Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need help answering Option 3: Research Expenditure. You are the chief financial officer of The Oakley Corporation (TOC). You must decide how to use $100,000

Need help answering Option 3: Research Expenditure.

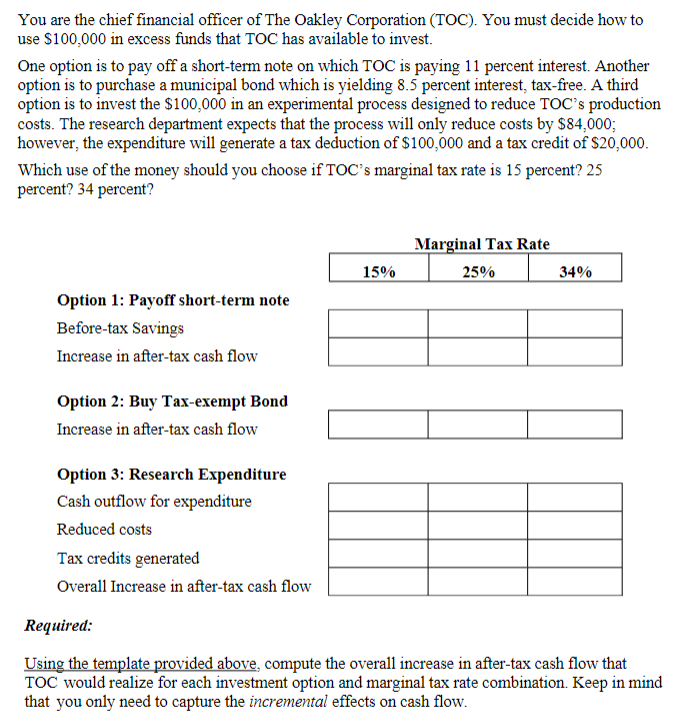

You are the chief financial officer of The Oakley Corporation (TOC). You must decide how to use $100,000 in excess funds that TOC has available to invest. One option is to pay off a short-term note on which TOC is paying 11 percent interest. Another option is to purchase a municipal bond which is yielding 8.5 percent interest, tax-free. A third option is to invest the $100,000 in an experimental process designed to reduce TOC's production costs. The research department expects that the process will only reduce costs by $84,000; however, the expenditure will generate a tax deduction of $100,000 and a tax credit of $20,000. Which use of the money should you choose if TOC's marginal tax rate is 15 percent? 25 percent? 34 percent? R Using the template provided above, compute the overall increase in after-tax cash flow that TOC would realize for each investment option and marginal tax rate combination. Keep in mind that you only need to capture the incremental effects on cash flowStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started