need help asap please !

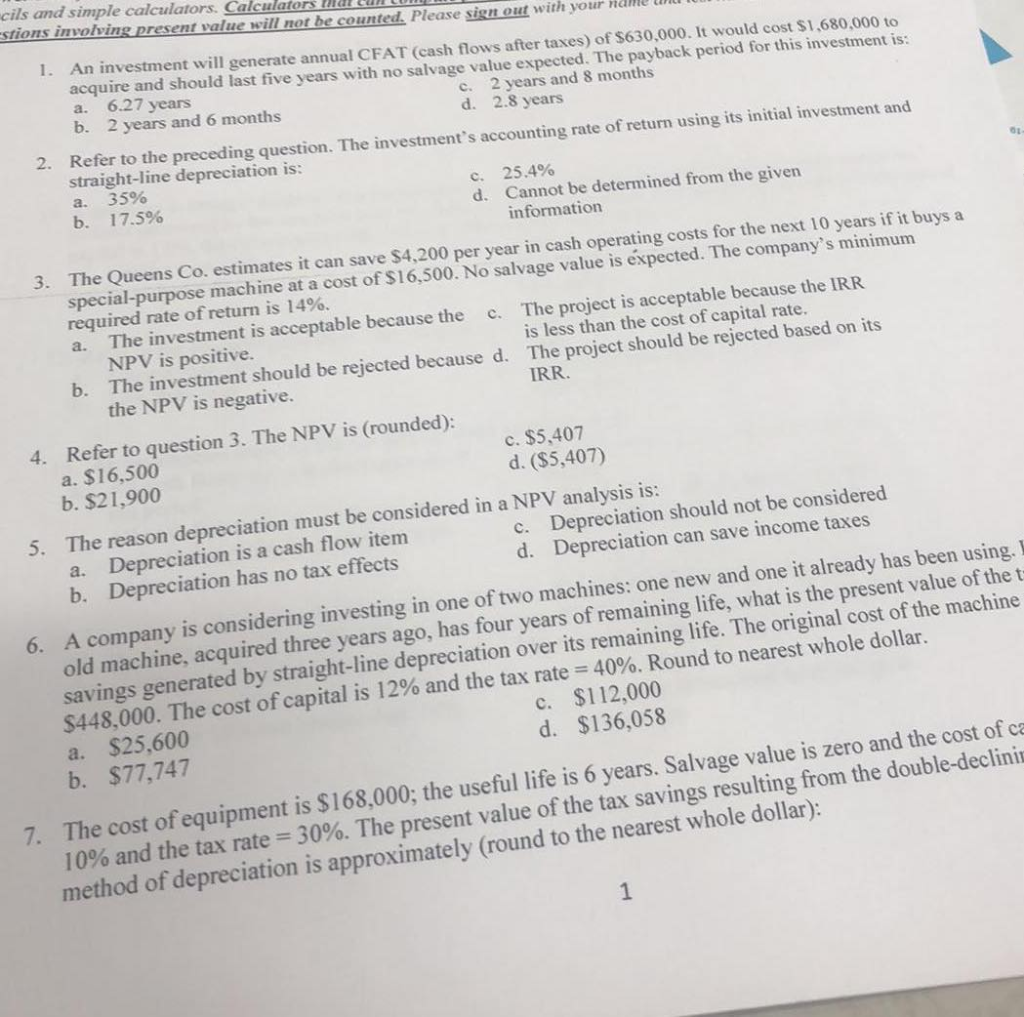

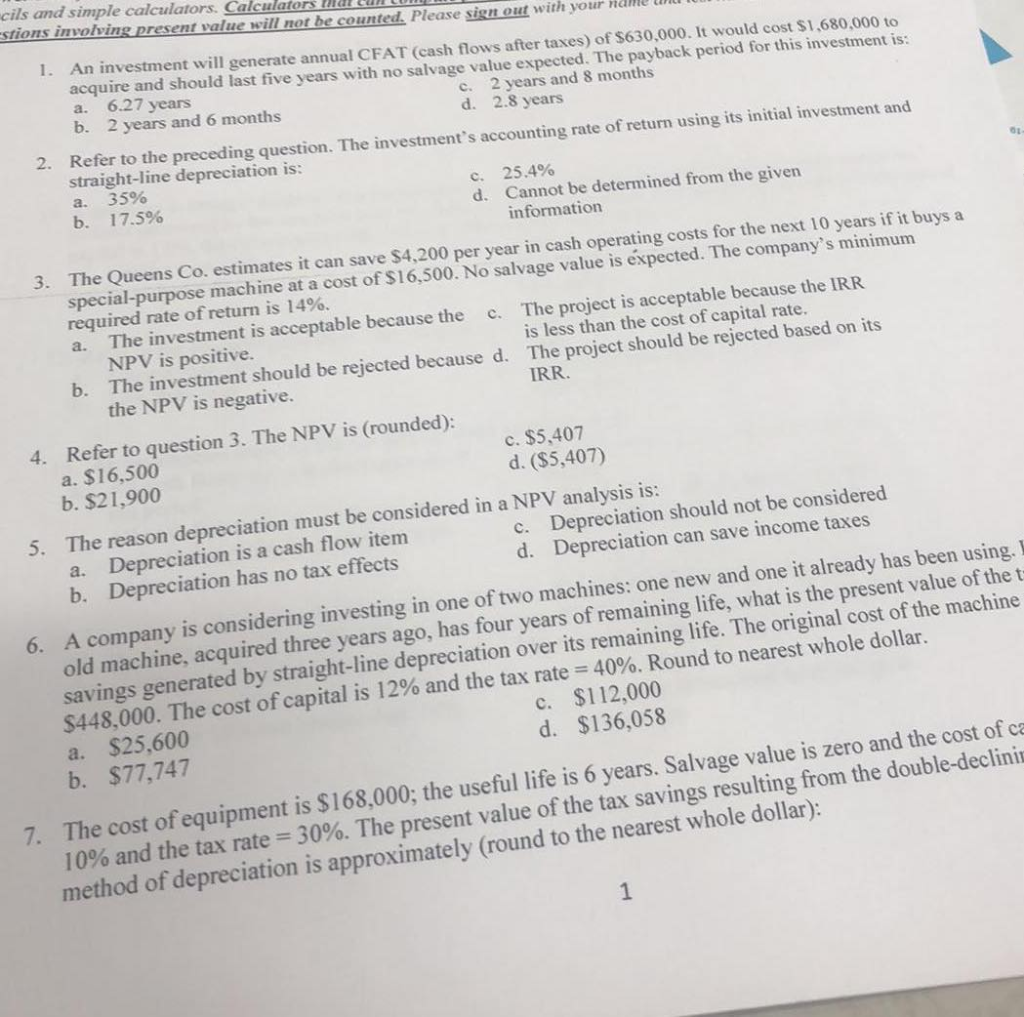

cils and simple calculators. Calculators lldt stions invollving present value will ot be counted. Please sign out with your nai 1. An investment will generate annual CFAT (cash flows after taxes) of $630,000. It would cost $1,680,000 to acquire and should last five years with no salvage value expected. The payback period for this investment is: a. 6.27 years b. 2 years and 6 months 2 years and 8 months d. 2.8 years c. 2. Refer to the preceding question. The investment's accounting rate of return using its initial investment and straight-line depreciation is: a. 35% b. 17.5% 25.4% d. Cannot be determined from the given information 3. The Queens Co. estimates it can save $4,200 per year in cash operating costs for the next 10 years if it buys a special-purpose machine at a cost of $16,500. No salvage value is expected. The company's minimum required rate of return is 14%. The investment is acceptable because the NPV is positive. b. The investment should be rejected because d. The project should be rejected based on its the NPV is negative. The project is acceptable because the IRR is less than the cost of capital rate. a. c. IRR. 4. Refer to question 3. The NPV is (rounded): a. $16,500 b. $21,900 c. $5,407 d. ($5,407) 5. The reason depreciation must be considered in a NPV analysis is: a. Depreciation is a cash flow item b. Depreciation has no tax effects c. Depreciation should not be considered d. Depreciation can save income taxes 6. A company is considering investing in one of two machines: one new and one it already has been using. old machine, acquired three years ago, has four years of remaining life, what is the present value of the t- savings generated by straight-line depreciation over its remaining life. The original cost of the machine $448,000. The cost of capital is 12% and the tax rate = 40%. Round to nearest whole dollar. $25,600 b. $77,747 c. $112,000 d. $136,058 a. 7. The cost of equipment is $168,000; the useful life is 6 years. Salvage value is zero and the cost of ca 10% and the tax rate 30%. The present value of the tax savings resulting from the double-declinis method of depreciation is approximately (round to the nearest whole dollar)