Need Chipotle Income Statement projections for 2020 and 2021. Please complete on excel and show steps

For 2020, management is anticipating the following:

- Mid-single digit comparable restaurant sales growth

- 150 to 165 new restaurant openings

- An estimated effective full year tax rate between 26% and 29%

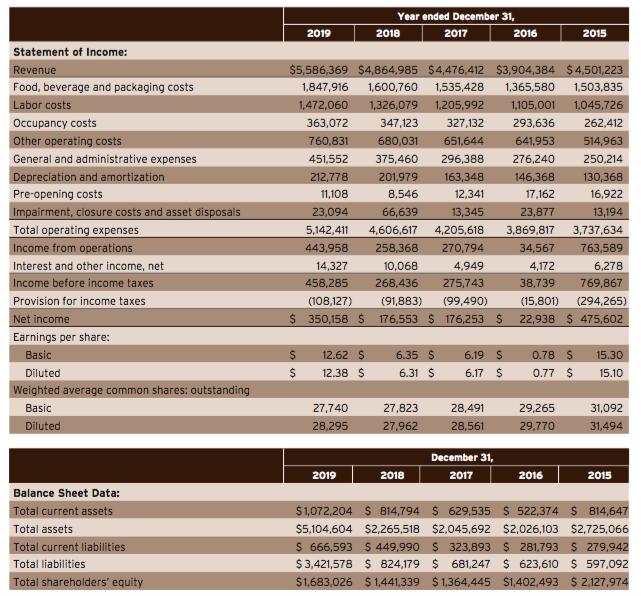

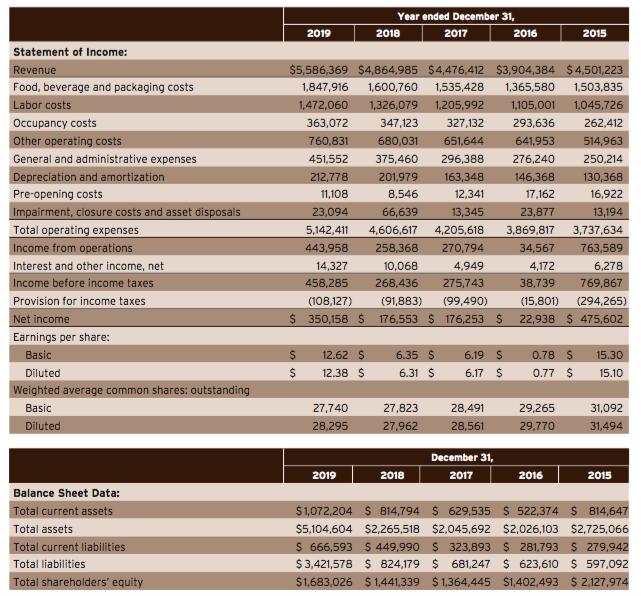

Year ended December 31, 2019 2018 2017 2016 2015 Statement of Income: Revenue Food, beverage and packaging costs Labor costs Occupancy costs Other operating costs General and administrative expenses Depreciation and amortization Pre-opening costs Impairment, closure costs and asset disposals Total operating expenses Income from operations Interest and other income, net Income before income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Weighted average common shares: outstanding Basic Diluted $5,586,369 $4,864,985 $4,476,412 $3,904,384 $4,501,223 1,847,916 1,600,760 1,535,428 1,365,580 1,503,835 1,472,060 1,326,079 1,205,992 1,105,001 1,045,726 363,072 347,123 327,132 293,636 262,412 760,831 680,031 651,644 641,953 514,963 451,552 375,460 296,388 276,240 250,214 212,778 201,979 163,348 146,368 130,368 11,108 8,546 12,341 17,162 16,922 23,094 66,639 13,345 23,877 13,194 5,142,411 4,606,617 4,205,618 3,869,817 3,737,634 443,958 258,368 270,794 34,567 763,589 14,327 10,068 4,949 4,172 6,278 458,285 268,436 275,743 38,739 769,867 (108,127) (91,883) (99,490) (15,801) (294,265) $ 350,158 $ 176,553 $ 176,253 $ 22,938 $ 475,602 $ 15.30 12.62 $ 12.38 $ 6.35 $ 6.31 $ 6.19 $ 6.17 $ 0.78 $ 0.77 $ $ 15.10 27,740 28,295 27.823 27,962 28,491 28,561 29,265 29,770 31,092 31,494 December 31, 2017 2019 2018 2016 2015 Balance Sheet Data: Total current assets Total assets Total current liabilities Total liabilities Total shareholders' equity $1,072,204 $814,794 $ 629,535 $ 522,374 $814,647 $5,104,604 $2,265,518 $2,045,692 $2,026,103 $2,725,066 $ 666,593 $ 449,990 $ 323,893 $ 281,793 $ 279,942 $ 3,421,578 $ 824,179 $ 681,247 $ 623,610 $ 597,092 $1,683,026 $1,441,339 $1,364,445 $1,402,493 $ 2,127,974 Year ended December 31, 2019 2018 2017 2016 2015 Statement of Income: Revenue Food, beverage and packaging costs Labor costs Occupancy costs Other operating costs General and administrative expenses Depreciation and amortization Pre-opening costs Impairment, closure costs and asset disposals Total operating expenses Income from operations Interest and other income, net Income before income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Weighted average common shares: outstanding Basic Diluted $5,586,369 $4,864,985 $4,476,412 $3,904,384 $4,501,223 1,847,916 1,600,760 1,535,428 1,365,580 1,503,835 1,472,060 1,326,079 1,205,992 1,105,001 1,045,726 363,072 347,123 327,132 293,636 262,412 760,831 680,031 651,644 641,953 514,963 451,552 375,460 296,388 276,240 250,214 212,778 201,979 163,348 146,368 130,368 11,108 8,546 12,341 17,162 16,922 23,094 66,639 13,345 23,877 13,194 5,142,411 4,606,617 4,205,618 3,869,817 3,737,634 443,958 258,368 270,794 34,567 763,589 14,327 10,068 4,949 4,172 6,278 458,285 268,436 275,743 38,739 769,867 (108,127) (91,883) (99,490) (15,801) (294,265) $ 350,158 $ 176,553 $ 176,253 $ 22,938 $ 475,602 $ 15.30 12.62 $ 12.38 $ 6.35 $ 6.31 $ 6.19 $ 6.17 $ 0.78 $ 0.77 $ $ 15.10 27,740 28,295 27.823 27,962 28,491 28,561 29,265 29,770 31,092 31,494 December 31, 2017 2019 2018 2016 2015 Balance Sheet Data: Total current assets Total assets Total current liabilities Total liabilities Total shareholders' equity $1,072,204 $814,794 $ 629,535 $ 522,374 $814,647 $5,104,604 $2,265,518 $2,045,692 $2,026,103 $2,725,066 $ 666,593 $ 449,990 $ 323,893 $ 281,793 $ 279,942 $ 3,421,578 $ 824,179 $ 681,247 $ 623,610 $ 597,092 $1,683,026 $1,441,339 $1,364,445 $1,402,493 $ 2,127,974