Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help A former Fry World USA CEO, Mike Lanning, said that purchasing a $33,000 robotic arm would be cheaper than paying fast-food workers $12

need help

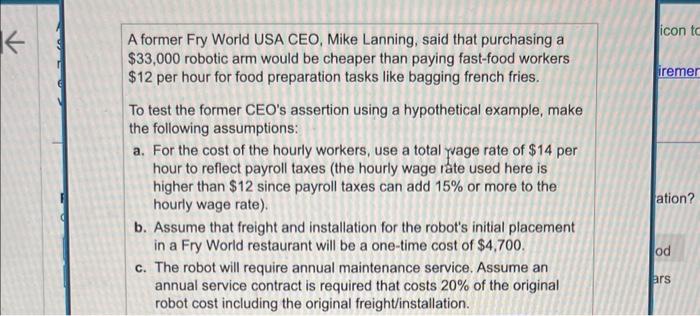

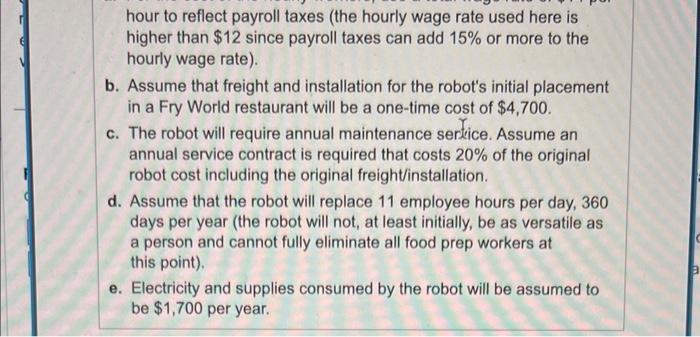

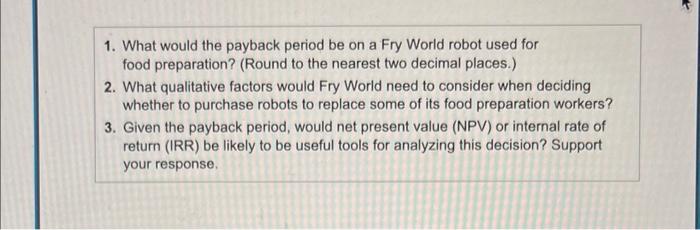

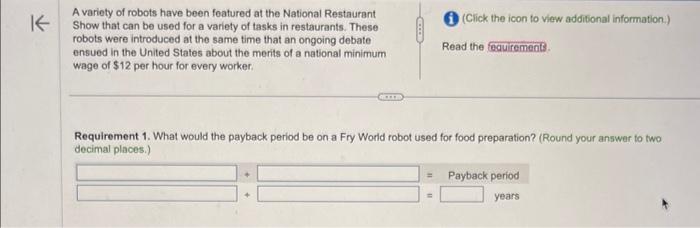

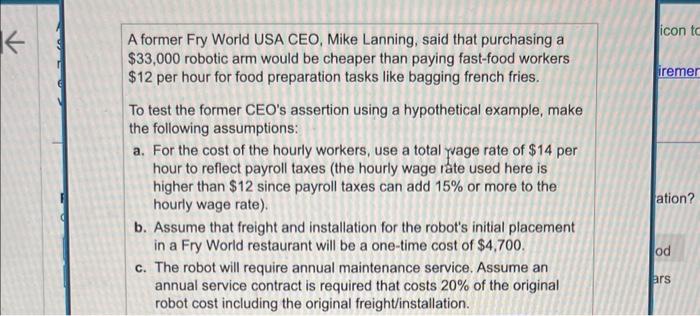

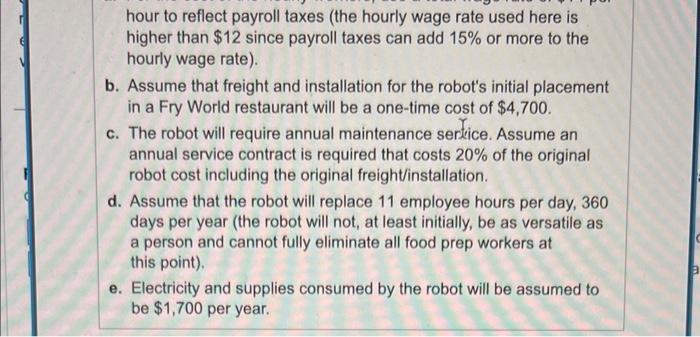

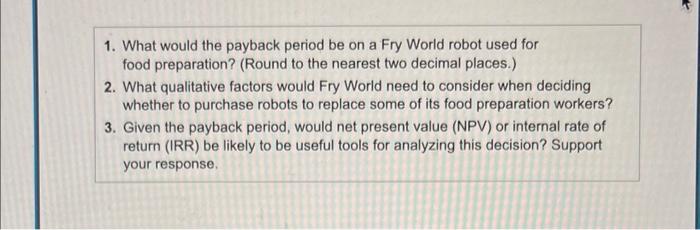

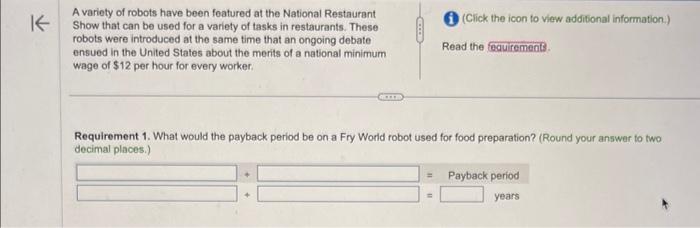

A former Fry World USA CEO, Mike Lanning, said that purchasing a $33,000 robotic arm would be cheaper than paying fast-food workers $12 per hour for food preparation tasks like bagging french fries. To test the former CEO's assertion using a hypothetical example, make the following assumptions: a. For the cost of the hourly workers, use a total yage rate of $14 per hour to reflect payroll taxes (the hourly wage rate used here is higher than $12 since payroll taxes can add 15% or more to the hourly wage rate). b. Assume that freight and installation for the robot's initial placement in a Fry World restaurant will be a one-time cost of $4,700. c. The robot will require annual maintenance service. Assume an annual service contract is required that costs 20% of the original robot cost including the original freight/installation. hour to reflect payroll taxes (the hourly wage rate used here is higher than $12 since payroll taxes can add 15% or more to the hourly wage rate). b. Assume that freight and installation for the robot's initial placement in a Fry World restaurant will be a one-time cost of $4,700. c. The robot will require annual maintenance sertice. Assume an annual service contract is required that costs 20% of the original robot cost including the original freight/installation. d. Assume that the robot will replace 11 employee hours per day, 360 days per year (the robot will not, at least initially, be as versatile as a person and cannot fully eliminate all food prep workers at this point). e. Electricity and supplies consumed by the robot will be assumed to be $1,700 per year. 1. What would the payback period be on a Fry World robot used for food preparation? (Round to the nearest two decimal places.) 2. What qualitative factors would Fry World need to consider when deciding whether to purchase robots to replace some of its food preparation workers? 3. Given the payback period, would net present value (NPV) or internal rate of return (IRR) be likely to be useful tools for analyzing this decision? Support your response, A variety of robots have been featured at the National RestaurBnt Show that can be used for a variety of tasks in restaurants. These 1. (Click the icon to view additional information.) robots were introduced at the same time that an ongoing debate ensued in the United States about the merits of a national minimum wage of $12 per hour for every worker: Requirement 1. What would the payback period be on a Fry World robot used for food preparation? (Round your answer to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started