Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need fast answer Alpha Ltd, a parent entity, acquired a voting interest of 40% in Beta Ltd on 1 July 2017 for a cash consideration

need fast answer

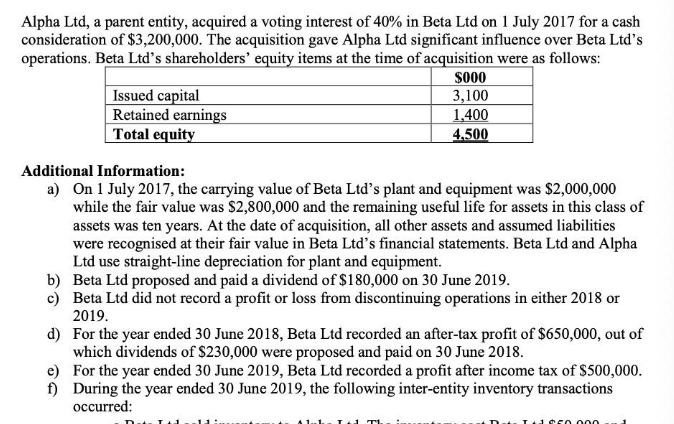

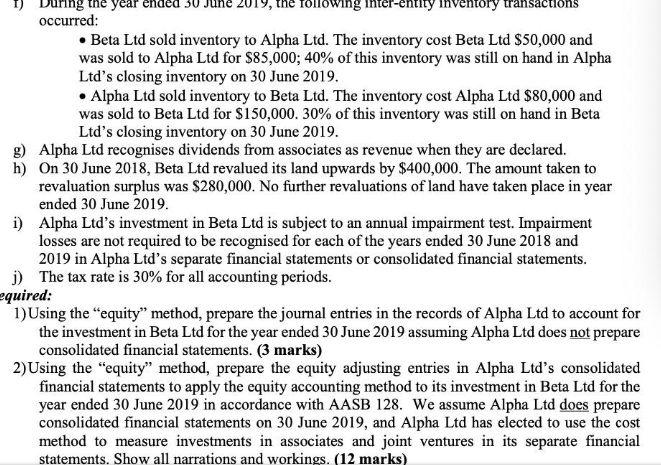

Alpha Ltd, a parent entity, acquired a voting interest of 40% in Beta Ltd on 1 July 2017 for a cash consideration of $3,200,000. The acquisition gave Alpha Ltd significant influence over Beta Ltd's operations. Beta Ltd's shareholders' equity items at the time of acquisition were as follows: $000 Issued capital 3,100 Retained earnings 1,400 Total equity 4.500 Additional Information: a) On 1 July 2017, the carrying value of Beta Ltd's plant and equipment was $2,000,000 while the fair value was $2,800,000 and the remaining useful life for assets in this class of assets was ten years. At the date of acquisition, all other assets and assumed liabilities were recognised at their fair value in Beta Ltd's financial statements. Beta Ltd and Alpha Ltd use straight-line depreciation for plant and equipment. b) Beta Ltd proposed and paid a dividend of $180,000 on 30 June 2019. c) Beta Ltd did not record a profit or loss from discontinuing operations in either 2018 or 2019. d) For the year ended 30 June 2018, Beta Ltd recorded an after-tax profit of $650,000, out of which dividends of $230,000 were proposed and paid on 30 June 2018. e) For the year ended 30 June 2019, Beta Ltd recorded a profit after income tax of $500,000. f) During the year ended 30 June 2019, the following inter-entity inventory transactions occurred: ennnn During year ended 30 the following inter-entity inventory transactions occurred: Beta Ltd sold inventory to Alpha Ltd. The inventory cost Beta Ltd $50,000 and was sold to Alpha Ltd for $85,000; 40% of this inventory was still on hand in Alpha Ltd's closing inventory on 30 June 2019. Alpha Ltd sold inventory to Beta Ltd. The inventory cost Alpha Ltd $80,000 and was sold to Beta Ltd for $150,000. 30% of this inventory was still on hand in Beta Ltd's closing inventory on 30 June 2019. g) Alpha Ltd recognises dividends from associates as revenue when they are declared. h) On 30 June 2018, Beta Ltd revalued its land upwards by $400,000. The amount taken to revaluation surplus was $280,000. No further revaluations of land have taken place in year ended 30 June 2019. i) Alpha Ltd's investment in Beta Ltd is subject to an annual impairment test. Impairment losses are not required to be recognised for each of the years ended 30 June 2018 and 2019 in Alpha Ltd's separate financial statements or consolidated financial statements. j) The tax rate is 30% for all accounting periods. equired: 1) Using the "equity" method, prepare the journal entries in the records of Alpha Ltd to account for the investment in Beta Ltd for the year ended 30 June 2019 assuming Alpha Ltd does not prepare consolidated financial statements. (3 marks) 2) Using the equity" method, prepare the equity adjusting entries in Alpha Ltd's consolidated financial statements to apply the equity accounting method to its investment in Beta Ltd for the year ended 30 June 2019 in accordance with AASB 128. We assume Alpha Ltd does prepare consolidated financial statements on 30 June 2019, and Alpha Ltd has elected to use the cost method to measure investments in associates and joint ventures in its separate financial statements. Show all narrations and workings. (12 marks) Alpha Ltd, a parent entity, acquired a voting interest of 40% in Beta Ltd on 1 July 2017 for a cash consideration of $3,200,000. The acquisition gave Alpha Ltd significant influence over Beta Ltd's operations. Beta Ltd's shareholders' equity items at the time of acquisition were as follows: $000 Issued capital 3,100 Retained earnings 1,400 Total equity 4.500 Additional Information: a) On 1 July 2017, the carrying value of Beta Ltd's plant and equipment was $2,000,000 while the fair value was $2,800,000 and the remaining useful life for assets in this class of assets was ten years. At the date of acquisition, all other assets and assumed liabilities were recognised at their fair value in Beta Ltd's financial statements. Beta Ltd and Alpha Ltd use straight-line depreciation for plant and equipment. b) Beta Ltd proposed and paid a dividend of $180,000 on 30 June 2019. c) Beta Ltd did not record a profit or loss from discontinuing operations in either 2018 or 2019. d) For the year ended 30 June 2018, Beta Ltd recorded an after-tax profit of $650,000, out of which dividends of $230,000 were proposed and paid on 30 June 2018. e) For the year ended 30 June 2019, Beta Ltd recorded a profit after income tax of $500,000. f) During the year ended 30 June 2019, the following inter-entity inventory transactions occurred: ennnn During year ended 30 the following inter-entity inventory transactions occurred: Beta Ltd sold inventory to Alpha Ltd. The inventory cost Beta Ltd $50,000 and was sold to Alpha Ltd for $85,000; 40% of this inventory was still on hand in Alpha Ltd's closing inventory on 30 June 2019. Alpha Ltd sold inventory to Beta Ltd. The inventory cost Alpha Ltd $80,000 and was sold to Beta Ltd for $150,000. 30% of this inventory was still on hand in Beta Ltd's closing inventory on 30 June 2019. g) Alpha Ltd recognises dividends from associates as revenue when they are declared. h) On 30 June 2018, Beta Ltd revalued its land upwards by $400,000. The amount taken to revaluation surplus was $280,000. No further revaluations of land have taken place in year ended 30 June 2019. i) Alpha Ltd's investment in Beta Ltd is subject to an annual impairment test. Impairment losses are not required to be recognised for each of the years ended 30 June 2018 and 2019 in Alpha Ltd's separate financial statements or consolidated financial statements. j) The tax rate is 30% for all accounting periods. equired: 1) Using the "equity" method, prepare the journal entries in the records of Alpha Ltd to account for the investment in Beta Ltd for the year ended 30 June 2019 assuming Alpha Ltd does not prepare consolidated financial statements. (3 marks) 2) Using the equity" method, prepare the equity adjusting entries in Alpha Ltd's consolidated financial statements to apply the equity accounting method to its investment in Beta Ltd for the year ended 30 June 2019 in accordance with AASB 128. We assume Alpha Ltd does prepare consolidated financial statements on 30 June 2019, and Alpha Ltd has elected to use the cost method to measure investments in associates and joint ventures in its separate financial statements. Show all narrations and workings. (12 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started