Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Need Help Answering Questions 1A, 1B, 2A, 2B, 2C, and 2D Required a. How many shares of common stock were outstanding at the end of

Need Help Answering Questions 1A, 1B, 2A, 2B, 2C, and 2D

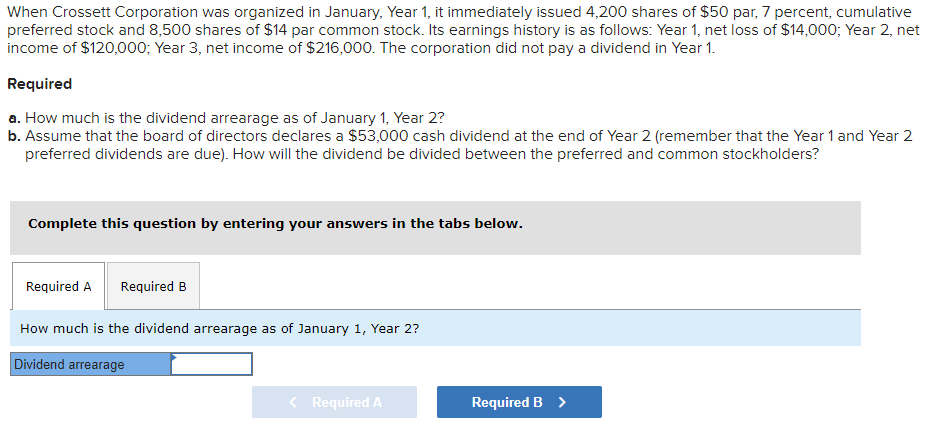

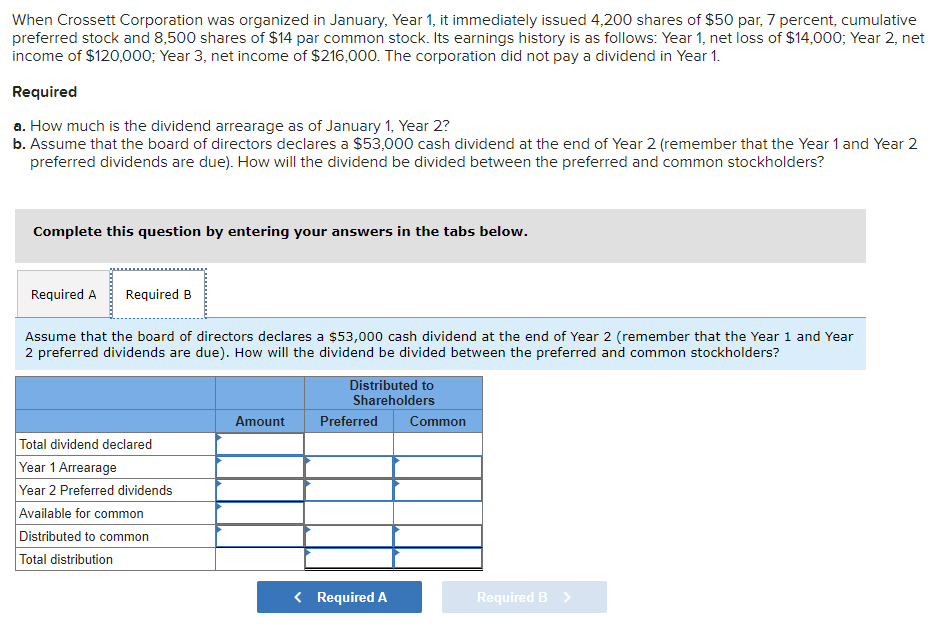

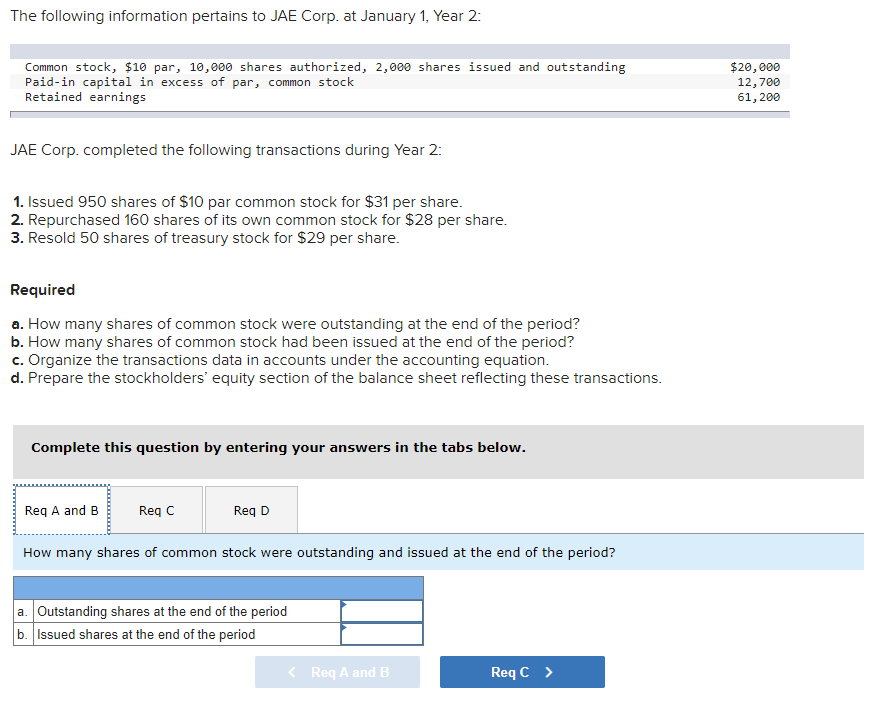

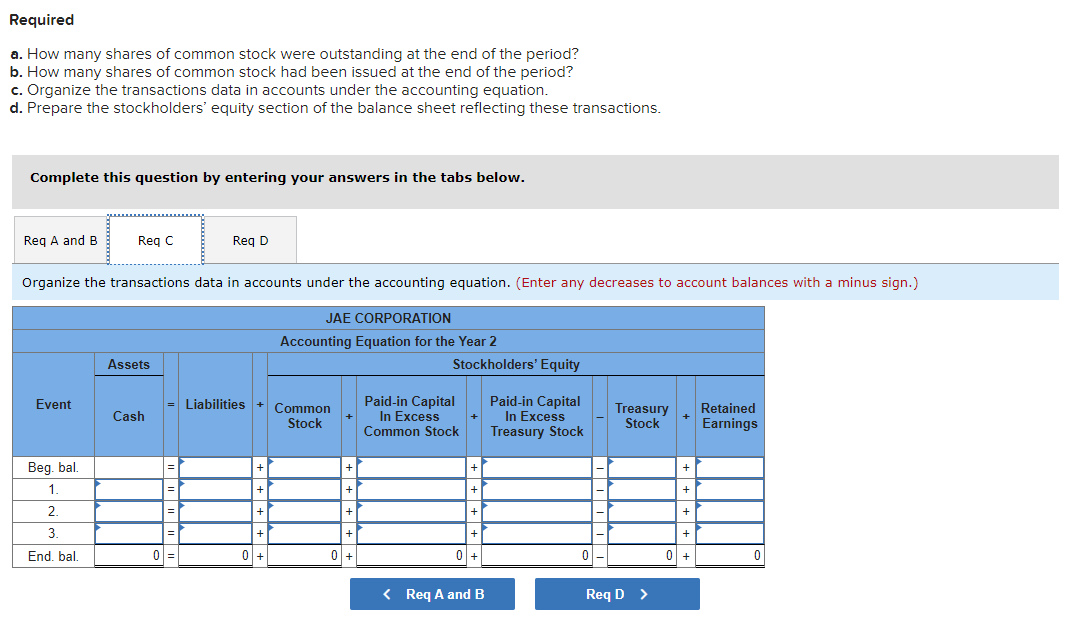

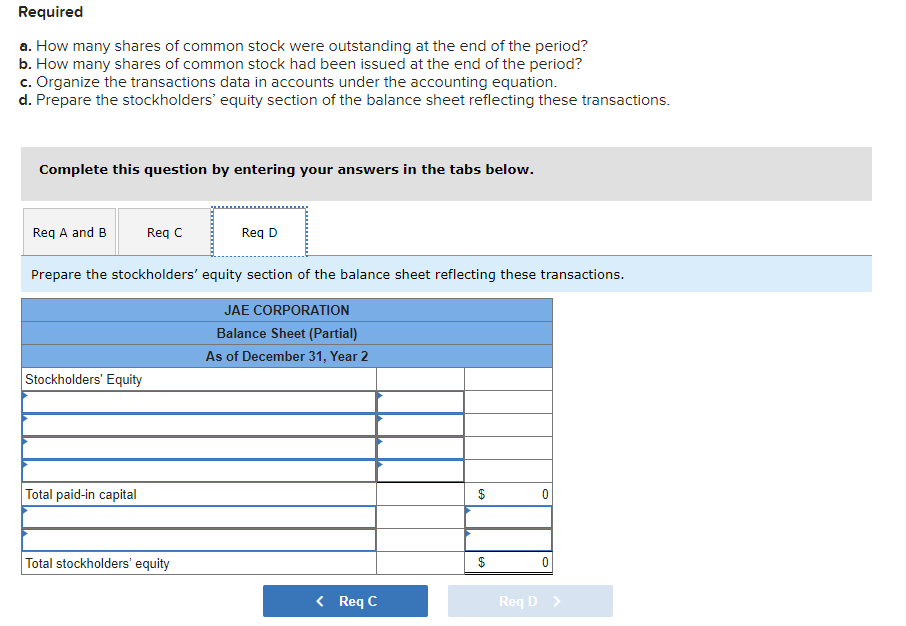

Required a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? c. Organize the transactions data in accounts under the accounting equation. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. Complete this question by entering your answers in the tabs below. The following information pertains to JAE Corp. at January 1, Year 2: JAE Corp. completed the following transactions during Year 2: 1. Issued 950 shares of $10 par common stock for $31 per share. 2. Repurchased 160 shares of its own common stock for $28 per share. 3. Resold 50 shares of treasury stock for $29 per share. Required a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? c. Organize the transactions data in accounts under the accounting equation. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions Complete this question by entering your answers in the tabs below. How many shares of common stock were outstanding and issued at the end of the period? Required a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? c. Organize the transactions data in accounts under the accounting equation. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. Complete this question by entering your answers in the tabs below. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. When Crossett Corporation was organized in January, Year 1 , it immediately issued 4,200 shares of $50 par, 7 percent, cumulative preferred stock and 8,500 shares of $14 par common stock. Its earnings history is as follows: Year 1, net loss of $14,000; Year 2, net income of $120,000; Year 3 , net income of $216,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1, Year 2? b. Assume that the board of directors declares a $53,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. Assume that the board of directors declares a $53,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? When Crossett Corporation was organized in January, Year 1 , it immediately issued 4,200 shares of $50 par, 7 percent, cumulative preferred stock and 8,500 shares of $14 par common stock. Its earnings history is as follows: Year 1 , net loss of $14,000; Year 2 , net income of $120,000; Year 3, net income of $216,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1, Year 2? b. Assume that the board of directors declares a $53,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. How much is the dividend arrearage as of January 1 , Year 2 ? Required a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? c. Organize the transactions data in accounts under the accounting equation. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. Complete this question by entering your answers in the tabs below. The following information pertains to JAE Corp. at January 1, Year 2: JAE Corp. completed the following transactions during Year 2: 1. Issued 950 shares of $10 par common stock for $31 per share. 2. Repurchased 160 shares of its own common stock for $28 per share. 3. Resold 50 shares of treasury stock for $29 per share. Required a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? c. Organize the transactions data in accounts under the accounting equation. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions Complete this question by entering your answers in the tabs below. How many shares of common stock were outstanding and issued at the end of the period? Required a. How many shares of common stock were outstanding at the end of the period? b. How many shares of common stock had been issued at the end of the period? c. Organize the transactions data in accounts under the accounting equation. d. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. Complete this question by entering your answers in the tabs below. Prepare the stockholders' equity section of the balance sheet reflecting these transactions. When Crossett Corporation was organized in January, Year 1 , it immediately issued 4,200 shares of $50 par, 7 percent, cumulative preferred stock and 8,500 shares of $14 par common stock. Its earnings history is as follows: Year 1, net loss of $14,000; Year 2, net income of $120,000; Year 3 , net income of $216,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1, Year 2? b. Assume that the board of directors declares a $53,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. Assume that the board of directors declares a $53,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? When Crossett Corporation was organized in January, Year 1 , it immediately issued 4,200 shares of $50 par, 7 percent, cumulative preferred stock and 8,500 shares of $14 par common stock. Its earnings history is as follows: Year 1 , net loss of $14,000; Year 2 , net income of $120,000; Year 3, net income of $216,000. The corporation did not pay a dividend in Year 1. Required a. How much is the dividend arrearage as of January 1, Year 2? b. Assume that the board of directors declares a $53,000 cash dividend at the end of Year 2 (remember that the Year 1 and Year 2 preferred dividends are due). How will the dividend be divided between the preferred and common stockholders? Complete this question by entering your answers in the tabs below. How much is the dividend arrearage as of January 1 , Year 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started