Answered step by step

Verified Expert Solution

Question

1 Approved Answer

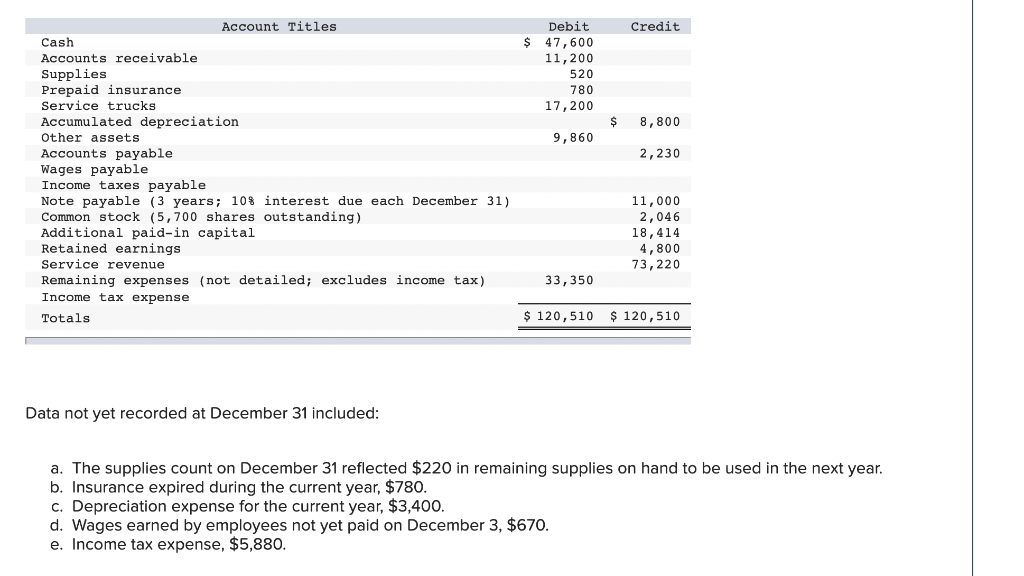

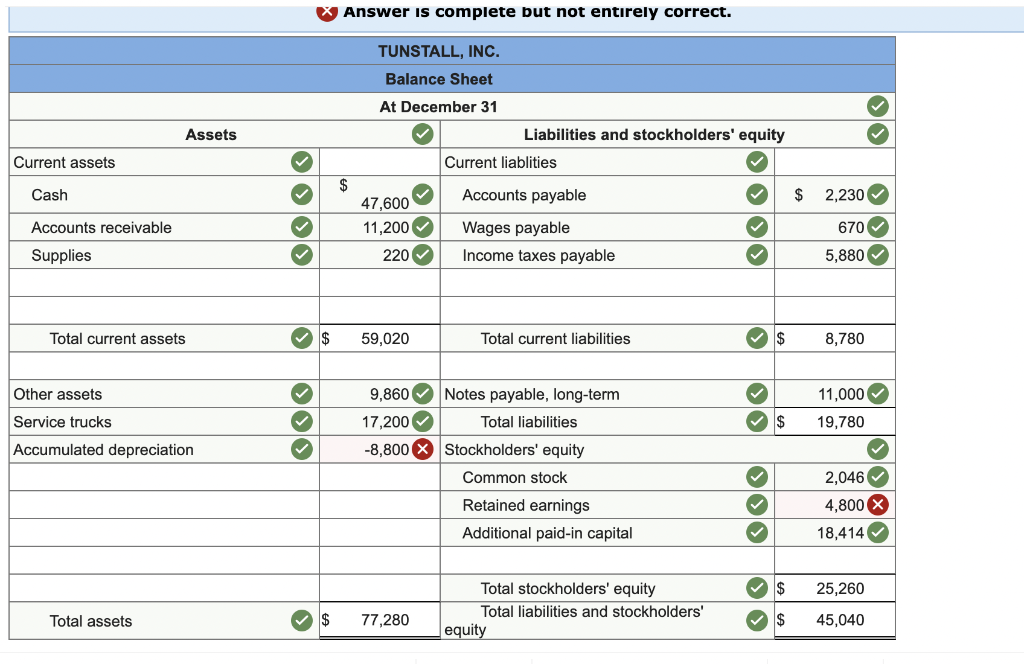

NEED HELP!!! Balance sheet- Retained earnings and Accumulated depreciation with steps! Thank you !!!!!! Credit $ Debit 47,600 11,200 520 780 17,200 $ 8,800 9,860

NEED HELP!!! Balance sheet- Retained earnings and Accumulated depreciation with steps! Thank you !!!!!!

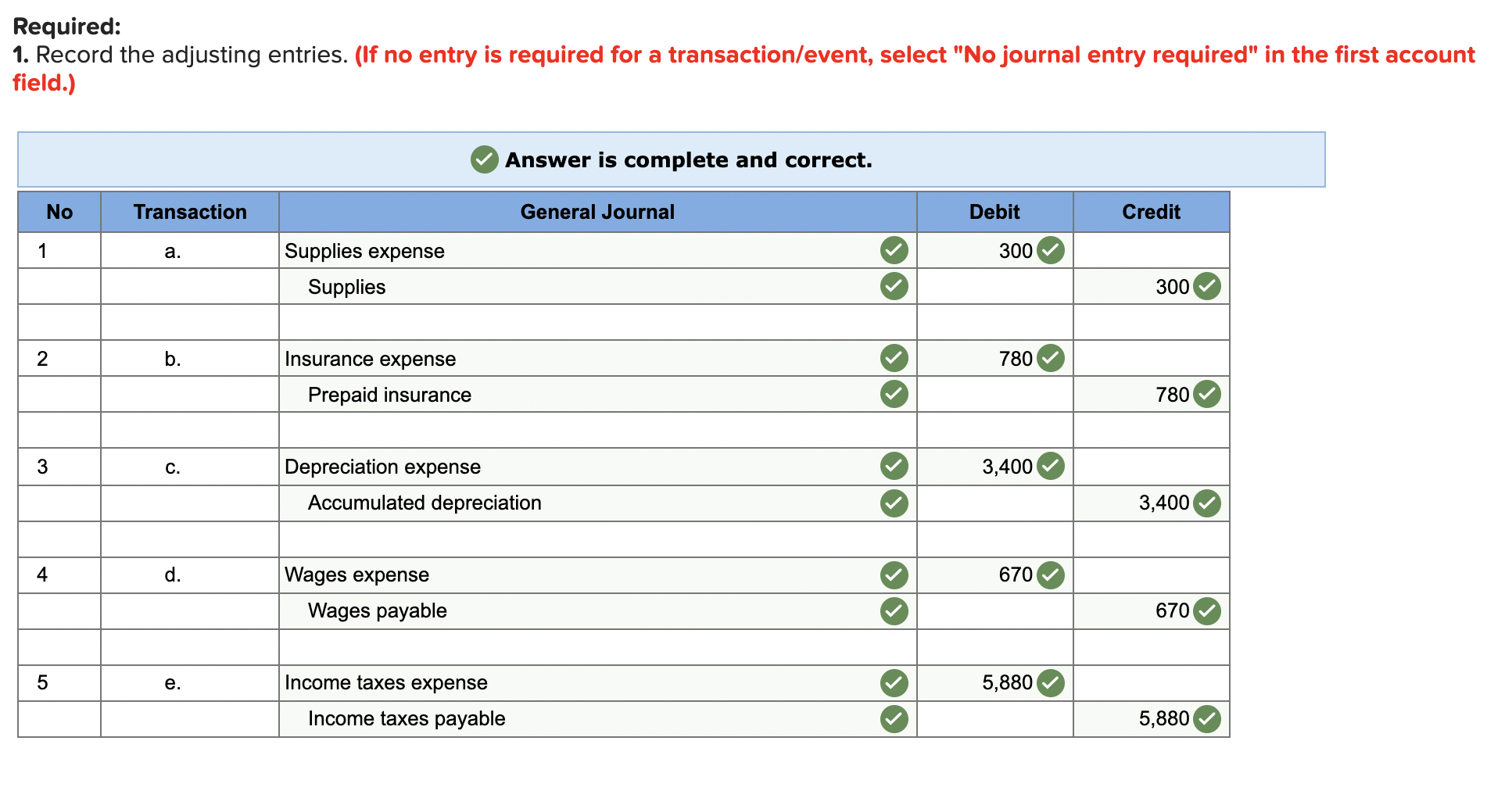

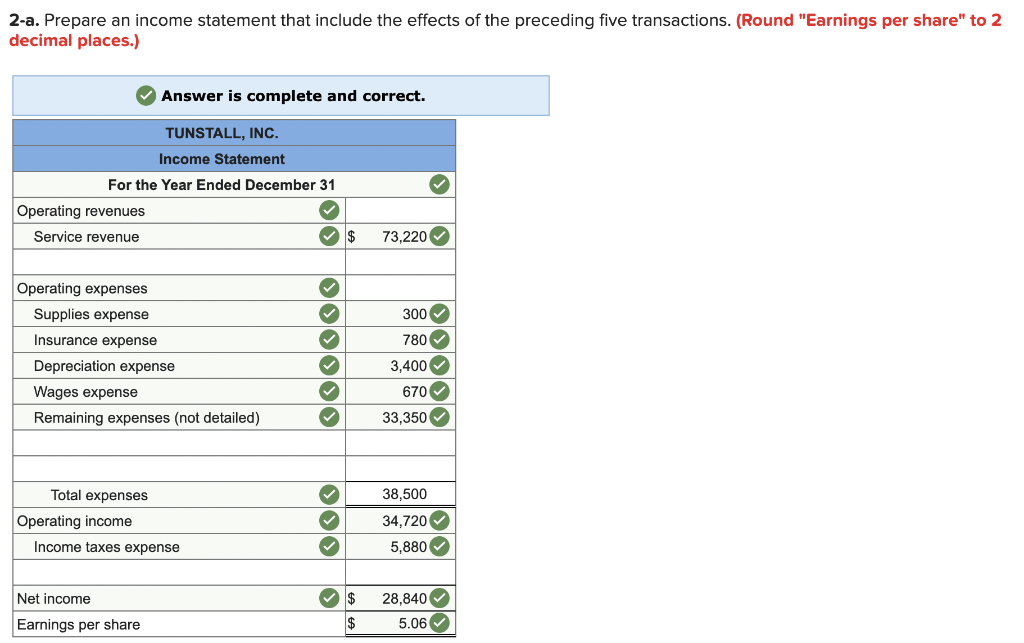

Credit $ Debit 47,600 11,200 520 780 17,200 $ 8,800 9,860 2,230 Account Titles Cash Accounts receivable Supplies Prepaid insurance Service trucks Accumulated depreciation Accounts pava payable Wages payable Income taxes payable Note payable 13 years; 108 interest due each December 31) Common stock (5,700 shares outstanding) Additional paid-in capital Retained earnings Service revenue Remaining expenses (not detailed; excludes income tax) Income tax expense Totals 11,000 2,046 18,414 4,800 73,220 33, 350 $ 120,510 $ 120,510 Data not yet recorded at December 31 included: a. The supplies count on December 31 reflected $220 in remaining supplies on hand to be used in the next year. b. Insurance expired during the current year, $780. c. Depreciation expense for the current year, $3,400. d. Wages earned by employees not yet paid on December 3, $670. e. Income tax expense, $5,880. Required: 1. Record the adjusting entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete and correct. No Transaction General Journal Debit Credit 1 a. 300 Supplies expense Supplies 300 2 . b. Insurance expense 780 Prepaid insurance 780 3 C. 3,400 Depreciation expense Accumulated depreciation 3,400 4 d. 670 Wages expense Wages payable 670 5 e. e. Income taxes expense 5,880 Income taxes payable 5,880 2-a. Prepare an income statement that include the effects of the preceding five transactions. (Round "Earnings per share" to 2 decimal places.) Answer is complete and correct. TUNSTALL, INC. Income Statement For the Year Ended December 31 Operating revenues Service revenue $ 73,220 300 780 Operating expenses Supplies expense Insurance expense Depreciation expense Wages expense Remaining expenses (not detailed) OOOOOO 3,400 670 33,350 38,500 Total expenses Operating income Income taxes expense OOO 34,720 5,880 Net income $ 28,840 5.06 Earnings per share $ Answer is complete but not entirely correct. TUNSTALL, INC. Balance Sheet At December 31 Liabilities and stockholders' equity Current liablities Assets Current assets $ Cash Accounts payable $ 2,230 Accounts receivable Supplies 670 47,600 11,200 220 Wages payable Income taxes payable 5,880 Total current assets $ 59,020 Total current liabilities $ 8,780 Other assets 11,000 19,780 Service trucks OOO $ Accumulated depreciation 9,860 Notes payable, long-term 17,200 Total liabilities -8,800 X Stockholders' equity Common stock Retained earnings Additional paid-in capital OOO OO 2,046 4,800 X 18,414 25,260 Total stockholders' equity Total liabilities and stockholders' Total assets $ 77,280 $ equity 45,040

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started