NEED HELP ASAP.. This is a question that was downloaded and already printed on the excel sheet if anyone is wondering where the excel sheet may be.

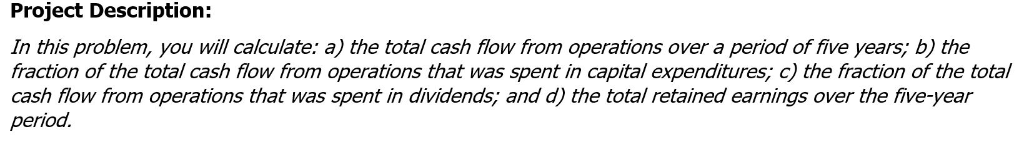

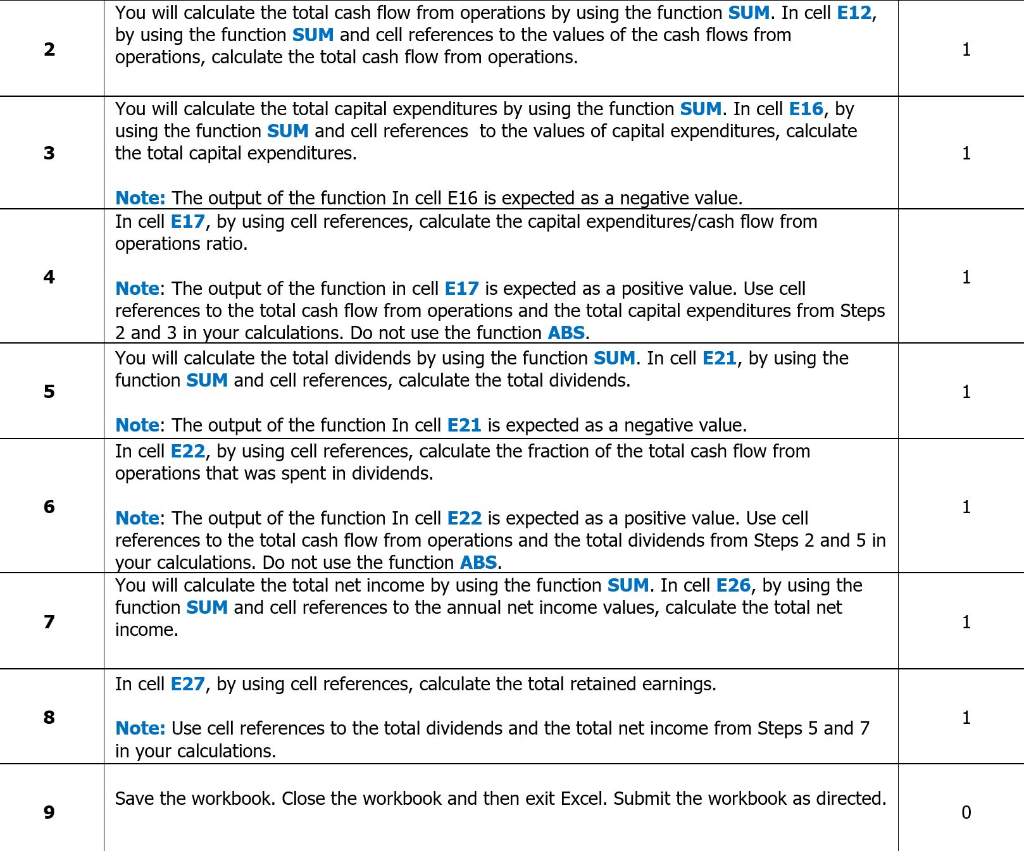

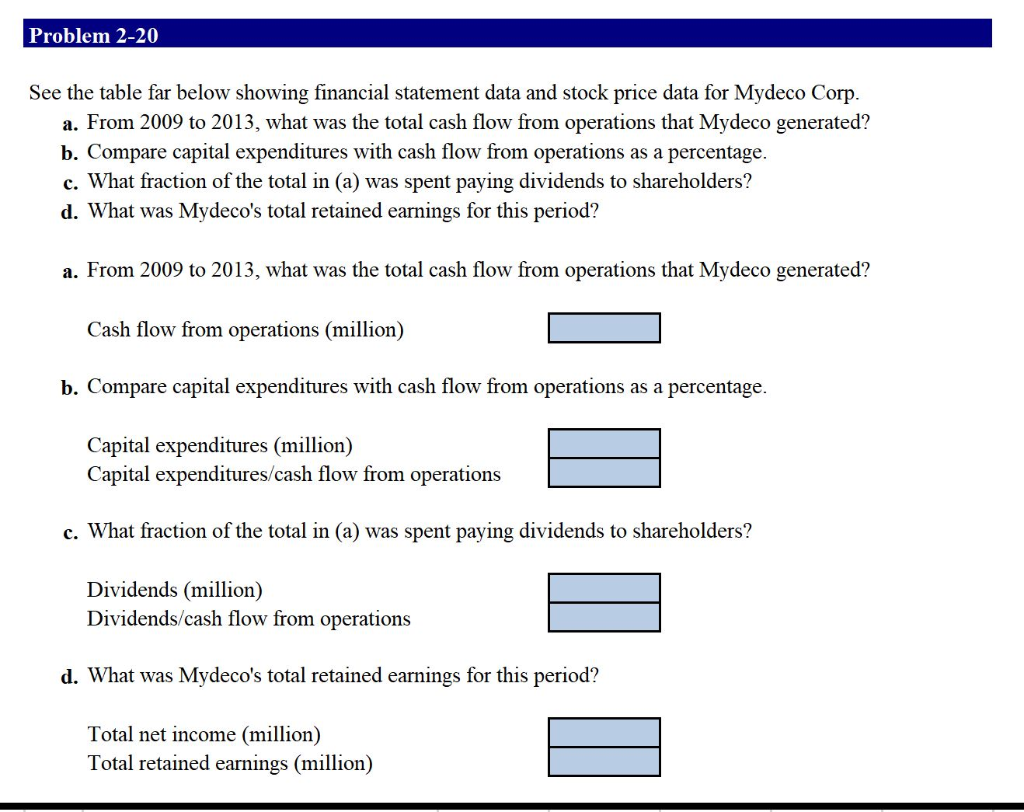

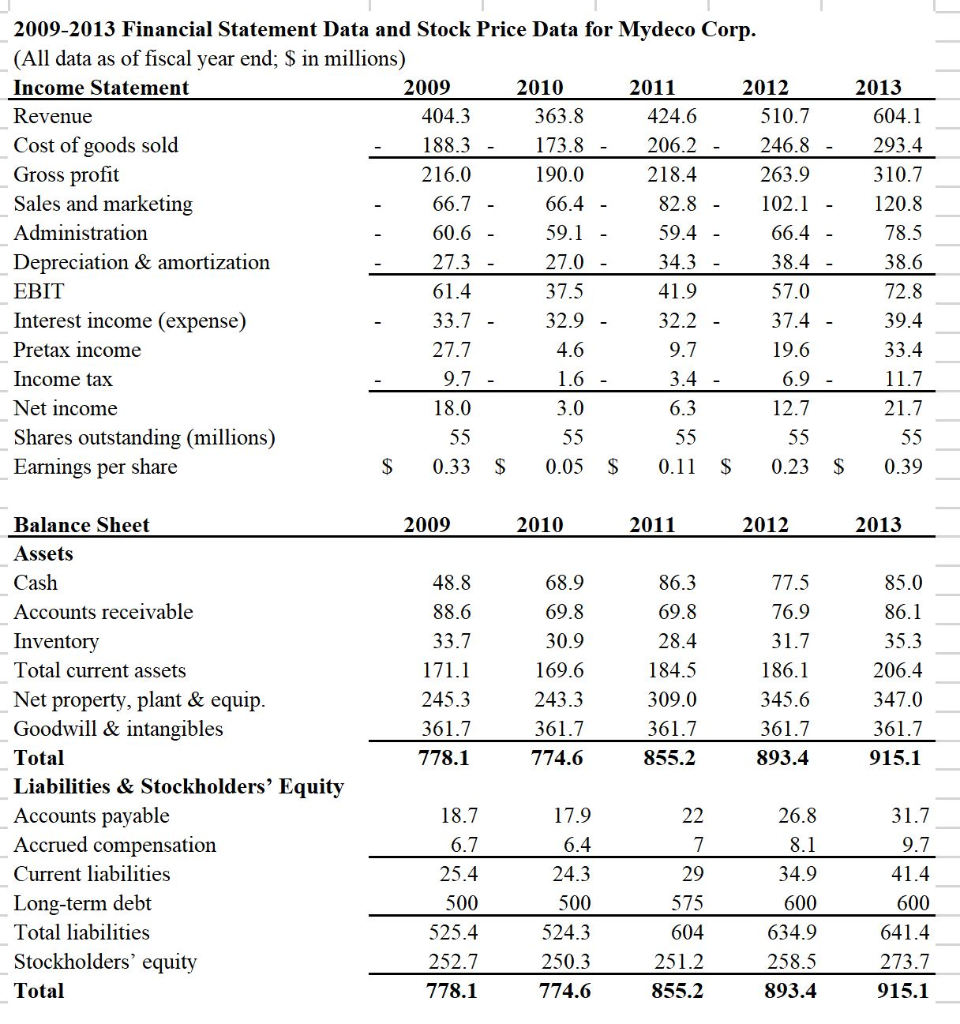

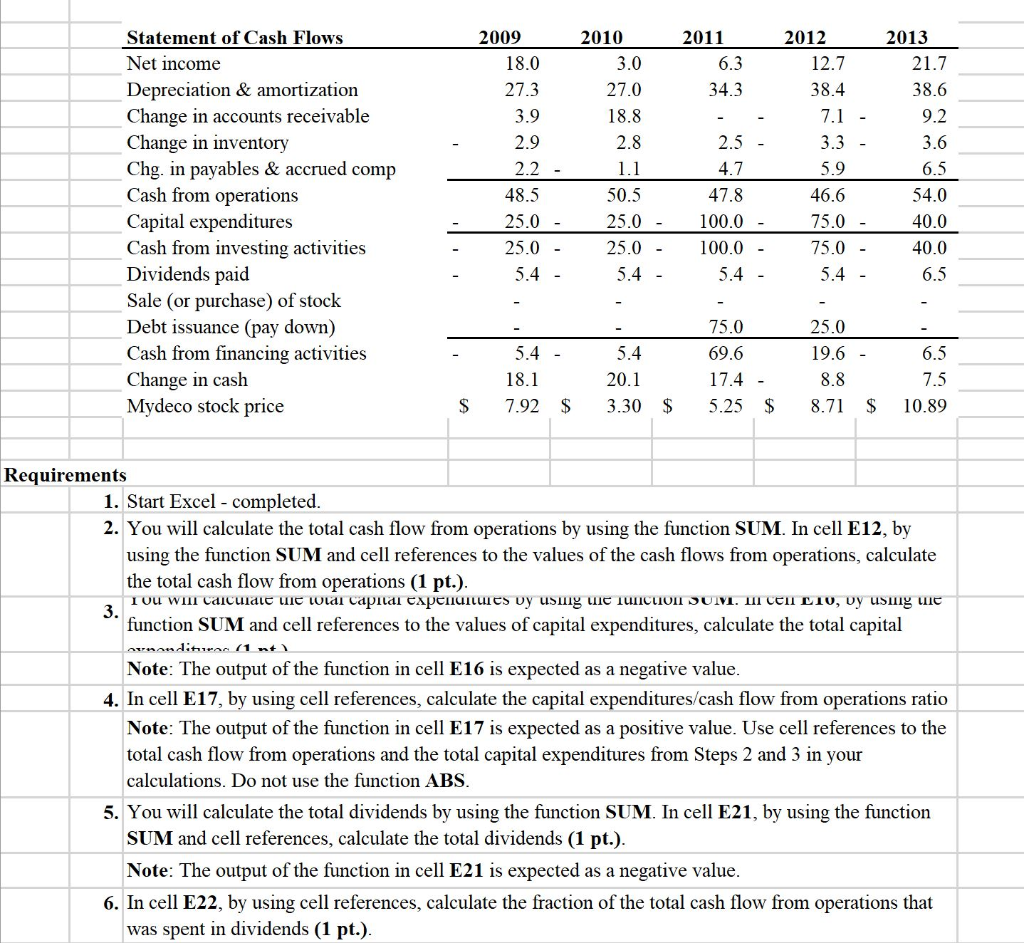

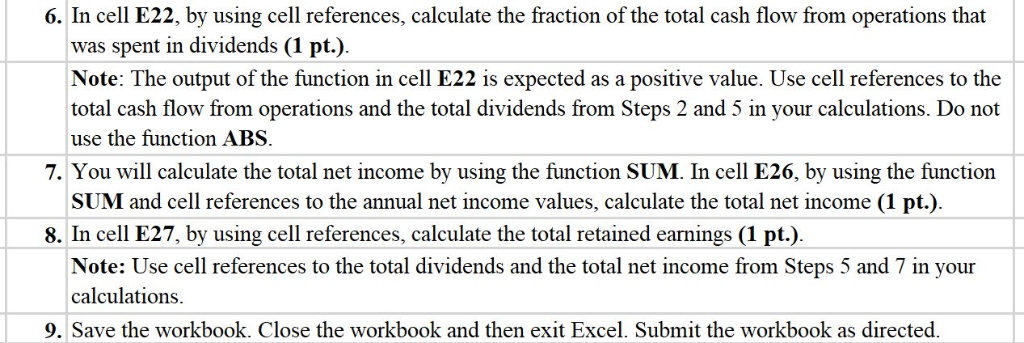

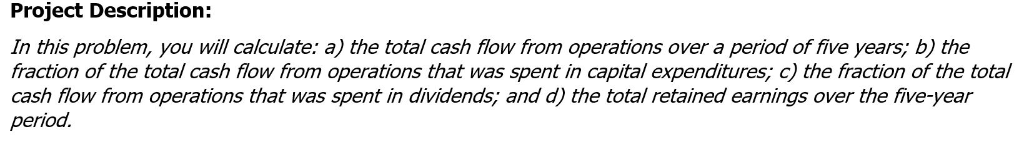

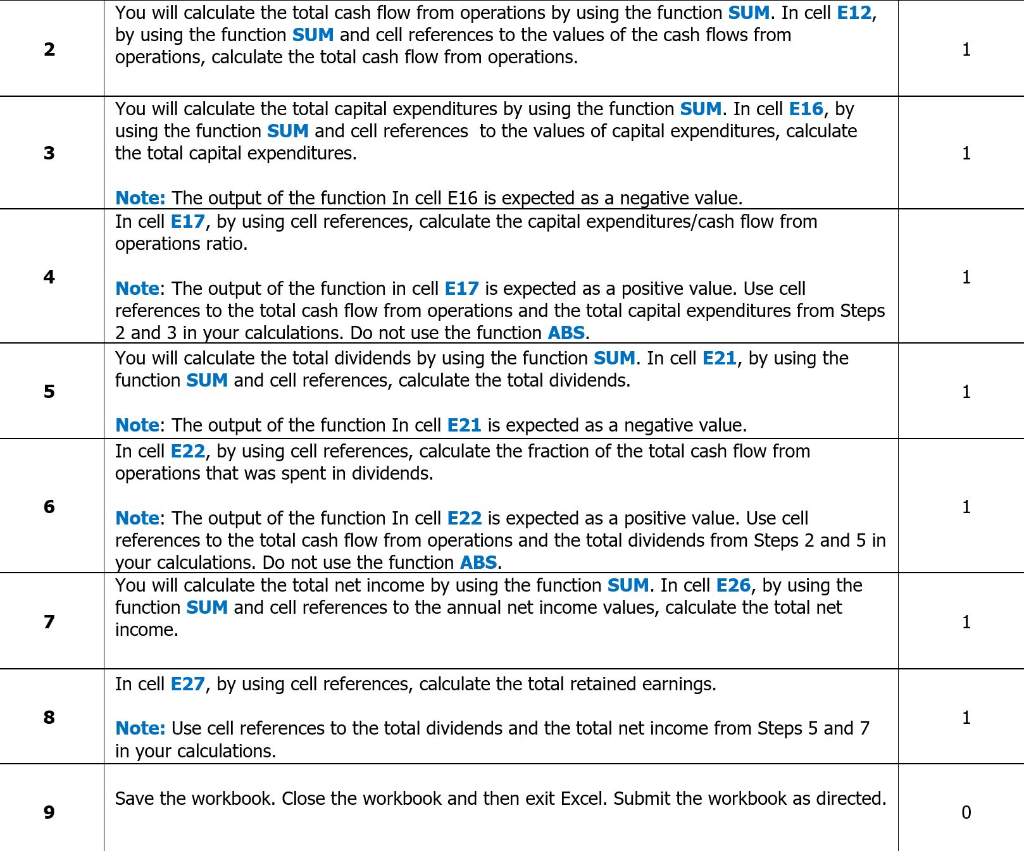

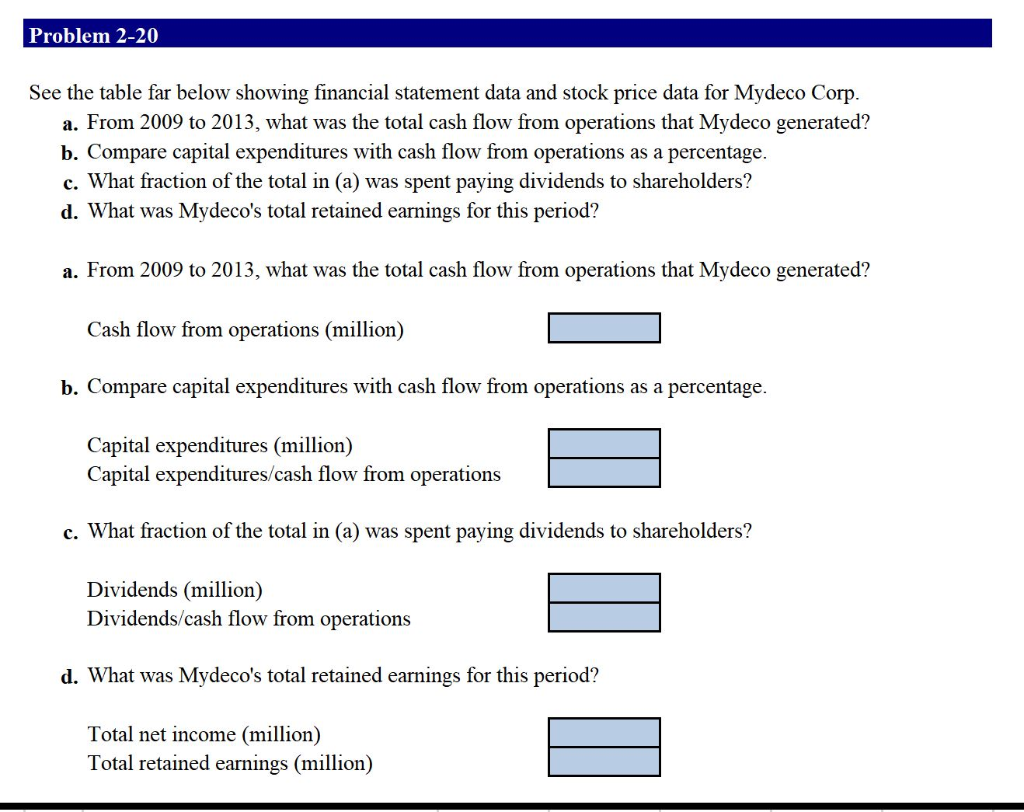

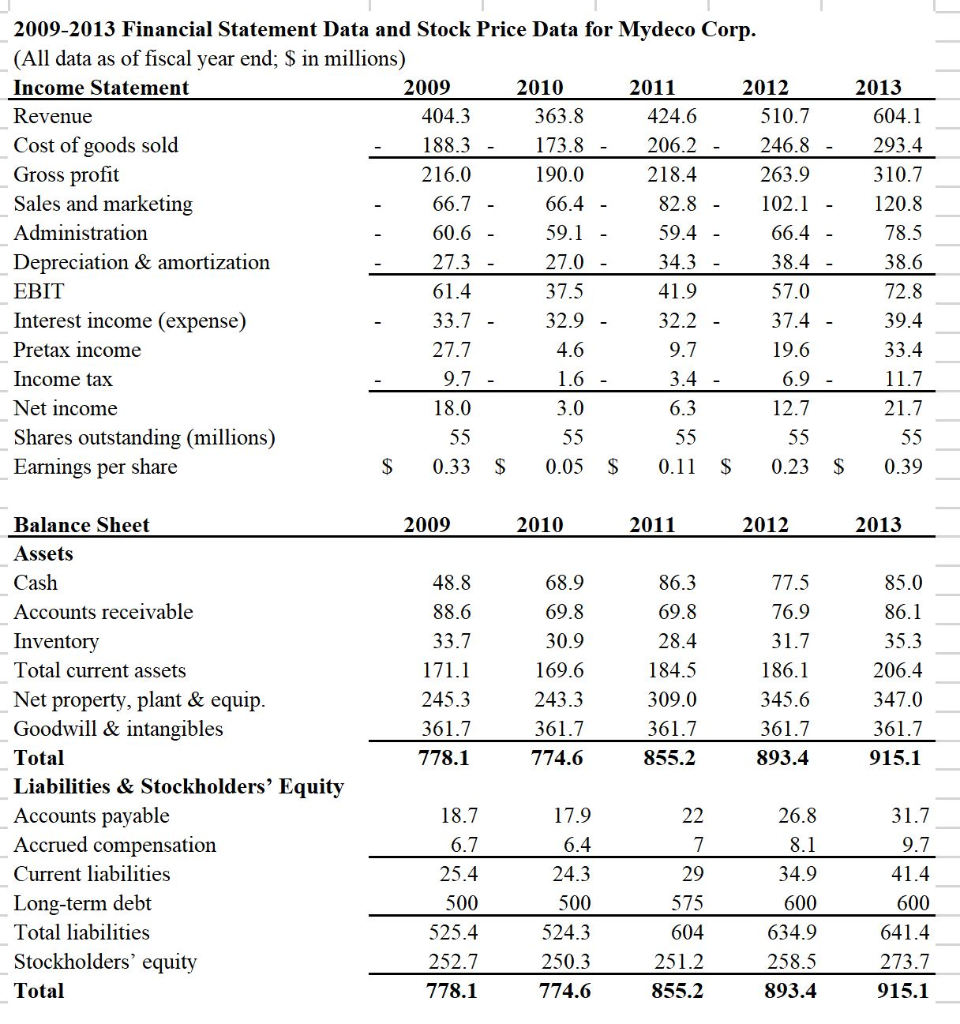

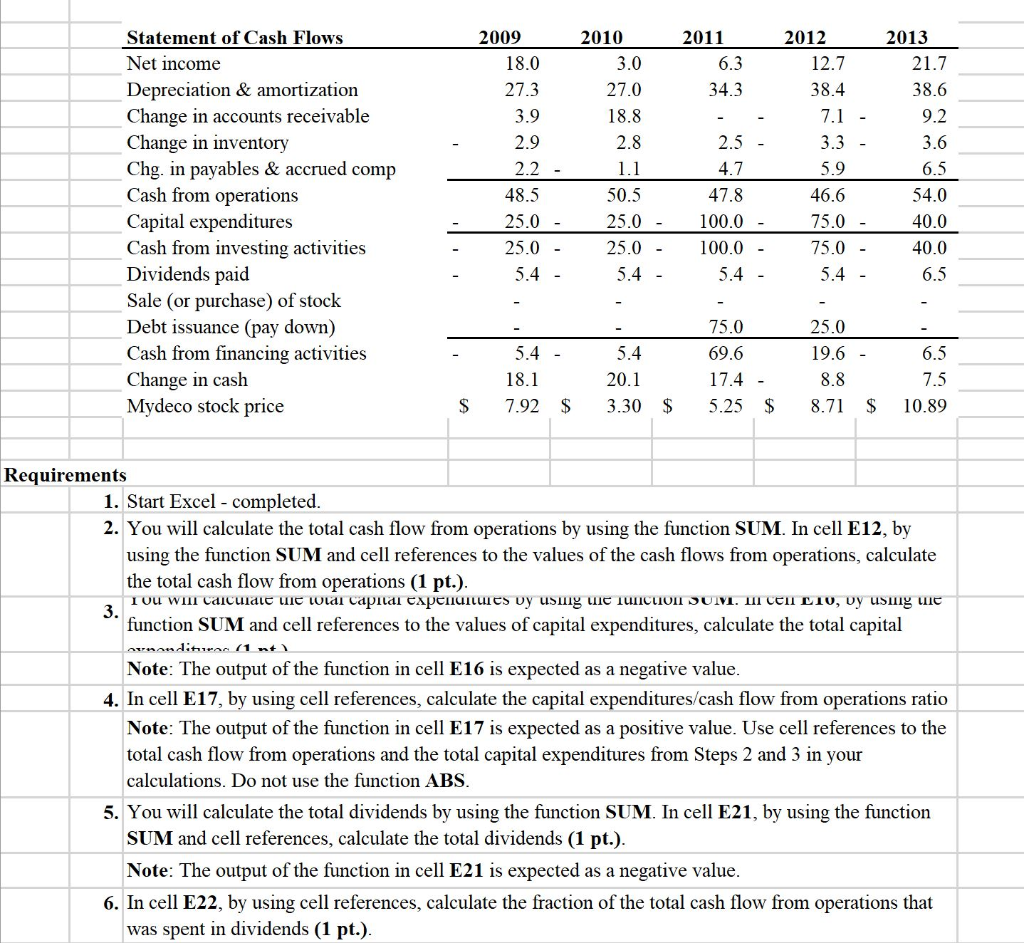

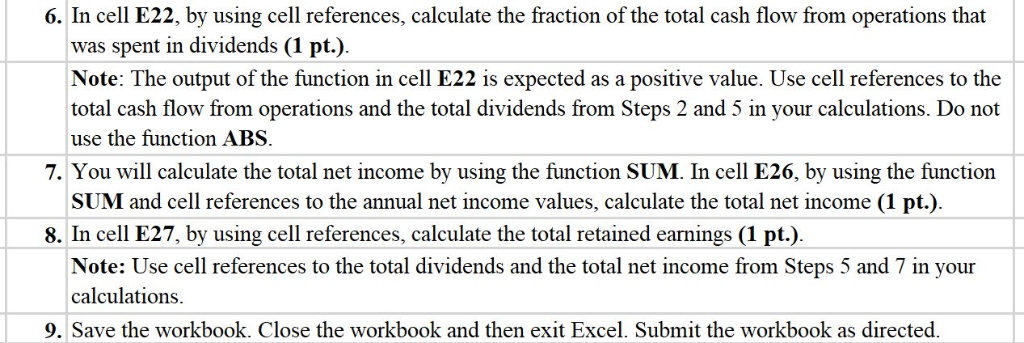

Project Description: In this problem, you will calculate.: a) the total cash flow from operations over a period of five years; b) the fraction of the total cash flow from operations that was spent in capital expenditures, c) the fraction of the total cash flow from operations that was spent in dividends; and d) the total retained earnings over the five-year period. You will calculate the total cash flow from operations by using the function SUM. In cell E12, by using the function SUM and cell references to the values of the cash flows from operations, calculate the total cash flow from operations. 2 You will calculate the total capital expenditures by using the function SUM. In cell E16, by using the function SUM and cell references to the values of capital expenditures, calculate the total capital expenditures 3 Note: The output of the function In cell E16 is expected as a negative value In cell E17, by using cell references, calculate the capital expenditures/cash flow from operations ratio 4 Note: The output of the function in cell E17 is expected as a positive value. Use cell references to the total cash flow from operations and the total capital expenditures from Steps 2 and 3 in your calculations. Do not use the function ABS You will calculate the total dividends by using the function SUM. In cell E21, by using the function SUM and cell references, calculate the total dividends 5 Note: The output of the function In cell E21 is expected as a negative value. In cell E22, by using cell references, calculate the fraction of the total cash flow from operations that was spent in dividends 6 Note: The output of the function In cell E22 is expected as a positive value. Use cell references to the total cash flow from operations and the total dividends from Steps 2 and 5 in our calculations. Do not use the function ABS You will calculate the total net income by using the function SUM. In cell E26, by using the function SUM and cell references to the annual net income values, calculate the total net income. In cell E27, by using cell references, calculate the total retained earnings 8 Note: Use cell references to the total dividends and the total net income from Steps 5 and 7 in your calculations Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed 9 Problem 2-20 See the table far below showing financial statement data and stock price data for Mydeco Cormp. a. From 2009 to 2013, what was the total cash flow from operations that Mydeco generated? b. Compare capital expenditures with cash flow from operations as a percentage. c. What fraction of the total in (a) was spent paying dividends to shareholders? d. What was Mydeco's total retained earnings for this period? a. From 2009 to 2013, what was the total cash flow from operations that Mydeco generated? Cash flow from operations (million) Compue opital ependineswit o from opentio aa parenage Capital expenditures (million) Capital expenditures/cash flow from operations c. What fraction of the total in (a) was spent paying dividends to shareholders? Dividends (million) Dividends/cash flow from operations d. What was Mydeco's total retained eamings for this period? Total net income (million) Total retained earnings (million) 2009-2013 Financial Statement Data and Stock Price Data for Mydeco Corp. (All data as of fiscal year end; S in millions) 2011 2012 2013 Income Statement 2009 2010 424.6 604.1 Revenue 404.3 363.8 510.7 293.4 206.2 Cost of goods sold Gross profit 188.3 246.8 190.0 216.0 263.9 310.7 218.4 120.8 Sales and marketing 82.8 Administration 66.4 60.6 78.5 Depreciation & amortization EBIT 57.0 Interest income (expense) Pretax income 27.7 Income tax Net income Shares outstanding (millions) $ 0.33 S0.05 0.11 S0.23 0.39 Earings per share Balance Sheet 2012 2013 2009 2010 2011 Assets Accounts receivable 69.8 69.8 Inventory 30.9 186.1 345.6 169.6 Total current assets 184.5 206.4 Net property, plant & equip 245.3 243.3 309.0 347.0 Goodwill & intangibles 361.7 361.7 361.7 361.7 361.7 778.1 915.1 Total 774.6 855.2 893.4 Liabilities & Stockholders' Equitv Accounts payable Accrued compensation Current liabilities 500 500 575 Long-term debt 600 600 Total liabilities 525.4 524.3 634.9 604 Stockholders' equitv 252.7 273.7 915.1 Total 778.1 774.6 855.2 893.4 2010 2011 Statement of Cash Flows 2009 2012 2013 Net income 18.0 3.0 6.3 12.7 21.7 Depreciation & amortization Change in accounts receivable Change in inventory Chg. in payables & accrued comp 27.3 27.0 34.3 38.4 38.6 3.9 18.8 9.2 2.9 2.8 2.5 3.6 2.2 4.7 5.9 6.5 Cash from operations 48.5 50.5 47.8 46.6 54.0 Capital expenditures Cash from investing activities 25.0 25.0 100.0 75.0 40.0 25.0 25.0 100.0 - 75.0 40.0 6.5 Dividends paid Sale (or purchase) of stock Debt issuance (pay down) 75.0 25.0 Cash from financing activities 69.6 19.6 18.1 20.1 17.4 8.8 7.5 Change in cash Mydeco stock price $ 7.92 $ 3.30 5.25 8.71 $10.89 Requirements 1. Start Excel - completed 2. You will calculate the total cash flow from operations by using the function SUM. In cell E12, by using the function SUM and cell references to the values of the cash flows from operations, calculate the total cash flow from operations (1 pt.) 3. function SUM and cell references to the values of capital expenditures, calculate the total capital Note: The output of the function in cell E16 is expected as a negative value 4. In cell E17, by using cell references, calculate the capital expenditures/cash flow from operations ratio Note: The output of the function in cell E17 is expected as a positive value. Use cell references to the total cash flow from operations and the total capital expenditures from Steps 2 and 3 in your calculations. Do not use the function ABS 5. You will calculate the total dividends by using the function SUM. In cell E21, by using the function SUM and cell references, calculate the total dividends (1 pt.) Note: The output of the function in cell E21 is expected as a negative value 6. In cell E22, by using cell references, calculate the fraction of the total cash flow from operations that was spent in dividends (1 pt.) 6. In cell E22, by using cell references, calculate the fraction of the total cash flow from operations that was spent in dividends (1 pt.). Note: The output of the function in cell E22 is expected as a positive value. Use cell references to the total cash flow from operations and the total dividends from Steps 2 and 5 in your calculations. Do not use the function ABS. 7. You will calculate the total net income by using the function SUM. In cell E26, by using the function SUM and cell references to the annual net income values, calculate the total net income (1 pt.). 8. In cell E27, by using cell references, calculate the total retained earnings (1 pt.) Note: Use cell references to the total dividends and the total net income from Steps 5 and 7 in your calculations 9. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed