Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need answer please Alison and Zander decide that they will create a now corporation, Cala Canoe Company, or CCC for short. Calla Canoe Company is

need answer please

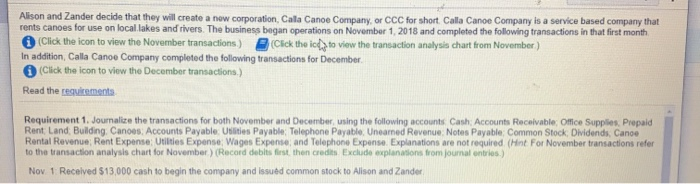

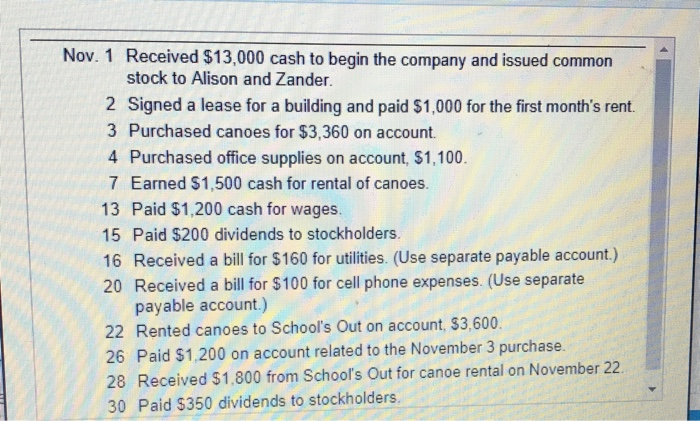

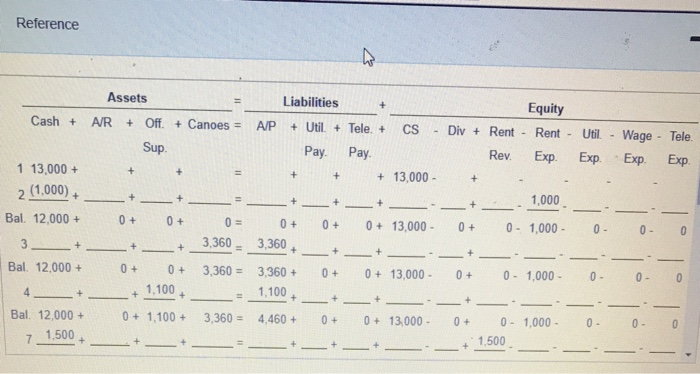

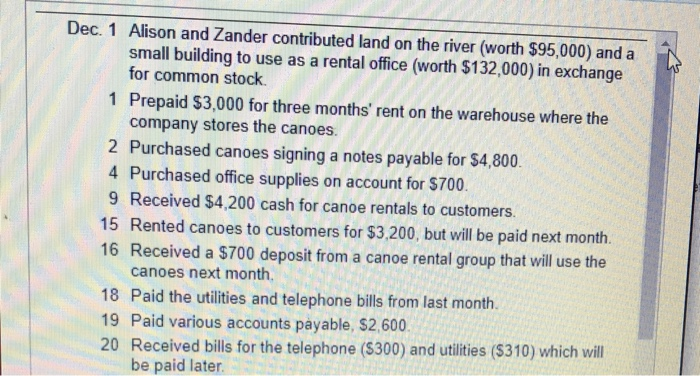

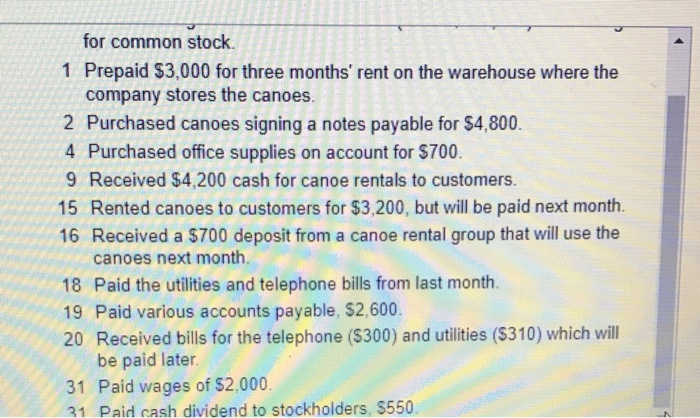

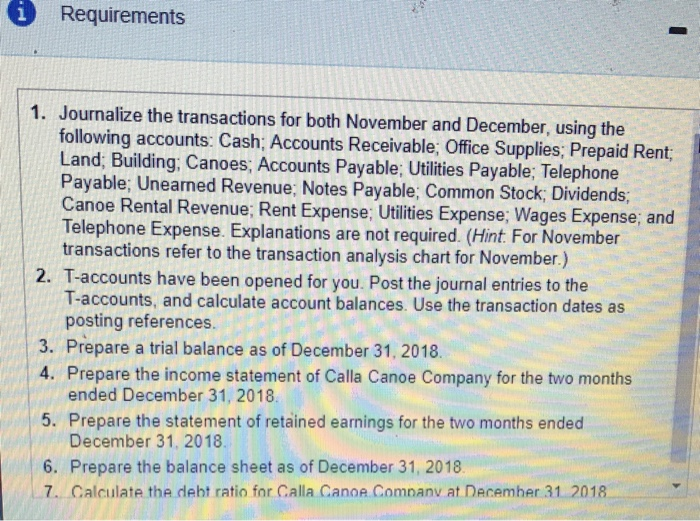

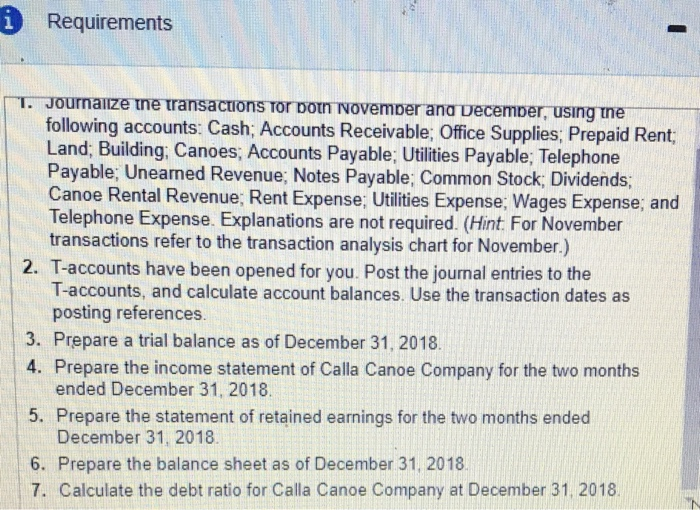

Alison and Zander decide that they will create a now corporation, Cala Canoe Company, or CCC for short. Calla Canoe Company is a service based company that rents canoes for use on local.lakes and rivers. The business began operations on November 1, 2018 and completed the following transactions in that first month i (Click the icon to view the November transactions.) (Cick the ic to view the transaction analysis chart from November ) In addition, Calla Canoe Company completed the following transactions for December. (Click the icon to view the December transactions.) Read the requirements Requirement 1. Journalize the transactions for both November and December, using the following accounts Cash: Accounts Receivable, Office Supplies, Prepaid Rent Land Building Canoes Accounts Payable: Uslities Payable: Telephone Payable, Unearmed Revenue. Notes Payable: Common Stock, Dividends, Canoe Rental Revenue, Rent Expense: Utilities Expense: Wages Expense, and Telephone Expense Explanations are not required (hHint For November transactions refer to the transaction analysis chart for November) (Record debits first, then credits Exclude explanasions from journal ontries.) Nov 1 Received$13,000 cash to begin the company and issud common stock to Alison and Zander Nov. 1 Received $13,000 cash to begin the company and issued common stock to Alison and Zander. 2 Signed a lease for a building and paid $1,000 for the first month's rent. 3 Purchased canoes for $3,360 on account 4 Purchased office supplies on account, $1,100 7 Earned $1,500 cash for rental of canoes. 13 Paid $1,200 cash for wages. 15 Paid $200 dividends to stockholders. 16 Received a bill for $160 for utilities. (Use separate payable account.) 20 Received a bill for $100 for cell phone expenses. (Use separate payable account.) 22 Rented canoes to School's Out on account, $3,600 26 Paid $1,200 on account related to the November 3 purchase. 28 Received $1,800 from School's Out for canoe rental on November 22 30 Paid $350 dividends to stockholders Reference Assets Liabilities Equity Cash + Off. +Canoes A/R A/P + Util +Tele. + CS Div Rent Rent Util. Wage Tele - Sup Pay Pay Exp Rev Exp Exp Exp 1 13,000+ 13,000 + + + + (1,000) 1,000 2 + + + + + Bal. 12,000 0 + 0 + 0 + 0 + 0-1,000- 0= 0+ 0+ 13,000- 0- 0- 0 3,360 + 3,360 + 4 + + + 0 0 + 0- 0- 0- Bal. 12,000 3,360= 3.360 + 0 + 0 + 1,000 0+ 0+ 13,000 1,100 1,100 + 4 + + + 0 13.000- 0- 0- 3.360= 0 + 01.000- Bal. 12.000 + 0+ 1.100+ 4.460 + 0 + 7 1,500 1,500 Sap Dec. 1 Alison and Zander contributed land on the river (worth $95,000) and a small building to use as a rental office (worth $132,000) in exchange for common stock 1 Prepaid $3,000 for three months' rent on the warehouse where the company stores the canoes 2 Purchased canoes signing a notes payable for $4,800 4 Purchased office supplies on account for $700 9 Received $4,200 cash for canoe rentals to customers 15 Rented canoes to customers for $3,200, but will be paid next month. 16 Received a $700 deposit from a canoe rental group that will use the canoes next month. 18 Paid the utilities and telephone bills from last month. 19 Paid various accounts payable, S2,600 20 Received bills for the telephone ($300) and utilities ($310) which will be paid later for common stock 1 Prepaid $3,000 for three months' rent on the warehouse where the company stores the canoes. 2 Purchased canoes signing a notes payable for $4,800 4 Purchased office supplies on account for $700. 9 Received $4,200 cash for canoe rentals to customers. 15 Rented canoes to customers for $3,200, but will be paid next month. 16 Received a $700 deposit from a canoe rental group that will use the canoes next month. 18 Paid the utilities and telephone bills from last month 19 Paid various accounts payable, $2,600. 20 Received bills for the telephone ($300) and utilities (S310) which will be paid later. 31 Paid wages of $2,000. 31 Paid cash dividend to stockholders, $550 Requirements 1. Journalize the transactions for both November and December, using the following accounts: Cash; Accounts Receivable; Office Supplies; Prepaid Rent Land, Building; Canoes; Accounts Payable; Utilities Payable; Telephone Payable; Unearned Revenue; Notes Payable; Common Stock; Dividends Canoe Rental Revenue; Rent Expense; Utilities Expense; Wages Expense, and Telephone Expense. Explanations are not required. (Hint For November transactions refer to the transaction analysis chart for November.) 2. T-accounts have been opened for you. Post the journal entries to the T-accounts, and calculate account balances. Use the transaction dates as posting references. 3. Prepare a trial balance as of December 31, 2018 4. Prepare the income statement of Calla Canoe Company for the two months ended December 31, 2018 5. Prepare the statement of retained earnings for the two months ended December 31, 2018 6. Prepare the balance sheet as of December 31, 2018 7 Calculate the debt ratio for Calla Canoe Companv at Decemher 31 2018) Requirements T. JOurnaize tne transacuons Tor Dotn Novemper ana December, using tne following accounts: Cash; Accounts Receivable; Office Supplies; Prepaid Rent; Land; Building, Canoes; Accounts Payable; Utilities Payable; Telephone Payable; Unearmed Revenue; Notes Payable; Common Stock, Dividends; Canoe Rental Revenue; Rent Expense; Utilities Expense; Wages Expense; and Telephone Expense. Explanations are not required. (Hint For November transactions refer to the transaction analysis chart for November.) 2. T-accounts have been opened for you. Post the journal entries to the T-accounts, and calculate account balances. Use the transaction dates as posting references. 3. Prepare a trial balance as of December 31, 2018 4. Prepare the income statement of Calla Canoe Company for the two months ended December 31, 2018 5. Prepare the statement of retained earnings for the two months ended December 31, 2018 6. Prepare the balance sheet as of December 31, 2018. 7. Calculate the debt ratio for Calla Canoe Company at December 31, 2018 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started