Answered step by step

Verified Expert Solution

Question

1 Approved Answer

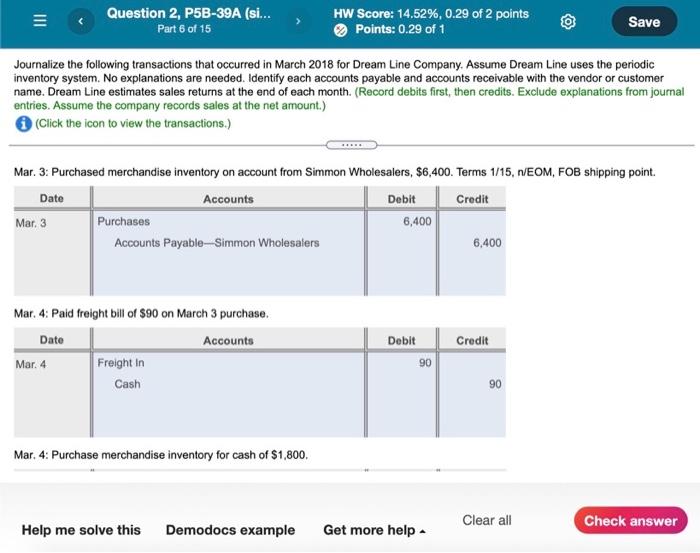

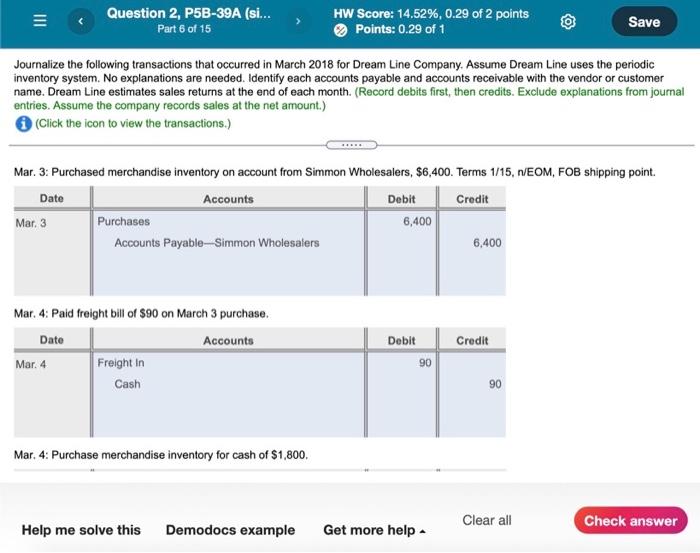

need help asap Question 2, P5B-39A (si... Part 6 of 15 HW Score: 14.52%, 0.29 of 2 points Points: 0.29 of 1 Save Journalize the

need help asap

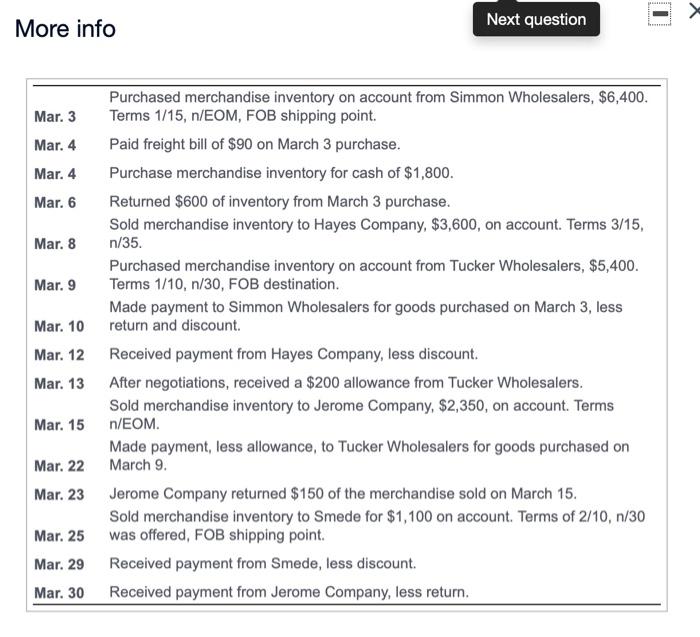

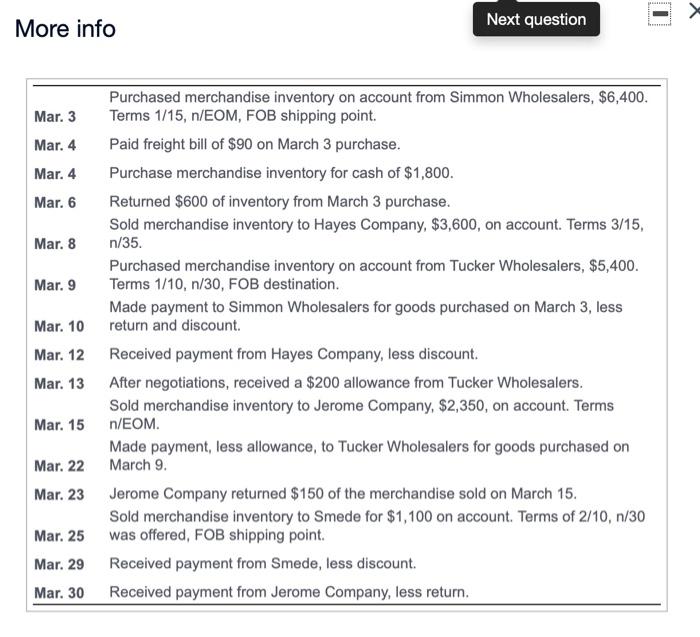

Question 2, P5B-39A (si... Part 6 of 15 HW Score: 14.52%, 0.29 of 2 points Points: 0.29 of 1 Save Journalize the following transactions that occurred in March 2018 for Dream Line Company. Assume Dream Line uses the periodic inventory system. No explanations are needed. Identify each accounts payable and accounts receivable with the vendor or customer name. Dream Line estimates sales returns at the end of each month. (Record debits first, then credits. Exclude explanations from journal entries. Assume the company records sales at the net amount.) (Click the icon to view the transactions.) Mar. 3. Purchased merchandise inventory on account from Simmon Wholesalers, $6,400. Terms 1/15, NEOM, FOB shipping point Date Accounts Debit Credit Mar. 3 Purchases 6,400 Accounts Payable-Simmon Wholesalers 6,400 Mar. 4: Paid freight bill of $90 on March 3 purchase. Date Accounts Mar. 4 Freight in Cash Credit Debit 90 90 Mar. 4: Purchase merchandise inventory for cash of $1,800. Clear all Check answer Help me solve this Demodocs example Get more help More info Next question Purchased merchandise inventory on account from Simmon Wholesalers, $6,400. Mar. 3 Terms 1/15, n/EOM, FOB shipping point Mar. 4 Paid freight bill of $90 on March 3 purchase. Mar. 4 Purchase merchandise inventory for cash of $1,800. Mar. 6 Returned $600 of inventory from March 3 purchase. Sold merchandise inventory to Hayes Company, $3,600, on account. Terms 3/15, Mar. 8 n/35. Purchased merchandise inventory on account from Tucker Wholesalers, $5,400. Mar. 9 Terms 1/10, n/30, FOB destination. Made payment to Simmon Wholesalers for goods purchased on March 3, less Mar. 10 return and discount Mar. 12 Received payment from Hayes Company, less discount. Mar. 13 After negotiations, received a $200 allowance from Tucker Wholesalers. Sold merchandise inventory to Jerome Company, $2,350, on account. Terms Mar. 15 n/EOM. Made payment, less allowance, to Tucker Wholesalers for goods purchased on Mar. 22 March 9. Mar. 23 Jerome Company returned $150 of the merchandise sold on March 15. Sold merchandise inventory to Smede for $1,100 on account. Terms of 2/10,n/30 Mar. 25 was offered, FOB shipping point. Mar. 29 Received payment from Smede, less discount. Mar. 30 Received payment from Jerome Company, less return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started