Need help answersing these four questions

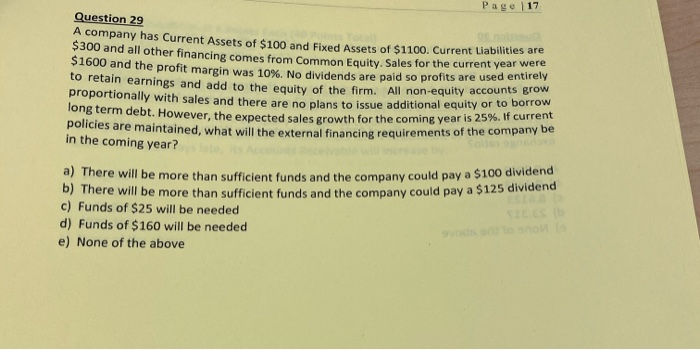

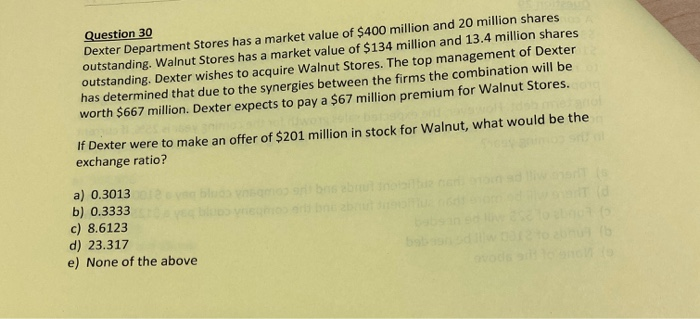

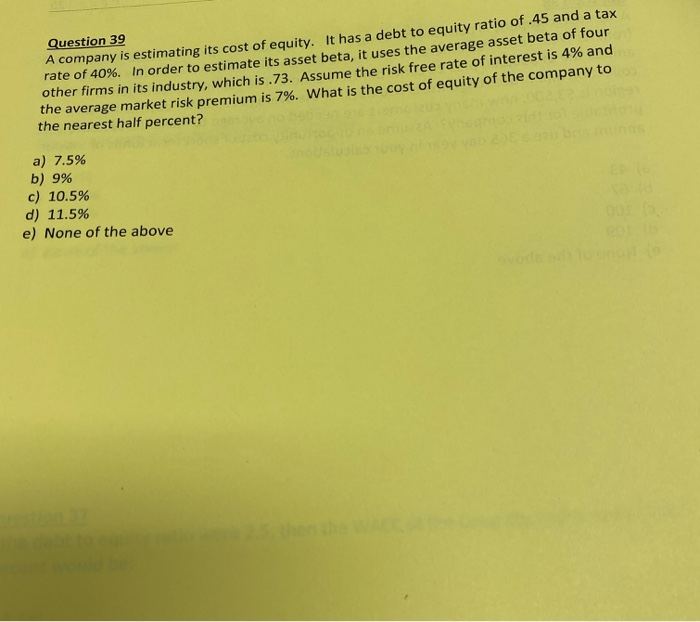

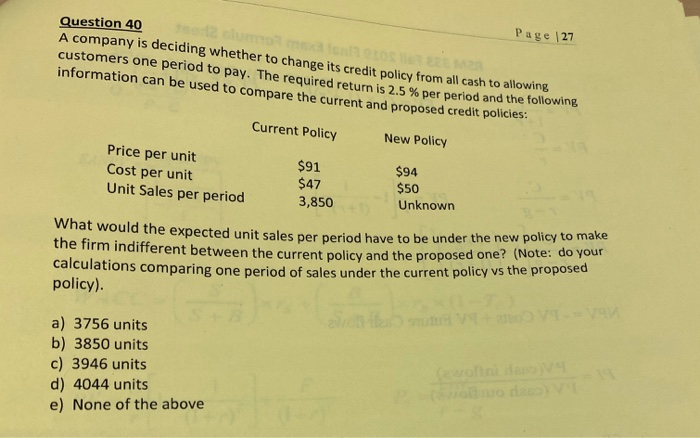

Page 17 Question 29 A company has Current Assets of $100 and Fixed Assets of $1100. Current Liabilities are $300 and all other financing comes from Common Equity. Sales DI000 and the profit margin was 100 No dividends are paid so profits are used entirely to retain earnings and add to the equity of the firm. All non-equity accounts proportionally with sales and there are no plans to issue additional equity or long term debt. However, the expected sales growth for th However, the expected sales growth for the coming year is 25%. If current policies are maintained, what will the external financing requir in the coming year? a) There will be more than sufficient funds and the company could pay as uld pay a $125 dividend There will be more than sufficient funds and the company could pay a $1250 c) Funds of $25 will be needed d) Funds of $160 will be needed e) None of the above Question 30 Dexter Department Stores has a market value of $400 million and 20 million shares outstanding. Walnut Stores has a market value of $134 million and 13.4 million shares outstanding. Dexter wishes to acquire Walnut Stores. The top management of Dexter has determined that due to the synergies between the firms the combination will be worth $667 million. Dexter expects to pay a $67 million premium for Walnut Stores. If Dexter were to make an offer of $201 million in stock for Walnut, what would be the exchange ratio? a) 0.3013 b) 0.3333 c) 8.6123 d) 23.317 e) None of the above Question 39 A company is estimating its cost of equity. It has a debt to equity ratio of .45 and a tax rate of 40%. In order to estimate its asset beta, it uses the average asset beta of four other firms in its industry, which is .73. Assume the risk free rate of interest is 4% and the average market risk premium is 7%. What is the cost of equity of the company to the nearest half percent? a) 7.5% b) 9% c) 10.5% d) 11.5% e) None of the above Question 40 Page 27 A company is deciding whether to change its credit policy from all cash to allowing customers one period to pay. The required return is 2.5 % per period and the following information can be used to compare the current and proposed credit policies. Current Policy $91 New Policy Price per unit Cost per unit $94 $47 $50 Unit Sales per period 3,850 Unknown What would the expected unit sales per period ha the expected unit sales per period have to be under the new policy to make the firm indifferent between the current policy and the pro erent between the current policy and the proposed one? (Note: do your s comparing one period of sales under the current policy vs the proposed policy). a) 3756 units b) 3850 units c) 3946 units d) 4044 units e) None of the above