Need help calculating these! thank you!

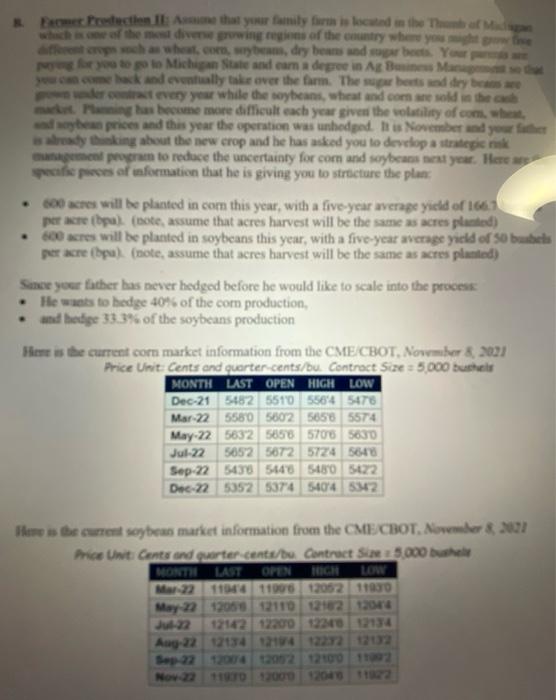

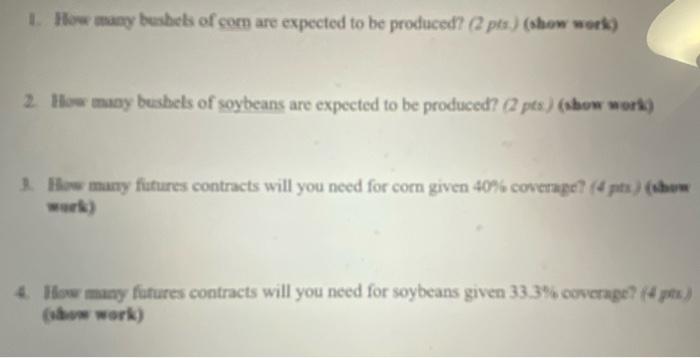

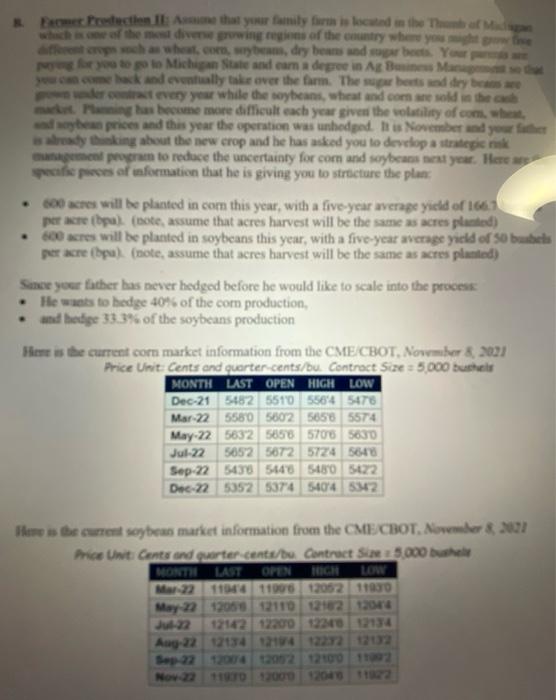

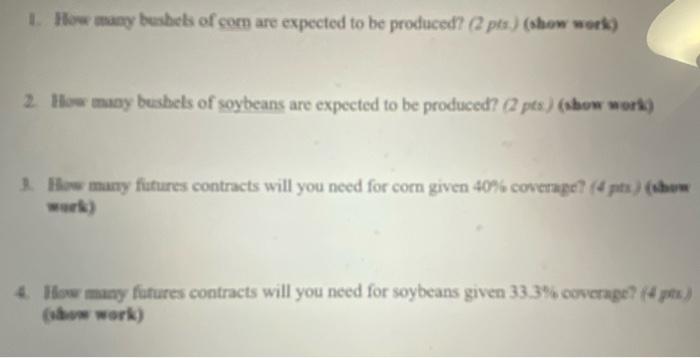

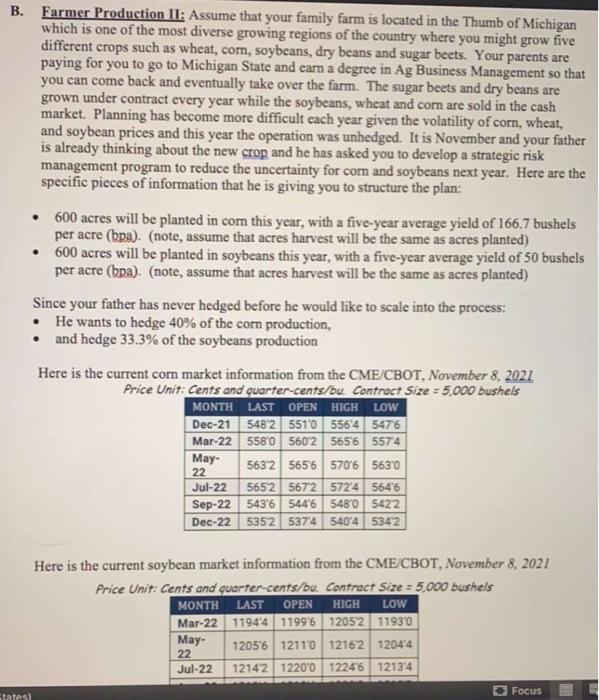

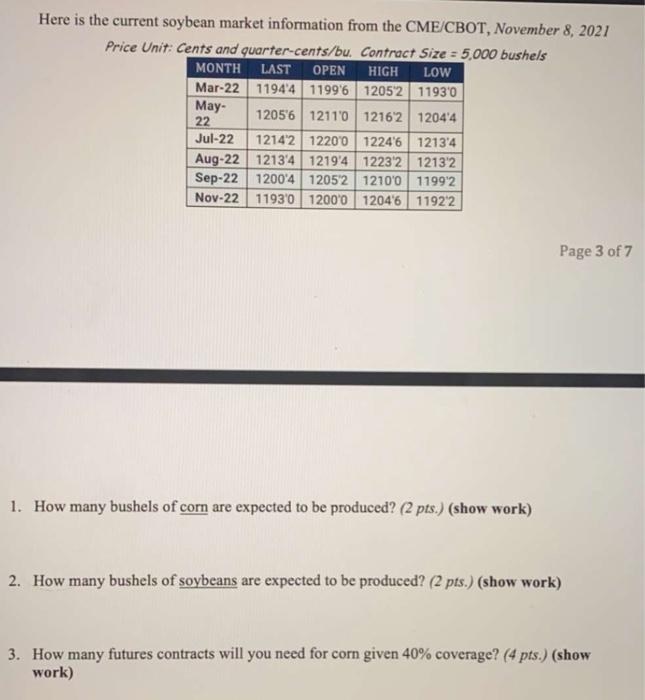

* Pecten that your family farm is located in the mes diverse growing regions of the car where you wheat.com, bam, dey beans and agree to Michigan State and earn a degree in AB hack and wally take over the farm. The sheets and dry be der every year while the soybeans, wheat and comes in the wg has become more difficult each year given the volatility of com. when dhe prices and this year the operation was unhedged his November and your face y thing about the new crop and he has asked you to develop a strategies mapem program to reduce the uncertainty for com and soybeans year. Here specific purce of information that he is giving you to structure the plan 600 acres will be planted in com this year, with a five year average yield of 1661 per acre bal bote, assume that acres harvest will be the same as acres planted) 600 acres will be planted in soybeans this year, with a five-year everage yield of 50 bubels per acreba (note, assume that acres harvest will be the same as acres planted) See your father has never hedged before he would like to scale into the process He wants to hedge 40% of the com production, and hedge 33.3% of the soybeans production Here is the current com market information from the CME CBOT. November 8, 2001 Price Unit: Cents and quarter cents/bu. Contract Size : 5.000 buche MONTH LAST OPEN HIGH LOW Dec-21 5452 5510 556'4 5478 Mar-2 5550 5602 5658 5574 May 22 5632 5856 5706 5630 Jul-22 5652 5672 5724 5648 Sep 2 5450 5446 5480 5422 Dec-22 5352 374 54074 5442 Here is the current soybeas market information from the CME CBOT. & 2001 ma Unt Center and curter cent/be Contract 5.000 MONTE OPEN Mar 22 110611906 12052 11990 May 22 1205012110 1218212044 LAST Aug 22 12134 2114 12292 120 Nov 1. How many bushels of com are expected to be produced? (2 pts) (show work) 2. How many bushels of soybeans are expected to be produced? (2 pts) (show work) 3. How many futures contracts will you need for corn given 40% coverage? (4 pts) (show ? 4. How many futures contracts will you need for soybeans given 33.3% coverage? (pts) show work) B. Farmer Production II: Assume that your family farm is located in the Thumb of Michigan which is one of the most diverse growing regions of the country where you might grow five different crops such as wheat, com, soybeans, dry beans and sugar beets. Your parents are paying for you to go to Michigan State and earn a degree in Ag Business Management so that you can come back and eventually take over the farm. The sugar beets and dry beans are grown under contract every year while the soybeans, wheat and corn are sold in the cash market. Planning has become more difficult each year given the volatility of corn, wheat, and soybean prices and this year the operation was unhedged. It is November and your father is already thinking about the new crop and he has asked you to develop a strategic risk management program to reduce the uncertainty for com and soybeans next year. Here are the specific pieces of information that he is giving you to structure the plan: 600 acres will be planted in com this year, with a five-year average yield of 166.7 bushels per acre (bpa). (note, assume that acres harvest will be the same as acres planted) 600 acres will be planted in soybeans this year, with a five-year average yield of 50 bushels per acre (bpa). (note, assume that acres harvest will be the same as acres planted) Since your father has never hedged before he would like to scale into the process: He wants to hedge 40% of the corn production, and hedge 33.3% of the soybeans production Here is the current cor market information from the CME/CBOT, November 8, 2021 Price Unit: Cents and quarter-cents/bu. Contract Size = 5,000 bushels MONTH LAST OPEN LOW 5482 5510 55645476 Mar-22 5580 5602 5656 5574 May- 5632 5656 570'6 5630 Jul-22 5652 56725724564'6 Sep-22 5436 5446 5480 5422 Dec-22 5352 5374 540'4 5342 HIGH Dec-21 22 Here is the current soybean market information from the CME/CBOT, November 8, 2021 Price Unit: Cents and quarter-cents/bu. Contract Size : 5.000 bushels HIGH LOW LAST OPEN 1194'4119961205211930 MONTH Mar-22 May 22 Jul-22 1205'6 1211012162 1204'4 1214212200 12246 12134 States Focus Here is the current soybean market information from the CME/CBOT, November 8, 2021 Price Unit: Cents and quarter-cents/bu. Contract Size = 5,000 bushels MONTH LAST OPEN HIGH LOW Mar-22 11944 11996 12052 11930 May- 120561211'0 121621204'4 22 Jul-22 12142122001224612134 Aug-22 12134 12194 12232 12132 Sep-22 1200'4120521210'011992 Nov-22 11930 12000 1204611922 Page 3 of 7 1. How many bushels of corn are expected to be produced? (2 pts.) (show work) 2. How many bushels of soybeans are expected to be produced? (2 pts.) (show work) 3. How many futures contracts will you need for corn given 40% coverage? (4 pts.) (show work) * Pecten that your family farm is located in the mes diverse growing regions of the car where you wheat.com, bam, dey beans and agree to Michigan State and earn a degree in AB hack and wally take over the farm. The sheets and dry be der every year while the soybeans, wheat and comes in the wg has become more difficult each year given the volatility of com. when dhe prices and this year the operation was unhedged his November and your face y thing about the new crop and he has asked you to develop a strategies mapem program to reduce the uncertainty for com and soybeans year. Here specific purce of information that he is giving you to structure the plan 600 acres will be planted in com this year, with a five year average yield of 1661 per acre bal bote, assume that acres harvest will be the same as acres planted) 600 acres will be planted in soybeans this year, with a five-year everage yield of 50 bubels per acreba (note, assume that acres harvest will be the same as acres planted) See your father has never hedged before he would like to scale into the process He wants to hedge 40% of the com production, and hedge 33.3% of the soybeans production Here is the current com market information from the CME CBOT. November 8, 2001 Price Unit: Cents and quarter cents/bu. Contract Size : 5.000 buche MONTH LAST OPEN HIGH LOW Dec-21 5452 5510 556'4 5478 Mar-2 5550 5602 5658 5574 May 22 5632 5856 5706 5630 Jul-22 5652 5672 5724 5648 Sep 2 5450 5446 5480 5422 Dec-22 5352 374 54074 5442 Here is the current soybeas market information from the CME CBOT. & 2001 ma Unt Center and curter cent/be Contract 5.000 MONTE OPEN Mar 22 110611906 12052 11990 May 22 1205012110 1218212044 LAST Aug 22 12134 2114 12292 120 Nov 1. How many bushels of com are expected to be produced? (2 pts) (show work) 2. How many bushels of soybeans are expected to be produced? (2 pts) (show work) 3. How many futures contracts will you need for corn given 40% coverage? (4 pts) (show ? 4. How many futures contracts will you need for soybeans given 33.3% coverage? (pts) show work) B. Farmer Production II: Assume that your family farm is located in the Thumb of Michigan which is one of the most diverse growing regions of the country where you might grow five different crops such as wheat, com, soybeans, dry beans and sugar beets. Your parents are paying for you to go to Michigan State and earn a degree in Ag Business Management so that you can come back and eventually take over the farm. The sugar beets and dry beans are grown under contract every year while the soybeans, wheat and corn are sold in the cash market. Planning has become more difficult each year given the volatility of corn, wheat, and soybean prices and this year the operation was unhedged. It is November and your father is already thinking about the new crop and he has asked you to develop a strategic risk management program to reduce the uncertainty for com and soybeans next year. Here are the specific pieces of information that he is giving you to structure the plan: 600 acres will be planted in com this year, with a five-year average yield of 166.7 bushels per acre (bpa). (note, assume that acres harvest will be the same as acres planted) 600 acres will be planted in soybeans this year, with a five-year average yield of 50 bushels per acre (bpa). (note, assume that acres harvest will be the same as acres planted) Since your father has never hedged before he would like to scale into the process: He wants to hedge 40% of the corn production, and hedge 33.3% of the soybeans production Here is the current cor market information from the CME/CBOT, November 8, 2021 Price Unit: Cents and quarter-cents/bu. Contract Size = 5,000 bushels MONTH LAST OPEN LOW 5482 5510 55645476 Mar-22 5580 5602 5656 5574 May- 5632 5656 570'6 5630 Jul-22 5652 56725724564'6 Sep-22 5436 5446 5480 5422 Dec-22 5352 5374 540'4 5342 HIGH Dec-21 22 Here is the current soybean market information from the CME/CBOT, November 8, 2021 Price Unit: Cents and quarter-cents/bu. Contract Size : 5.000 bushels HIGH LOW LAST OPEN 1194'4119961205211930 MONTH Mar-22 May 22 Jul-22 1205'6 1211012162 1204'4 1214212200 12246 12134 States Focus Here is the current soybean market information from the CME/CBOT, November 8, 2021 Price Unit: Cents and quarter-cents/bu. Contract Size = 5,000 bushels MONTH LAST OPEN HIGH LOW Mar-22 11944 11996 12052 11930 May- 120561211'0 121621204'4 22 Jul-22 12142122001224612134 Aug-22 12134 12194 12232 12132 Sep-22 1200'4120521210'011992 Nov-22 11930 12000 1204611922 Page 3 of 7 1. How many bushels of corn are expected to be produced? (2 pts.) (show work) 2. How many bushels of soybeans are expected to be produced? (2 pts.) (show work) 3. How many futures contracts will you need for corn given 40% coverage? (4 pts.) (show work)