Answered step by step

Verified Expert Solution

Question

1 Approved Answer

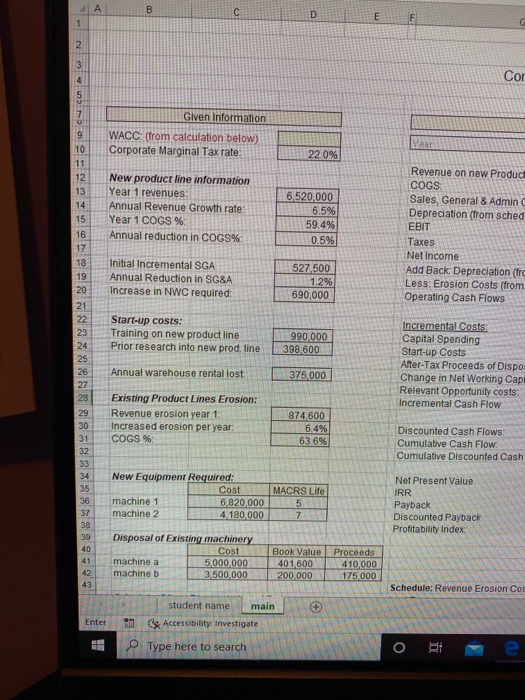

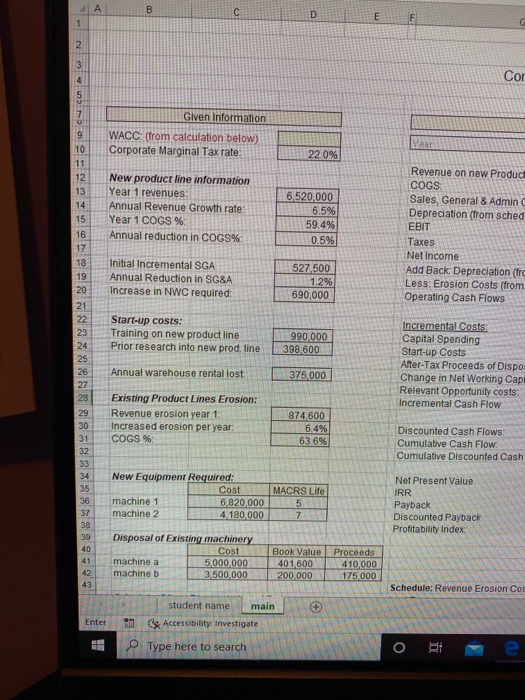

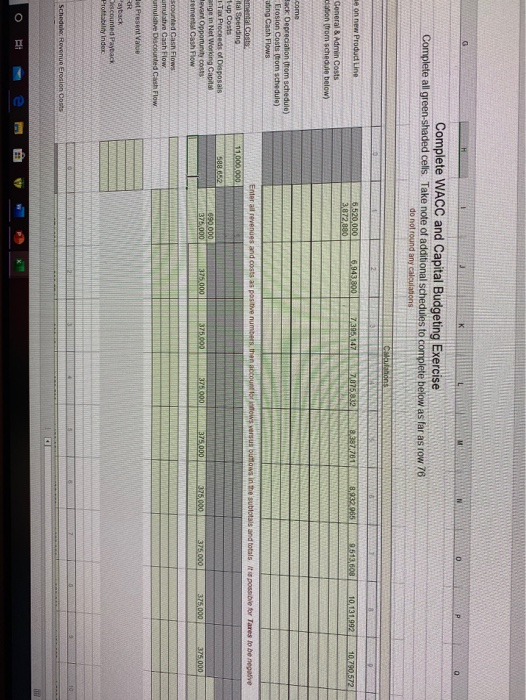

need excel formulas for boxes in green there are two pictures i cant change the color, its all the ones that are not grey NO

need excel formulas for boxes in green

there are two pictures

i cant change the color, its all the ones that are not grey

NO Given Information WACC: (from calculation below) Corporate Marginal Tax rate: 22 0% New product line information Year 1 revenues Annual Revenue Growth rate: Year 1 COGS % Annual reduction in COGS% 16,520,000 6.5% 159.4% 21 0.5 16 Revenue on new Product COGS Sales, General & Admin Depreciation (from sched EBIT Taxes Net Income Add Back Depreciation (frc Less: Erosion Costs (from Operating Cash Flows Initial Incremental SGA Annual Reduction in SG&A Increase in NWC required: 527,500 1 1.2 690,000 Start-up costs: Training on new product line Prior research into new prod. line 990,000 398 600 Incremental Costs: Capital Spending Start-up Costs After-Tax Proceeds of Dispos Change in Net Working Cap Relevant Opportunity costs: Incremental Cash Flow Annual warehouse rental lost 375.000 Existing Product Lines Erosion: Revenue erosion year 1: Increased erosion per year COGS%: 874,600 6.4% 63.6% Discounted Cash Flows Cumulative Cash Flow. Cumulative Discounted Cash New Equipment Required: Cost machine 1 6.820,000 machine 2 4 180.000 MACRS Life 5 Net Present Value IRR Payback Discounted Payback Profitability Index Disposal of Existing machinery Cost machine a 5,000,000 machine b 3 .500.000 B ook Value 401,600 200 000 Proceeds 410,000 175,000 Schedule: Revenue Erosion Cog Enter student name main Accessibility: Investigate Type here to search Complete WACC and Capital Budgeting Exercise Complete all green-shaded cells. Take note of additional schedules to complete below as far as row 76 do not found any calculations ne on new Produd Line 5,520,000 3.812 880 5,943.800 73951 U7028 387 7018937965 10790,52 General & Admin Costs Gation from schedule below) come Sack Depreciation from schedule) Erosion Cost from schedule) ating Cash Flows Enter all revenues and costs a positive numbers, then account for o 11 000 000 ver ows in the sublotals and totals possible for lares to be negative mentals Atal Spending tup Costs Tax Proceeds of oposals ange in Net Working Capital evant Opportunity oment Cash Flow 588 62 DODO 375.000 175.000 125,000 35.000 376,000 scounted Cash Flow umulative Cash Flow umulative Discounted Cash Flow et Present Valot ayback iscounted Payback Profitabilny inder Schedule Revenue Erosion Costs NO Given Information WACC: (from calculation below) Corporate Marginal Tax rate: 22 0% New product line information Year 1 revenues Annual Revenue Growth rate: Year 1 COGS % Annual reduction in COGS% 16,520,000 6.5% 159.4% 21 0.5 16 Revenue on new Product COGS Sales, General & Admin Depreciation (from sched EBIT Taxes Net Income Add Back Depreciation (frc Less: Erosion Costs (from Operating Cash Flows Initial Incremental SGA Annual Reduction in SG&A Increase in NWC required: 527,500 1 1.2 690,000 Start-up costs: Training on new product line Prior research into new prod. line 990,000 398 600 Incremental Costs: Capital Spending Start-up Costs After-Tax Proceeds of Dispos Change in Net Working Cap Relevant Opportunity costs: Incremental Cash Flow Annual warehouse rental lost 375.000 Existing Product Lines Erosion: Revenue erosion year 1: Increased erosion per year COGS%: 874,600 6.4% 63.6% Discounted Cash Flows Cumulative Cash Flow. Cumulative Discounted Cash New Equipment Required: Cost machine 1 6.820,000 machine 2 4 180.000 MACRS Life 5 Net Present Value IRR Payback Discounted Payback Profitability Index Disposal of Existing machinery Cost machine a 5,000,000 machine b 3 .500.000 B ook Value 401,600 200 000 Proceeds 410,000 175,000 Schedule: Revenue Erosion Cog Enter student name main Accessibility: Investigate Type here to search Complete WACC and Capital Budgeting Exercise Complete all green-shaded cells. Take note of additional schedules to complete below as far as row 76 do not found any calculations ne on new Produd Line 5,520,000 3.812 880 5,943.800 73951 U7028 387 7018937965 10790,52 General & Admin Costs Gation from schedule below) come Sack Depreciation from schedule) Erosion Cost from schedule) ating Cash Flows Enter all revenues and costs a positive numbers, then account for o 11 000 000 ver ows in the sublotals and totals possible for lares to be negative mentals Atal Spending tup Costs Tax Proceeds of oposals ange in Net Working Capital evant Opportunity oment Cash Flow 588 62 DODO 375.000 175.000 125,000 35.000 376,000 scounted Cash Flow umulative Cash Flow umulative Discounted Cash Flow et Present Valot ayback iscounted Payback Profitabilny inder Schedule Revenue Erosion Costs Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started