Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need calculations done in accordance to all 3: FIFO, LIFO, and Weighted Average Part 3: Inventory Valuation Finally, in the company, determine which inventory method

Need calculations done in accordance to all 3: FIFO, LIFO, and Weighted Average

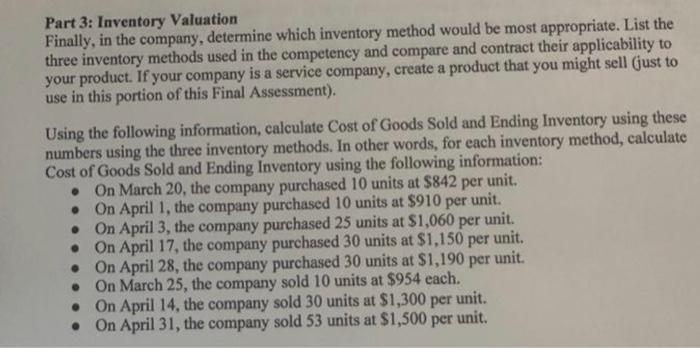

Part 3: Inventory Valuation Finally, in the company, determine which inventory method would be most appropriate. List the three inventory methods used in the competency and compare and contract their applicability to your product. If your company is a service company, create a product that you might sell (just to use in this portion of this Final Assessment). Using the following information, calculate Cost of Goods Sold and Ending Inventory using these numbers using the three inventory methods. In other words, for each inventory method, calculate Cost of Goods Sold and Ending Inventory using the following information: - On March 20, the company purchased 10 units at $842 per unit. - On April 1, the company purchased 10 units at $910 per unit. - On April 3, the company purchased 25 units at \$1,060 per unit. - On April 17, the company purchased 30 units at $1,150 per unit. - On April 28, the company purchased 30 units at \$1,190 per unit. - On March 25, the company sold 10 units at \$954 each. - On April 14, the company sold 30 units at $1,300 per unit. - On April 31, the company sold 53 units at \$1,500 per unit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started