Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need answers A)S.168.000 favorable B) 368.000 unfavorable C) $16.000 favorable D) $16.000 unfavorable Schooner Corporation used the following data to evaluate its current operating system

need answers

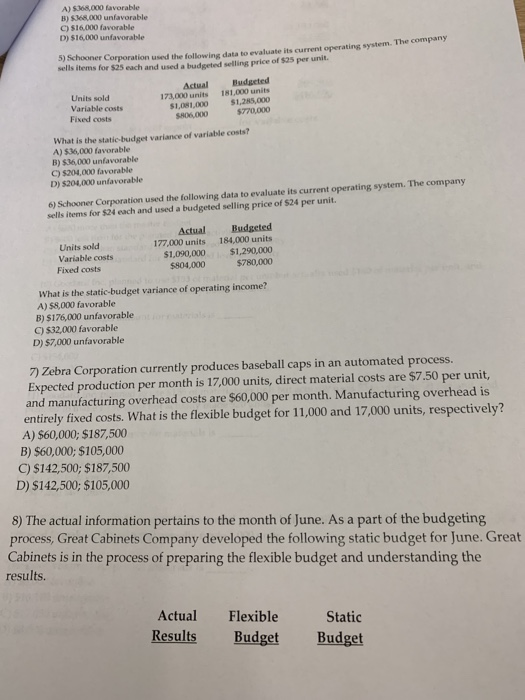

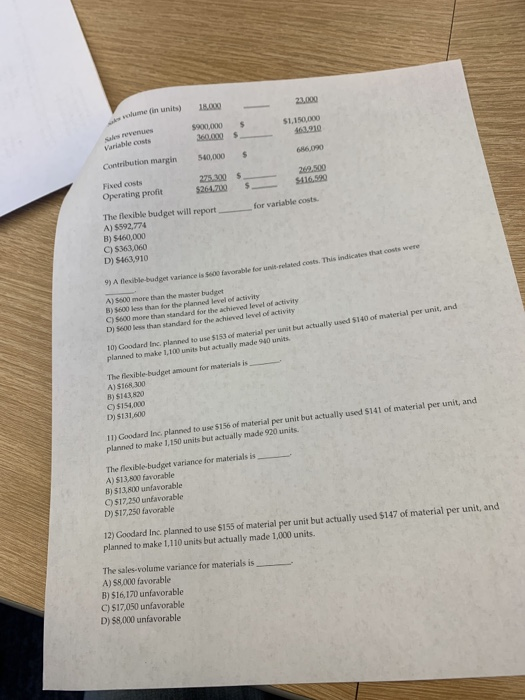

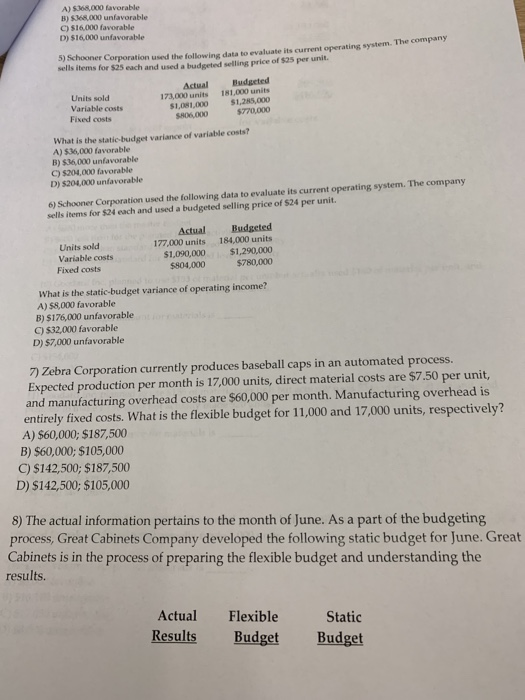

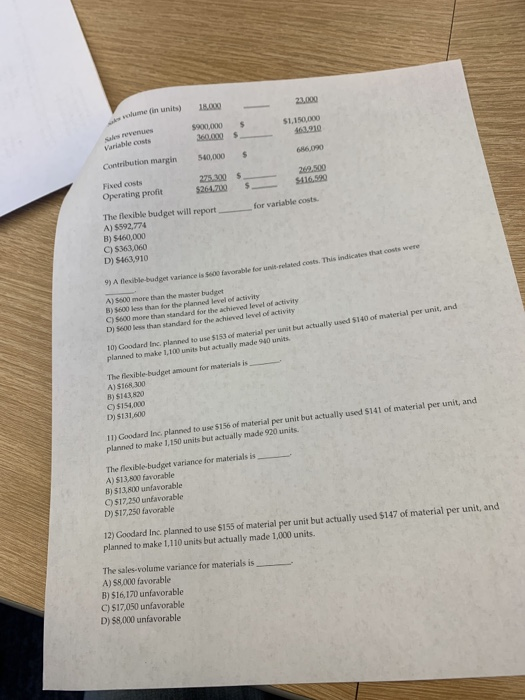

need answers  A)S.168.000 favorable B) 368.000 unfavorable C) $16.000 favorable D) $16.000 unfavorable Schooner Corporation used the following data to evaluate its current operating system sells items for $25 each and used a budgeted selling price of $25 per unit. Units sold Variable costs Fixed costs Actual 173,000 units 51.091.000 CH MINH Budgeted 181,000 units $1,285,000 $770,000 What is the state budget variance of variable costs? A) $6,000 favorable B) 36,000 unfavorable C) 5204.000 favorable D) $200.000 unfavorable 6) Schooner Corporation used the following data to evaluate its current operating system. The company sells items for $24 each and used a budgeted selling price of $24 per unit. Units sold Variable costs Fixed costs Actual 177,000 units 177,000 units $1,090,000 $804,000 Budgeted 184,000 units $1,290,000 $780,000 What is the static-budget variance of operating income? A) 58.000 favorable B) $176,000 unfavorable C) 532,000 favorable D) $7,000 unfavorable 7) Zebra Corporation currently produces baseball caps in an automated process. Expected production per month is 17,000 units, direct material costs are $7.50 per unit, and manufacturing overhead costs are $60,000 per month. Manufacturing overhead is entirely fixed costs. What is the flexible budget for 11,000 and 17,000 units, respectively? A) $60,000; $187,500 B) $60,000;$105,000 C) $142,500; $187,500 D) $142,500; $105,000 8) The actual information pertains to the month of June. As a part of the budgeting process, Great Cabinets Company developed the following static budget for June. Great Cabinets is in the process of preparing the flexible budget and understanding the results. Actual Results Flexible Budget Static Budget 20.000 18.000 me in units) 51.150.000 1,000 $ 161010 66.00 540,000 $ Contribution margin 275.00 $264.700 $116.90 Fixed costs Operating profit for variable costs The flexible budget will report A) $592,774 B) 160,000 C) 563,060 D) $463.910 related costs. This indicates tha 9) A flexible budget variance is cos favorable for A) S600 more than the master budget B) 600 less than for the planned level of activity C) 600 more than standard for the achieved level of activity D) $600 less than standard for the achieved level of activity 10) Goodard Inc. planned to use $153 of material per unit but actually used 5140 of material per unit, and planned to make1.100 units but actually made 940 units. The flexible-budget amount for materials is A) $168100 B) $143,20 O $150.000 D) $131.000 In) Goodard Inc. planned to use 5156 of material per unit but actually used $141 of material per unit, and planned to make 1,150 units but actually made 920 units. The flexible-budget variance for materials is A) $13.800 favorable B) 513.800 unfavorable C)517,250 unfavorable D) $17,250 favorable 12) Goodard Inc. planned to use $155 of material per unit but actually used $147 of material per unit, and planned to make 1.110 units but actually made 1,000 units. The sales volume variance for materials is A) S8.000 favorable B) $16,170 unfavorable C) $17,050 unfavorable D) 58.000 unfavorable

A)S.168.000 favorable B) 368.000 unfavorable C) $16.000 favorable D) $16.000 unfavorable Schooner Corporation used the following data to evaluate its current operating system sells items for $25 each and used a budgeted selling price of $25 per unit. Units sold Variable costs Fixed costs Actual 173,000 units 51.091.000 CH MINH Budgeted 181,000 units $1,285,000 $770,000 What is the state budget variance of variable costs? A) $6,000 favorable B) 36,000 unfavorable C) 5204.000 favorable D) $200.000 unfavorable 6) Schooner Corporation used the following data to evaluate its current operating system. The company sells items for $24 each and used a budgeted selling price of $24 per unit. Units sold Variable costs Fixed costs Actual 177,000 units 177,000 units $1,090,000 $804,000 Budgeted 184,000 units $1,290,000 $780,000 What is the static-budget variance of operating income? A) 58.000 favorable B) $176,000 unfavorable C) 532,000 favorable D) $7,000 unfavorable 7) Zebra Corporation currently produces baseball caps in an automated process. Expected production per month is 17,000 units, direct material costs are $7.50 per unit, and manufacturing overhead costs are $60,000 per month. Manufacturing overhead is entirely fixed costs. What is the flexible budget for 11,000 and 17,000 units, respectively? A) $60,000; $187,500 B) $60,000;$105,000 C) $142,500; $187,500 D) $142,500; $105,000 8) The actual information pertains to the month of June. As a part of the budgeting process, Great Cabinets Company developed the following static budget for June. Great Cabinets is in the process of preparing the flexible budget and understanding the results. Actual Results Flexible Budget Static Budget 20.000 18.000 me in units) 51.150.000 1,000 $ 161010 66.00 540,000 $ Contribution margin 275.00 $264.700 $116.90 Fixed costs Operating profit for variable costs The flexible budget will report A) $592,774 B) 160,000 C) 563,060 D) $463.910 related costs. This indicates tha 9) A flexible budget variance is cos favorable for A) S600 more than the master budget B) 600 less than for the planned level of activity C) 600 more than standard for the achieved level of activity D) $600 less than standard for the achieved level of activity 10) Goodard Inc. planned to use $153 of material per unit but actually used 5140 of material per unit, and planned to make1.100 units but actually made 940 units. The flexible-budget amount for materials is A) $168100 B) $143,20 O $150.000 D) $131.000 In) Goodard Inc. planned to use 5156 of material per unit but actually used $141 of material per unit, and planned to make 1,150 units but actually made 920 units. The flexible-budget variance for materials is A) $13.800 favorable B) 513.800 unfavorable C)517,250 unfavorable D) $17,250 favorable 12) Goodard Inc. planned to use $155 of material per unit but actually used $147 of material per unit, and planned to make 1.110 units but actually made 1,000 units. The sales volume variance for materials is A) S8.000 favorable B) $16,170 unfavorable C) $17,050 unfavorable D) 58.000 unfavorable

need answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started