Answered step by step

Verified Expert Solution

Question

1 Approved Answer

need help asap! i'll leave a thumbs up During the adjusting process, Winnie Co.'s account balances changed as follows (assume balances are at their normal

need help asap! i'll leave a thumbs up

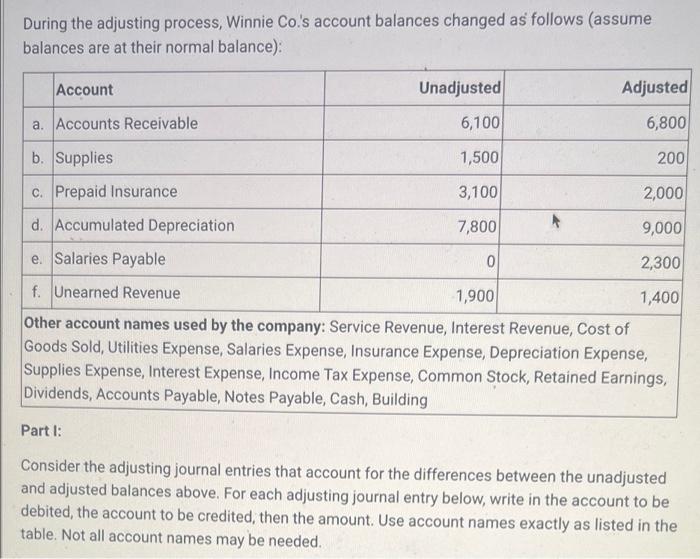

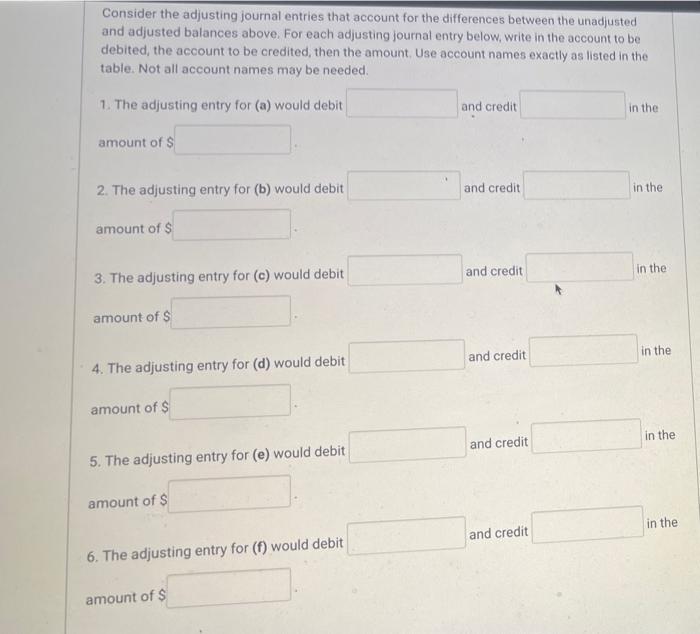

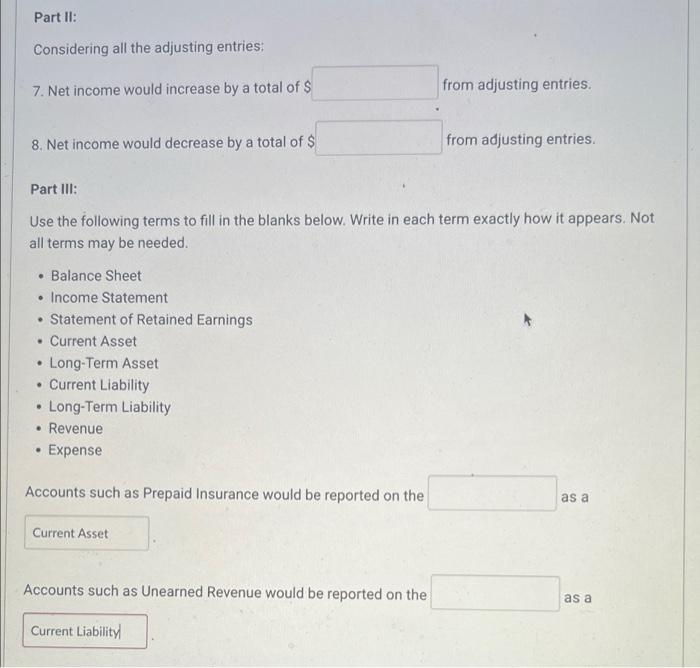

During the adjusting process, Winnie Co.'s account balances changed as follows (assume balances are at their normal balance): Account Unadjusted Adjusted a. Accounts Receivable 6,100 6,800 b. Supplies 1,500 200 c. Prepaid Insurance 3,100 2,000 d. Accumulated Depreciation 7,800 9,000 e Salaries Payable 0 2,300 f. Unearned Revenue 1,900 1,400 Other account names used by the company: Service Revenue, Interest Revenue, Cost of Goods Sold, Utilities Expense, Salaries Expense, Insurance Expense, Depreciation Expense, Supplies Expense, Interest Expense, Income Tax Expense, Common Stock, Retained Earnings, Dividends, Accounts Payable, Notes Payable, Cash, Building Part I: Consider the adjusting journal entries that account for the differences between the unadjusted and adjusted balances above. For each adjusting journal entry below, write in the account to be debited, the account to be credited, then the amount. Use account names exactly as listed in the table. Not all account names may be needed. Consider the adjusting journal entries that account for the differences between the unadjusted and adjusted balances above. For each adjusting journal entry below, write in the account to be debited, the account to be credited, then the amount Use account names exactly as listed in the table. Not all account names may be needed. 1. The adjusting entry for (a) would debit and credit in the amount of 2. The adjusting entry for (b) would debit and credit in the amount of S and credit in the 3. The adjusting entry for (c) would debit amount of s and credit in the 4. The adjusting entry for (d) would debit amount of $ in the and credit 5. The adjusting entry for (e) would debit amount of $ in the and credit 6. The adjusting entry for (f) would debit amount of $ Part II: Considering all the adjusting entries: 7. Net income would increase by a total of $ from adjusting entries. 8. Net income would decrease by a total of $ from adjusting entries. Part III: Use the following terms to fill in the blanks below. Write in each term exactly how it appears. Not all terms may be needed. Balance Sheet Income Statement Statement of Retained Earnings Current Asset Long-Term Asset Current Liability Long-Term Liability Revenue Expense . . . Accounts such as Prepaid Insurance would be reported on the as a Current Asset Accounts such as Unearned Revenue would be reported on the as a Current Liability Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started