Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need hand-written explanation Suppose you want to develop a scholarship fund that pays out $50k/ year in perpetuity, starting in 30 years. The fund will

Need hand-written explanation

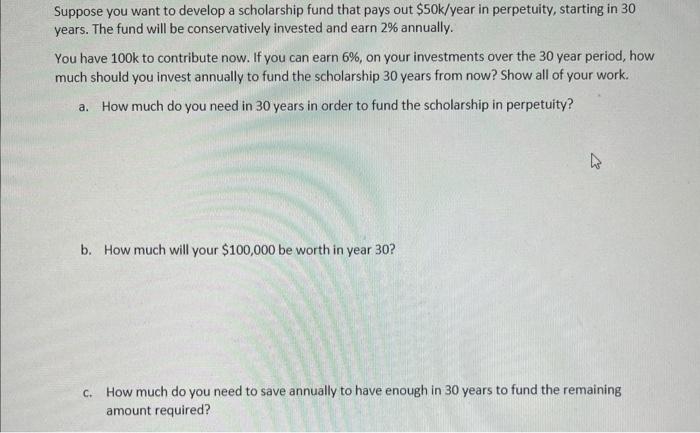

Suppose you want to develop a scholarship fund that pays out $50k/ year in perpetuity, starting in 30 years. The fund will be conservatively invested and earn 2% annually. You have 100k to contribute now. If you can earn 6%, on your investments over the 30 year period, how much should you invest annually to fund the scholarship 30 years from now? Show all of your work. a. How much do you need in 30 years in order to fund the scholarship in perpetuity? b. How much will your $100,000 be worth in year 30 ? c. How much do you need to save annually to have enough in 30 years to fund the remaining amount required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started