Need for the projected 2022 figures. Not sure if what I have completed is correct.

Need for the projected 2022 figures. Not sure if what I have completed is correct.

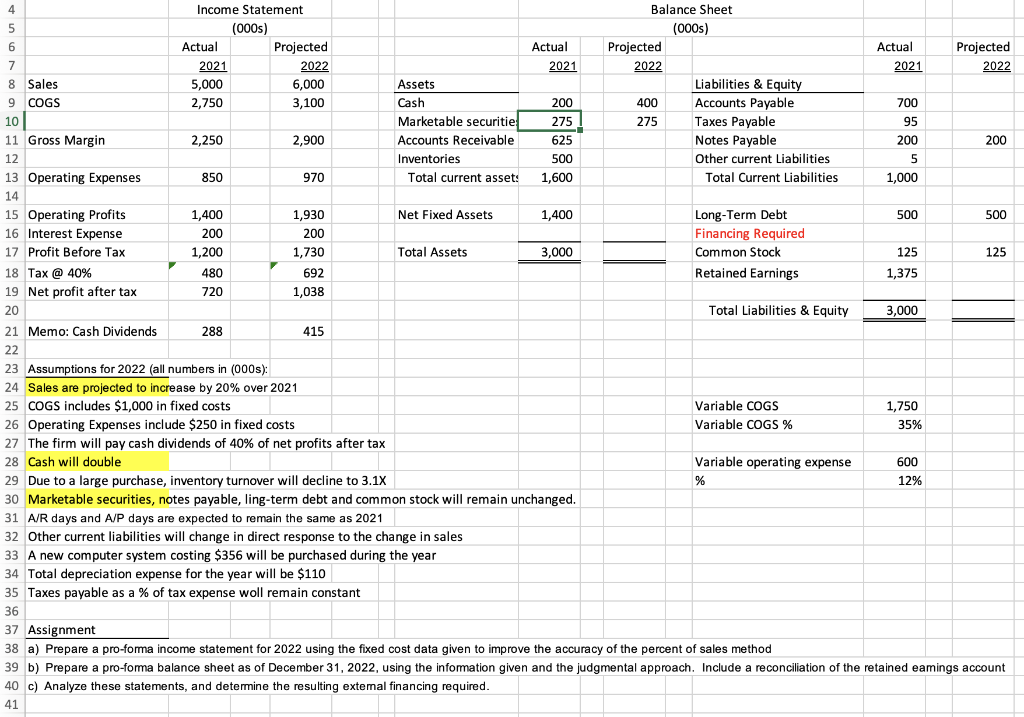

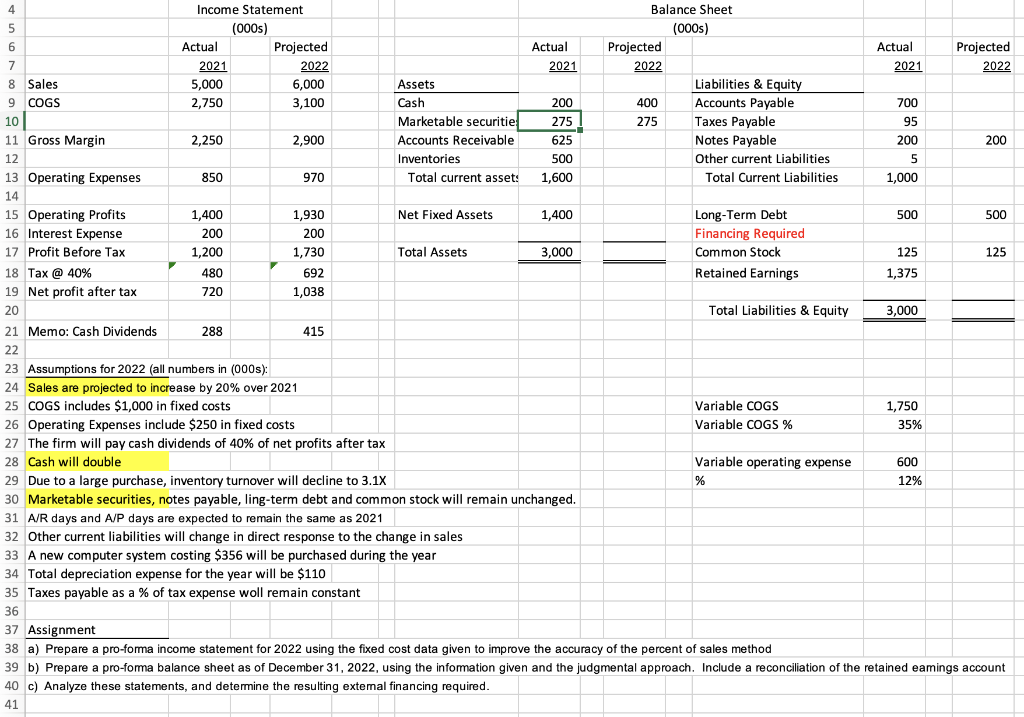

4 Income Statement Balance Sheet 5 (000s) (000s) 6 Actual Projected Actual Projected Actual Projected 7 2021 2022 2021 2022 2021 2022 8 Sales 5,000 6,000 Assets Liabilities & Equity 9 COGS 2,750 3,100 Cash 200 400 Accounts Payable 700 10 Marketable securitie 275 275 Taxes Payable 95 11 Gross Margin 2,250 2,900 Accounts Receivable 625 Notes Payable 200 200 12 Inventories 500 Other current Liabilities 5 13 Operating Expenses 850 970 Total current asset: 1,600 Total Current Liabilities 1,000 14 15 Operating Profits 1,400 1,930 Net Fixed Assets 1,400 Long-Term Debt 500 500 16 Interest Expense 200 200 Financing Required 17 Profit Before Tax 1,200 1,730 Total Assets 3,000 Common Stock 125 125 18 Tax @ 40% 480 692 Retained Earnings 1,375 19 Net profit after tax 720 1,038 20 Total Liabilities & Equity 3,000 21 Memo: Cash Dividends 288 415 22 23 Assumptions for 2022 (all numbers in (000s): 24 Sales are projected to increase by 20% over 2021 25 COGS includes $1,000 in fixed costs Variable COGS 1,750 26 Operating Expenses include $250 in fixed costs Variable COGS % 35% 27 The firm will pay cash dividends of 40% of net profits after tax 28 Cash will double Variable operating expense 600 29 Due to a large purchase, inventory turnover will decline to 3.1x % 12% 30 Marketable securities, notes payable, ling-term debt and common stock will remain unchanged. 31 A/R days and A/P days are expected to remain the same as 2021 32 Other current liabilities will change in direct response to the change in sales 33 A new computer system costing $356 will be purchased during the year 34 Total depreciation expense for the year will be $110 35 Taxes payable as a % of tax expense woll remain constant 36 37 Assignment 38 a) Prepare a pro-forma income statement for 2022 using the fixed cost data given to improve the accuracy of the percent of sales method 39 b) Prepare a pro-foma balance sheet as of December 31, 2022, using the information given and the judgmental approach. Include a reconciliation of the retained eamings account 40 c) Analyze these statements, and determine the resulting extemal financing required. 41 4 Income Statement Balance Sheet 5 (000s) (000s) 6 Actual Projected Actual Projected Actual Projected 7 2021 2022 2021 2022 2021 2022 8 Sales 5,000 6,000 Assets Liabilities & Equity 9 COGS 2,750 3,100 Cash 200 400 Accounts Payable 700 10 Marketable securitie 275 275 Taxes Payable 95 11 Gross Margin 2,250 2,900 Accounts Receivable 625 Notes Payable 200 200 12 Inventories 500 Other current Liabilities 5 13 Operating Expenses 850 970 Total current asset: 1,600 Total Current Liabilities 1,000 14 15 Operating Profits 1,400 1,930 Net Fixed Assets 1,400 Long-Term Debt 500 500 16 Interest Expense 200 200 Financing Required 17 Profit Before Tax 1,200 1,730 Total Assets 3,000 Common Stock 125 125 18 Tax @ 40% 480 692 Retained Earnings 1,375 19 Net profit after tax 720 1,038 20 Total Liabilities & Equity 3,000 21 Memo: Cash Dividends 288 415 22 23 Assumptions for 2022 (all numbers in (000s): 24 Sales are projected to increase by 20% over 2021 25 COGS includes $1,000 in fixed costs Variable COGS 1,750 26 Operating Expenses include $250 in fixed costs Variable COGS % 35% 27 The firm will pay cash dividends of 40% of net profits after tax 28 Cash will double Variable operating expense 600 29 Due to a large purchase, inventory turnover will decline to 3.1x % 12% 30 Marketable securities, notes payable, ling-term debt and common stock will remain unchanged. 31 A/R days and A/P days are expected to remain the same as 2021 32 Other current liabilities will change in direct response to the change in sales 33 A new computer system costing $356 will be purchased during the year 34 Total depreciation expense for the year will be $110 35 Taxes payable as a % of tax expense woll remain constant 36 37 Assignment 38 a) Prepare a pro-forma income statement for 2022 using the fixed cost data given to improve the accuracy of the percent of sales method 39 b) Prepare a pro-foma balance sheet as of December 31, 2022, using the information given and the judgmental approach. Include a reconciliation of the retained eamings account 40 c) Analyze these statements, and determine the resulting extemal financing required. 41

Need for the projected 2022 figures. Not sure if what I have completed is correct.

Need for the projected 2022 figures. Not sure if what I have completed is correct.