Need help answering 13-20. Have done the math for 13,-15, and I keep getting the wrong answers!! Please help.

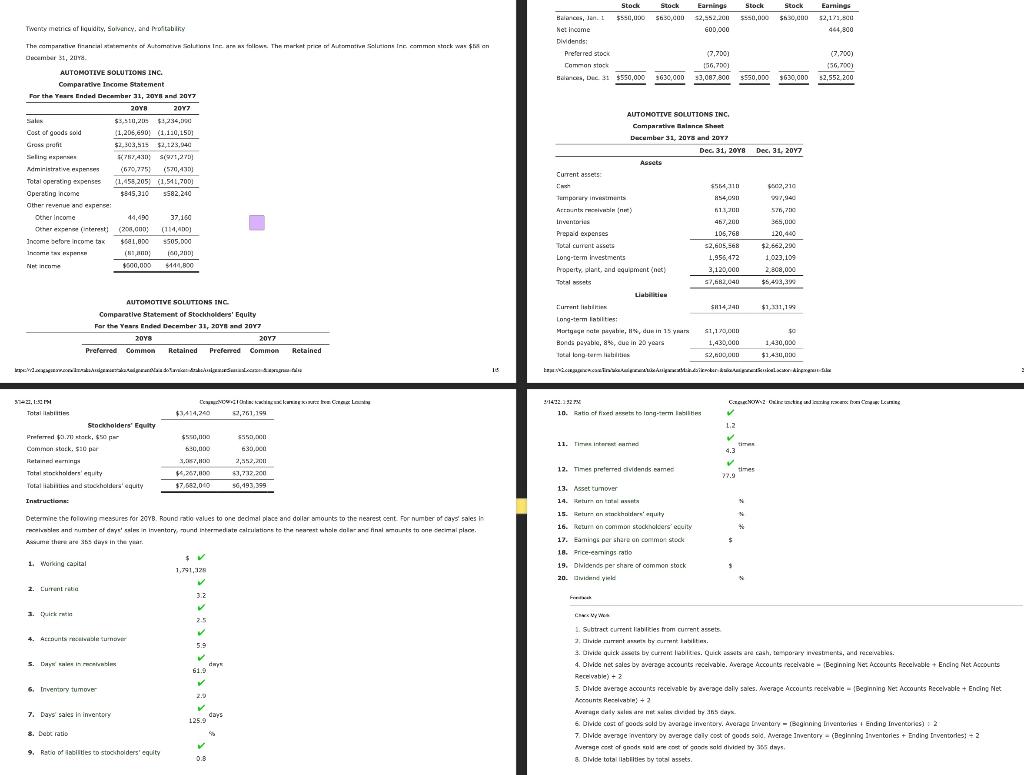

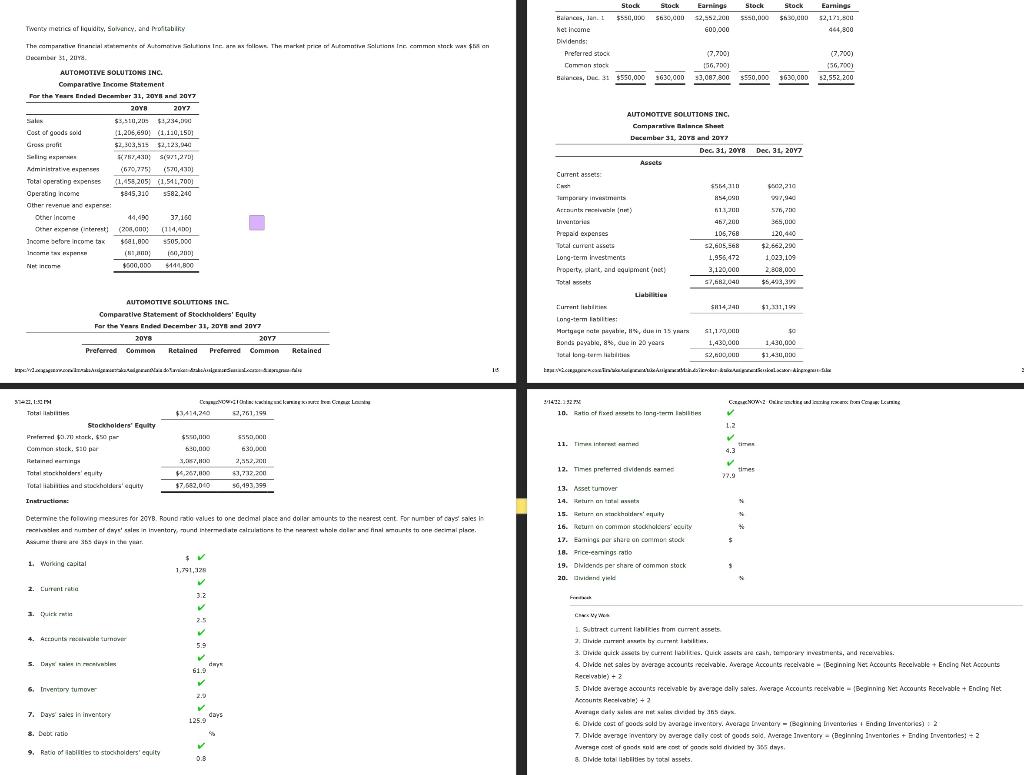

Stock Stock Stock Earnings S630,000 $2,552.200 GOD.000 5550,00 $530,000 Earnings 52,173,500 444.300 Twenty metrics of liquidity, Solvency, and Potability Stock Bale, Jan. L $50,000 $ Net income Dividends Preferred OCK Common stock Bancs DC 31 $550,000 (7.2001 156,7901 $3,087.300 $550.000 (7.700) 156.700) 52,552 200 $630,000 $630,000 The comparat news of Xtomotive Solution Inc. follows. The market promotion Solintine Inc. common stark was son Umber 31, 2018 AUTOMOTIVE SOLUTIONS INC. Comparative Income Statement For the Year Ended December 31, 204 and 2017 2018 2017 $5,90,20 1,234.000 $ Cost of goods sod (1,205,690) (1.130,150) Gross prant $2,503,513 $2,129,040 Sing per $ 767,430) 1971,270) ministrative pe (670,775) (520,490) Total operating expenses (1,455,205) (1.541,700) Operating come $545,310 5582.240 Other revenue and expense Other income 44,490 37.100 Other examinaret (200,000 (114,400) Income before income tax $501.00 5505.000 Income IND ( on, 2010 ( Net nem 500,000 9144.800 AUTOMOTIVE SOLUTIONS INC Comparative innre that December 31, 2018 and 2017 Dec 31, 2018 Dec 31, 2017 Assets Current assets S5410 $609,210 Tumporary woments M54,0901 97,940 Arrants in 513 Un 576,700 Inventorius 467,200 365,000 Prepad expenses 105,768 120,400 Total current as 52,605.568 $2,662,200 Long-term Investments 1,955,172 1,023,109 Property, blant and equipment (net 3,120,000 2.800,000 Total webs 57,682,040 $5,493,392 Liabilities Current ishte SH14.241 $1. 11,1 Inng-tamil Mortgage ca peh,, dus in 15 yrs $1,170,000 so Bonda payable, 8%, cue in 20 years 1,435.000 1,430,000 Total long termes $2,500 $1,450,000 ETXERACOTA korkeudexx AUTOMOTIVE SOLUTIONS INC Comparative Statement of Stockholders' Equity For the Year Ended December 31, 2017 and 2017 2018 2017 Preferred Comition Retained Preferred Common Retained pVXxx Angeles La 18 CELON2 Ocak olan DIRECL $1.414,740 9,761.199 3:1492.327 10. Bate of tong-womes 1.2 35-21, Totalisht Stockholders' Equity Printed $3.713 sterk, $50 Common stock. $10 per ring Total desequity Totalities and stockholders' equity 3550.000 630.00u 11. +tar 4.3 $55,00 520,000 3.KST, MEIO 1,267,000 $7,662,000 12. Times preferredsvidends cames times 22.9 $3,712,200 56,193.399 Instruction Determine the following ressures for 20YB. Round ratio vales to one decimal place and dollar amounts to the nearest cent. For number of days sales roles and bar of dwellin inventory, mund -hermediate calculation to the nearest wholene finnur non implcm Aset there are 365 days in the year 13. Asset tumor 14. turn on 15. ure an inchirieremuly 16. Return on common stockholders uity 17. aming per share on como Stock 18. rennings ratio 19. Dridends per share of common stock 20. vind yuld 1. Working capital $ 1,791,128 2. Current riba 3.2 3. Duitkratis Cheww 2.5 4. Dunavar 5.9 S. DU Kini dwy 61,0 6. Crventory tumover 2.9 1. Subtract current liabilities from current assets 2. Bus by Dr. 3. De aicksts by current abilities. Quck assets are tash, temporary mestment, and recevables. 4. DMide net sales by average accounts receivable. Average Accounts receivable - Beginning Net Accounts Receivable + Ending Net Accounts Receivable) + 2 5. DNide average accounts receivable by average dely sales. Average Accounts receivabe - Beginning Net Accounts Receivable + Ending Net Accounts Receivabe + 2 Average call are divided by 6. Divide cost of poods sold by average imetry. Average wentary - (Beginning Driventris Ending Inventories): 2 7 DMde average nventory by average caly cost of goods sold. Average Inventory - (Beginning inventaries + Ending Erventories: 2 Average cost of goods and cont of shock als died by des & Orde total abities by cal assets. 7. Days sales inimentary 125 days 8. Debe ratio 5 9. Ratio of abilities to stockholders' equity 0.8 Stock Stock Stock Earnings S630,000 $2,552.200 GOD.000 5550,00 $530,000 Earnings 52,173,500 444.300 Twenty metrics of liquidity, Solvency, and Potability Stock Bale, Jan. L $50,000 $ Net income Dividends Preferred OCK Common stock Bancs DC 31 $550,000 (7.2001 156,7901 $3,087.300 $550.000 (7.700) 156.700) 52,552 200 $630,000 $630,000 The comparat news of Xtomotive Solution Inc. follows. The market promotion Solintine Inc. common stark was son Umber 31, 2018 AUTOMOTIVE SOLUTIONS INC. Comparative Income Statement For the Year Ended December 31, 204 and 2017 2018 2017 $5,90,20 1,234.000 $ Cost of goods sod (1,205,690) (1.130,150) Gross prant $2,503,513 $2,129,040 Sing per $ 767,430) 1971,270) ministrative pe (670,775) (520,490) Total operating expenses (1,455,205) (1.541,700) Operating come $545,310 5582.240 Other revenue and expense Other income 44,490 37.100 Other examinaret (200,000 (114,400) Income before income tax $501.00 5505.000 Income IND ( on, 2010 ( Net nem 500,000 9144.800 AUTOMOTIVE SOLUTIONS INC Comparative innre that December 31, 2018 and 2017 Dec 31, 2018 Dec 31, 2017 Assets Current assets S5410 $609,210 Tumporary woments M54,0901 97,940 Arrants in 513 Un 576,700 Inventorius 467,200 365,000 Prepad expenses 105,768 120,400 Total current as 52,605.568 $2,662,200 Long-term Investments 1,955,172 1,023,109 Property, blant and equipment (net 3,120,000 2.800,000 Total webs 57,682,040 $5,493,392 Liabilities Current ishte SH14.241 $1. 11,1 Inng-tamil Mortgage ca peh,, dus in 15 yrs $1,170,000 so Bonda payable, 8%, cue in 20 years 1,435.000 1,430,000 Total long termes $2,500 $1,450,000 ETXERACOTA korkeudexx AUTOMOTIVE SOLUTIONS INC Comparative Statement of Stockholders' Equity For the Year Ended December 31, 2017 and 2017 2018 2017 Preferred Comition Retained Preferred Common Retained pVXxx Angeles La 18 CELON2 Ocak olan DIRECL $1.414,740 9,761.199 3:1492.327 10. Bate of tong-womes 1.2 35-21, Totalisht Stockholders' Equity Printed $3.713 sterk, $50 Common stock. $10 per ring Total desequity Totalities and stockholders' equity 3550.000 630.00u 11. +tar 4.3 $55,00 520,000 3.KST, MEIO 1,267,000 $7,662,000 12. Times preferredsvidends cames times 22.9 $3,712,200 56,193.399 Instruction Determine the following ressures for 20YB. Round ratio vales to one decimal place and dollar amounts to the nearest cent. For number of days sales roles and bar of dwellin inventory, mund -hermediate calculation to the nearest wholene finnur non implcm Aset there are 365 days in the year 13. Asset tumor 14. turn on 15. ure an inchirieremuly 16. Return on common stockholders uity 17. aming per share on como Stock 18. rennings ratio 19. Dridends per share of common stock 20. vind yuld 1. Working capital $ 1,791,128 2. Current riba 3.2 3. Duitkratis Cheww 2.5 4. Dunavar 5.9 S. DU Kini dwy 61,0 6. Crventory tumover 2.9 1. Subtract current liabilities from current assets 2. Bus by Dr. 3. De aicksts by current abilities. Quck assets are tash, temporary mestment, and recevables. 4. DMide net sales by average accounts receivable. Average Accounts receivable - Beginning Net Accounts Receivable + Ending Net Accounts Receivable) + 2 5. DNide average accounts receivable by average dely sales. Average Accounts receivabe - Beginning Net Accounts Receivable + Ending Net Accounts Receivabe + 2 Average call are divided by 6. Divide cost of poods sold by average imetry. Average wentary - (Beginning Driventris Ending Inventories): 2 7 DMde average nventory by average caly cost of goods sold. Average Inventory - (Beginning inventaries + Ending Erventories: 2 Average cost of goods and cont of shock als died by des & Orde total abities by cal assets. 7. Days sales inimentary 125 days 8. Debe ratio 5 9. Ratio of abilities to stockholders' equity 0.8