Need help answering number 55 please A-G.

.

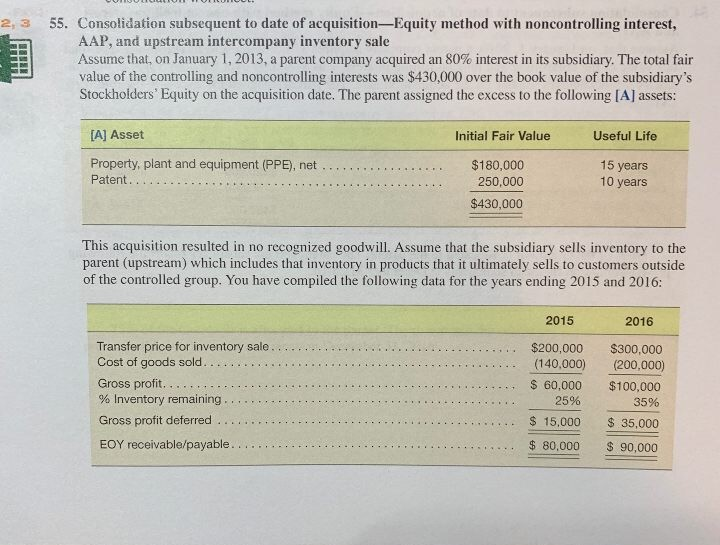

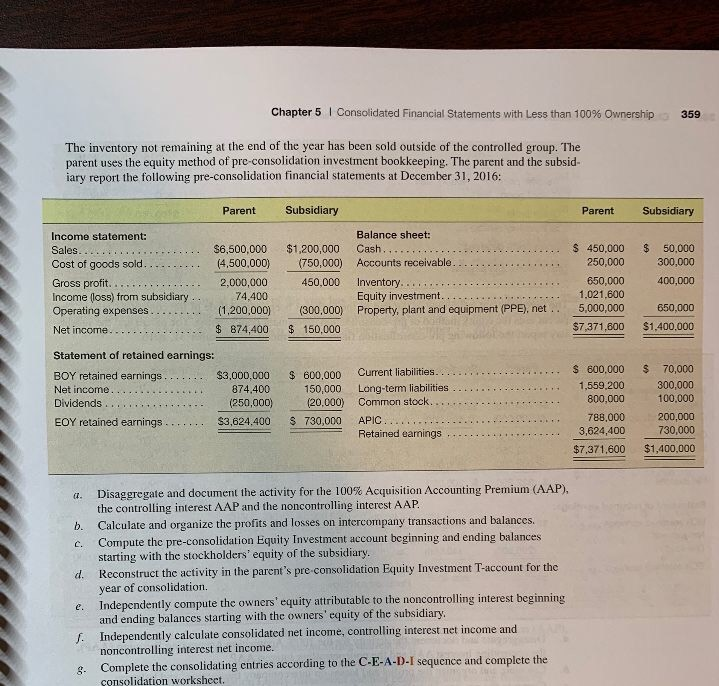

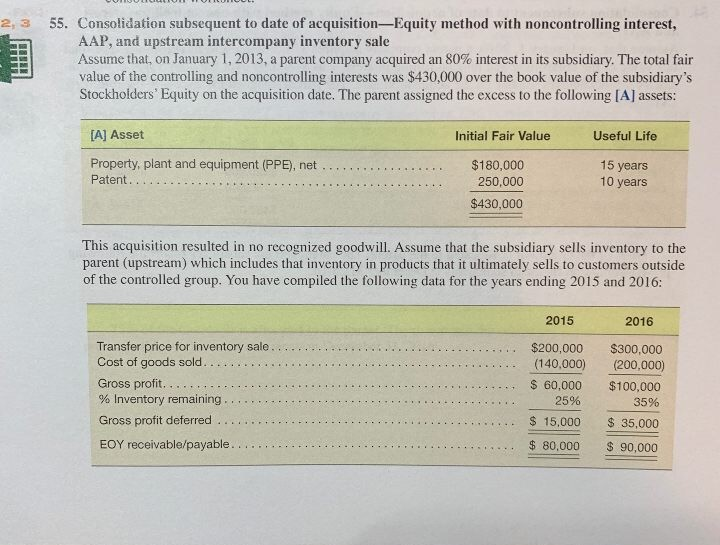

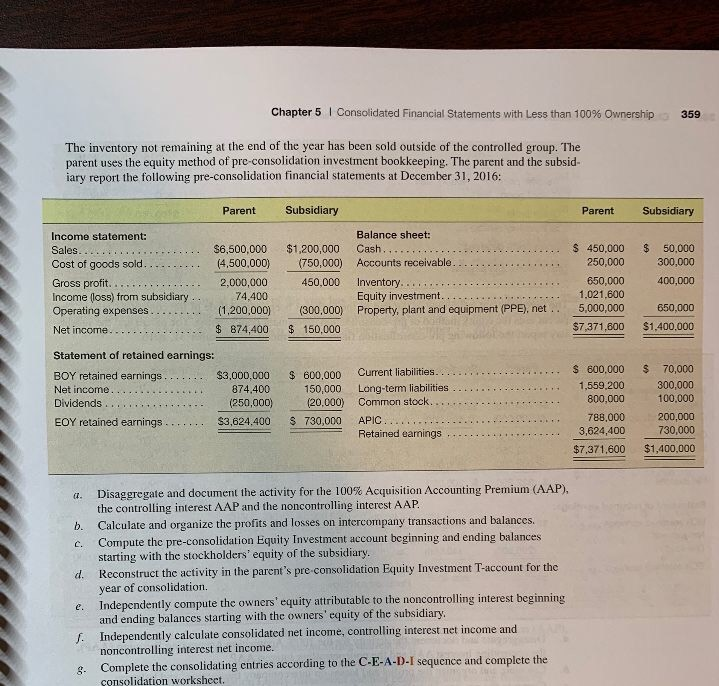

2, 3 55. Consolidation subsequent to date of acquisition-Equity method with noncontrolling interest, AAP, and upstream intercompany inventory sale Assume that, on January 1, 2013, a parent company acquired an 80% interest in its subsidiary. The total fair value of the controlling and noncontrolling interests was $430,000 over the book value of the subsidiary's Stockholders' Equity on the acquisition date. The parent assigned the excess to the following [A] assets: [A] Asset Initial Fair Value Useful Life Property, plant and equipment (PPE), net Patent... $180,000 250,000 15 years 10 years $430,000 This acquisition resulted in no recognized goodwill. Assume that the subsidiary sells inventory to the parent (upstream) which includes that inventory in products that it ultimately sells to customers outside of the controlled group. You have compiled the following data for the years ending 2015 and 2016: 2015 2016 Transfer price for inventory sale Cost of goods sold.... Gross profit. . % inventory remaining . Gross profit deferred. EOY receivable/payable. . $200,000 $300,000 (140,000) (200,000) 60,000 $100,000 25% 35% 15,000 35,000 .80,000 90,000 2, 3 55. Consolidation subsequent to date of acquisition-Equity method with noncontrolling interest, AAP, and upstream intercompany inventory sale Assume that, on January 1, 2013, a parent company acquired an 80% interest in its subsidiary. The total fair value of the controlling and noncontrolling interests was $430,000 over the book value of the subsidiary's Stockholders' Equity on the acquisition date. The parent assigned the excess to the following [A] assets: [A] Asset Initial Fair Value Useful Life Property, plant and equipment (PPE), net Patent... $180,000 250,000 15 years 10 years $430,000 This acquisition resulted in no recognized goodwill. Assume that the subsidiary sells inventory to the parent (upstream) which includes that inventory in products that it ultimately sells to customers outside of the controlled group. You have compiled the following data for the years ending 2015 and 2016: 2015 2016 Transfer price for inventory sale Cost of goods sold.... Gross profit. . % inventory remaining . Gross profit deferred. EOY receivable/payable. . $200,000 $300,000 (140,000) (200,000) 60,000 $100,000 25% 35% 15,000 35,000 .80,000 90,000