Question

NEED ASSISTANCE WITH CASH BUDGET DISBURSEMENT ON A FINANCIAL STATEMENT FOR VARIABLE AND FIXED AMOUNTS. Payment is based on certain criteria listed below. I have

NEED ASSISTANCE WITH CASH BUDGET DISBURSEMENT ON A FINANCIAL STATEMENT

FOR VARIABLE AND FIXED AMOUNTS.

Payment is based on certain criteria listed below.

I have taken screenshots and attached the data accordingly. .

The first set of numbers is the information used to solve the problem. Some of the incomplete work is empty or wrong because I am not sure what to do! The fixed annual insurance may be incorrect as I spaced it out over the 12 months, but I don't think I should have done that. Am I correct in thinking that the $84,000 would show up ONLY in January?

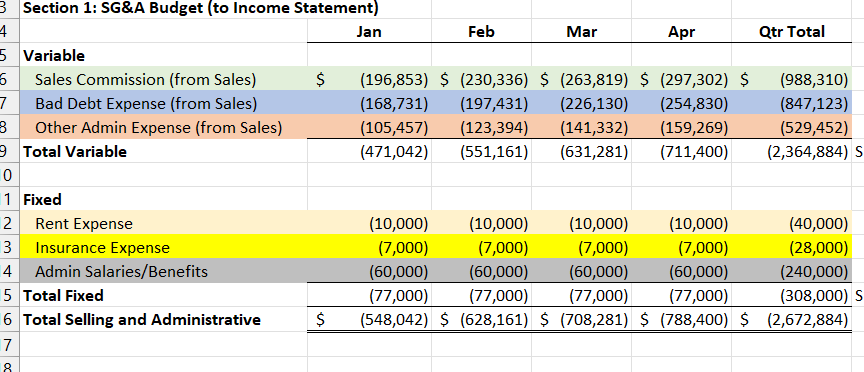

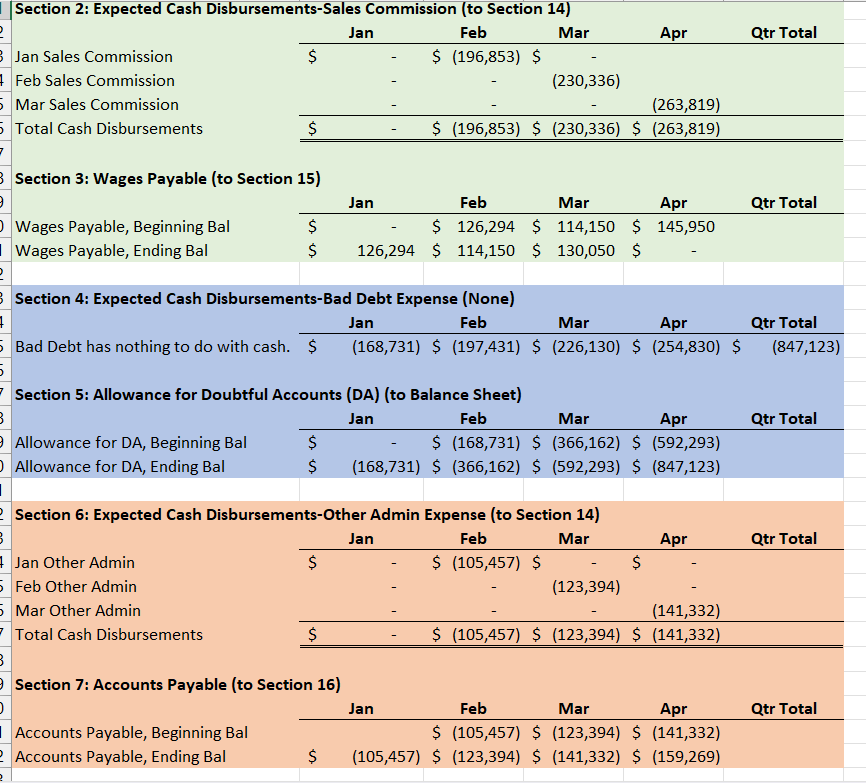

h. Sales commissions are 14% of sales price. 100% of sales commissions are payable on the 15th day of the month after the sale.

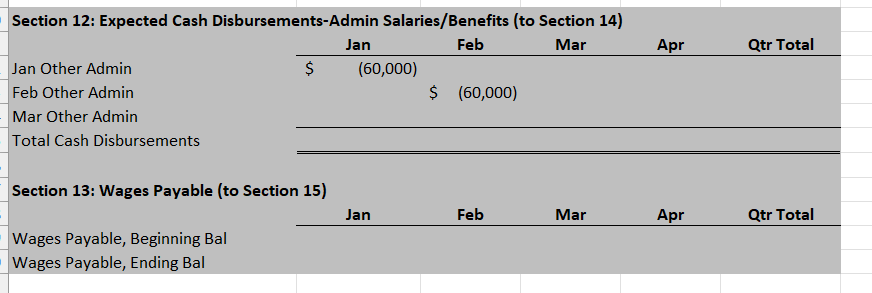

i. Administrative salaries and fringe benefits are $60,000 per month. Administrative salaries are paid one-half on the third Friday of the current month and one-half is on the first Friday of the next month.

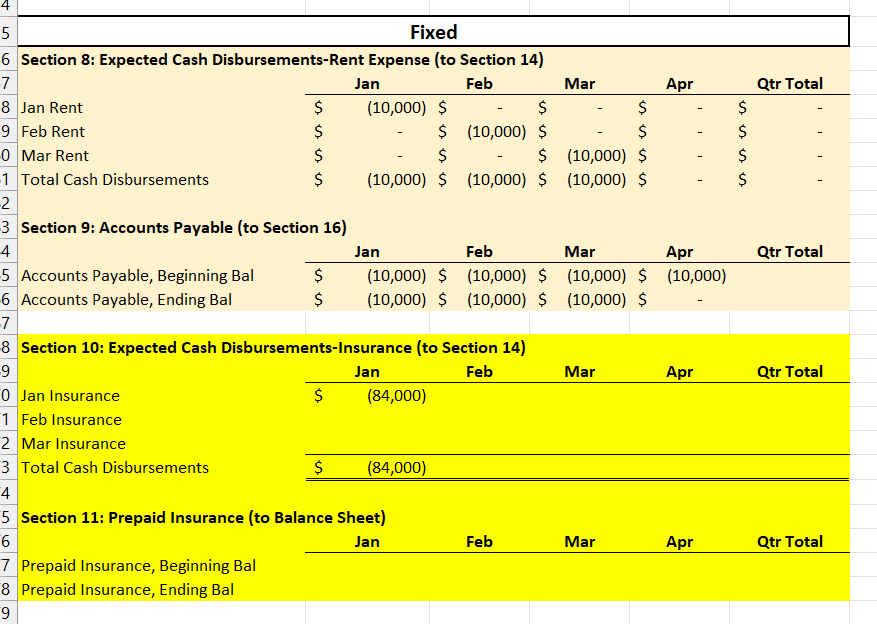

j. Rent on administrative office space is $10,000 per month. Rent for each month is due on the first day of each month.

k. On January 1, 20xx the Company will pay an $84,000 annual insurance liability premium covering January through December, 20xx. This insurance policy is a different policy than MOH insurance.

l. Other administrative expenses are estimated to be 7.5% of sales. Other administrative expenses are paid in the month after the expense occurs.

| Section 1: SG&A Budget (to Income Statement) | |||||

| Jan | Feb | Mar | Apr | Qtr Total | |

| Variable | |||||

| Sales Commission (from Sales) | $ (196,853) | $ (230,336) | $ (263,819) | $ (297,302) | $ (988,310) |

| Bad Debt Expense (from Sales) | (168,731) | (197,431) | (226,130) | (254,830) | (847,123) |

| Other Admin Expense (from Sales) | (105,457) | (123,394) | (141,332) | (159,269) | (529,452) |

| Total Variable | (471,042) | (551,161) | (631,281) | (711,400) | (2,364,884) |

| Fixed | |||||

| Rent Expense | (10,000) | (10,000) | (10,000) | (10,000) | (40,000) |

| Insurance Expense | (7,000) | (7,000) | (7,000) | (7,000) | (28,000) |

| Admin Salaries/Benefits | (60,000) | (60,000) | (60,000) | (60,000) | (240,000) |

| Total Fixed | (77,000) | (77,000) | (77,000) | (77,000) | (308,000) |

| Total Selling and Administrative | $ (548,042) | $ (628,161) | $ (708,281) | $ (788,400) | $ (2,672,884) |

I AM UNSURE ABOUT JANUARY AND WHETHER THE OTHER MONTHS ARE CORRECT!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started