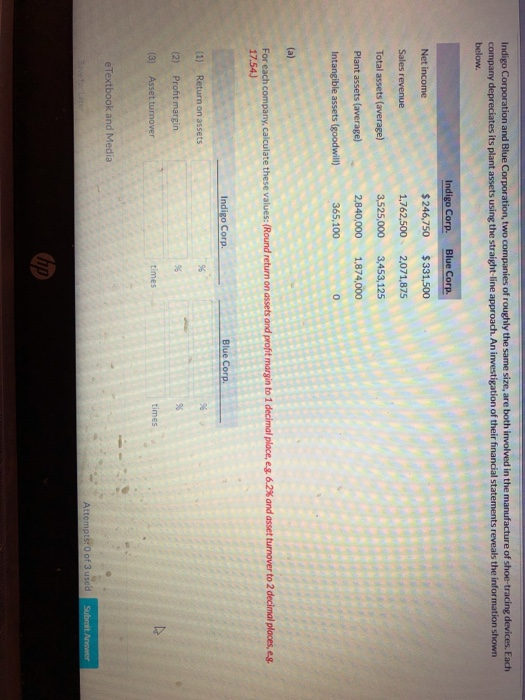

Cullumber Company was organized on January 1. During the first year of operations, the following plant asset expenditures and receipts were recorded in random order. di random order. 1. 2. 3. 4. 5. 6. 7. 8. 9. Debit Excavation costs for new building Architect's fees on building plans Full payment to building contractor Cost of real estate purchased as a plant site (land $247,000 and building $25,000) Cost of parking lots and driveways Accrued real estate taxes paid at time of purchase of land Installation cost of fences around property Cost of demolishing building to make land suitable for construction of new building Real estate taxes paid for the current year on land $15,000 25,000 632,000 272,000 21,000 2,370 6,000 23,000 5.600 $1.001.970 Credit 10. Proceeds from salvage of demolished building $ 11,200 Analyze the transactions using the following table column headings. Enter the amounts in the appropriate columns. For amounts in the Other Accounts column, also indicate the account title. (If an amount falls into either the Land or Buildings column, enter "Not Applicable" in the account title column. Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses e.. (45).) Other Accounts Item Land Building Amounts Account Title Other Accounts Item Land Building Amounts Account Title 5 e Textbook and Media Current Attempt in Progress In recent years, Crane Company has purchased three machines. Because of frequent employee turnover in the accounting department, a different accountant was in charge of selecting the depreciation method for each machine, and various methods have been used. Information concerning the machines is summarized in the table below. Machine Cost Salvage Value Useful Life (in years) Depreciation Method 10 Straight-line Acquired Jan 1, 2020 July 1, 2021 Nov. 1, 2021 N $121,500 71,000 68,100 $11,500 12,000 8,100 Declining-balance W Units-of-activity For the declining balance method, Crane Company uses the double-declining rate. For the units-of-activity method, total machine hours are expected to be 30,000. Actual hours of use in the first 3 years were: 2021, 710:2022, 5,900; and 2023,7,300. (a) Compute the amount of accumulated depreciation on each machine at December 31, 2023 MACHINE 1 MACHINE 2 MACHINE 3 Accumulated Depreciation at December 31 S Question 3 View Policies Current Attempt in Progress On January 1, 2022, Pharoah Company had a balance of $395,500 of goodwill on its balance sheet that resulted from the purchase of a small business in a prior year. The goodwill had an indefinite life. During 2022, the company had the following additional transactions. Jan. 2 Purchased a patent (7-year life) $351,750. July 1 Acquired a 10-year franchise; expiration date July 1, 2,032, 5604,800. Sept. 1 Research and development costs $177,000. Prepare the necessary entries to record the transactions related to intangibles. All costs incurred were for cash. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Prepare the necessary entries to record the transactions related to intangibles. All costs incurred were for cash. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit e Textbook and Media List of Accounts STOLLE Attempts: 0 of 3 used Submit Answer Indigo Corporation and Blue Corporation, two companies of roughly the same size, are both involved in the manufacture of shoe-tracing devices. Each company depreciates its plant assets using the straight-line approach. An investigation of their financial statements reveals the information shown below. Net income Indigo Corp. $ 246,750 1,762,500 Blue Corp. $331,500 2,071,875 Sales revenue Total assets (average) 3,525,000 2,840,000 3,453,125 1,874,000 Plant assets (average) Intangible assets (goodwill) 365,100 0 For each company, calculate these values: (Round return on assets and profit margin to 1 decimal place, eg. 6.2% and asset turnover to 2 decimal places, eg. 17.54) Indigo Corp. Blue Corp. (1) Return on assets (2) Profit margin (3) Asset turnover times times e Textbook and Media Attempts: 0 of 3 used Submit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started