Need answer for Questions 5 - 8

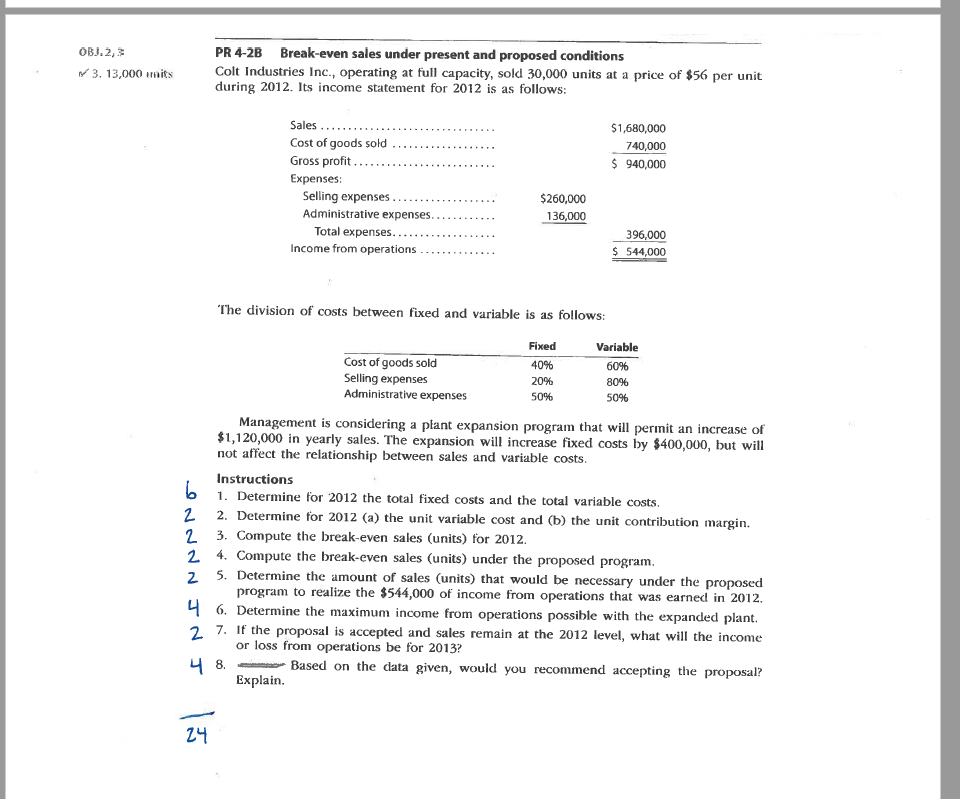

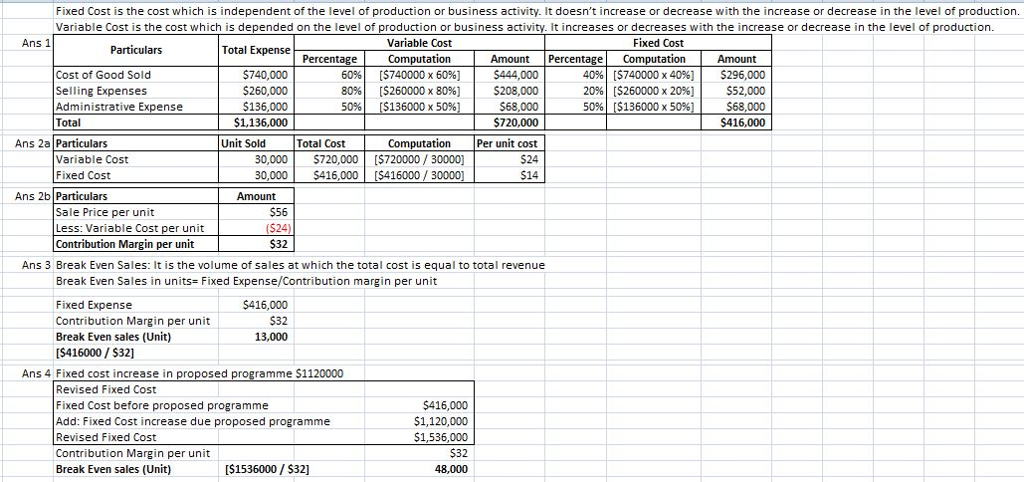

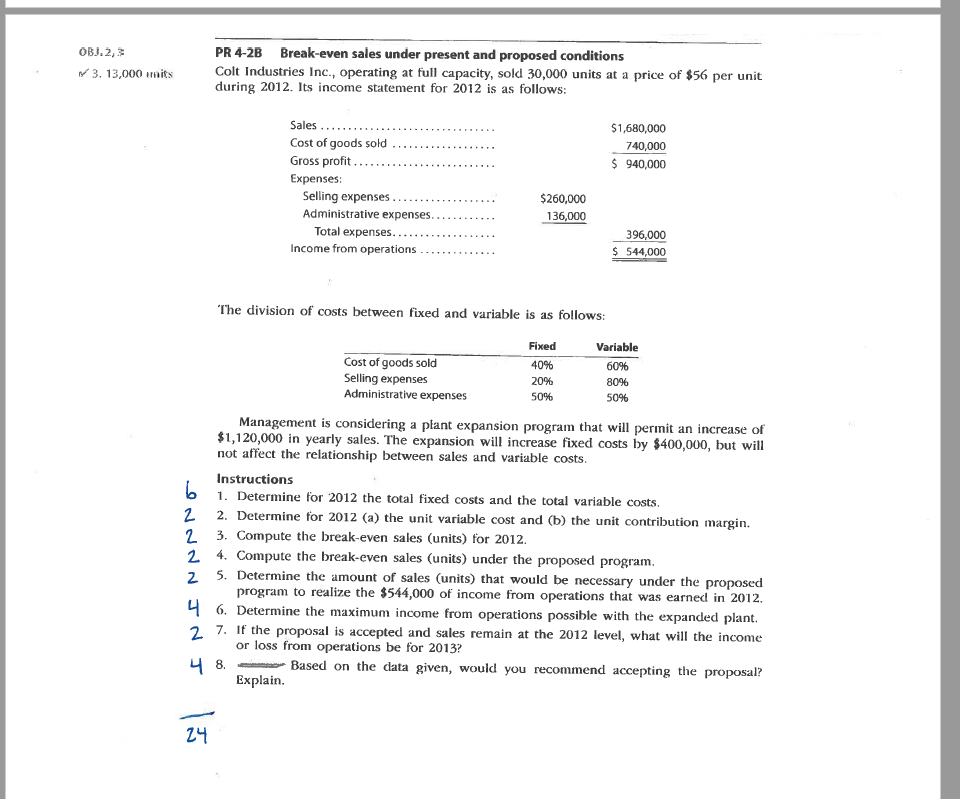

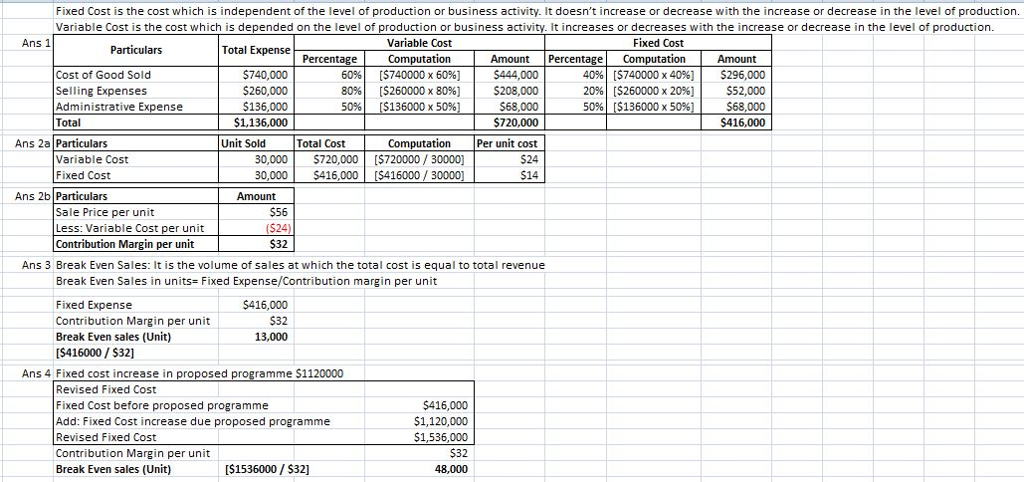

oBJ.2, PR 4-2B Break-even sales under present and proposed conditions Colt Industries Inc., operating at full capacity, sold 30,000 units at a price of $56 per unit during 2012. Its income statement for 2012 is as follows 3. 13,000 mits Sales Cost of goods sold Gross profit... . Expenses $1,680,000 740,000 940,000 Selling expenses Administrative expenses. 260,000 136,000 Total expenses Income from operations 396,000 $544,000 The division of costs between fixed and variable is as follows Cost of goods sold Selling expenses Administrative expenses Fixed 40% 20% 5096 Variable 60% 80% 5096 Management is considering a plant expansion program that will perinit an increase of 1,120,000 in yearly sales. The expansion will increase fixed costs by $400,000, but will not affect the relationship between sales and variable costs Instructions 1. Determine for 2012 the total fixed costs and the total variable costs 2 2. Determine for 2012 (the unit variable cost and (b) the unit contribution margin. 2 3. Compute the break-even sales (units) for 2012 2 4. Compute the break-even sales (units) under the proposed program 2 5. Determine the amount of sales (units) that would be necessary under thep oposeod program to realize the $544,000 of income from operations that was earned in 2012. 6. Determine the maximum income from operations possible with the expanded plant. 2 7. If the proposal is accepted and sales remain at the 2012 level, what will the income or loss from operations be for 2013? 8. Based on the data given, would you recommend accepting the proposal? Explain 21 Fixed Cost is the cost which is independent of the level of production or business activity. It doesn't increase or decrease with the increase or decrease in the level of production. Variable Cost is the cost which is depended on the level of production or business a It increases or decreases with the increase or decrease in the level of production. Ans 1 Total Expense Percentage Variable Cost Fixed Cost Particulars Co ation Amount Percentage ation $740,000 $260,000 $136,000 $1.136.000 60%| 8096| 50%) [S740000 x 6096] [S260000 x 8096] 36000 x 50% $444,000 %) | S208.000 $68,000 $720,000 409 209 50%) I$136000 x 50% [S740000 x 40%) | ($260000 x 20%) | Cost of Good Sold Selling Expenses Administrative Expense Total S296,000 S52,000 68,000 $416,000 Ans 2a Particulars Unit Sold Total Cost Variable Cost Fixed Cost 0,000$720,000 ($720000/ 30000 30,000$416,000 [$416000/ tion Per unit cost S24 S14 Ans 2b Particulars Amount Sale Price per unit Less: Variable Cost per unit Contribution Margin per unit 556 ($24) 532 Ans 3 Break Even Sales: It is the volume of sales at which the total cost is equal to total revenue Break Even Sales in units- Fixed Expense/Contribution margin per unit Fixed Expense Contribution Margin per unit Break Even sales (Unit) IS416000/ $32] $416,000 $32 13,000 Ans 4 Fixed cost increase in proposed programme $1120000 Revised Fixed Cost Fixed Cost before proposed programme Add: Fixed Cost increase due proposed programme Revised Fixed Cost Contribution Margin per unit Break Even sales (Unit) $416,000 $1,120,000 $1,536,000 532 48,000 IS1536000/$32]