Question: Need answer for 2nd scenario, can someone help me with that The initial cash outlay at Time 0 is simply the cost of the new

Need answer for 2nd scenario, can someone help me with that

Need answer for 2nd scenario, can someone help me with that

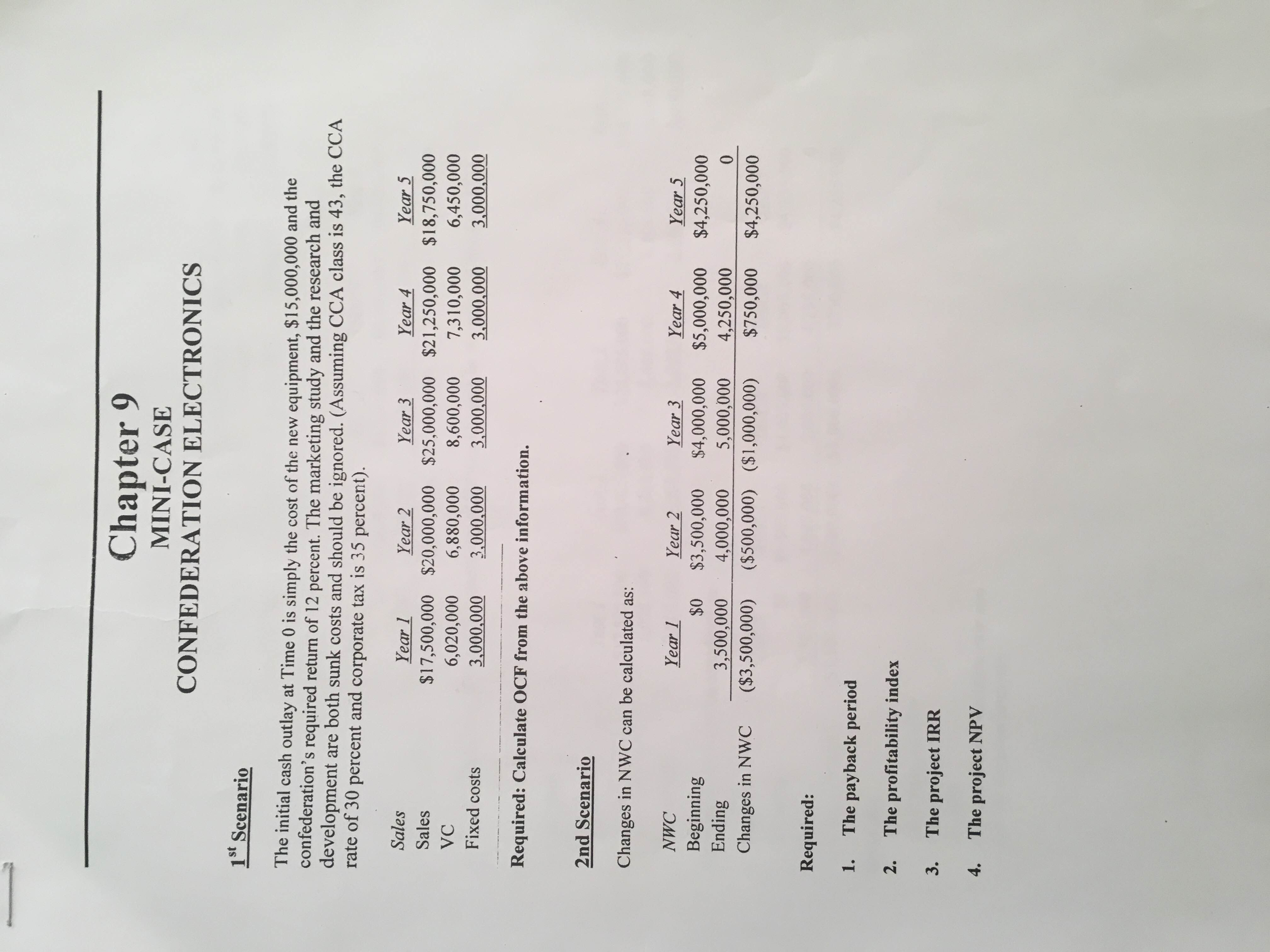

The initial cash outlay at Time 0 is simply the cost of the new equipment, $15,000,000 and the confederation's required return of 12 percent. The marketing study and the research and development are both sunk costs and should be ignored. (Assuming CCA class is 43, the CCA rate of 30 percent and corporate tax is 35 percent). Required: Calculate OCF from the above information. Changes in NWC can be calculated as: Required: The payback period The profitability index The project IRR The project NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts