Question

NEED ASAP Computer King Company Balance Sheet Items as of Nov 31, 1996: Cash $ 5,900 Supplies Inventory $ 550 Land $10,000 Accounts Payable $

NEED ASAP

Computer King Company

Balance Sheet Items as of Nov 31, 1996:

Cash $ 5,900

Supplies Inventory $ 550

Land $10,000

Accounts Payable $ 400

Pat King, Capital $16,050

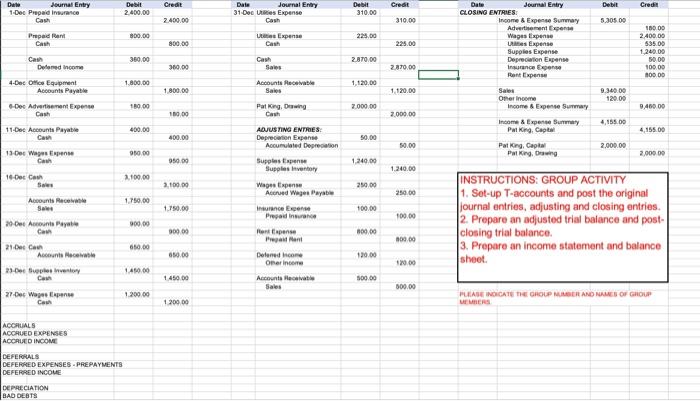

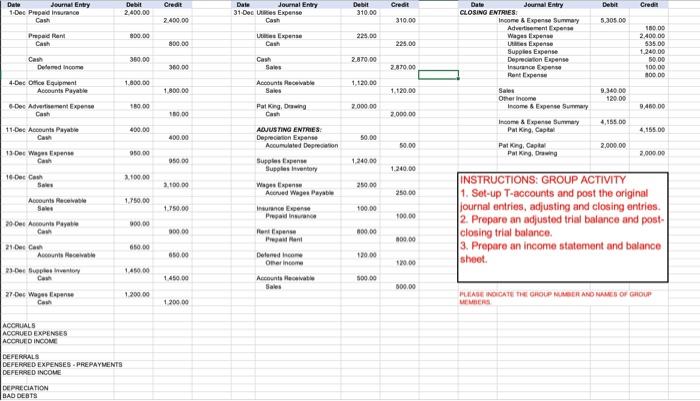

The following transaction occurred during the month of December, 1996:

Dec 1. Computer King paid a premium of $2,400 for a comprehensive insurance policy covering liability, theft and fire. The policy covers a two-year period.

Dec 1. Computer King paid rent for December $800. The company from which Computer King is renting its store space now requires the payment of rent on the 1st of each month, rather than the end of the month.

Dec 1. Computer King received an offer from a local retailer to rent the land purchased on November 5. The retailer plans to use the land as a parking lot for its employees and customers. Computer King agreed to rent the land for three months, payable in advance. Computer King received $360 for three months rent beginning December 1.

Dec 4. Purchased office equipment on account from Executive Supply Co. for $1,800.

Dec 6. Paid $180 for a newspaper advertisement.

Dec 11. Paid supply creditors $400.

Dec 13. Paid receptionists and part-time assistant $950 for two weeks wages.

Dec 16. Received $3,100 from sales earned the first half of December.

Dec 16. Sales earned on account totaled $1,750 for the first half of December.

Dec 20. Paid $900 to Executive Supply Co. on the $1,800 debt owed.

Dec 21. Received $650 from customers in payment of their accounts.

Dec 23. Paid $1,450 for supplies.

Dec 27. Paid receptionists and part-time assistant $1,200 for two weeks wages.

Dec 31. Paid $310 telephone bill for the month.

Dec 31. Paid $225 electric bill for the month.

Dec 31. Received $2,870 from sales earned for the second half of December.

Dec 31. Sales earned on account totaled $1,120 for the second half of December.

Dec 31. Pat King withdrew $2,000 for personal use.

Other Information:

- Total Depreciation for the month of December amounted to $50.

- Supplies Inventory on hand on December 31 was worth $760.

- December 28 and 29 is Saturday and Sunday, respectively. Wages earned by workers on December 30 and 31 totaled to $250.

- Computer King signed an agreement with Danker Co. on December 15. The agreement provides that Computer King will be on call to answer questions and render assistance to Danker Co.s employees concerning computer problems. The services provided will be billed to Danker Co. on the fifteenth of each month at a rate of $20 per hour. As of December 31, Computer King has provided 25 hours of assistance to Danker Co.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started