Question

Need Calculations Telecom Inc. is a family-owned business founded in 1985, and it has been providing TV broadcasting in east Canada. In 2008, it planned

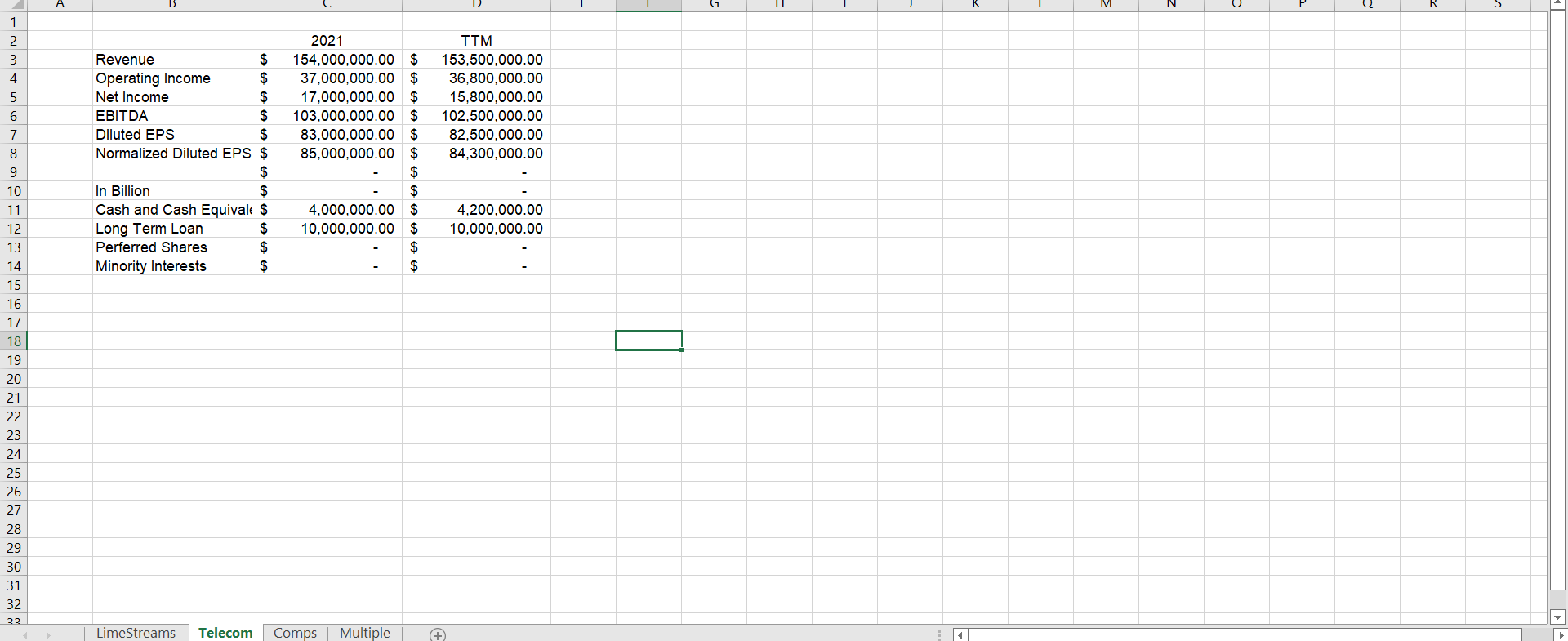

Need Calculations Telecom Inc. is a family-owned business founded in 1985, and it has been providing TV broadcasting in east Canada. In 2008, it planned to go public and list on the Toronto exchange. However, the financial market collapsed, and the company had to withdraw from the IPO process. Instead, Telecom proceeded with a private placement with a syndicate of local private equity groups and issued 5 million shares at $20 per share. After issuing, Telecom has 10 million shares outstanding. Five years ago, the company also borrowed a $20 million long-term loan outstanding at a 6.5% annual interest rate to expand its satellite TV business. Telecom's marginal tax rate is 34%. Industry Outlook In 2019, the tv broadcasting industry generated $2.8 billion in revenue, with a compounded annual growth rate of 1%. The industry is profitable but highly saturated. Currently, there are five major players dominating the market. Bell Blue Media, 35% market shares CBC News, 20% market shares Corus Live Inc., 15% market shares Rog Entertainment 10% market shares Rouge Stone Inc. 6% market shares Others, 14% market shares According to the industry report, this industry in Canada will continue to be challenged by a shifting media environment over the next decade. The main threat to this industry is primarily online streaming platforms in the USA, and this competition is expected to intensify and plummet industry growth and revenue. Consumers continue to lower their reliance on TV broadcasts for their media source as they increase their dependence on digital forms, including tablets and mobile phones. This trend lures advertisers to increase their commercial budget for new media outlets. In response, the Canadian Radio-television and Telecommunications Commission (CRTC) has lessened content rules and increased funding and pilot programs to provide new avenues for Canadian broadcasting companies, but this may ultimately not be enough to offset further revenue declines. The board of Telecom, mainly controlled by the private equity groups, called a board meeting to urge the management to develop a forward-thinking strategy and reevaluate the IPO opportunity. The board concluded that they must restructure their business models, add digital platform infrastructure, and generate online advertising revenue. The private equity groups have held their investment for more than ten years. Now it is time for them to exist and capitalize on their return via IPO in the stock market. The board wants to know the intrinsic value of their holdings. Board's Agenda One of the directors suggested that the company invests in online streaming platforms and set up a few content-creating studios in-house. She believes this strategy will create synergy between new streaming and current broadcasting. Telecom is able to utilize current employees' talent and maintain content quality and brand identity. She also holds a seat on another company, LimeStreaming Inc. as an independent director. LimeStream has been growing rapidly in the online stream space. She knows that the founders of LimeStreaming are looking for buyers. She suggested the board consider an acquisition as an option to expand Telecom's online business advertising service. The board requests a second opinion on the acquisition deal and the IPO. They want to know whether the acquisition will benefit their shareholders and how much would be the fair value of LimeStreaming Inc. Also, all the board members agree to proceed with the IPO and determine the fair share price before moving forward. Valuation Methods In valuing a business, there is no single or specific mathematical formula. The particular approach and the factors to consider will vary in each case. Where there is evidence of open market transactions having occurred involving the shares, or operating assets, of a business interest, those transactions may often form the basis for establishing the value of the company. Because LimeStreaming and Telecom are private companies, which lack open market transactions, the generally accepted approaches for valuing a private business interest are: Method 1: The Capitalized Earnings Approach (LimeStream) Method 2 The Capitalized EBITDA Approach (LimeStream) Method 3: The Market Approach (Telecom) The Capitalized Earnings/EDITDA Approaches are a general way of determining a business value by using one or more methods wherein a value is determined by capitalizing or discounting anticipated future benefits. This approach emphases on the continuation of the operations as if the business is a "going concern". The Market Approach to valuation is a general way of determining a business value or equity interest by using one or more methods that compare the subject entity to similar businesses, business ownership interests, and securities that have been sold in the public market at a fair price. In the report, you need to address the board's concern regarding the LimeStream acquisition and the company IPO, including the pros and cons of each strategy. Moreover, you are requested to perform quantitative analysis and provide the business value of LimeStream and the fair share price of Telecom Inc

Need Calculations Telecom Inc. is a family-owned business founded in 1985, and it has been providing TV broadcasting in east Canada. In 2008, it planned to go public and list on the Toronto exchange. However, the financial market collapsed, and the company had to withdraw from the IPO process. Instead, Telecom proceeded with a private placement with a syndicate of local private equity groups and issued 5 million shares at $20 per share. After issuing, Telecom has 10 million shares outstanding. Five years ago, the company also borrowed a $20 million long-term loan outstanding at a 6.5% annual interest rate to expand its satellite TV business. Telecom's marginal tax rate is 34%. Industry Outlook In 2019, the tv broadcasting industry generated $2.8 billion in revenue, with a compounded annual growth rate of 1%. The industry is profitable but highly saturated. Currently, there are five major players dominating the market. Bell Blue Media, 35% market shares CBC News, 20% market shares Corus Live Inc., 15% market shares Rog Entertainment 10% market shares Rouge Stone Inc. 6% market shares Others, 14% market shares According to the industry report, this industry in Canada will continue to be challenged by a shifting media environment over the next decade. The main threat to this industry is primarily online streaming platforms in the USA, and this competition is expected to intensify and plummet industry growth and revenue. Consumers continue to lower their reliance on TV broadcasts for their media source as they increase their dependence on digital forms, including tablets and mobile phones. This trend lures advertisers to increase their commercial budget for new media outlets. In response, the Canadian Radio-television and Telecommunications Commission (CRTC) has lessened content rules and increased funding and pilot programs to provide new avenues for Canadian broadcasting companies, but this may ultimately not be enough to offset further revenue declines. The board of Telecom, mainly controlled by the private equity groups, called a board meeting to urge the management to develop a forward-thinking strategy and reevaluate the IPO opportunity. The board concluded that they must restructure their business models, add digital platform infrastructure, and generate online advertising revenue. The private equity groups have held their investment for more than ten years. Now it is time for them to exist and capitalize on their return via IPO in the stock market. The board wants to know the intrinsic value of their holdings. Board's Agenda One of the directors suggested that the company invests in online streaming platforms and set up a few content-creating studios in-house. She believes this strategy will create synergy between new streaming and current broadcasting. Telecom is able to utilize current employees' talent and maintain content quality and brand identity. She also holds a seat on another company, LimeStreaming Inc. as an independent director. LimeStream has been growing rapidly in the online stream space. She knows that the founders of LimeStreaming are looking for buyers. She suggested the board consider an acquisition as an option to expand Telecom's online business advertising service. The board requests a second opinion on the acquisition deal and the IPO. They want to know whether the acquisition will benefit their shareholders and how much would be the fair value of LimeStreaming Inc. Also, all the board members agree to proceed with the IPO and determine the fair share price before moving forward. Valuation Methods In valuing a business, there is no single or specific mathematical formula. The particular approach and the factors to consider will vary in each case. Where there is evidence of open market transactions having occurred involving the shares, or operating assets, of a business interest, those transactions may often form the basis for establishing the value of the company. Because LimeStreaming and Telecom are private companies, which lack open market transactions, the generally accepted approaches for valuing a private business interest are: Method 1: The Capitalized Earnings Approach (LimeStream) Method 2 The Capitalized EBITDA Approach (LimeStream) Method 3: The Market Approach (Telecom) The Capitalized Earnings/EDITDA Approaches are a general way of determining a business value by using one or more methods wherein a value is determined by capitalizing or discounting anticipated future benefits. This approach emphases on the continuation of the operations as if the business is a "going concern". The Market Approach to valuation is a general way of determining a business value or equity interest by using one or more methods that compare the subject entity to similar businesses, business ownership interests, and securities that have been sold in the public market at a fair price. In the report, you need to address the board's concern regarding the LimeStream acquisition and the company IPO, including the pros and cons of each strategy. Moreover, you are requested to perform quantitative analysis and provide the business value of LimeStream and the fair share price of Telecom Inc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started