Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need answers for both with solutions asap. Will leave a great review as soon as I get the solutions. Thank you 14. LaddiesCaddies is a

Need answers for both with solutions asap. Will leave a great review as soon as I get the solutions.

Need answers for both with solutions asap. Will leave a great review as soon as I get the solutions.

Thank you

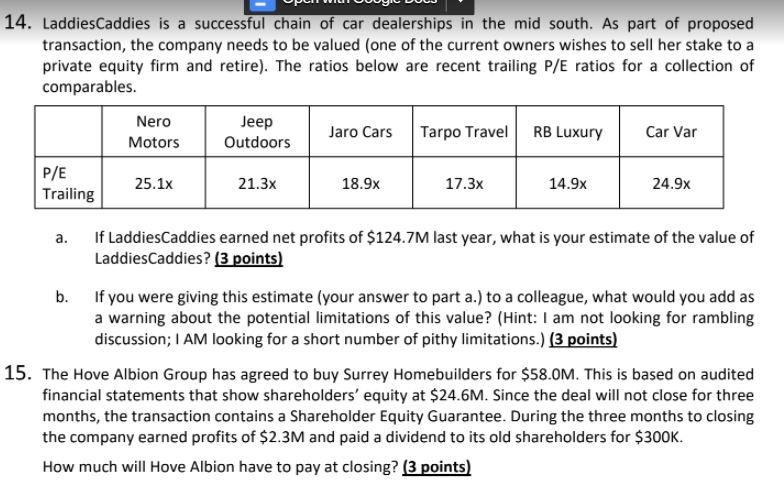

14. LaddiesCaddies is a successful chain of car dealerships in the mid south. As part of proposed transaction, the company needs to be valued (one of the current owners wishes to sell her stake to a private equity firm and retire). The ratios below are recent trailing P/E ratios for a collection of comparables. Nero Motors Jeep Outdoors Jaro Cars Tarpo Travel RB Luxury Car Var P/E Trailing 25.1x 21.3x 18.9x 17.3x 14.9x 24.9x a. If LaddiesCaddies earned net profits of $124.7M last year, what is your estimate of the value of LaddiesCaddies? (3 points) b. If you were giving this estimate (your answer to part a.) to a colleague, what would you add as a warning about the potential limitations of this value? (Hint: I am not looking for rambling discussion; I AM looking for a short number of pithy limitations.) (3 points) 15. The Hove Albion Group has agreed to buy Surrey Homebuilders for $58.0M. This is based on audited financial statements that show shareholders' equity at $24.6M. Since the deal will not close for three months, the transaction contains a Shareholder Equity Guarantee. During the three months to closing the company earned profits of $2.3M and paid a dividend to its old shareholders for $300K. How much will Hove Albion have to pay at closing? (3 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started