Question

need answer You need to create an excel file as per described in the following questions and upload it to your Schoology account. Steps: Create

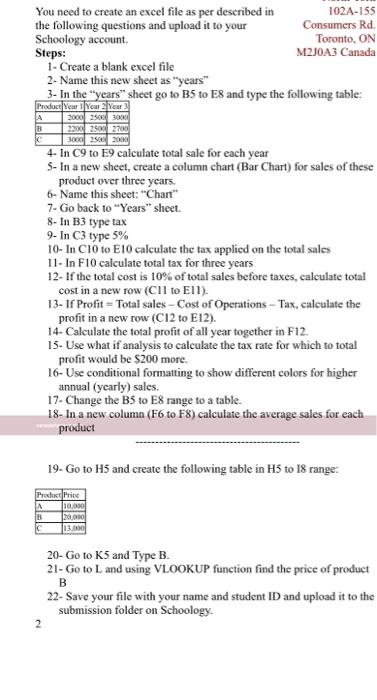

You need to create an excel file as per described in the following questions and upload it to your Schoology account.

Steps:

Create a blank excel file

Name this new sheet as years

In the years sheet go to B5 to E8 and type the following table:

Product | Year 1 | Year 2 | Year 3 |

A | 2000 | 2500 | 3000 |

B | 2200 | 2500 | 2700 |

C | 3000 | 2500 | 2000 |

In C9 to E9 calculate total sale for each year

In a new sheet, create a column chart (Bar Chart) for sales of these product over three years.

Name this sheet: Chart

Go back to Years sheet.

In B3 type tax

In C3 type 5%

In C10 to E10 calculate the tax applied on the total sales

In F10 calculate total tax for three years

If the total cost is 10% of total sales before taxes, calculate total cost in a new row (C11 to E11).

1

North York

102A-155 Consumers Rd. Toronto, ON

M2J0A3 Canada

If Profit = Total sales Cost of Operations Tax, calculate the profit in a new row (C12 to E12).

Calculate the total profit of all year together in F12.

Use what if analysis to calculate the tax rate for which to total profit would be $200 more.

Use conditional formatting to show different colors for higher annual (yearly) sales.

Change the B5 to E8 range to a table.

In a new column (F6 to F8) calculate the average sales for each product

------------------------------------------

Go to H5 and create the following table in H5 to I8 range:

Product | Price |

A | 10,000 |

B | 20,000 |

C | 13,000 |

Go to K5 and Type B.

Go to L and using VLOOKUP function find the price of product B

Save your file with your name and student ID and upload it to the submission folder on Schoology.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started