Answered step by step

Verified Expert Solution

Question

1 Approved Answer

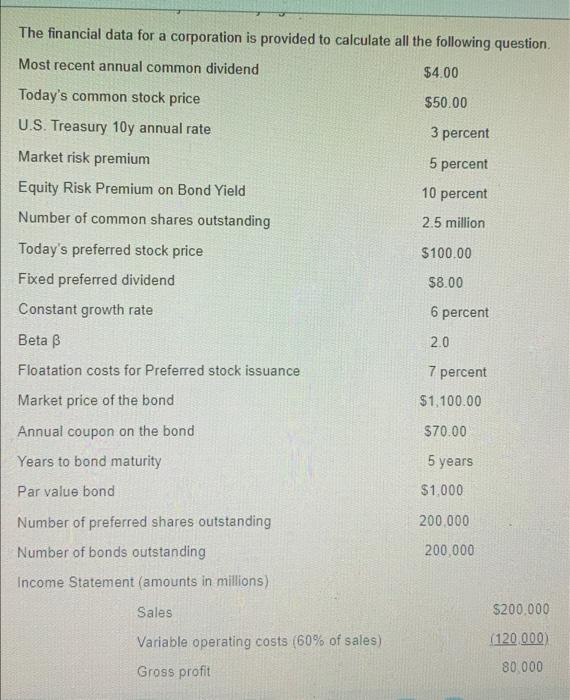

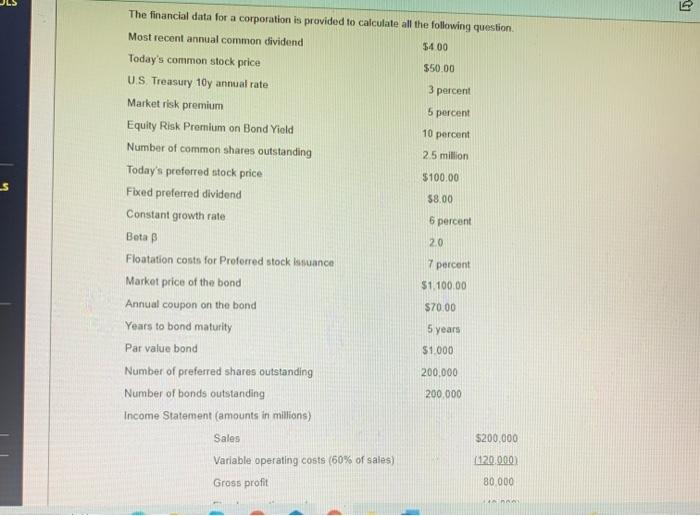

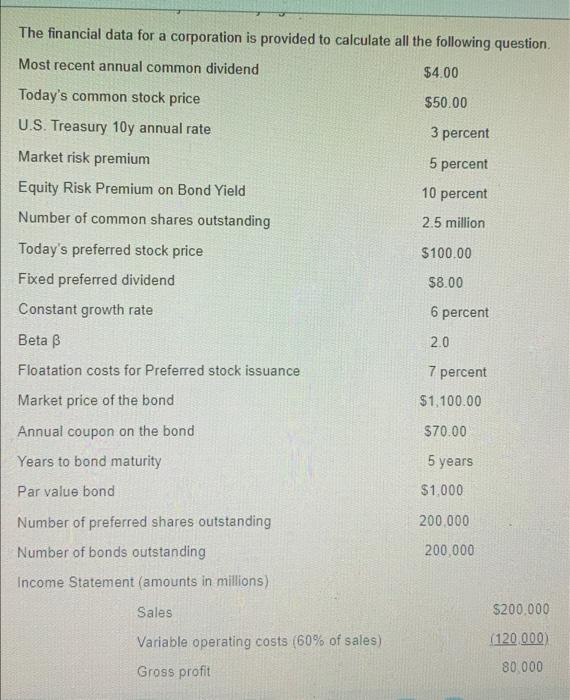

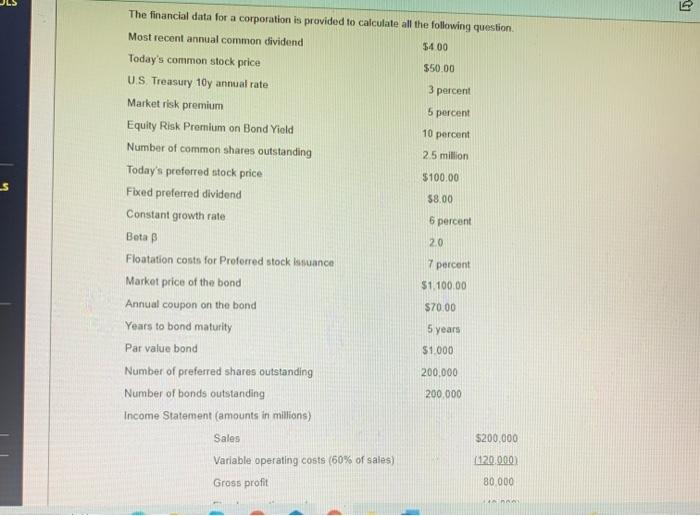

need help asap The financial data for a corporation is provided to calculate all the following question Most recent annual common dividend $4.00 $50.00 Today's

need help asap

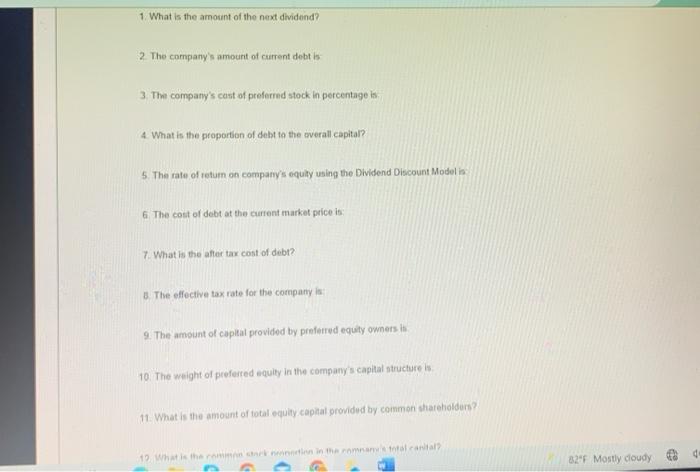

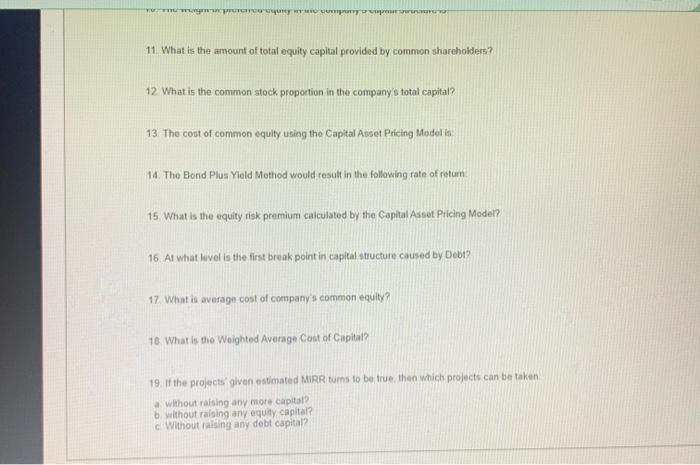

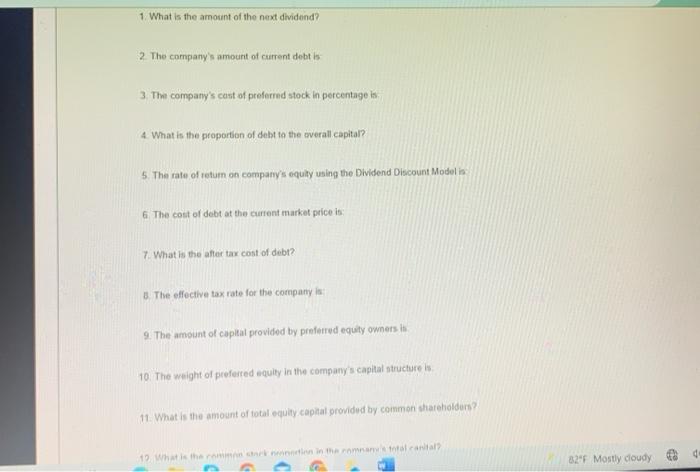

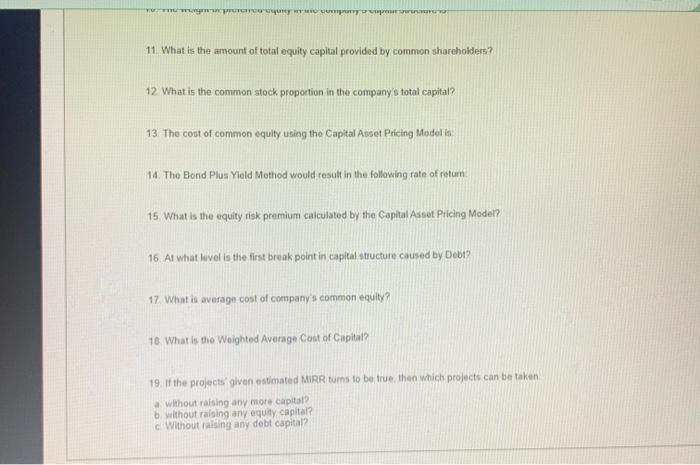

The financial data for a corporation is provided to calculate all the following question Most recent annual common dividend $4.00 $50.00 Today's common stock price U.S. Treasury 10y annual rate 3 percent Market risk premium 5 percent 10 percent 2.5 million Equity Risk Premium on Bond Yield Number of common shares outstanding Today's preferred stock price Fixed preferred dividend $100.00 $8.00 Constant growth rate 6 percent Beta B 2.0 Floatation costs for Preferred stock issuance 7 percent Market price of the bond $1,100.00 Annual coupon on the bond $70.00 Years to bond maturity 5 years Par value bond $1,000 200.000 Number of preferred shares outstanding Number of bonds outstanding Income Statement (amounts in millions) 200.000 Sales $200.000 Variable operating costs (60% of sales) (120.000) Gross profit 80.000 1 What is the amount of the next dividend? 2 The company's amount of current debt is 3. The company's cost of preferred stock in percentage is 4. What is the proportion of debt to the overall capital? 5. The rate of return on company's equity using the Dividend Discount Modelis 6 The cost of debt at the current market price is 7. What is the after tax cost of debt? The effective tax rate for the company is 9. The amount of capital provided by preferred equity owners in 10. The weight of preferred equity in the company's capital structure is 11. What is the amount of total equity capital provided by common shareholders? 12. What is there in the name aantal 32'F Mostly cloudy 10 $8.00 The financial data for a corporation is provided to calculate all the following question Most recent annual common dividend $400 Today's common stock price $50.00 US Treasury 10y annual rate 3 percent Market risk premium 5 percent Equity Risk Premium on Bond Yield 10 percent Number of common shares outstanding 2.5 million Today's preferred stock price $100.00 Fixed preferred dividend Constant growth rate 6 percent Betap 20 Floatation costs for Proferred stock issuance 7 percent Market price of the bond $1.100.00 Annual coupon on the bond $70.00 Years to bond maturity 5 years Par value bond $1.000 Number of preferred shares outstanding 200,000 200.000 Number of bonds outstanding Income Statement (amounts in millions) $200,000 Sales (120.000 Variable operating costs (60% of sales) Gross profit 80.000 SAA wenty por 11 What is the amount of total equity capital provided by common shareholders? 12 What is the common stock proportion in the company's total capital? 13. The cost of common equity using the Capital Asset Pricing Modelis 14. The Bond Plus Yield Mothod would result in the following rate of retum 15. What is the equity risk premium calculated by the Capital Asset Pricing Model 16. At what love is the first break point in capital structure caused by Debt? 17 What is average cost of company's common equity 18 What is the weighted Average Cost of Capital? 19. if the projects given estimated MIRR turns to be true then which projects can be taken without raising any more capital? without raising any equity capital? c Without raising any debit capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started