- NEED DONE ASAP!!!! PLEASE HELP! need part 4 done and the other images should help solve part 4

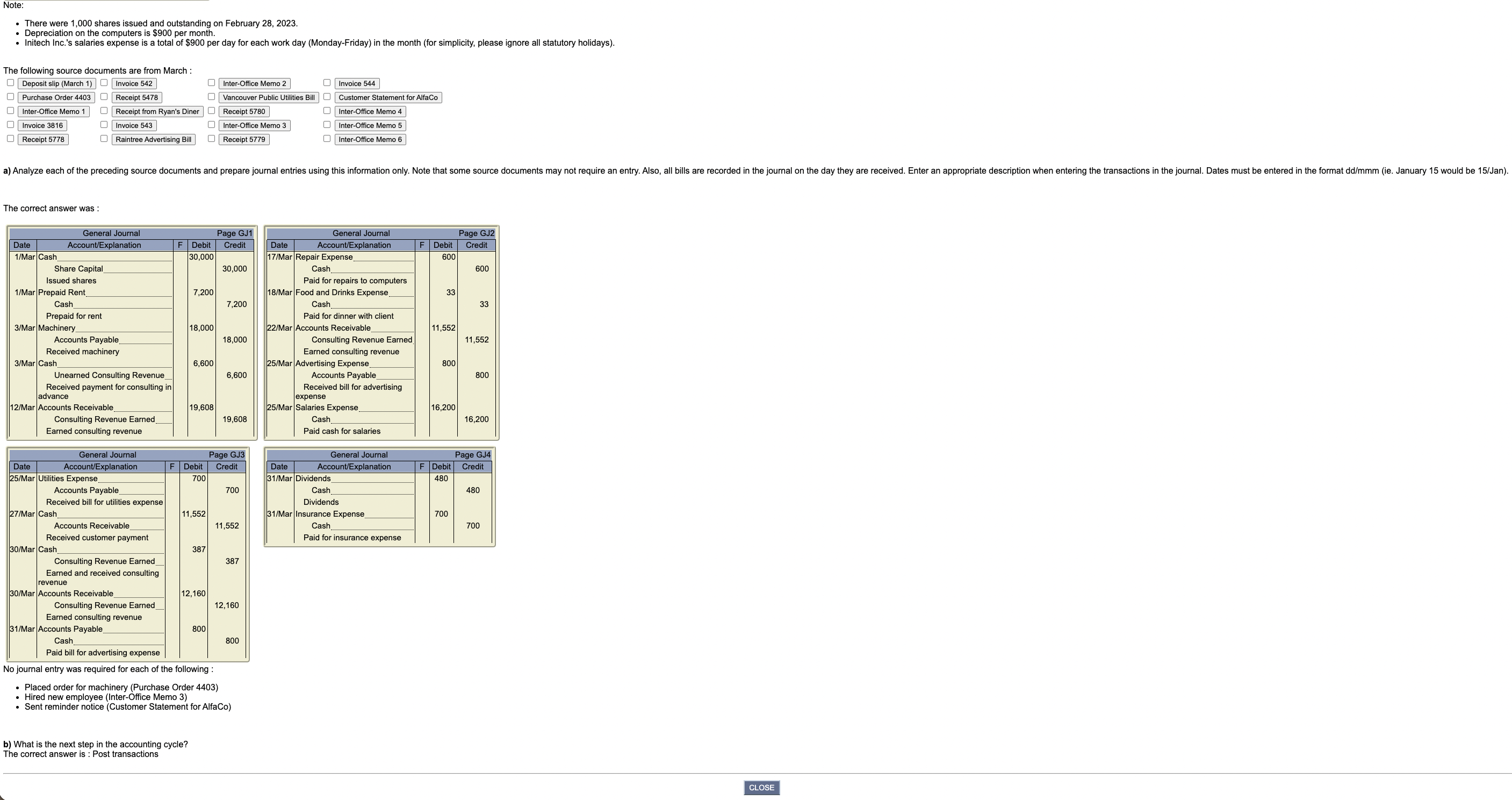

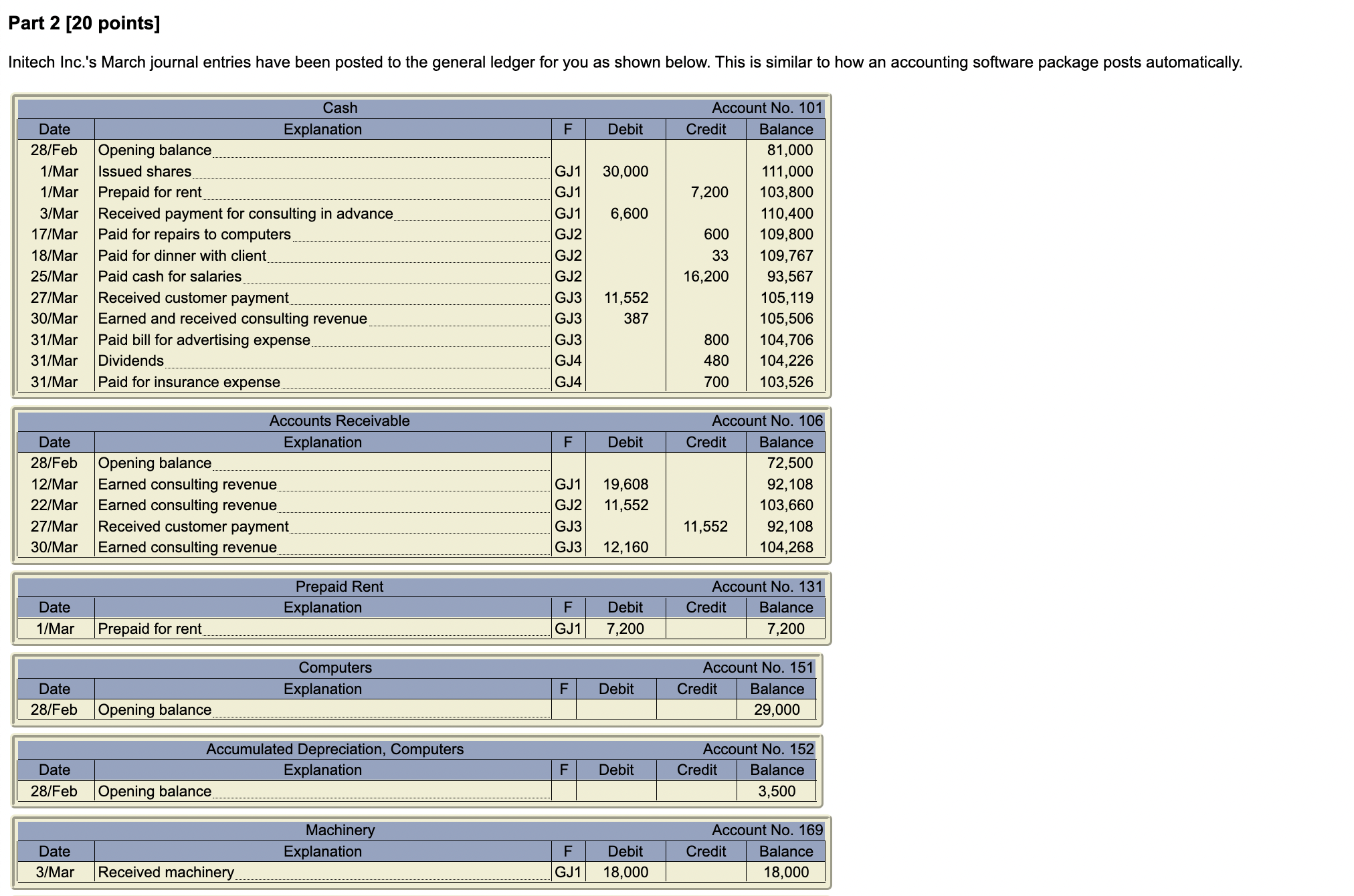

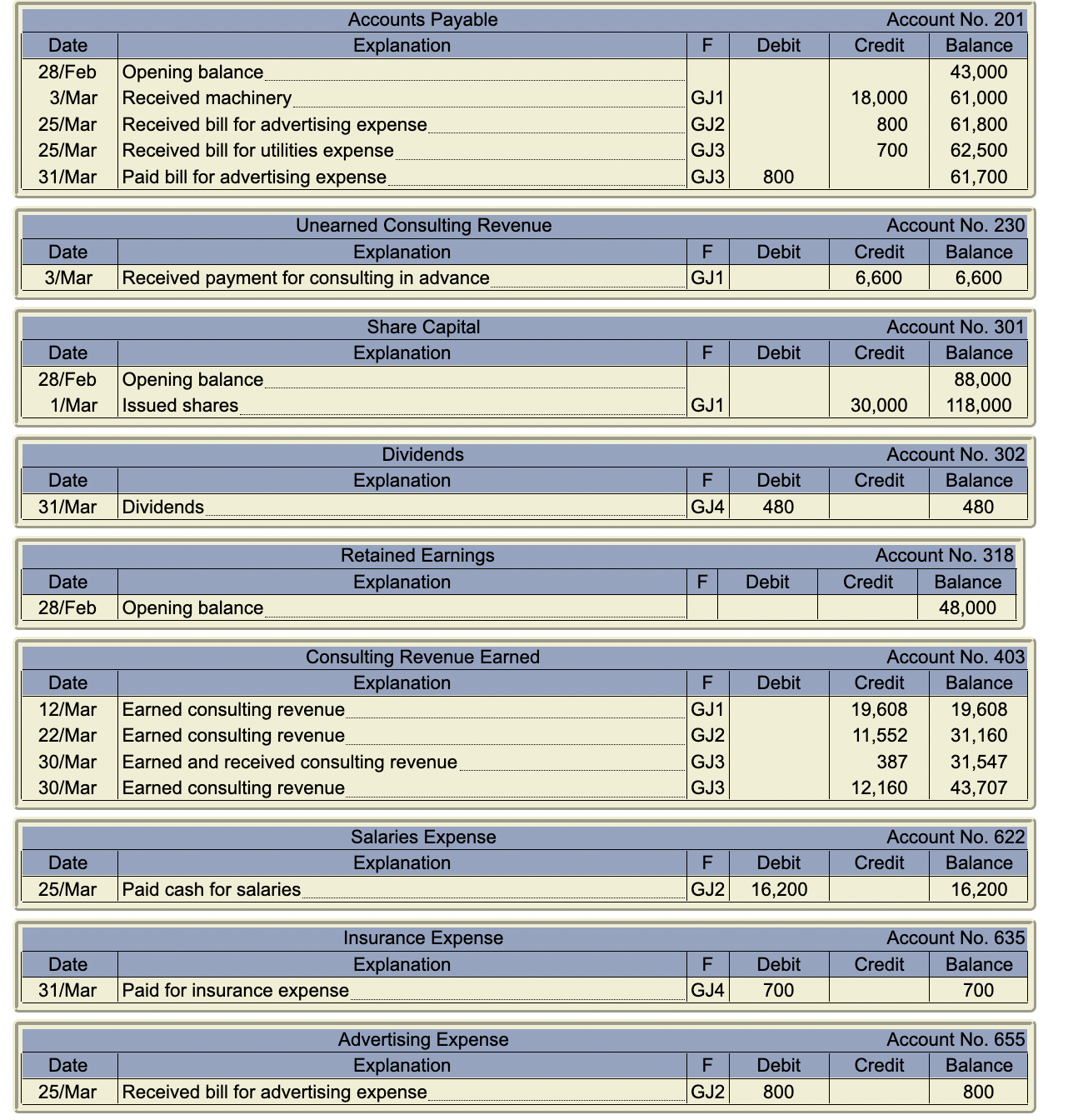

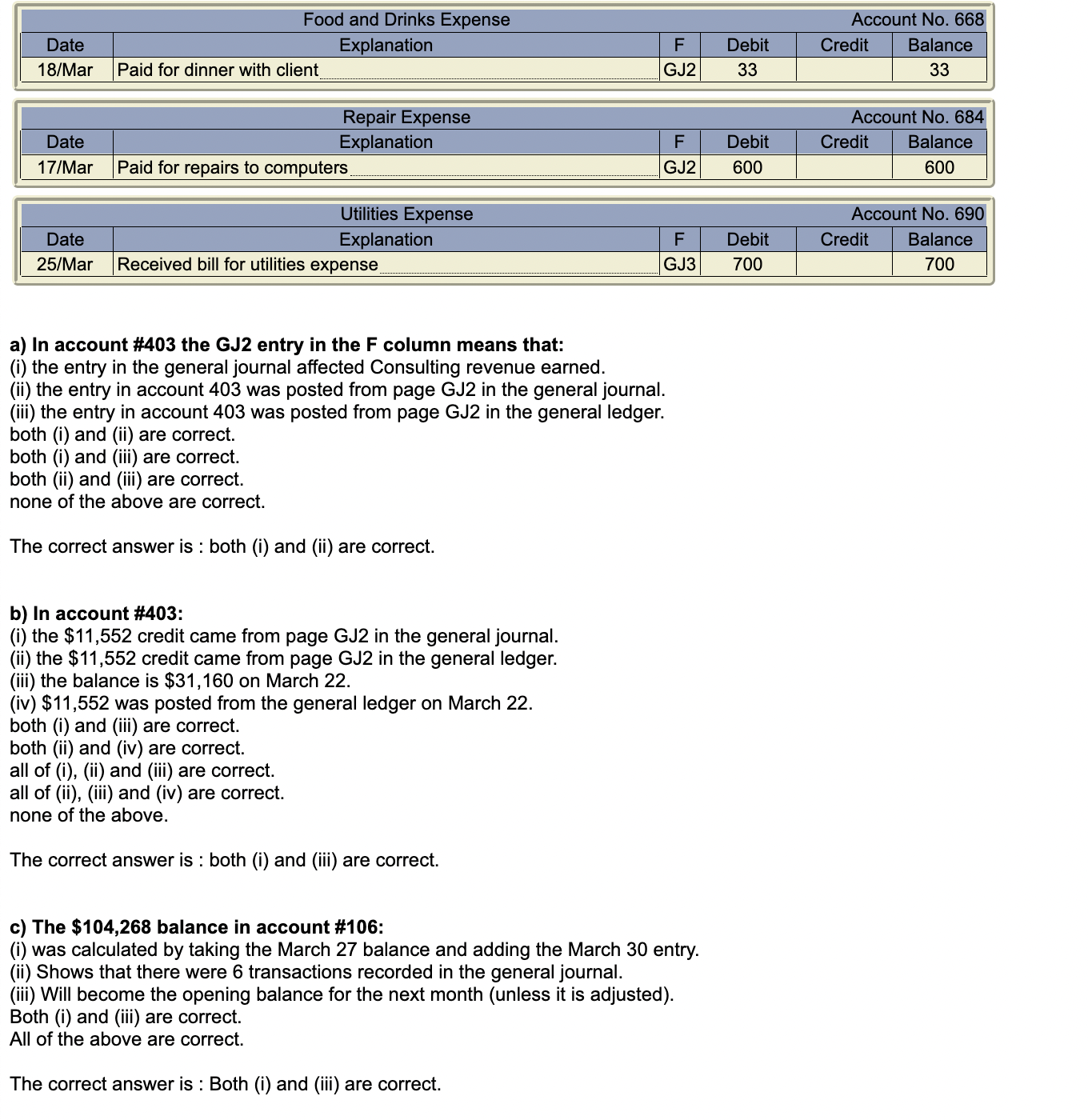

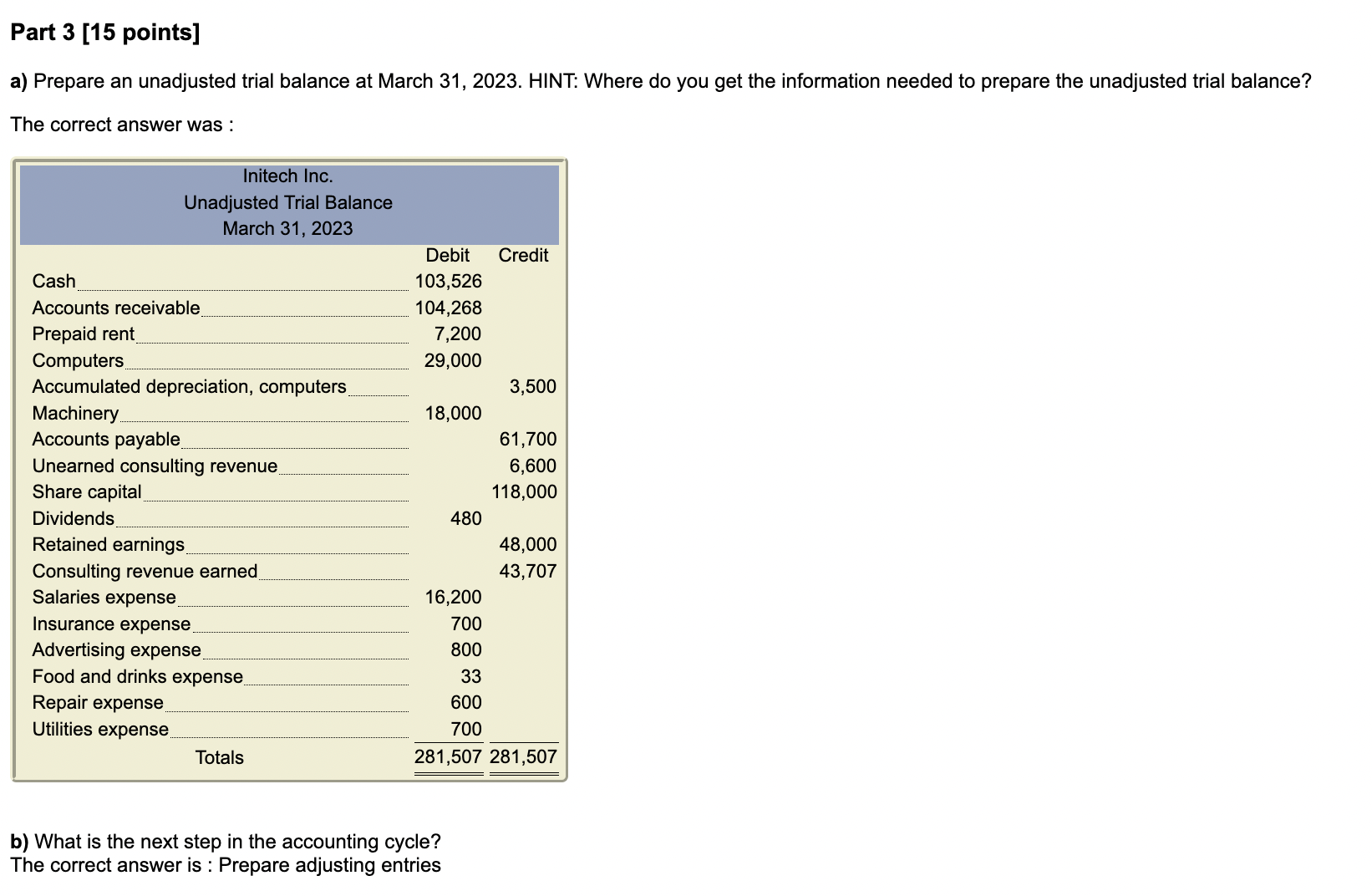

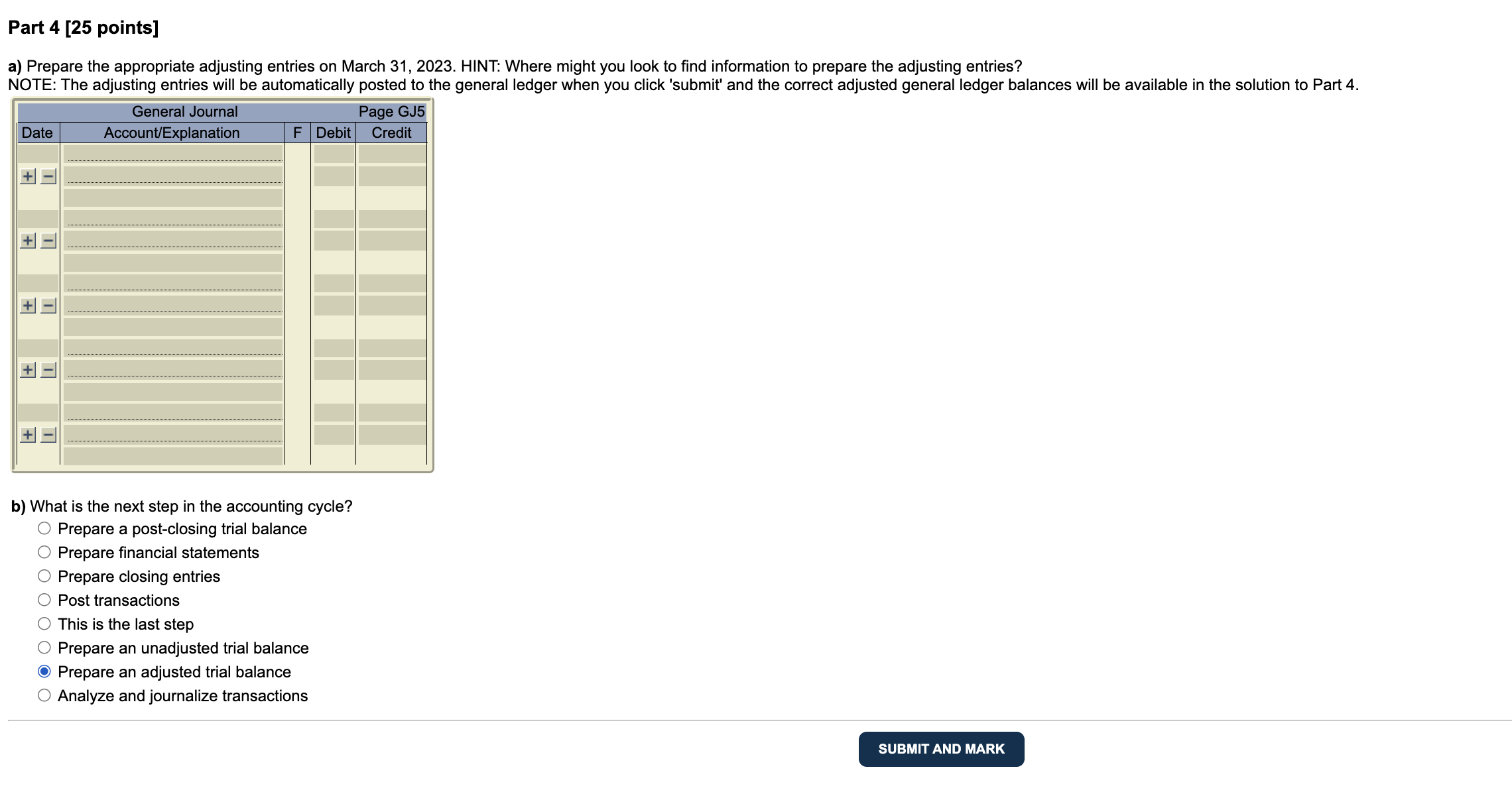

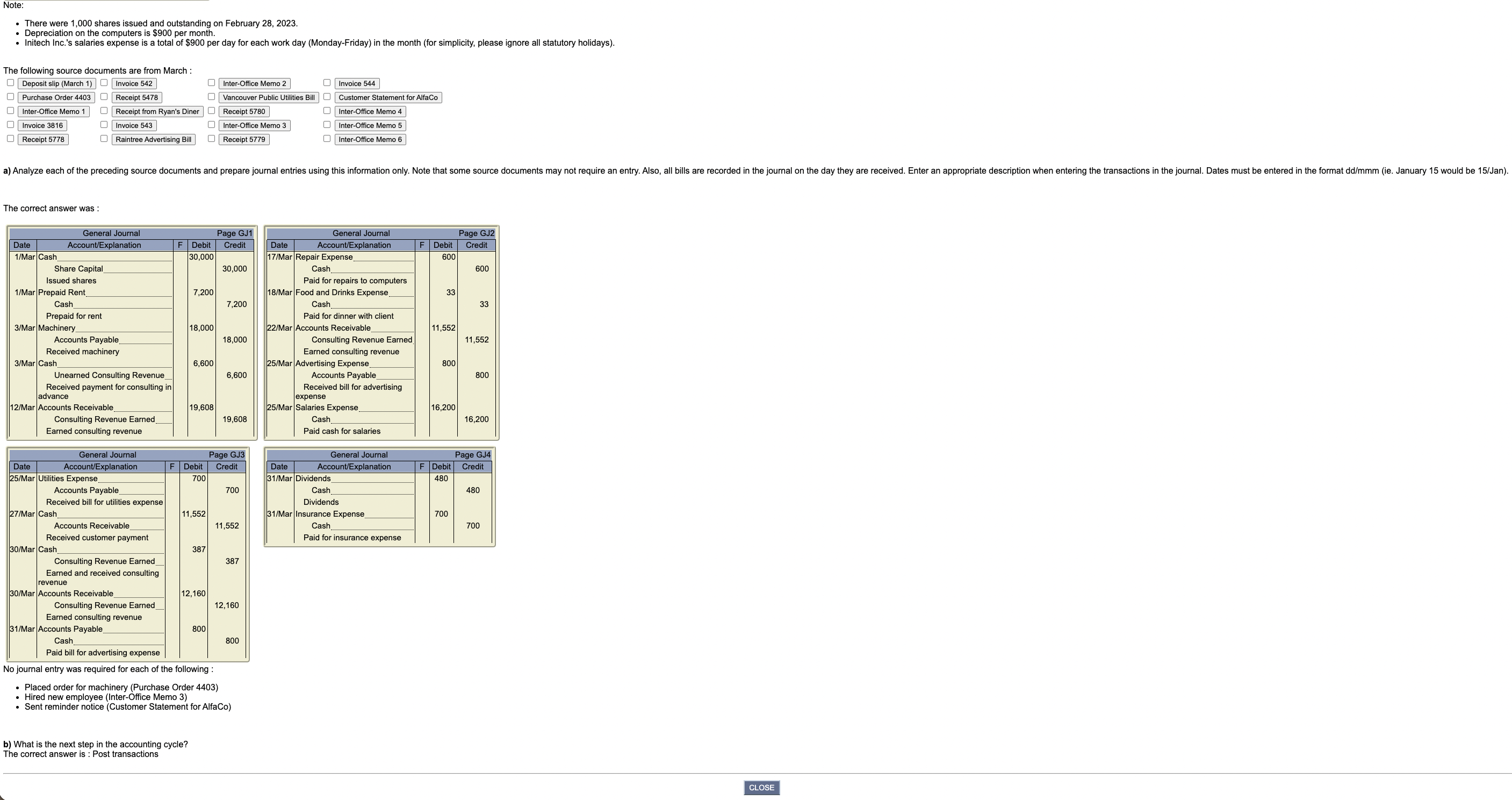

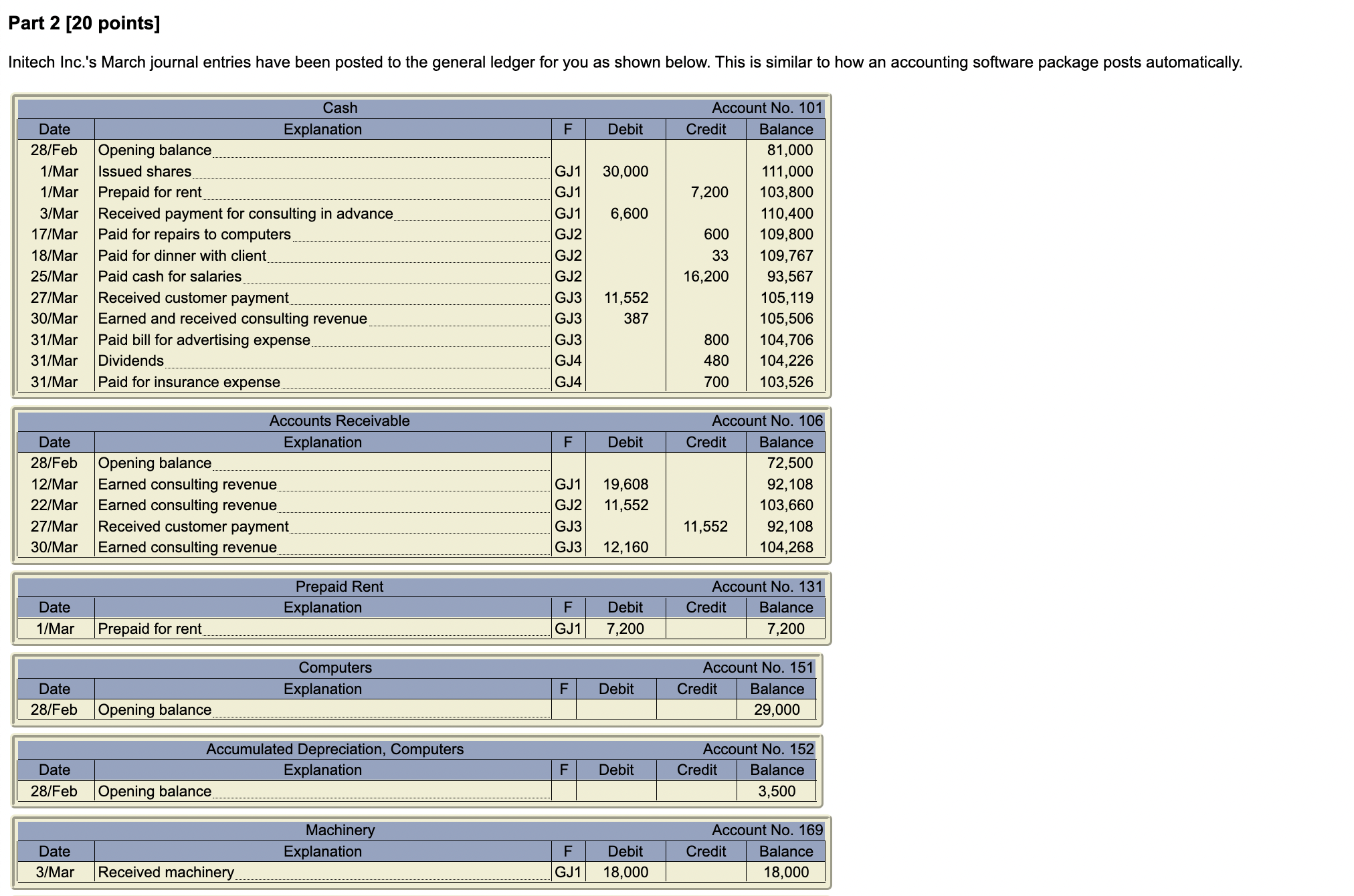

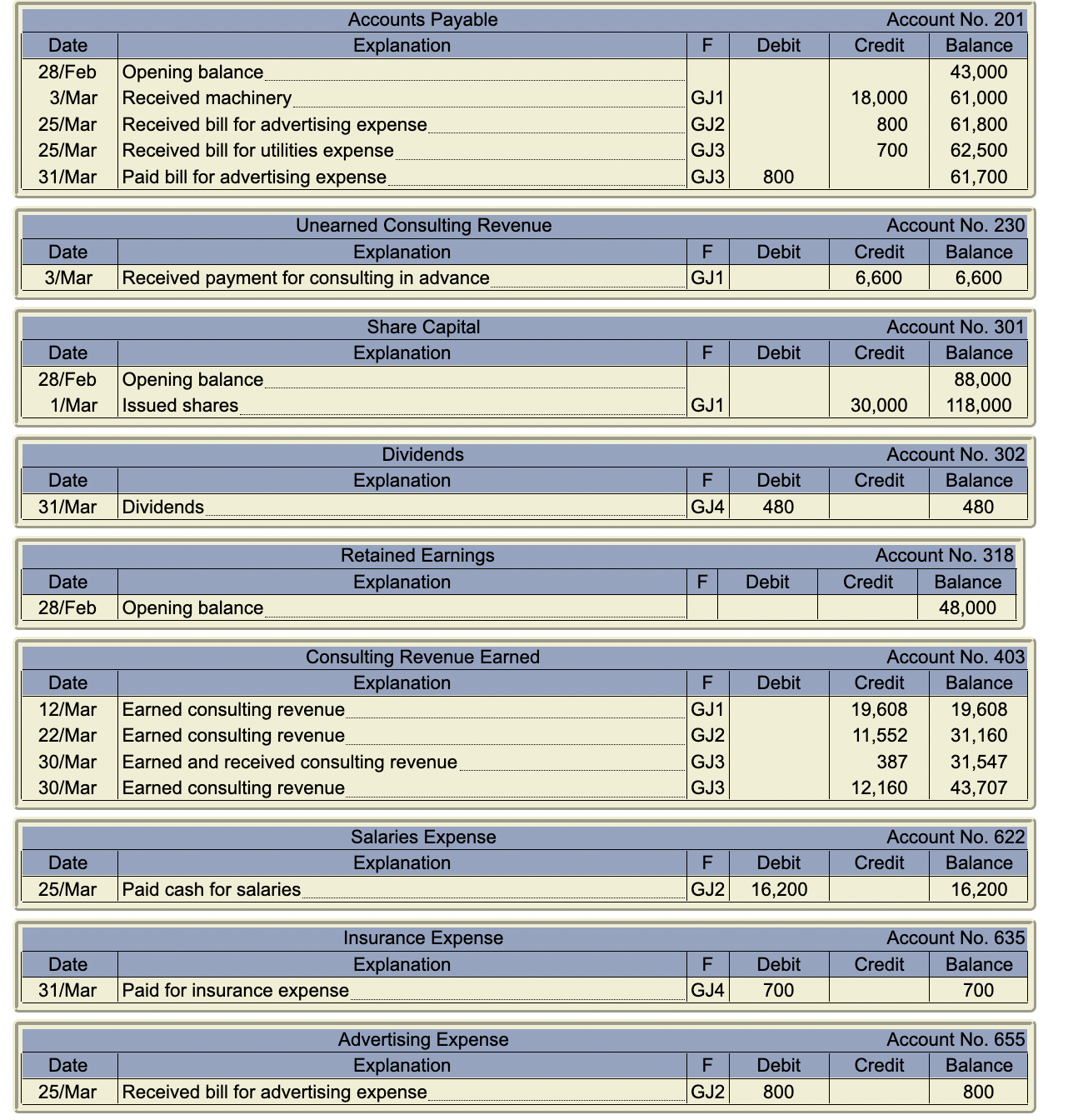

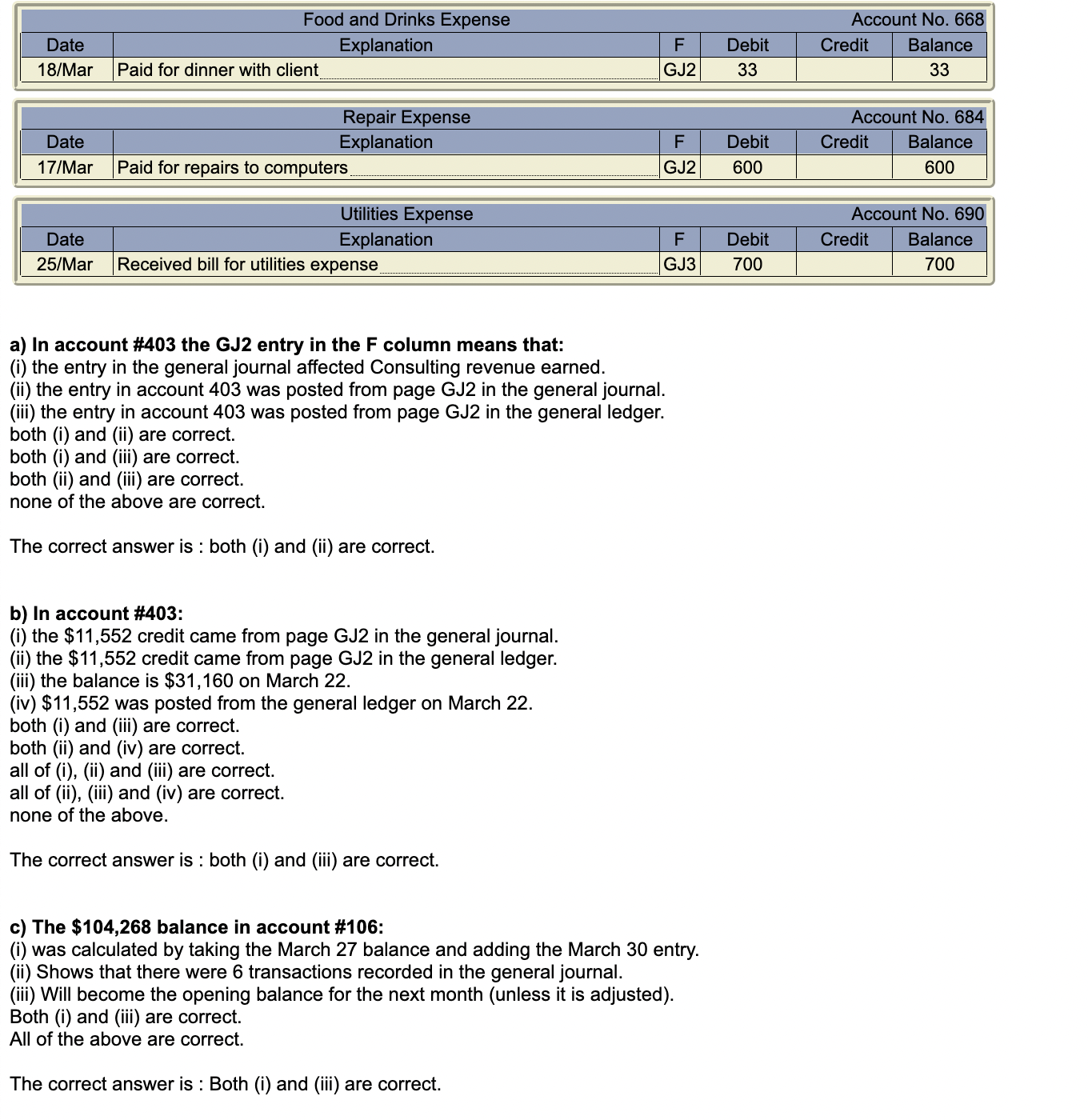

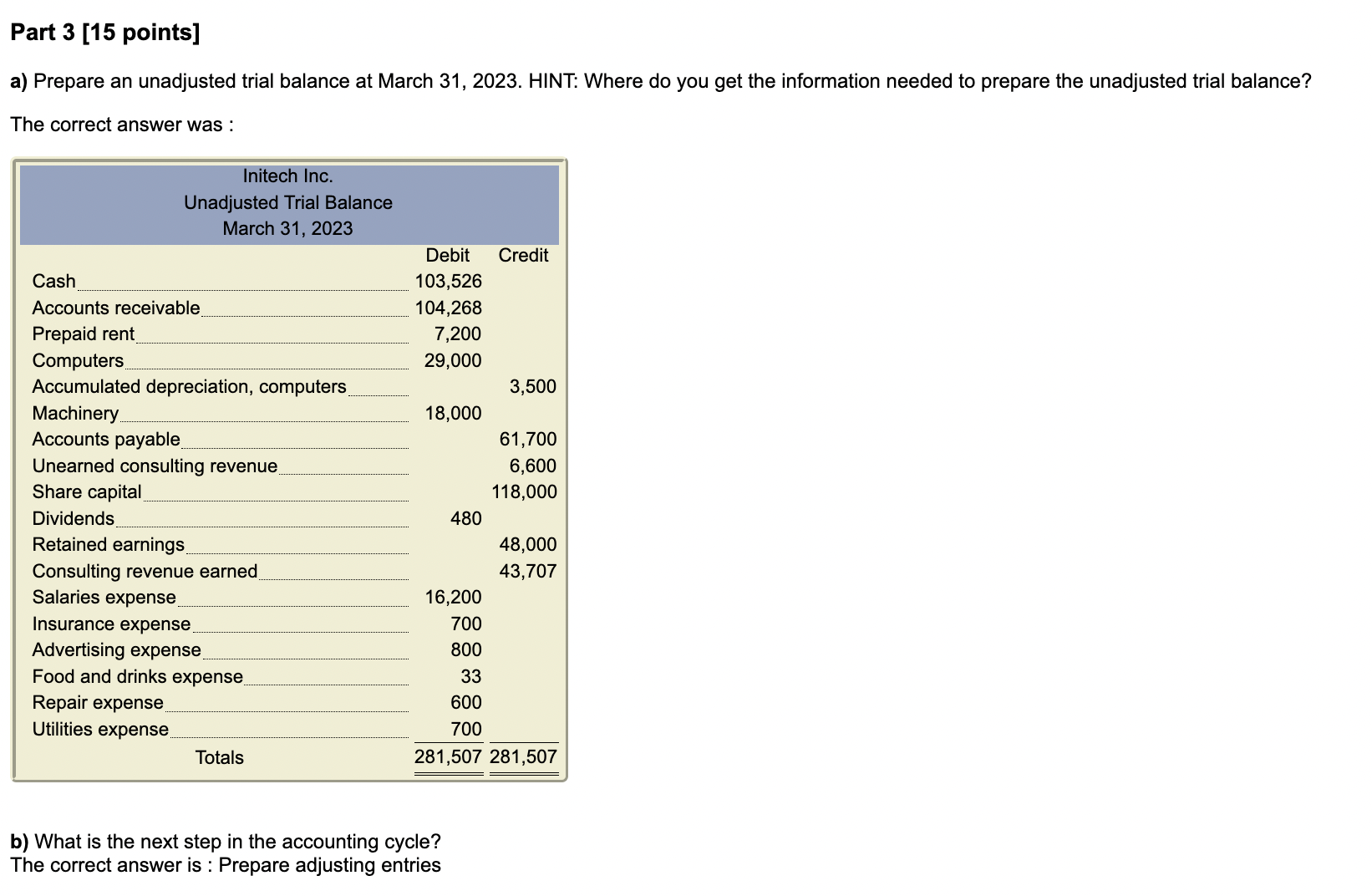

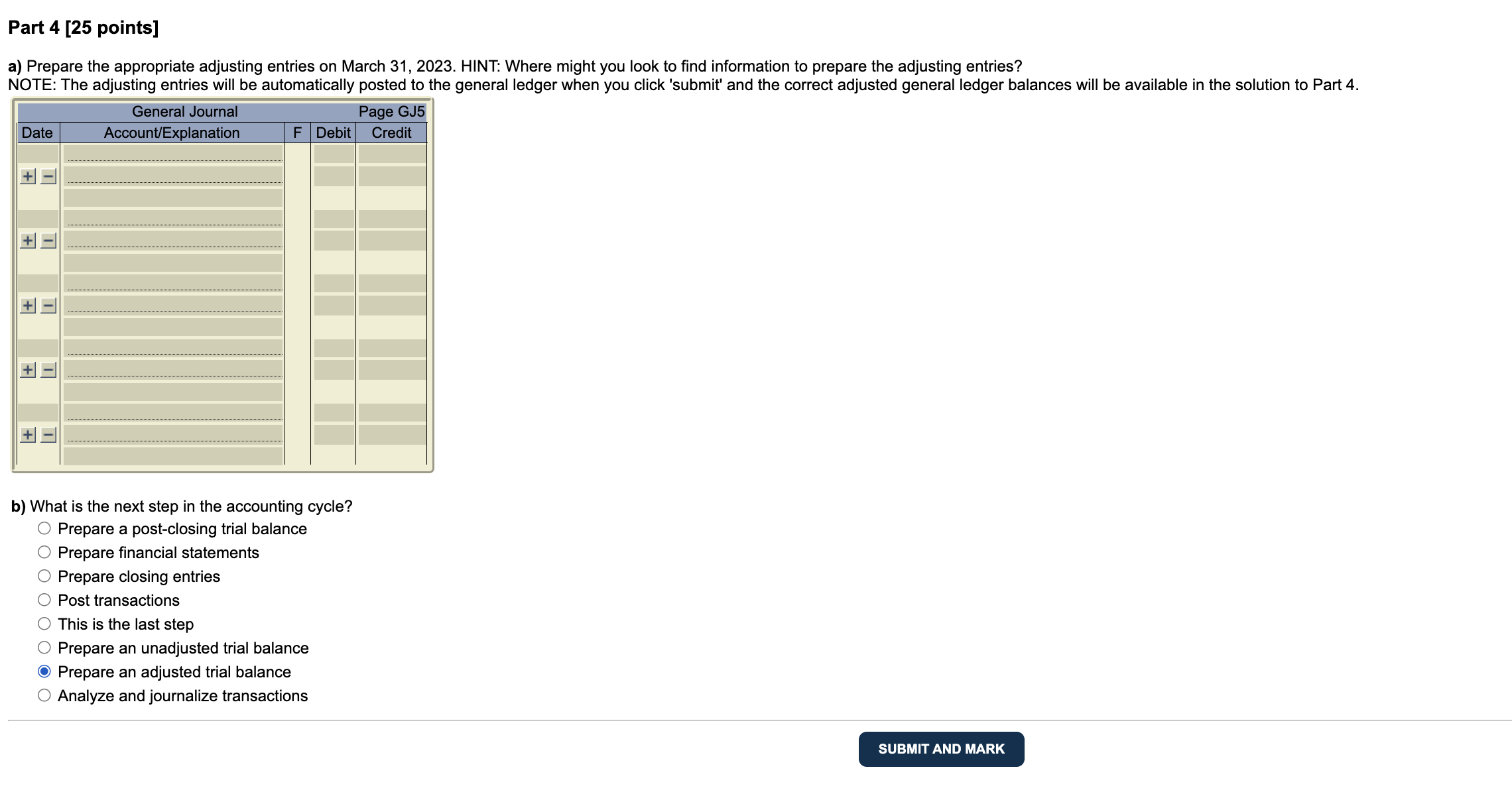

\begin{tabular}{|c|l|c|c|r|c|} \hline \multicolumn{1}{|c|}{ Accounts Payable } & \multicolumn{3}{c|}{ Account No. 201} \\ \hline Date & \multicolumn{1}{|c|}{ Explanation } & F & Debit & Credit & Balance \\ \hline 28/Feb & Opening balance & & & & 43,000 \\ 3/Mar & Received machinery & GJ1 & & 18,000 & 61,000 \\ 25/Mar & Received bill for advertising expense & GJ2 & & 800 & 61,800 \\ 25/Mar & Received bill for utilities expense & GJ3 & & 700 & 62,500 \\ 31/Mar & Paid bill for advertising expense & GJ3 & 800 & & 61,700 \\ \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Unearned Consulting Revenue } & \multicolumn{3}{c|}{ Account No. 230 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 3/Mar & Received payment for consulting in advance & GJ1 & & 6,600 & 6,600 \\ \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Dividends } & \multicolumn{3}{c|}{ Account No. 302 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 31/Mar & Dividends & GJ4 & 480 & & 480 \\ \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Retained Earnings } & Account No. 318 \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 28/Feb & Opening balance & & & & 48,000 \\ \hline \end{tabular} \begin{tabular}{||c|l|c|c|c|c|} \hline \multicolumn{1}{|c}{ Consulting Revenue Earned } & \multicolumn{3}{c|}{ Account No. 403 } \\ \hline Date & \multicolumn{1}{|c|}{ Explanation } & F & Debit & Credit & Balance \\ \hline 12/Mar & Earned consulting revenue & GJ1 & & 19,608 & 19,608 \\ 22/Mar & Earned consulting revenue & GJ2 & & 11,552 & 31,160 \\ 30/Mar & Earned and received consulting revenue & GJ3 & & 387 & 31,547 \\ 30/Mar & Earned consulting revenue & GJ3 & & 12,160 & 43,707 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Salaries Expense } & \multicolumn{3}{c|}{ Account No. 622 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 25/Mar & Paid cash for salaries & GJ2 & 16,200 & & 16,200 \\ \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c|} \hline \multicolumn{1}{|c|}{ Insurance Expense } & \multicolumn{3}{c|}{ Account No. 635 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 31/Mar & Paid for insurance expense & GJ4 & 700 & & 700 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c}{ Advertising Expense } & Account No. 655 \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 25/Mar & Received bill for advertising expense & GJ2 & 800 & & 800 \\ \hline \end{tabular} Part 2 [20 points] Initech Inc.'s March journal entries have been posted to the general ledger for you as shown below. This is similar to how an accounting software package posts automatically. a) Prepare the appropriate adjusting entries on March 31, 2023. HINT: Where might you look to find information to prepare the adjusting entries? b) What is the next step in the accounting cycle? Prepare a post-closing trial balance Prepare financial statements Prepare closing entries Post transactions This is the last step Prepare an unadjusted trial balance Prepare an adjusted trial balance Analyze and journalize transactions - There were 1,000 shares issued and outstanding on February 28, 2023. - Depreciation on the computers is $900 per month. - Initech Inc.'s salaries expense is a total of $900 per day for each work day (Monday-Friday) in the month (for simplicity, please ignore all statutory holidays). a) Analyze each of the preceding source documents and prepare journal entries using this information only. Note that some source documents may not require an entr The correct answer was : No journal entry was required for each of the following : - Placed order for machinery (Purchase Order 4403) - Hired new employee (Inter-Office Memo 3) - Sent reminder notice (Customer Statement for AlfaCo) b) What is the next step in the accounting cycle? The correct answer is : Post transactions a) Prepare an unadjusted trial balance at March 31, 2023. HINT: Where do you get the information needed to prepare the unadjusted trial balance? The correct answer was : b) What is the next step in the accounting cycle? The correct answer is : Prepare adjusting entries a) In account \#403 the GJ2 entry in the F column means that: (i) the entry in the general journal affected Consulting revenue earned. (ii) the entry in account 403 was posted from page GJ2 in the general journal. (iii) the entry in account 403 was posted from page GJ2 in the general ledger. both (i) and (ii) are correct. both (i) and (iii) are correct. both (ii) and (iii) are correct. none of the above are correct. The correct answer is : both (i) and (ii) are correct. b) In account \#403: (i) the $11,552 credit came from page GJ2 in the general journal. (ii) the $11,552 credit came from page GJ2 in the general ledger. (iii) the balance is $31,160 on March 22. (iv) $11,552 was posted from the general ledger on March 22. both (i) and (iii) are correct. both (ii) and (iv) are correct. all of (i), (ii) and (iii) are correct. all of (ii), (iii) and (iv) are correct. none of the above. The correct answer is : both (i) and (iii) are correct. c) The $104,268 balance in account \#106: (i) was calculated by taking the March 27 balance and adding the March 30 entry. (ii) Shows that there were 6 transactions recorded in the general journal. (iii) Will become the opening balance for the next month (unless it is adjusted). Both (i) and (iii) are correct. All of the above are correct. The correct answer is : Both (i) and (iii) are correct. \begin{tabular}{|c|l|c|c|r|c|} \hline \multicolumn{1}{|c|}{ Accounts Payable } & \multicolumn{3}{c|}{ Account No. 201} \\ \hline Date & \multicolumn{1}{|c|}{ Explanation } & F & Debit & Credit & Balance \\ \hline 28/Feb & Opening balance & & & & 43,000 \\ 3/Mar & Received machinery & GJ1 & & 18,000 & 61,000 \\ 25/Mar & Received bill for advertising expense & GJ2 & & 800 & 61,800 \\ 25/Mar & Received bill for utilities expense & GJ3 & & 700 & 62,500 \\ 31/Mar & Paid bill for advertising expense & GJ3 & 800 & & 61,700 \\ \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Unearned Consulting Revenue } & \multicolumn{3}{c|}{ Account No. 230 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 3/Mar & Received payment for consulting in advance & GJ1 & & 6,600 & 6,600 \\ \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Dividends } & \multicolumn{3}{c|}{ Account No. 302 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 31/Mar & Dividends & GJ4 & 480 & & 480 \\ \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Retained Earnings } & Account No. 318 \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 28/Feb & Opening balance & & & & 48,000 \\ \hline \end{tabular} \begin{tabular}{||c|l|c|c|c|c|} \hline \multicolumn{1}{|c}{ Consulting Revenue Earned } & \multicolumn{3}{c|}{ Account No. 403 } \\ \hline Date & \multicolumn{1}{|c|}{ Explanation } & F & Debit & Credit & Balance \\ \hline 12/Mar & Earned consulting revenue & GJ1 & & 19,608 & 19,608 \\ 22/Mar & Earned consulting revenue & GJ2 & & 11,552 & 31,160 \\ 30/Mar & Earned and received consulting revenue & GJ3 & & 387 & 31,547 \\ 30/Mar & Earned consulting revenue & GJ3 & & 12,160 & 43,707 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Salaries Expense } & \multicolumn{3}{c|}{ Account No. 622 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 25/Mar & Paid cash for salaries & GJ2 & 16,200 & & 16,200 \\ \hline \end{tabular} \begin{tabular}{||c|c|c|c|c|c|} \hline \multicolumn{1}{|c|}{ Insurance Expense } & \multicolumn{3}{c|}{ Account No. 635 } \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 31/Mar & Paid for insurance expense & GJ4 & 700 & & 700 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{4}{|c}{ Advertising Expense } & Account No. 655 \\ \hline Date & Explanation & F & Debit & Credit & Balance \\ \hline 25/Mar & Received bill for advertising expense & GJ2 & 800 & & 800 \\ \hline \end{tabular} Part 2 [20 points] Initech Inc.'s March journal entries have been posted to the general ledger for you as shown below. This is similar to how an accounting software package posts automatically. a) Prepare the appropriate adjusting entries on March 31, 2023. HINT: Where might you look to find information to prepare the adjusting entries? b) What is the next step in the accounting cycle? Prepare a post-closing trial balance Prepare financial statements Prepare closing entries Post transactions This is the last step Prepare an unadjusted trial balance Prepare an adjusted trial balance Analyze and journalize transactions - There were 1,000 shares issued and outstanding on February 28, 2023. - Depreciation on the computers is $900 per month. - Initech Inc.'s salaries expense is a total of $900 per day for each work day (Monday-Friday) in the month (for simplicity, please ignore all statutory holidays). a) Analyze each of the preceding source documents and prepare journal entries using this information only. Note that some source documents may not require an entr The correct answer was : No journal entry was required for each of the following : - Placed order for machinery (Purchase Order 4403) - Hired new employee (Inter-Office Memo 3) - Sent reminder notice (Customer Statement for AlfaCo) b) What is the next step in the accounting cycle? The correct answer is : Post transactions a) Prepare an unadjusted trial balance at March 31, 2023. HINT: Where do you get the information needed to prepare the unadjusted trial balance? The correct answer was : b) What is the next step in the accounting cycle? The correct answer is : Prepare adjusting entries a) In account \#403 the GJ2 entry in the F column means that: (i) the entry in the general journal affected Consulting revenue earned. (ii) the entry in account 403 was posted from page GJ2 in the general journal. (iii) the entry in account 403 was posted from page GJ2 in the general ledger. both (i) and (ii) are correct. both (i) and (iii) are correct. both (ii) and (iii) are correct. none of the above are correct. The correct answer is : both (i) and (ii) are correct. b) In account \#403: (i) the $11,552 credit came from page GJ2 in the general journal. (ii) the $11,552 credit came from page GJ2 in the general ledger. (iii) the balance is $31,160 on March 22. (iv) $11,552 was posted from the general ledger on March 22. both (i) and (iii) are correct. both (ii) and (iv) are correct. all of (i), (ii) and (iii) are correct. all of (ii), (iii) and (iv) are correct. none of the above. The correct answer is : both (i) and (iii) are correct. c) The $104,268 balance in account \#106: (i) was calculated by taking the March 27 balance and adding the March 30 entry. (ii) Shows that there were 6 transactions recorded in the general journal. (iii) Will become the opening balance for the next month (unless it is adjusted). Both (i) and (iii) are correct. All of the above are correct. The correct answer is : Both (i) and (iii) are correct