2. Yield To Maturity. A firm's bonds have a maturity of 10 years with a $1,000 face value, have an 8% semiannual coupon, are

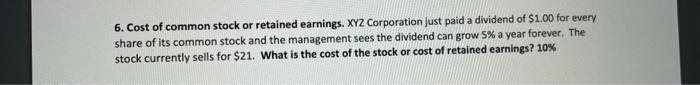

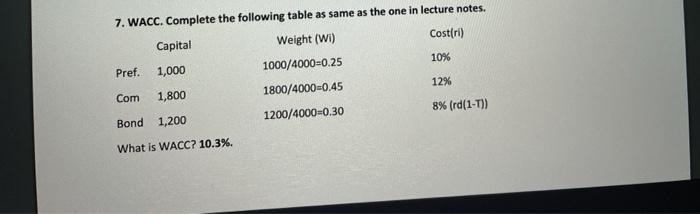

2. Yield To Maturity. A firm's bonds have a maturity of 10 years with a $1,000 face value, have an 8% semiannual coupon, are callable in 5 years at $1,050, and currently sell at a price of $1,100. What are their nominal yield to maturity and their nominal yield to call? YTM-6.617%, YTC=6.4886% 3. Variable growth rates. XYZ Company recently paid a common stock dividend of $1.50 and the management predicts the following dividend growth rates: 7% for next four years, and then turns to 3% forever. The company has a beta of 0.8. The current risk free rate of interest is 4% and the market risk premium is 5%. What is the stock price? $35.71 (see lecture notes for details). 4. Cost of bond. XYZ Corporation has an outstanding 10-year bond with a 6% coupon rate which sells for $1,015. The company has a 35% tax rate. How much does the bond cost to the company? 3.77% 5. Cost of new preferred stock. Assume that a new preferred stock with a par of $50 pays a 6% dividend. The stock currently sells for $37.50. The flotation cost is 10% of the price. How much is the cost of the new preferred stock? 8.89% 6. Cost of common stock or retained earnings. XYZ Corporation just paid a dividend of $1.00 for every share of its common stock and the management sees the dividend can grow 5% a year forever. The stock currently sells for $21. What is the cost of the stock or cost of retained earnings? 10% 7. WACC. Complete the following table as same as the one in lecture notes. Pref.. Capital 1,000 Weight (Wi) Cost(ri) 1000/4000=0.25 10% Com 1,800 1800/4000=0.45 12% Bond 1,200 1200/4000=0.30 8% (rd (1-T)) What is WACC? 10.3%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets go through each part step by step 2 Yield to Maturity YTM and Yield to Call YTC Given Face Value 1000 Semiannual Coupon Rate 8 per annum 4 per pe...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started