Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help asap; all pictures are for one question Required Information (The following Information applies to the questions displayed below) Alcorn Service Company was formed

need help asap; all pictures are for one question

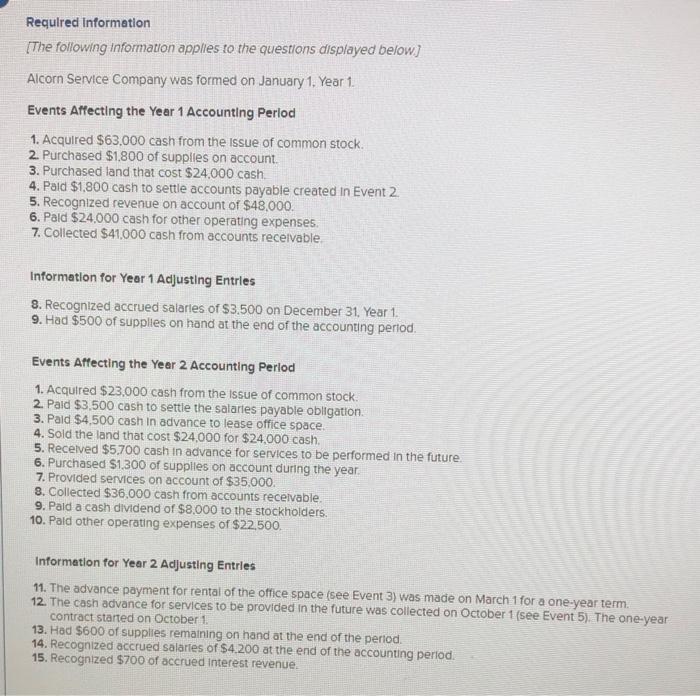

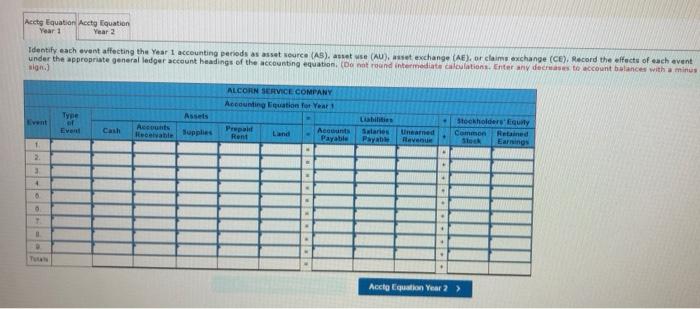

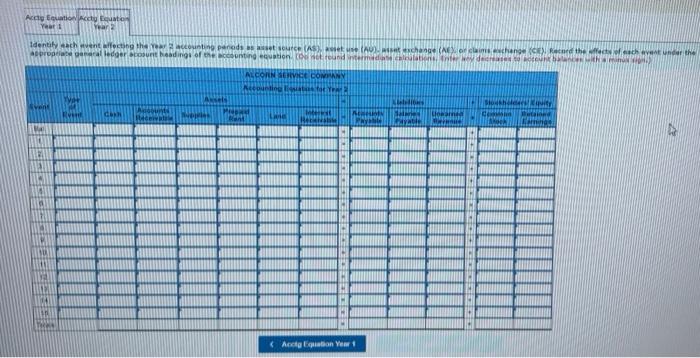

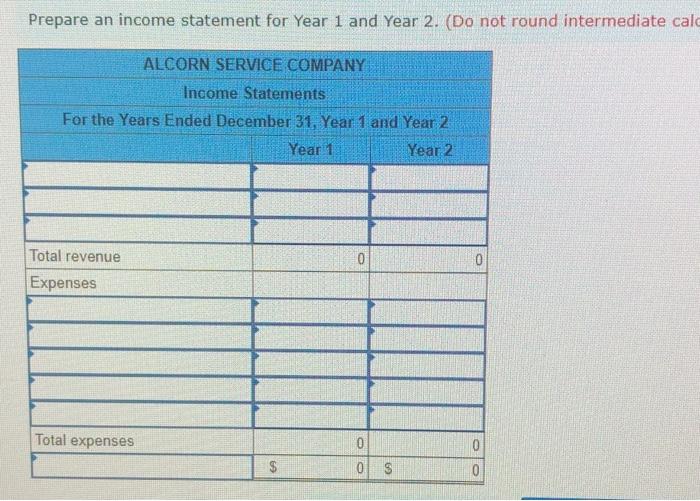

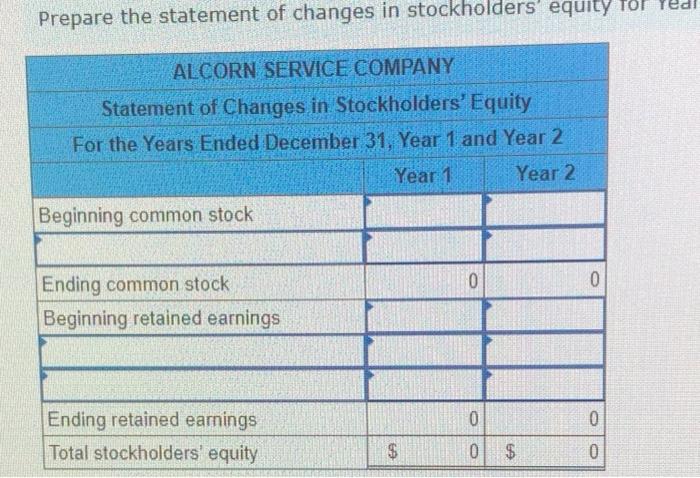

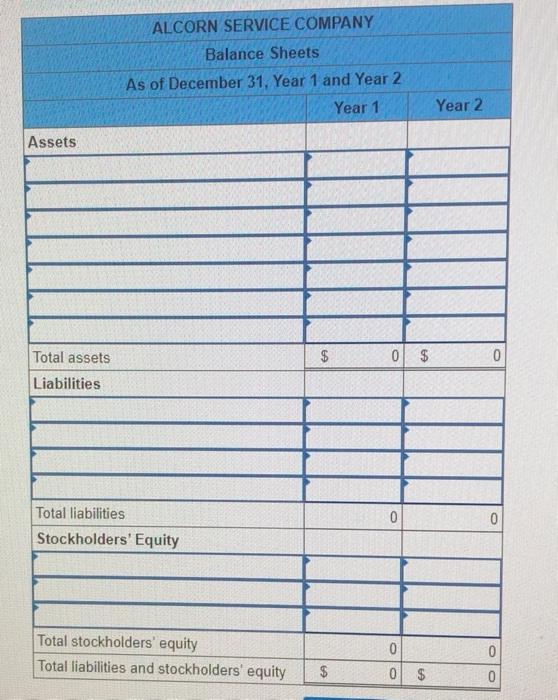

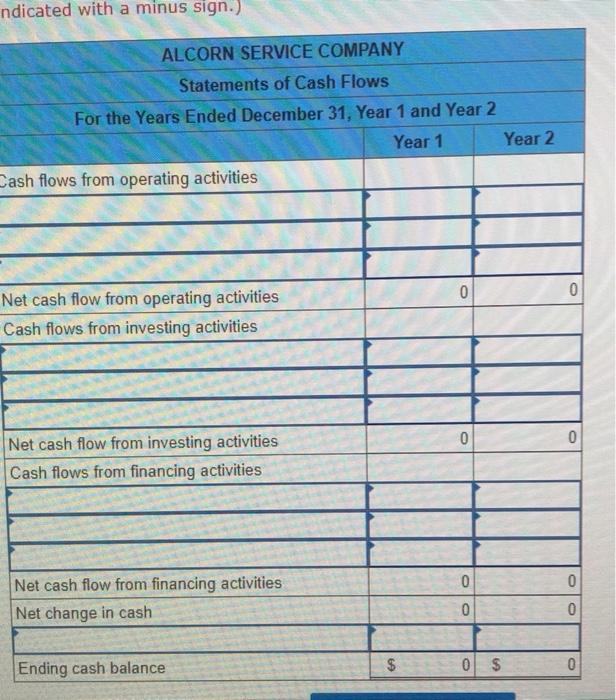

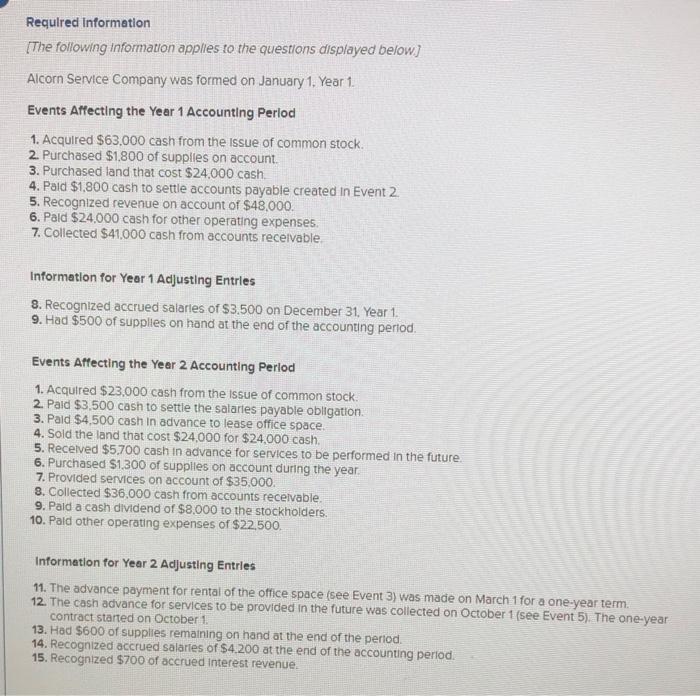

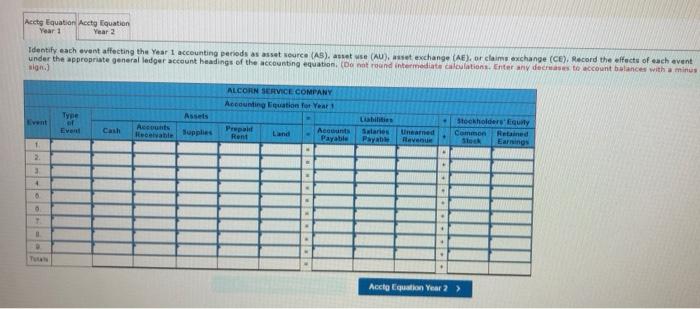

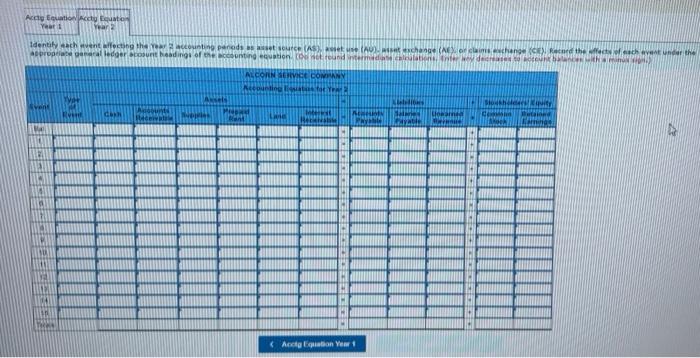

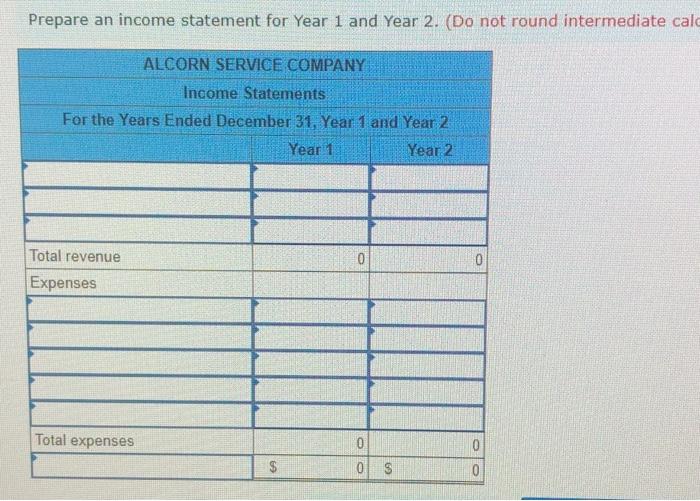

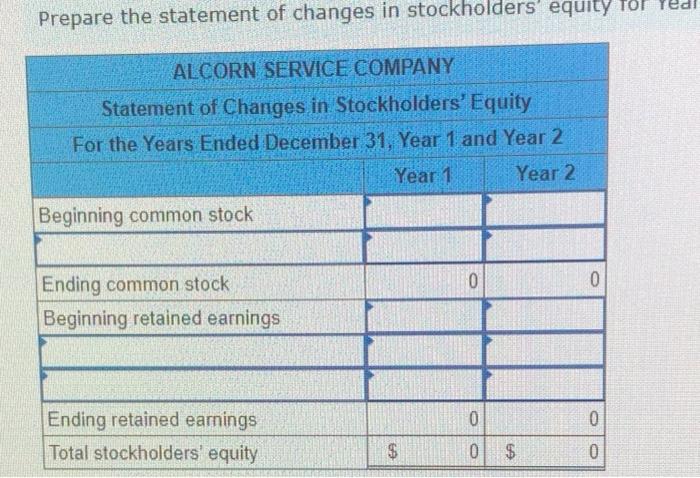

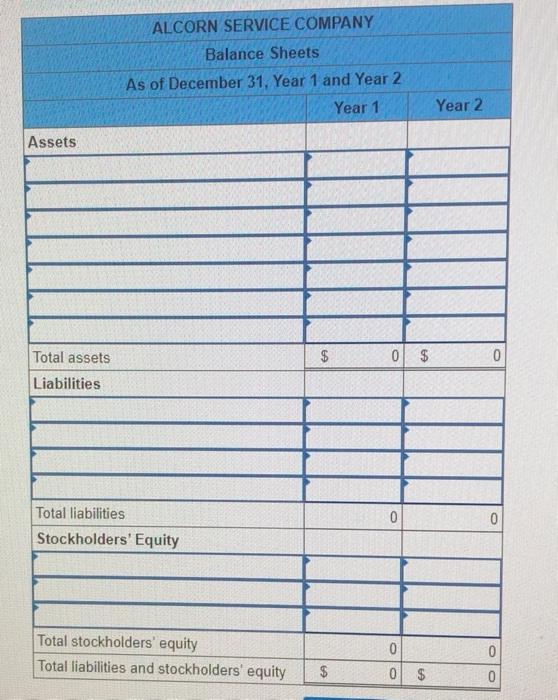

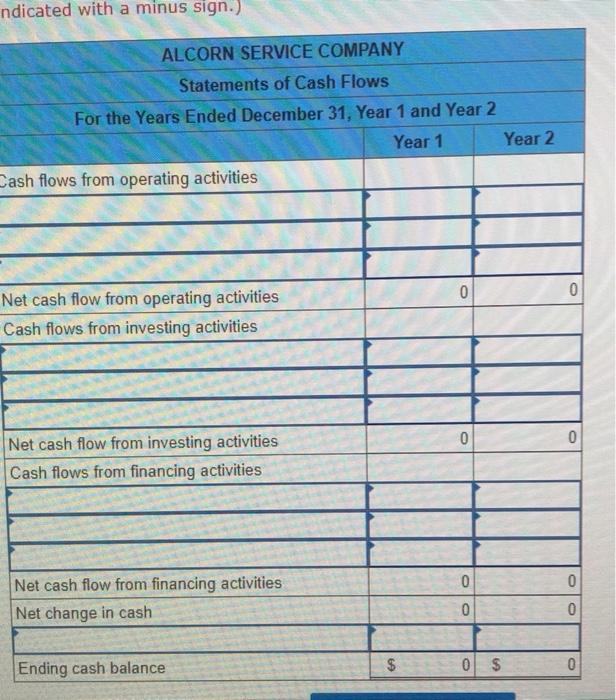

Required Information (The following Information applies to the questions displayed below) Alcorn Service Company was formed on January 1, Year 1. Events Affecting the Year 1 Accounting Perlod 1. Acquired $63.000 cash from the issue of common stock. 2. Purchased $1.800 of supplies on account. 3. Purchased land that cost $24.000 cash 4. Paid $1,800 cash to settle accounts payable created in Event 2. 5. Recognized revenue on account of $48,000. 6. Pald $24,000 cash for other operating expenses. 7. Collected $41,000 cash from accounts receivable Information for Year 1 Adjusting Entries 8. Recognized accrued salaries of $3.500 on December 31, Year 1. 9. Had $500 of supplies on hand at the end of the accounting period. Events Affecting the Year 2 Accounting Period 1. Acquired $23.000 cash from the issue of common stock 2. Paid $3,500 cash to settle the salarles payable obligation 3. Pald $4,500 cash in advance to lease office space. 4. Sold the land that cost $24,000 for $24.000 cash, 5. Received $5700 cash in advance for services to be performed in the future. 6. Purchased $1,300 of supplies on account during the year. 7. Provided services on account of $35.000. 8. Collected $36,000 cash from accounts receivable, 9. Pald a cash dividend of $8,000 to the stockholders. 10. Pald other operating expenses of $22.500. Information for Year 2 Adjusting Entries 11. The advance payment for rental of the office space (see Event 3) was made on March 1 for a one-year term. 12. The cash advance for services to be provided in the future was collected on October 1 (see Event 5). The one-year contract started on October 1 13. Had $600 of supplies remaining on hand at the end of the period. 14. Recognized accrued salaries of $4.200 at the end of the accounting period. 15. Recognized $700 of accrued interest revenue Acety Equation Acety Equation Year 1 Year 2 Identily each event affecting the Year 1 accounting periods as asset source (AS), as we (AU), et exchange (AE), or claims exchange (CE). Record the effects of each event under the appropriate general ledger account headings of the accounting equation (Do not round intermediate calculations. Enter any decreases te account balances with a minus in.) ALCORN SERVICE COMPANY Accounting liquation for Year Type of Event Cau Accounts Receivable Supplies Prvpall Rent Land Acounts Payable Cabilities Salaries need Payable Revenue Stockholders' Equity Common Retained Earnings 1 2 3 + 4 . 6 Accig Equation Year 2 > Acety Equatio acety Equation Yeart Year Identify the went wilecting the accounting periode escurc (AU) .change (Neolichen Record the chance the aprop ledger Soundings of the continuation Cente ALCORN VICE COMMANY Nec NEL end CA PAVING H HI IN M TRA (Action Yew 1 Prepare an income statement for Year 1 and Year 2. (Do not round intermediate calo ALCORN SERVICE COMPANY Income Statements For the Years Ended December 31, Year 1 and Year 2 Year 1 Year 2 0 0 Total revenue Expenses Total expenses 0 0 $ 0 GA 0 Prepare the statement of changes in stockholders' equity for yedi ALCORN SERVICE COMPANY Statement of Changes in Stockholders' Equity For the Years Ended December 31, Year 1 and Year 2 Year 1 Year 2 Beginning common stock 0 0 Ending common stock Beginning retained earnings 0 0 Ending retained earnings Total stockholders' equity $ 0 $ 0 ALCORN SERVICE COMPANY Balance Sheets As of December 31, Year 1 and Year 2 Year 1 Year 2 Assets Total assets $ 0$ 0 Liabilities 0 Total liabilities Stockholders' Equity 0 Total stockholders' equity Total liabilities and stockholders' equity 0 0 $ 0 $ 0 ndicated with a minus sign.) ALCORN SERVICE COMPANY Statements of Cash Flows For the Years Ended December 31, Year 1 and Year 2 Year 1 Year 2 Cash flows from operating activities 0 0 Net cash flow from operating activities Cash flows from investing activities 0 0 Net cash flow from investing activities Cash flows from financing activities 0 0 Net cash flow from financing activities Net change in cash 0 0 Ending cash balance $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started