need helo plz

need helo plz

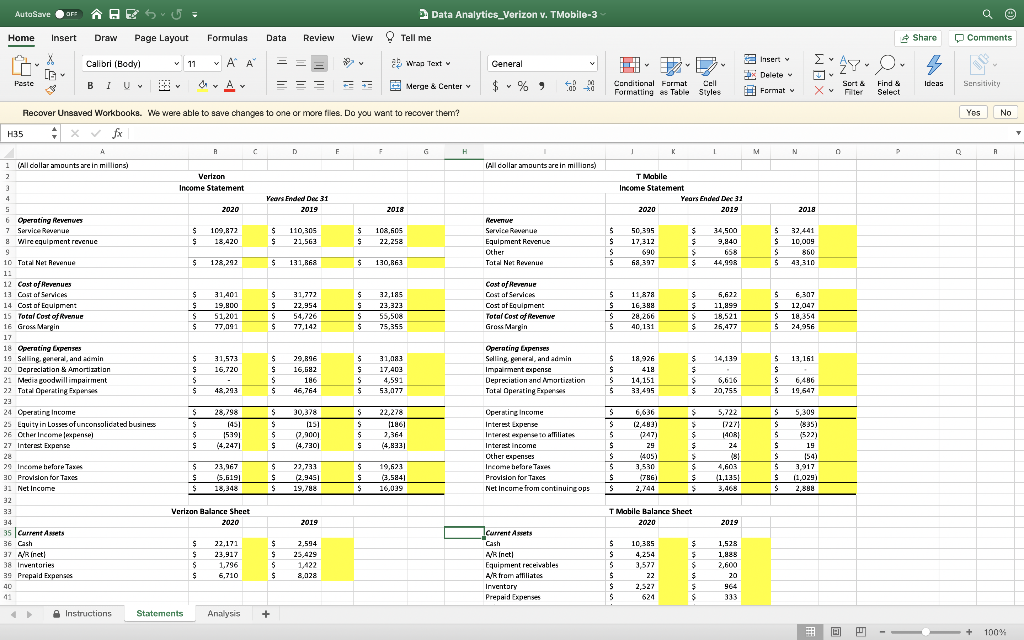

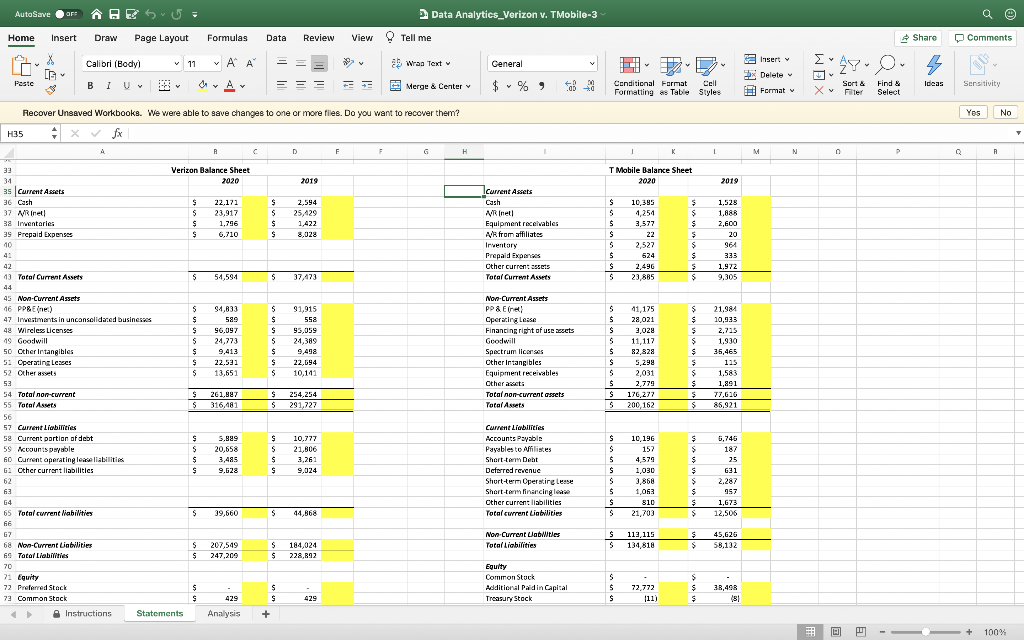

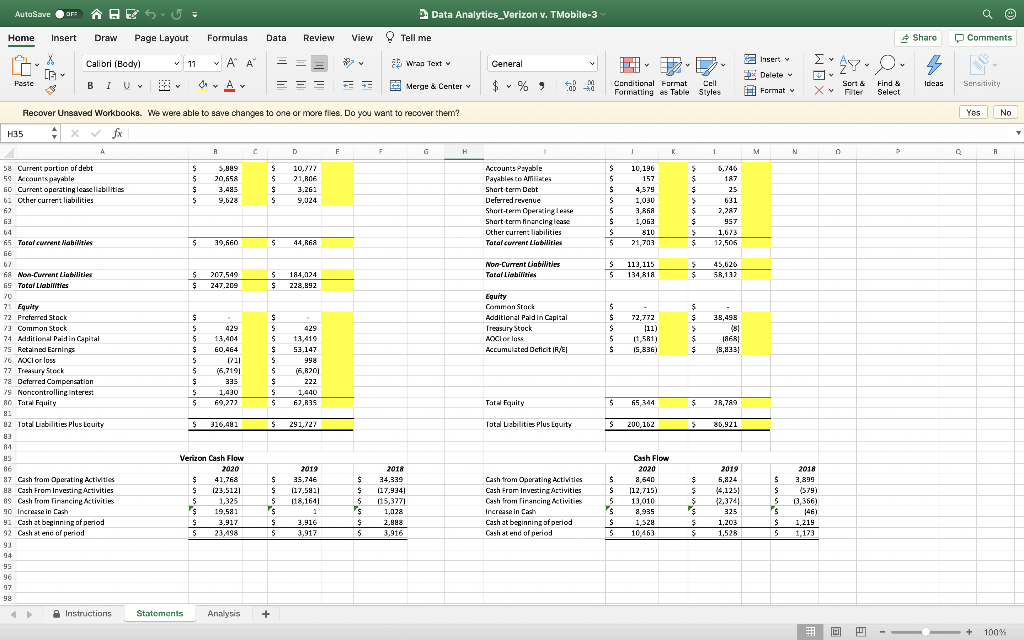

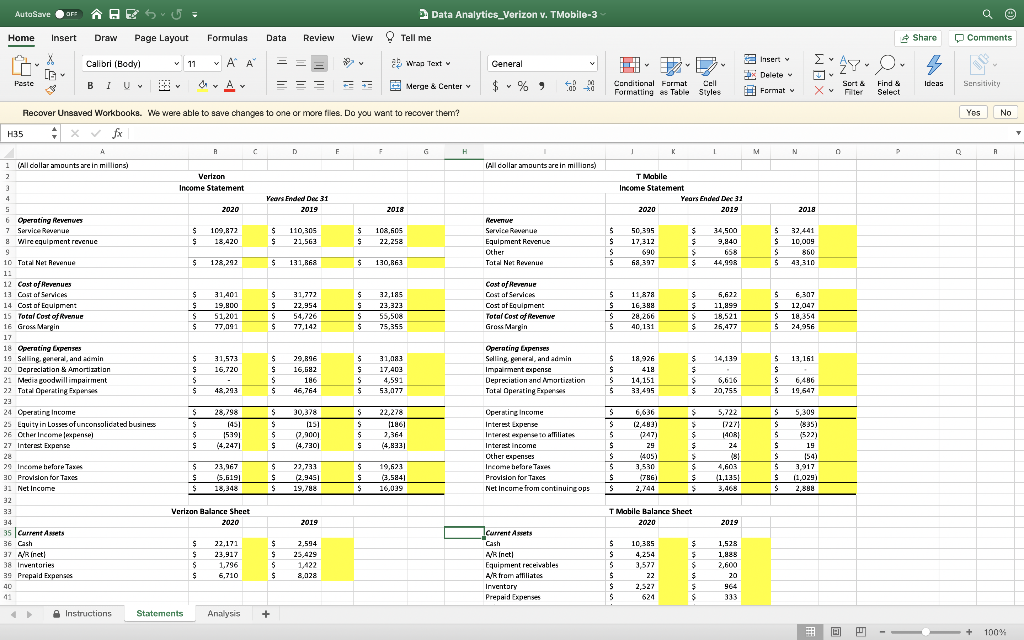

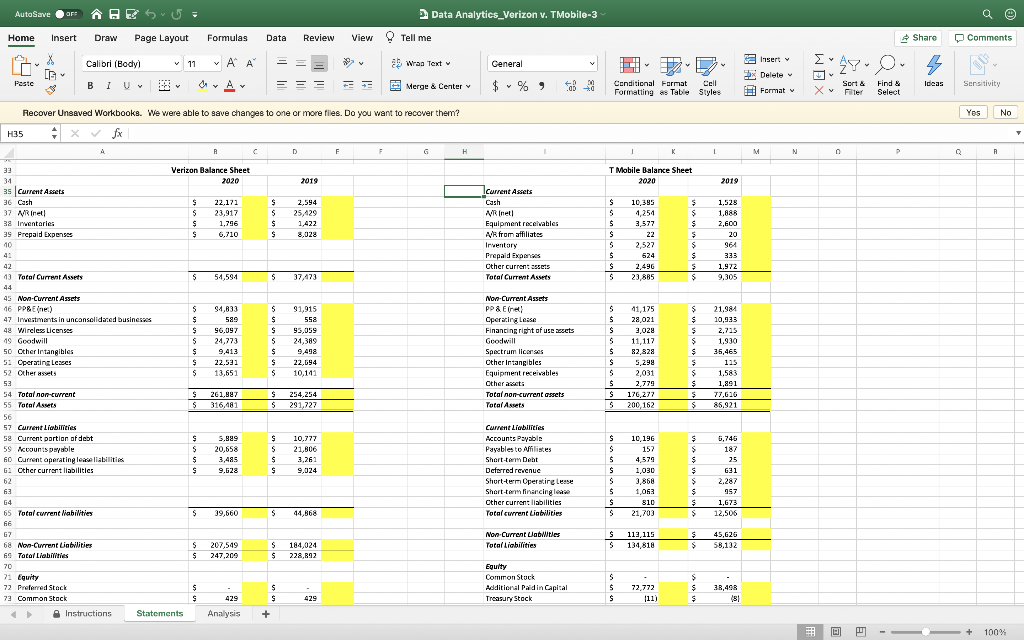

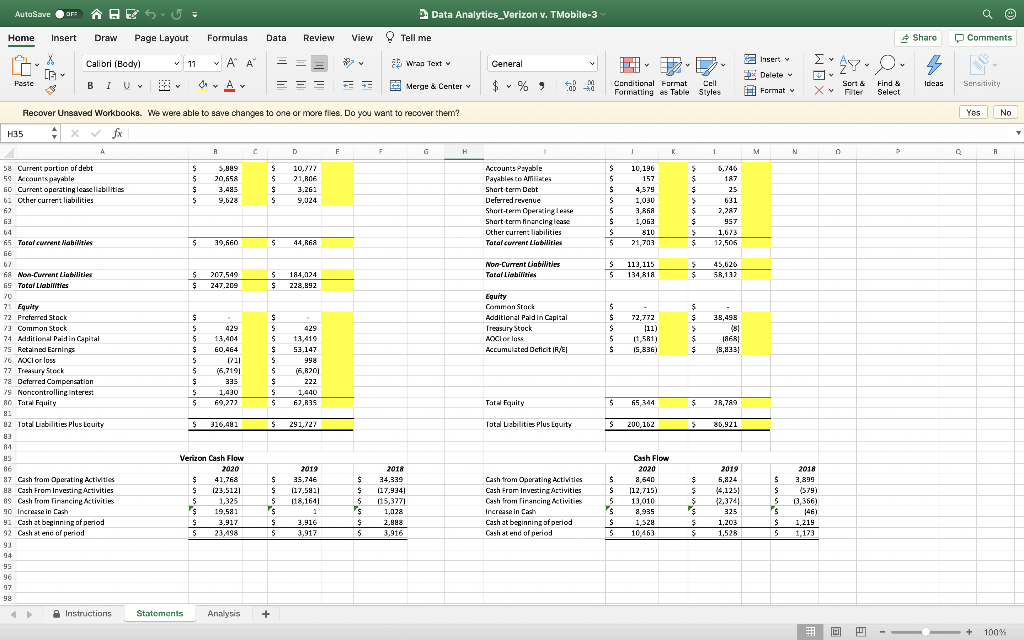

AutoSave OFF BES Home Insert Draw Page Layout Formulas Data Review View Calibri (Body) 11 [A S` A Wrap Text Merge & Center v Paste BI UV P 5JP Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? H35 + x fx A R C D F F G H 1 (All collar amounts are in millions) 2 Verizon 3 Income Statement 4 Years Ended Dec 31 5 2020 2019 6 Operating Revenues 7 Service Revenue $ 109,872 $ 110,305 8 $ 18,420 $ 21,563 9 10 Tatal Net Revenue $ 128,292 $ 131,868 11 12 Cost of Revenues 13 Cost of Services $ 31,401 $ 31,772 22,954 14 Cost of Equipment $ 19,800 $ 15 Total Cost of Revenue $ 51,201 S 54,726 16 Gross Margin $ 77,091 $ 77,142 17 18 Operating Expenses 19 Selling general, and admin $ 31,573 $ 29,896 20 Depreciation & Amortization $ 16,720 $ 16,682 21 Media goodwill impairment S 5 186 46,764 22 Total Operating Expens $ 48,293 S 23 24 Operating Income $ 28,798 $ 30,378 25 Equity in Losses of unconsolicated business $ (45) $ (15) (2,900) 26 Other Income [expense) 5 15391 $ 27 Interest Expense $ (4.2471 $ (4,730) 28 29 Income before Taxes $ 23,967 $ 22,733 30 Provision for Taxes $ (5.619) $ (2,945) 31 Net Income $ 18,348 $ 19,788 32 33 Verizon Balance Sheet 34 2020 2019 35 Current Assets 36 Cash $ 22,171 37 A/R (net) $ 23,917 1,796 $ $ 5 2,594 25,429 1,422 38 Inventories 5 39 Prepaid Expenses $ 6,710 $ 8,028 40 41 Analysis + Wire equipment revenue Instructions Statements O Tell me 2018 $ 108,605 22,258 $ $ 130,863 $ 32,185 $ 23,323 $ 55,508 $ 75,355 $ $ 31,083 17,403 4,591 53,077 S $ S 22,278 $ $ 7,364 $ (4,833) 5 19,623 $ (3.5841 $ 16,039 Data Analytics_Verizon v. TMobile-3~ General v $ % 9 Y (All collar amounts are in millions) Revenue Service Revenue Equipment Revenue Other Total Net Revenue Cost of Revenue Cost of Services Cost of Equipment Total Cost of Revenue Gross Margin Operating Expenses Selling general, and admin Impairment expense Depreciation and Amortization Tatal Operating Expenses Operating Income Interest Expense Interest expense to affiliates Interest income Other expenses Income before Taxes Provision for Taxes Net Income from continuing ops Current Assets Cash A/Rinet Equipment receivables. A/R from affiliates Inventory Prepaid Expenses (186) V Cell Conditional Format Formatting as Table Styles J K L T Mobile Income Statement Years Ended Dec 31 2019 2020 5 50,395 $ 17,312 S 690 68,397 $ $ $ $ 34,500 9,840 658 44,998 5 5 $ $ $ 11,878 16,388 28,266 40,131 5,622 11,899 18,521 25,477 S > 5 $ 18.926 $ 14,139 5 $ S 418 14,151 33,495 $ $ $ 6,616 20,755 5 S S 6,636 (2,483) (247) 29 $ $ $ 5 $ $ $ (405) $ 5 3,530 $ $ S (786) 2,744 $ $ T Mobile Balance Sheet 2020 $ $ 10,385 4,254 $ 5 $ $ $ $ 3,577 22 2,527 624 $ $ $ |: 5 5,722 17271 1408) 24 281 4,603 (1,135) 3,468 2019 1,528 1,888 2,600 20 964 333 M [AD x Insert v Delete Format v N 5 $ S 5 2018 32,441 10,009 860 43,310 6.307 12,047 5 $ S 5 18,354 24,956 5 13,161 $ 6,486 S 5 19,647 S S 5 $ S 5 $ S 5,309 (835) (522) 19 154) ) 3,917 (1,029) 2,888 3 0 Find & Select P Share Ideas Q a Comments Sensitivity Yes R No + 100% AutoSave OFF BES Home Insert Draw Page Layout Formulas Data Review View Calibri (Body) 11 Wrap Text v G [A Paste A == BI U Y Merge & Center v 5JP Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? + X fxx H35 A R C D F F G H 33 Verizon Balance Sheet 34 2020 2019 35 Current Assets 36 Cash $ 2,594 $ 5 37 Anet 22,171 23,917 1,796 5 25,429 38 Inventaries $ $ 1,422 39 Prepaid Expenses $ 6,710 8,028 40 41 42 43 Total Current Assets 5 54,594 5 37,473 44 45 Non-Current Assets 16 PPBE(ne) 5 94,833 5 91,915 47 Investments in unconsolidated businesses $ $ 558 589 56,097 48 Wireless Licenses $ $ 95,059 49 Goodwill S 24,773 5 24,389 50 Other Intangibles $ 9,413 $ 9,498 51 Operating Leases $ 22,531 $ 22,694 52 Other assets 5 13,651 5 10,141 53 54 Total non-current $ 261,887 $ 254,254 55 Total Assets 5 316,481 5 291,727 56 57 Current Liabilities 58 Current portion of debt $ $ 10,777 59 Accounts payable $ $ 21,806 5,889 20,658 3,485 9.628 60 Current operating lease liabilities $ $ 3,261 61 Other current liabilities $ $ 9,024 62 63 G4 65 Total current liabilities $ 39,660 $ 44.868 66 67 68 Non-Current Liabilities $ 207,549 $ 184,024 69 Total Liabilities $ 247,209 $ 228,892 70 71 Equity 72 Preferred Stock $ $ 73 Common Stock $ 429 $ 429 Analysis + Instructions Statements Data Analytics_Verizon v. TMobile-3~ General v $ % 9 Y O Tell me Current Assets Cash AR [net] Equipment receivables A/R from affiliates Inventory Prepaid Expenses Other current assets Total Current Assets Non-Current Assets PP & Einet) Operating Lease Financing right of use assets Goodwill Spectrum licenses Other Intangibles Equipment receivables Other assets Total non-current assets Total Assets Current Liabilities Accounts Payable Payables to Affiliates Short-term Debt Deferred revenue Short-term Operating Lease Short-term financing lease Other current liabilities Total current Liabilities Non-Current Liabilities Total Liabilities Equity Common Stock Additional Paid in Capital Treasury Stock V Cell Conditional Format Formatting as Table Styles K L T Mobile Balance Sheet 2020 $ 5 10,385 4.254 3,577 $ $ $ $ S 22 $ 2,527 524 2,496 23,885 41,175 28,021 3,028 11.117 82,828 5,298 2,031 2,779 176,277 200.162 10,196 157 4,579 1,030 3,868 1,063 810 21,703 113,115 134,818 72,772 5 $ S 5 5 $ $ 5 $ Te $ 5 $ | 5 $ S S 5 $ S 5 $ S $ S S $ $ (11) $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 2019 1,528 1.888 2,600 20 964 333 1,972 9,305 21,984 10,933 2,715 1,930 35,465 115 1,583 1,891 77,626 85,921 5,746 187 25 631 2,287 957 1,673 12,506 45,626 58.132 38,498 (81 M Insert v Delete Format v N [A WBX 0 D Share Find & Ideas Select P a Comments Sensitivity Yes No A + 100% AutoSave OFF BES Home Insert Draw Page Layout Formulas Data Review View Calibri (Body) 11 Wrap Text S` [A 5JP Paste BI U Y A == Merge & Center v Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? H35 X fxx A R c D F F G H 58 Current portion of debt $ 5,889 20,658 $ $ 10,777 21,806 59 Accounts payable 5 60 Current operating lease liabilities $ $ 3,261 3,485 9,628 61 Other current liabilities $ $ 9,024 62 63 64 65 Total current liabilities $ 39,660 $ 44,868 66 67 68 Non-Current Liabilities 5 207,549 $ 184,024 69 Total Liabilities $ 247,209 $ 228,892 70 71 Equity 72 Preferred Stock $ $ .. 73 Common Stock $ 429 $ 74 Additional Paid in Capital S 13,404 $ 75 Retained Earnings $ 60,464 $ 76 AOCI or loss $ (71) $ 77 Treasury Stock S (6,719) $ 78 Deferred Compensation $ 335 $ 79 Noncontrolling interest $ 1,430 $ 80 Total Equity $ 69,272 $ 82 Total Liabilities Plus Equity $ 316,481 $ 83 84 85 Verizon Cash Flow 86 2020 87 Cash from Operating Activities $ $ 88 Cash From Investing Activities $ $ 41,768 (23,512) 1,325 19,581 89 Cash from Financing Activities 5 $ 5 $ 90 Increase in Cash $ 91 Cash at beginning of period $ 3,917 $ 5 92 Cash at end of period 5 23,498 93 94 95 96 97 98 Analysis + Instructions Statements 429 13,419 53,147 998 (6,820) 222 1,440 62,835 291,727 2019 35,746 (17,581) (18,164) 1 3,916 3,917 Data Analytics_Verizon v. TMobile-3~ General v $ % 9 Y Accounts Payable Payables to Affiliates Short term Debt Deferred revenue Short-term Operating lease Short term financing lease Other current liabilities Total current Liabilities Non-Current Liabilities Total Liabilities Equity Common Stock Additional Paid in Capital Treasury Stock AOCI or loss Accumulated Deficit (R/EI Total Equity Total Lizbilities Plus Equity Cash from Operating Activities Cash From Investing Activities Cash from financing Activities Increase in Cash Cash at beginning of period Cash at end of period O Tell me 2018 $ 34,339 $ 5 (17,934) (15,377) 1,028 s $ 2,988 5 3,916 V Cell Conditional Format Formatting as Table Styles J K L S 5 $ S 5 $ S 5 S 5 5 $ S 5 $ 5 S $ $ 5 S S 5 10,196 157 4,579 1,030 3,868 1,063 810 21,703 113,115 134,818 72,772 (11) (1,581) (5,836) 65,344 200,162 $ 6.746 $ 0,790 187 25 $ $ 631 $ 2,287 $ 957 1,673 $ 12.506 45,626 $ $ 43,020 58,132 $ $ $ $ $ 38,498 (81 (868) (8,833) 28,789 86,921 2019 5,824 (4,1251 (2.374) 325 1,203 1,528 $ $ Cash Flow 2020 8,540 $ (12,715) $ 13,010 $ 8,935 $ 1,528 $ 10,463 $ Insert v Delete Format v N M $ $ 5 $ $ 5 [A Xv 2018 3,899 (579) (3,366) 1461 1,219 1,173 3 D Find & Select P Share Ideas a Comments Sensitivity Yes R No + 100% AutoSave OFF BES Home Insert Draw Page Layout Formulas Data Review View Calibri (Body) 11 Wrap Text G [A A Paste == BI U Merge & Center v 5pP Recover Unsaved Workbooks. We were able to save changes to one or more files. Do you want to recover them? H17 + x fx A B C D F F H I Verizon T Mobile Whose is best in each year? 2020 Data Analytics_Verizon v. TMobile-3~ General v Y Instructions O Tell me 1 2 3 2020 2019 2020 2019 4 Current Ratio 5 Debt Ratio 6 Total Asset Turnover Ratio 7 Net Profit Margin 8 Return on Equity 9 10 Upon completion of the above, in which company would you invest your $1,000? Why? Use your analysis to support your choice. 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 Statements Analysis + 2019 J V Cell Conditional Format Formatting as Table Styles K L M N Insert v Delete Format v 0 [A x P Q 3 Find & Select R Share Ideas a Comments Sensitivity Yes No 5 T U + 100% Instructions Statements Analysis Data Analytics / Financial Ratio Analysis This assignment will focus on the comparison between T Mobile and Verizon. Identify each company's weak and or strong areas of performance. After analysis, if you had $1,000 to purchase stock in either of these companies, which would you choose? (Please see the rubric in Canvas for directions on grading) Calculate the following in this workbook for both T Mobile and Verizon from the most recent years. Complete the vertical analysis in the statements worksheet. Complete the ratio analysis in the analysis worksheet Vertical Analysis of both the income statement three years) and balance sheet (wo years) Use the yellow highlighted columns for your vertical analysis. 2. Current rate this examines a company's liquidity 3.Debt ratio (Total Liabilities/Total Assets). This examines the capital structure of a company 4. Total settornover ratie - This examines a company's efficiency 5. Net profil margin (net income net revenue) - This is a profitability ratio 6. Return on Equity. This is also a profitability ratio Upon completion of the showe, in which company would you invest your $1,000? Why? Use your analysis to support your choice. Instructions Statements Analysis Verizon 2020 T Mobile 2020 Whose is best in each year? 2020 2019 2019 2019 Current Ratio Debt Ratio Total Asset Turnover Ratio Net Profit Margin Return on Equity Upon completion of the above, in which company would you invest your $1,000? Why? Use your analysis to support your choice. Instructions Statements Analysis (All in l Vartva Income Stateme Q Wir spre Colofo Cast of Suns of b Depecat & Ant da good inquinam Open ho the d Exp Pin a N Cumhu Ca ALI Peped www CA No PAND La Geded Ohe Open La the mo T Ted from C L enky List pap ORCIDAK PERFEINEIN sessapa, anaj basmanda n Palvel Cook WDOY maksaj pretjspmannas f Pl indy Tomay kak Del Con NI Ta Pare Cap Cities CFA Ca sealja fassali, a 1063) www V Bal ILOI BK 11,401 11,301 34,11 16.731 144 46.29 3820 - 4347 POST Cla 3600 25,171 URT Le 670 MEYE www. 100% GALVE 50 CHAU 21.01 15601 AK PAY 31641 Kon Ca www 14 CVE 350 Exe 1 2413 S Tak www le 4TH ** PRE CATE Tier WOW. 41,7 2000 1, THCHE ANT Jarit Ended 2014 THEM PLME 1170 B SELE IMM INE www Mak 313 200 4TH MAMIL 819 (MSZ BLACK LACE MON MAIN MURES 598 waw 243 ser's 15,44 1041 34000 291,7271 IKT 3,00 INCY FOR www. IM PRE 11 429 HAW 5.147 ww 400 222 ma 11879 291727 2019 15,7 JUNE born www. E AMIT 2013 3339 BREAKE 72381 2530 45,500 ILARI VALE TIHE 2200 AN 2164 4811 PRADE 336 1641 WK www HAVE 45477 13 2401 I HE Sever Fog Her g Cof Coffe C y Siling, pendand advis pant expu To Operating Incom Ex Oda expenses for Tam Neg Ca Cat ANON Y CHARIJAI NEI KIA MODALA mga pak y Exp A Creat PALING Opening L Truiningi: Gooded Sp fo Ofer KA AP De That Opening Come Of Na-Ca L to Com Alhad Traney Mick M AB) Pla Romy ww maq lazamaj mar many Razonky o pred PO PO C Cabang Ca TH Income Statement 2020 6341 11312 HART BEATE ww HICH 26364 BEBE www. 117 Tom SWEE SAN -2461 341 24 HE Pal TMale Sale Sheet 300 HOW 4200 HET 21 2.321 Al NIFT 338345 41.39 26000 300 aru KIXIK 524 2011 THALE 3630 1819 1sh 43TH HOTE 3444 KH 35.760 HEMS YATE -16 10) -4304 65341 C bare 2024 www AEPIE nect han KIRIK 3320 Instructions Statements Analysis Data Analytics / Financial Ratio Analysis This assignment will focus on the comparison between T Mobile and Verizon. Identify each company's weak and/or strong areas of performance. After analysis, if you had $1,000 to purchase stock in either of these companies, which would you choose? (Please see the rubric in Canvas for directions on grading) Calculate the following in this workbook for both T Mobile and Verizon from the most recent 2 years. Complete the vertical analysis in the statements worksheet. Complete the ratio analysis in the analysis worksheet. 1. Vertical Analysis of both the income statement (three years) and balance sheet (two years). Use the yellow highlighted columns for your vertical analysis. 2. Current ratio- this examines a company's liquidity 3. Debt ratio (Total Liabilities/Total Assets) - This examines the capital structure of a company 4. Total asset turnover ratio- This examines a company's efficiency 5. Net profit margin (net income / net revenue) - This is a profitability ratio 6. Return on Equity - This is also a profitability ratio Upon completion of the above, in which company would you invest your $1,000? Why? Use your analysis to support your choice. Instructions (All dollar amata are te molim Operating Re Serve Reveme Wapp Tal Reve Cand of Reven Cast of Con of Egipt Cof Selling and a D&Am Modi gode men ping ity Lofundidated on Ober ter Expe van sy Tan man Not Curnlum Ca ARIND Sveries Popid Expenses and Car PFAE Invas is madalated businesse L Oberbangbi Omunating tomers Other Tal Car portion of d As peable Caree pucturity uns nar cumee line Lahatman Equity PM Como Stack A din Capital da NOCT Toy Stock De Coton Nog Yond Figury Statements S Ly CachCuttingAatvtian Ca xanh trong raising A in C Cabengo period Cal Analysis Veries 2004 SMATZ 18,43 KOWLING www sand 51300 ELCH 16,730 48.290 PACK 41 AN 4347 141 14,340 Narin Balance She NOW 22,411 21917 Un 5434 94433 H W 24,771 LIPA 21.311 BASE 261,307 THERIC Jam 20,496 3,485 $428 wwww 2013 247-2 428 11:44 www n ATH 338 AFE #4312 HAMI Ver Cad Flow 2830 41.700 -21402 NOW 19,301 ANY 21,40 Ended 31 2009 C 2134) WILL 14.772 72354 34734 RIO 20 IAM IN PALW 490 4TH 2441 10700 2009 2.994 25429 140 KICK STATE PLAY 584 eurse 2030 ar's PHYCE 1814 VE T 21MM 1361 YOUN KA HOPEE NDAY 323 Lav 2009 1634 INST 8.30 3804 ANT 2004 (RM) Jare 5630 KUI SUD Wil C 1 225 2.54 -3.4 4184 Hu TASM and from Servies Reveme Spent Rev Y Cate Cof Cof Operating Expe In ng pand pe and A Opng Ex ofer stan, ang mg tingen Not va continuing ope C Cok ARING F AR way Piped Expe Oder c PALING L ng Cau nam je zapka berman Gondell Sp res Fes Oder land Li te P M pak tem prospe Tyk ADC Sty ng Lowe ing from szary stand, man Car Cang terda Call of petal C VEJA MAINE TM Income Statement 2430 16.3 DIELE M.J Kri 1436 WHENE MILL 38300 414 www www OFF T Mobile Balance Sheet 2428 18.30 4294 3379 # 1327 404 NFT (KIT 41,379 KFT HAIT SZACH 1.39 INCE LENE 2014 18M UST 4579 talo LA UNE I MAN SIXTEL 72312 TP: ICE #54 Cal 2420 LAND taid 1328 18.40 Instructions Statements Verizon Analysis 2020 2019 2020 2019 Current Ratio Debt Ratio Total Asset Turnover Ratio Net Profit Margin Return on Equity Upon completion of the above, in which company would you invest your $1,000? Why? Use your analysis to support your choice. T Mobile Whose is best in each year? 2020 2019

need helo plz

need helo plz