Answered step by step

Verified Expert Solution

Question

1 Approved Answer

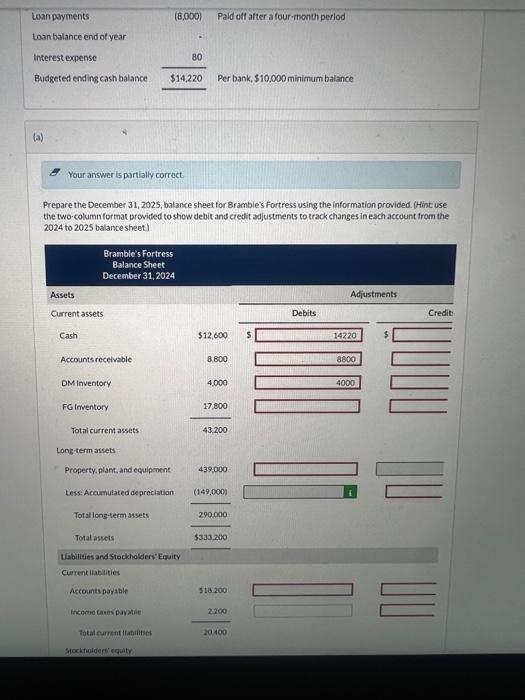

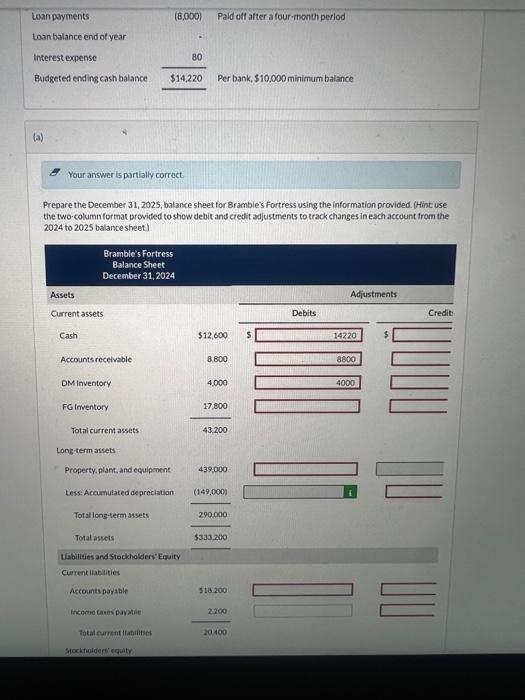

need debits and credit adjustments Your answer is partially correct. Prepare the December 31, 2025, balance sheet for Bramble's Fortress using the information provided. (Hint:

need debits and credit adjustments

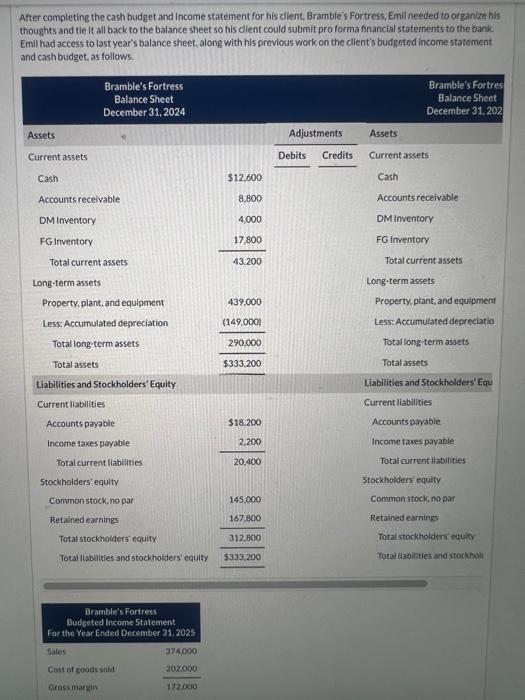

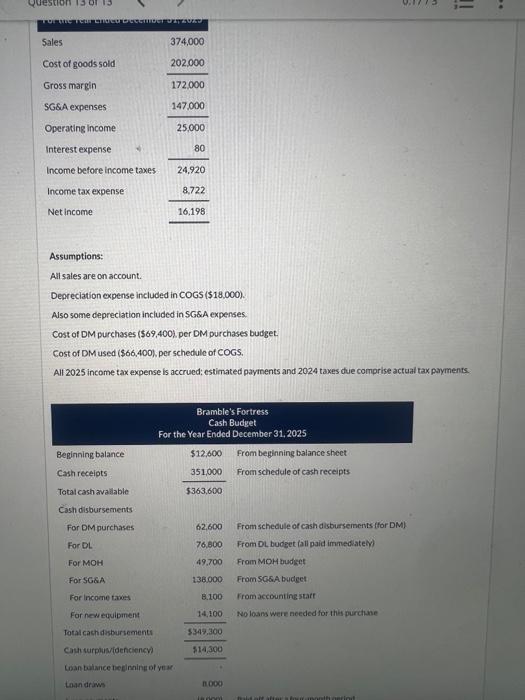

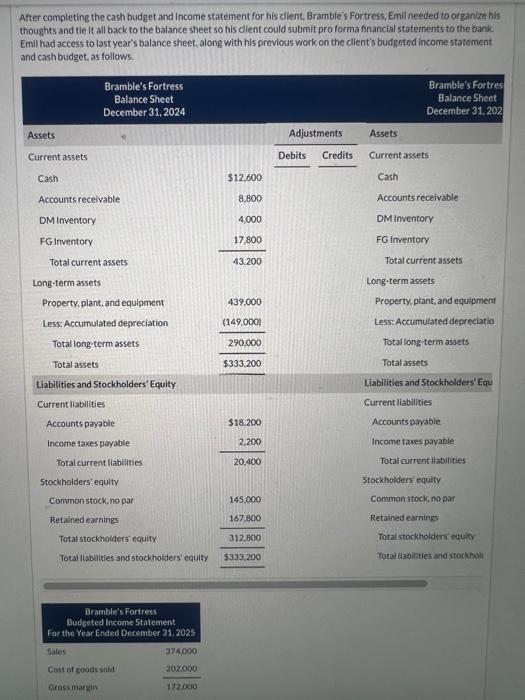

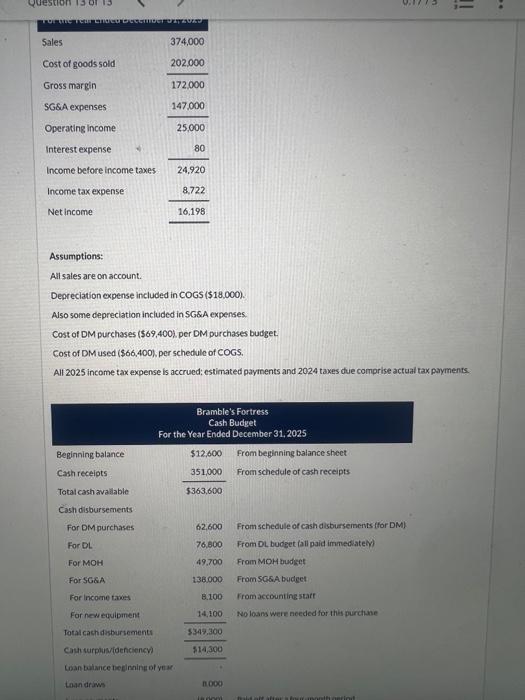

Your answer is partially correct. Prepare the December 31, 2025, balance sheet for Bramble's Fortress using the information provided. (Hint: use the two-column format provided to show debit and credit adjustments to track changes in each account from the 2024 to 2025 balance sheet) After completing the cash budget and income statement for his clent, Bramble's Fortress, Emil needed to organize his thoughts and tie it all back to the balance sheet so his client could submit pro forma financial statements to the bank Emill had access to last year's balance sheet, along with his previous work on the cllent's budgeted income statement and cash budget. as follows. Assumptions: All sales are on account. Depreciation expense included in coGs($18,000). Also some depreciation included in SG\&A expenses. Cost of DM purchases ($69,400), per OM purchases budget. Cost of DM used ( $66,400), per schedule of COGS. All 2025 income tax expense is accrued: estimated payments and (b) Your answer is partially correct. Prepare the December 31, 2025, balance sheet for Bramble's Fortress using the information provided. (Hint: use the two-column format provided to show debit and credit adjustments to track changes in each account from the 2024 to 2025 balance sheet) After completing the cash budget and income statement for his clent, Bramble's Fortress, Emil needed to organize his thoughts and tie it all back to the balance sheet so his client could submit pro forma financial statements to the bank Emill had access to last year's balance sheet, along with his previous work on the cllent's budgeted income statement and cash budget. as follows. Assumptions: All sales are on account. Depreciation expense included in coGs($18,000). Also some depreciation included in SG\&A expenses. Cost of DM purchases ($69,400), per OM purchases budget. Cost of DM used ( $66,400), per schedule of COGS. All 2025 income tax expense is accrued: estimated payments and (b)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started