Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NEED HELP ASSAP!!!! Partial Answers for Checking Work (15B-2) Refunding Analysis Mullet Technologies is considering whether or not to refund a $75 million, 12% coupon,

NEED HELP ASSAP!!!!

Partial Answers for Checking Work

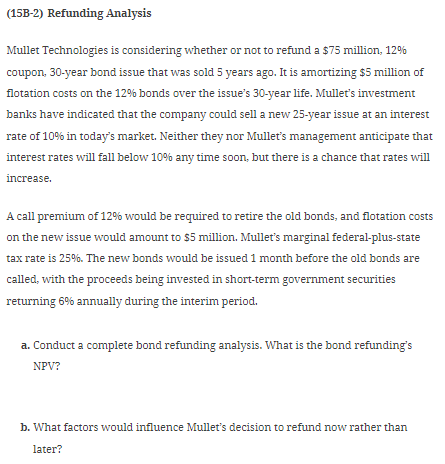

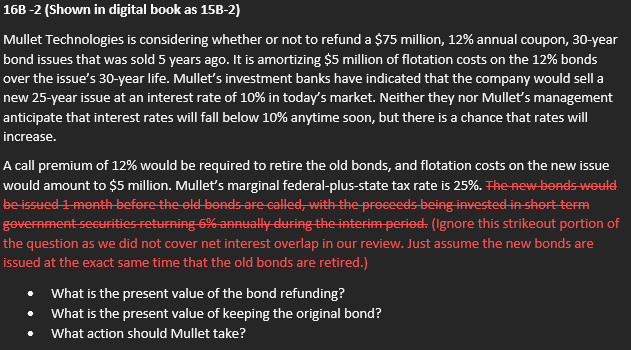

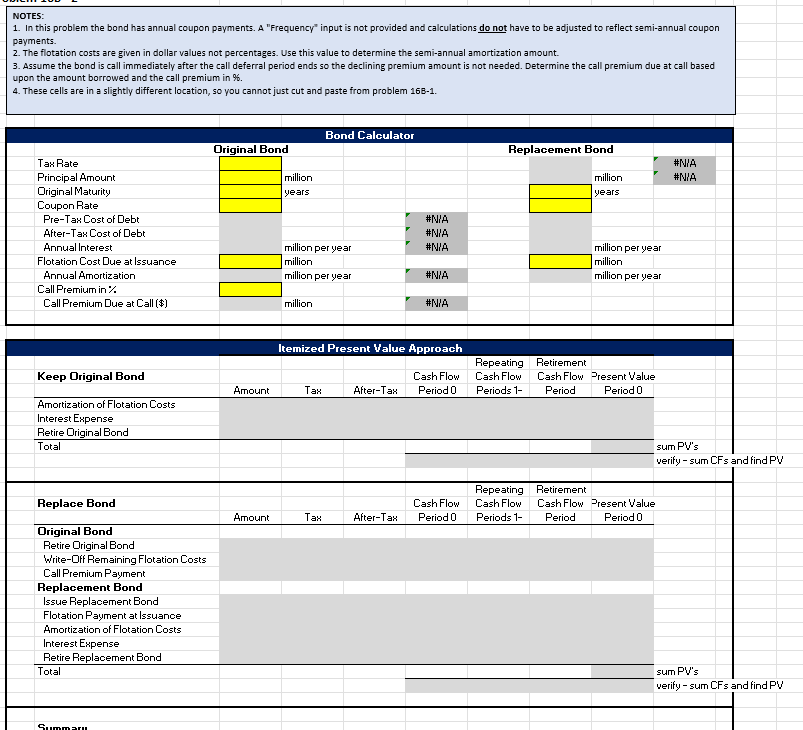

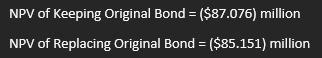

(15B-2) Refunding Analysis Mullet Technologies is considering whether or not to refund a $75 million, 12% coupon, 30-year bond issue that was sold 5 years ago. It is amortizing $5 million of flotation costs on the 12% bonds over the issue's 30 -year life. Mullet's investment banks have indicated that the company could sell a new 25-year issue at an interest rate of 10% in today's market. Neither they nor Mullet's management anticipate that interest rates will fall below 10% any time soon, but there is a chance that rates will increase. A call premium of 12% would be required to retire the old bonds, and flotation costs on the new issue would amount to $5 million. Mullet's marginal federal-plus-state tax rate is 25%. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being invested in short-term government securities returning 6% annually during the interim period. a. Conduct a complete bond refunding analysis. What is the bond refunding's NPV? b. What factors would influence Mullet's decision to refund now rather than later? Mullet Technologies is considering whether or not to refund a $75 million, 12% annual coupon, 30 -year bond issues that was sold 5 years ago. It is amortizing $5 million of flotation costs on the 12% bonds over the issue's 30-year life. Mullet's investment banks have indicated that the company would sell a new 25 -year issue at an interest rate of 10% in today's market. Neither they nor Mullet's management anticipate that interest rates will fall below 10% anytime soon, but there is a chance that rates will increase. A call premium of 12% would be required to retire the old bonds, and flotation costs on the new issue would amount to $5 million. Mullet's marginal federal-plus-state tax rate is 25%. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being inverted in short term government securities returning 6% annually during the interim period. (Ignore this strikeout portion of the question as we did not cover net interest overlap in our review. Just assume the new bonds are issued at the exact same time that the old bonds are retired.) - What is the present value of the bond refunding? - What is the present value of keeping the original bond? - What action should Mullet take? NOTES: payments. 2. The flotation costs are given in dollar values not percentages. Use this value to determine the semi-annual amortization amount. upon the amount borrowed and the call premium in %. 4. These cells are in a slightly different location, so you cannot just cut and paste from problem 16B1. Bond Calculator Summary NPV of Keeping Driginal Bond NP' of Replacing Bond Differenoe (Replace - Keep) NPV of Keeping Original Bond =($87.076) million NPV of Replacing Original Bond =($85.151) million

(15B-2) Refunding Analysis Mullet Technologies is considering whether or not to refund a $75 million, 12% coupon, 30-year bond issue that was sold 5 years ago. It is amortizing $5 million of flotation costs on the 12% bonds over the issue's 30 -year life. Mullet's investment banks have indicated that the company could sell a new 25-year issue at an interest rate of 10% in today's market. Neither they nor Mullet's management anticipate that interest rates will fall below 10% any time soon, but there is a chance that rates will increase. A call premium of 12% would be required to retire the old bonds, and flotation costs on the new issue would amount to $5 million. Mullet's marginal federal-plus-state tax rate is 25%. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being invested in short-term government securities returning 6% annually during the interim period. a. Conduct a complete bond refunding analysis. What is the bond refunding's NPV? b. What factors would influence Mullet's decision to refund now rather than later? Mullet Technologies is considering whether or not to refund a $75 million, 12% annual coupon, 30 -year bond issues that was sold 5 years ago. It is amortizing $5 million of flotation costs on the 12% bonds over the issue's 30-year life. Mullet's investment banks have indicated that the company would sell a new 25 -year issue at an interest rate of 10% in today's market. Neither they nor Mullet's management anticipate that interest rates will fall below 10% anytime soon, but there is a chance that rates will increase. A call premium of 12% would be required to retire the old bonds, and flotation costs on the new issue would amount to $5 million. Mullet's marginal federal-plus-state tax rate is 25%. The new bonds would be issued 1 month before the old bonds are called, with the proceeds being inverted in short term government securities returning 6% annually during the interim period. (Ignore this strikeout portion of the question as we did not cover net interest overlap in our review. Just assume the new bonds are issued at the exact same time that the old bonds are retired.) - What is the present value of the bond refunding? - What is the present value of keeping the original bond? - What action should Mullet take? NOTES: payments. 2. The flotation costs are given in dollar values not percentages. Use this value to determine the semi-annual amortization amount. upon the amount borrowed and the call premium in %. 4. These cells are in a slightly different location, so you cannot just cut and paste from problem 16B1. Bond Calculator Summary NPV of Keeping Driginal Bond NP' of Replacing Bond Differenoe (Replace - Keep) NPV of Keeping Original Bond =($87.076) million NPV of Replacing Original Bond =($85.151) million Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started