Answered step by step

Verified Expert Solution

Question

1 Approved Answer

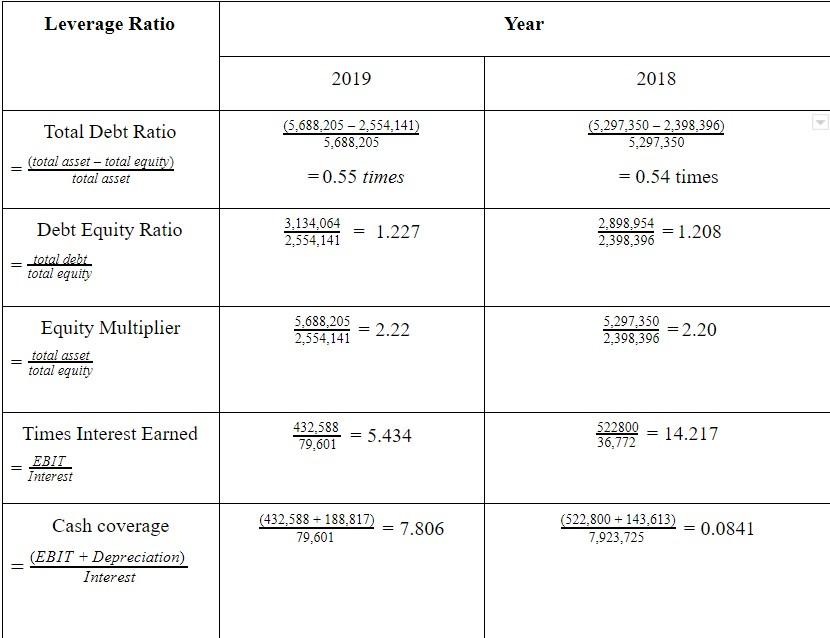

Need analysis for the leverage ratio above. need brief explnation for total debt ratio, cash coverage, debt equity ratio, equity multiplier and times interest earned.

Need analysis for the leverage ratio above. need brief explnation for total debt ratio, cash coverage, debt equity ratio, equity multiplier and times interest earned. compare the figures in both years. need this asap pls help me..

= Leverage Ratio Total Debt Ratio (total asset total equity) total asset - total debt total equity = Debt Equity Ratio Equity Multiplier total asset total equity Times Interest Earned Interest Cash coverage (EBIT+ Depreciation) Interest 2019 (5,688,205 - 2,554,141) 5,688,205 = 0.55 times 3,134,064 2,554,141 5,688,205 2,554,141 432,588 79,601 = 1.227 79,601 = 2.22 = = 5.434 (432,588 188,817) = 7.806 Year 2018 (5,297,350-2,398,396) 5,297,350 = 0.54 times 2,898,954 2,398,396 5,297,350 2,398,396 522800 36,772 = = 1.208 = 2.20 14.217 (522,800+ 143,613) 7,923,725 = 0.0841

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

A Cash coverage ratio The cash coverage ratio is useful for determining the amount of cash available ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started