Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need answer for Q2 1. Table Al lists the European option prices on a stock that pays no dividends on a given date. Time to

Need answer for Q2

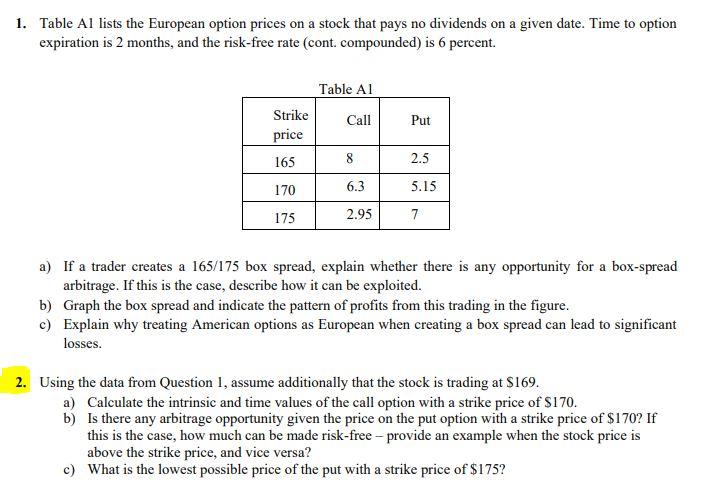

1. Table Al lists the European option prices on a stock that pays no dividends on a given date. Time to option expiration is 2 months, and the risk-free rate (cont. compounded) is 6 percent. Table Al Call Put Strike price 165 8 2.5 170 6.3 5.15 175 2.95 7 a) If a trader creates a 165/175 box spread, explain whether there is any opportunity for a box-spread arbitrage. If this is the case, describe how it can be exploited. b) Graph the box spread and indicate the pattern of profits from this trading in the figure. c) Explain why treating American options as European when creating a box spread can lead to significant losses. 2. Using the data from Question 1, assume additionally that the stock is trading at $169. a) Calculate the intrinsic and time values of the call option with a strike price of $170. b) Is there any arbitrage opportunity given the price on the put option with a strike price of $170? If this is the case, how much can be made risk-free - provide an example when the stock price is above the strike price, and vice versa? c) What is the lowest possible price of the put with a strike price of $175? 1. Table Al lists the European option prices on a stock that pays no dividends on a given date. Time to option expiration is 2 months, and the risk-free rate (cont. compounded) is 6 percent. Table Al Call Put Strike price 165 8 2.5 170 6.3 5.15 175 2.95 7 a) If a trader creates a 165/175 box spread, explain whether there is any opportunity for a box-spread arbitrage. If this is the case, describe how it can be exploited. b) Graph the box spread and indicate the pattern of profits from this trading in the figure. c) Explain why treating American options as European when creating a box spread can lead to significant losses. 2. Using the data from Question 1, assume additionally that the stock is trading at $169. a) Calculate the intrinsic and time values of the call option with a strike price of $170. b) Is there any arbitrage opportunity given the price on the put option with a strike price of $170? If this is the case, how much can be made risk-free - provide an example when the stock price is above the strike price, and vice versa? c) What is the lowest possible price of the put with a strike price of $175Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started