need answers for sections B-E

Please show work! thank you!

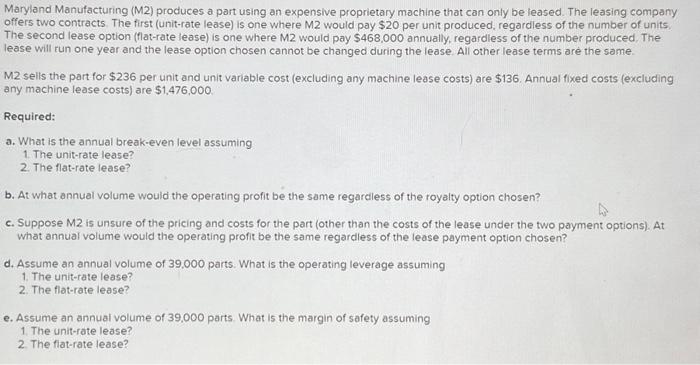

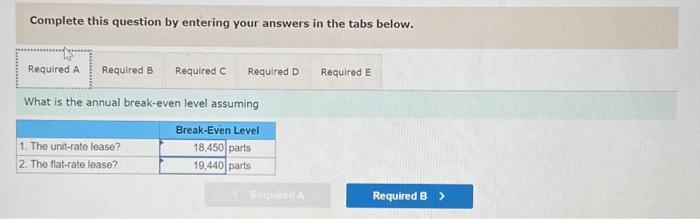

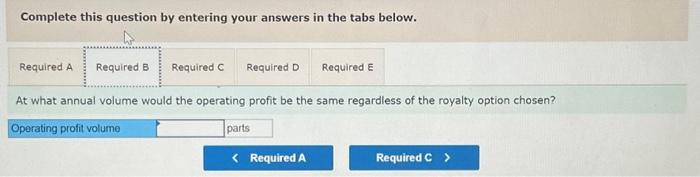

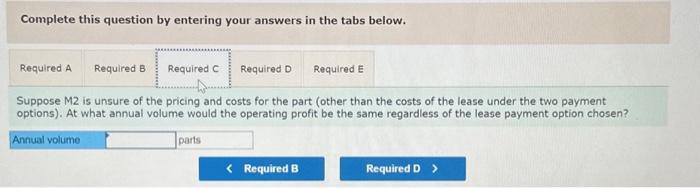

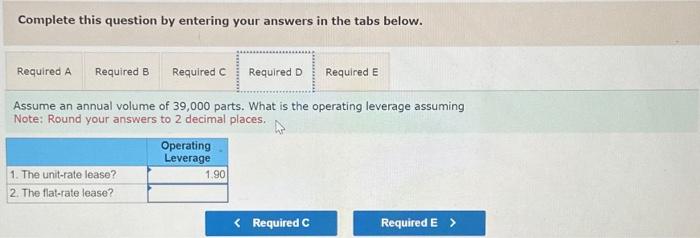

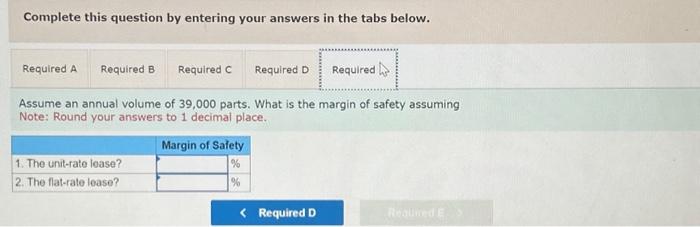

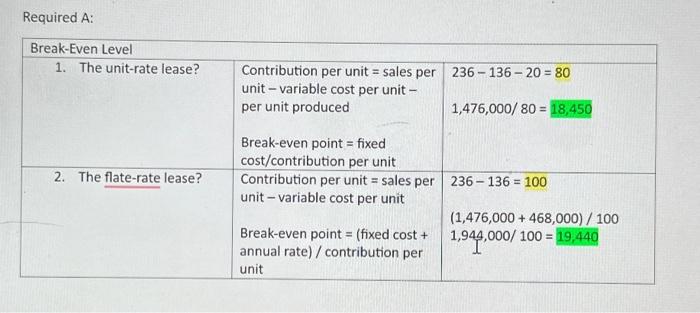

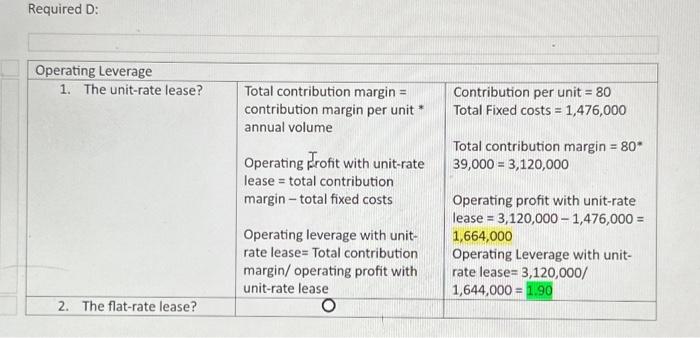

Complete this question by entering your answers in the tabs below. Assume an annual volume of 39,000 parts. What is the margin of safety assuming Note: Round your answers to 1 decimal place. Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units. The second lease option (flat-rate lease) is one where M2 would pay $468,000 annually, regardless of the number produced, The lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same. M2 sells the part for $236 per unit and unit variable cost (excluding any machine lease costs) are \$136. Annual fixed costs (excluding any machine lease costs) are $1,476,000. Required: a. What is the annual break-even level assuming 1. The unit-rate lease? 2. The flat-rate lease? b. At what annual volume would the operating profit be the same regardless of the royalty option chosen? c. Suppose M2 is unsure of the pricing and costs for the part (other than the costs of the lease under the two payment options). At What annual volume would the operating profit be the same regardless of the lease payment option chosen? d. Assume an annual volume of 39.000 parts. What is the operating leverage assuming 1. The unit-rate lease? 2. The flat-rate lease? e. Assume an annual volume of 39,000 parts. What is the margin of safety assuming 1. The unit-rate lease? 2. The fiat-rate lease? Complete this question by entering your answers in the tabs below. Assume an annual volume of 39,000 parts. What is the operating leverage assuming Note: Round your answers to 2 decimal places. Complete this question by entering your answers in the tabs below. At what annual volume would the operating profit be the same regardless of the royalty option chosen? Complete this question by entering your answers in the tabs below. Suppose M2 is unsure of the pricing and costs for the part (other than the costs of the lease under the two payment options). At what annual volume would the operating profit be the same regardless of the lease payment option chosen? Required D: \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Operating Leverage } \\ \hline 1. The unit-rate lease? & \begin{tabular}{l} Total contribution margin = \\ contribution margin per unit * \\ annual volume \\ Operating frofit with unit-rate \\ lease = total contribution \\ margin - total fixed costs \\ Operating leverage with unit- \\ rate lease= Total contribution \\ margin/ operating profit with \\ unit-rate lease \end{tabular} & \begin{tabular}{l} Contribution per unit =80 \\ Total Fixed costs =1,476,000 \\ Total contribution margin =80 \\ 39,000=3,120,000 \\ Operating profit with unit-rate \\ lease =3,120,0001,476,000= \\ 1,664,000 \\ Operating Leverage with unit- \\ rate lease =3,120,000/ \\ 1,644,000=1.90 \end{tabular} \\ \hline 2. The flat-rate lease? & 0 & \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. What is the annual break-even level assuming Required A: \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Break-Even Level } \\ \hline 1. The unit-rate lease? & \begin{tabular}{l} Contribution per unit = sales per \\ unit - variable cost per unit - \\ per unit produced \\ Break-even point = fixed \\ cost/contribution per unit \end{tabular} & \begin{tabular}{l} 23613620=80 \\ 1,476,000/80=18,450 \end{tabular} \\ \hline 2. The flate-rate lease? & \begin{tabular}{l} Contribution per unit = sales per \\ unit - variable cost per unit \\ Break-even point = (fixed cost + \\ annual rate) / contribution per \\ unit \end{tabular} & \begin{tabular}{l} 236136=100 \\ (1,476,000+468,000)/100 \\ 1,944,000/100=19,440 \end{tabular} \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. Assume an annual volume of 39,000 parts. What is the margin of safety assuming Note: Round your answers to 1 decimal place. Maryland Manufacturing (M2) produces a part using an expensive proprietary machine that can only be leased. The leasing company offers two contracts. The first (unit-rate lease) is one where M2 would pay $20 per unit produced, regardless of the number of units. The second lease option (flat-rate lease) is one where M2 would pay $468,000 annually, regardless of the number produced, The lease will run one year and the lease option chosen cannot be changed during the lease. All other lease terms are the same. M2 sells the part for $236 per unit and unit variable cost (excluding any machine lease costs) are \$136. Annual fixed costs (excluding any machine lease costs) are $1,476,000. Required: a. What is the annual break-even level assuming 1. The unit-rate lease? 2. The flat-rate lease? b. At what annual volume would the operating profit be the same regardless of the royalty option chosen? c. Suppose M2 is unsure of the pricing and costs for the part (other than the costs of the lease under the two payment options). At What annual volume would the operating profit be the same regardless of the lease payment option chosen? d. Assume an annual volume of 39.000 parts. What is the operating leverage assuming 1. The unit-rate lease? 2. The flat-rate lease? e. Assume an annual volume of 39,000 parts. What is the margin of safety assuming 1. The unit-rate lease? 2. The fiat-rate lease? Complete this question by entering your answers in the tabs below. Assume an annual volume of 39,000 parts. What is the operating leverage assuming Note: Round your answers to 2 decimal places. Complete this question by entering your answers in the tabs below. At what annual volume would the operating profit be the same regardless of the royalty option chosen? Complete this question by entering your answers in the tabs below. Suppose M2 is unsure of the pricing and costs for the part (other than the costs of the lease under the two payment options). At what annual volume would the operating profit be the same regardless of the lease payment option chosen? Required D: \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Operating Leverage } \\ \hline 1. The unit-rate lease? & \begin{tabular}{l} Total contribution margin = \\ contribution margin per unit * \\ annual volume \\ Operating frofit with unit-rate \\ lease = total contribution \\ margin - total fixed costs \\ Operating leverage with unit- \\ rate lease= Total contribution \\ margin/ operating profit with \\ unit-rate lease \end{tabular} & \begin{tabular}{l} Contribution per unit =80 \\ Total Fixed costs =1,476,000 \\ Total contribution margin =80 \\ 39,000=3,120,000 \\ Operating profit with unit-rate \\ lease =3,120,0001,476,000= \\ 1,664,000 \\ Operating Leverage with unit- \\ rate lease =3,120,000/ \\ 1,644,000=1.90 \end{tabular} \\ \hline 2. The flat-rate lease? & 0 & \\ \hline \end{tabular} Complete this question by entering your answers in the tabs below. What is the annual break-even level assuming Required A: \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Break-Even Level } \\ \hline 1. The unit-rate lease? & \begin{tabular}{l} Contribution per unit = sales per \\ unit - variable cost per unit - \\ per unit produced \\ Break-even point = fixed \\ cost/contribution per unit \end{tabular} & \begin{tabular}{l} 23613620=80 \\ 1,476,000/80=18,450 \end{tabular} \\ \hline 2. The flate-rate lease? & \begin{tabular}{l} Contribution per unit = sales per \\ unit - variable cost per unit \\ Break-even point = (fixed cost + \\ annual rate) / contribution per \\ unit \end{tabular} & \begin{tabular}{l} 236136=100 \\ (1,476,000+468,000)/100 \\ 1,944,000/100=19,440 \end{tabular} \\ \hline \end{tabular}