Need answers for questions 1-5

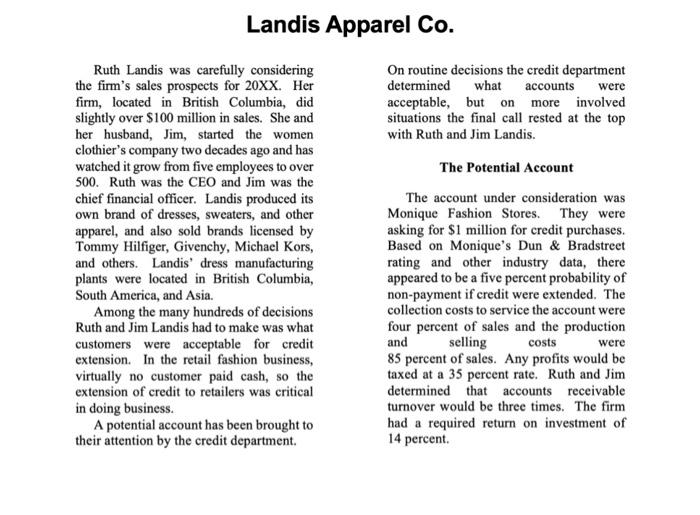

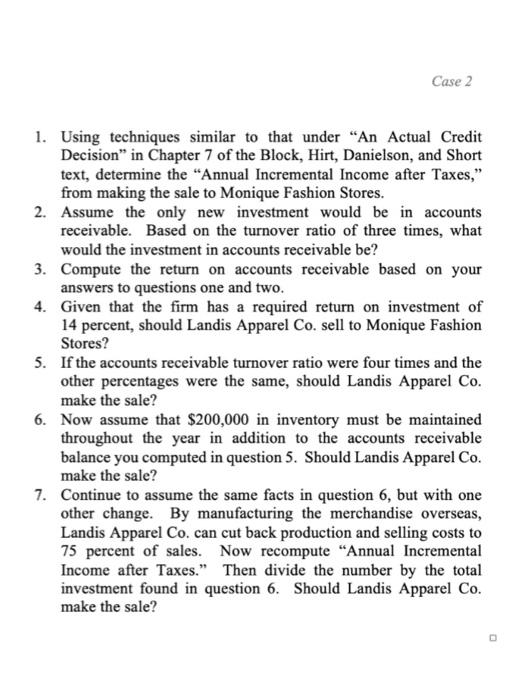

Landis Apparel Co. Ruth Landis was carefully considering On routine decisions the credit department the firm's sales prospects for 20XX. Her determined what accounts were firm, located in British Columbia, did acceptable, but on more involved slightly over $100 million in sales. She and situations the final call rested at the top her husband, Jim, started the women with Ruth and Jim Landis. clothier's company two decades ago and has watched it grow from five employees to over The Potential Account 500. Ruth was the CEO and Jim was the chief financial officer. Landis produced its The account under consideration was own brand of dresses, sweaters, and other Monique Fashion Stores. They were apparel, and also sold brands licensed by asking for $1 million for credit purchases. Tommy Hilfiger, Givenchy, Michael Kors, Based on Monique's Dun \& Bradstreet and others. Landis' dress manufacturing rating and other industry data, there plants were located in British Columbia, appeared to be a five percent probability of South America, and Asia. non-payment if credit were extended. The Among the many hundreds of decisions collection costs to service the account were Ruth and Jim Landis had to make was what four percent of sales and the production customers were acceptable for credit and selling costs were extension. In the retail fashion business, 85 percent of sales. Any profits would be virtually no customer paid cash, so the taxed at a 35 percent rate. Ruth and Jim extension of credit to retailers was critical determined that accounts receivable in doing business. turnover would be three times. The firm A potential account has been brought to had a required return on investment of their attention by the credit department. 14 percent. 1. Using techniques similar to that under "An Actual Credit Decision" in Chapter 7 of the Block, Hirt, Danielson, and Short text, determine the "Annual Incremental Income after Taxes," from making the sale to Monique Fashion Stores. 2. Assume the only new investment would be in accounts receivable. Based on the turnover ratio of three times, what would the investment in accounts receivable be? 3. Compute the return on accounts receivable based on your answers to questions one and two. 4. Given that the firm has a required return on investment of 14 percent, should Landis Apparel Co. sell to Monique Fashion Stores? 5. If the accounts receivable turnover ratio were four times and the other percentages were the same, should Landis Apparel Co. make the sale? 6. Now assume that $200,000 in inventory must be maintained throughout the year in addition to the accounts receivable balance you computed in question 5. Should Landis Apparel Co. make the sale? 7. Continue to assume the same facts in question 6 , but with one other change. By manufacturing the merchandise overseas, Landis Apparel Co. can cut back production and selling costs to 75 percent of sales. Now recompute "Annual Incremental Income after Taxes." Then divide the number by the total investment found in question 6. Should Landis Apparel Co. make the sale