Answered step by step

Verified Expert Solution

Question

1 Approved Answer

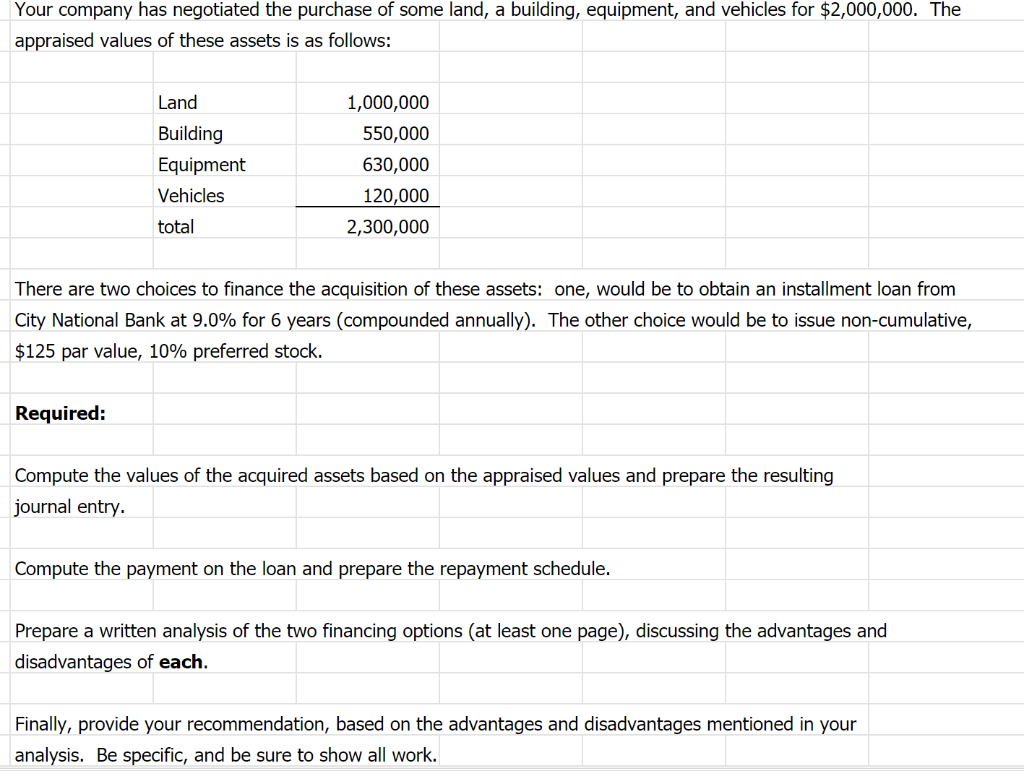

Need help checking journal entries. Hello, I am not sure if I did the journal entries correct for the second page because the $125 par

Need help checking journal entries. Hello, I am not sure if I did the journal entries correct for the second page because the $125 par value and the fact that the stock was 10% preferred seemed irrelevant in the end. Thanks!

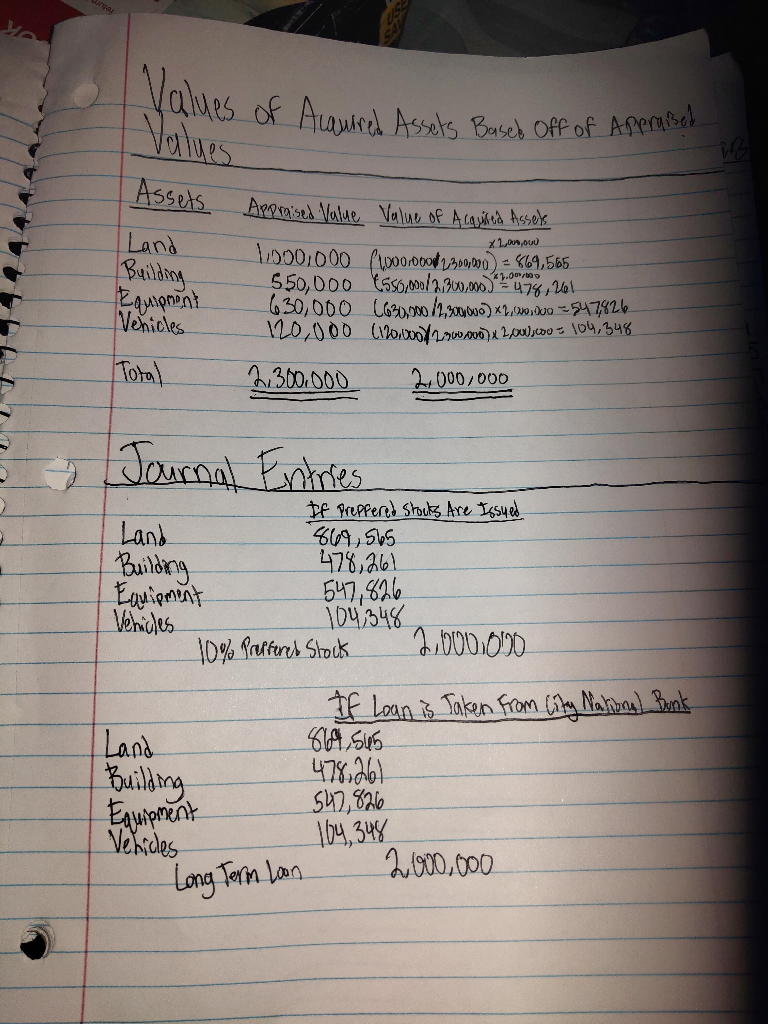

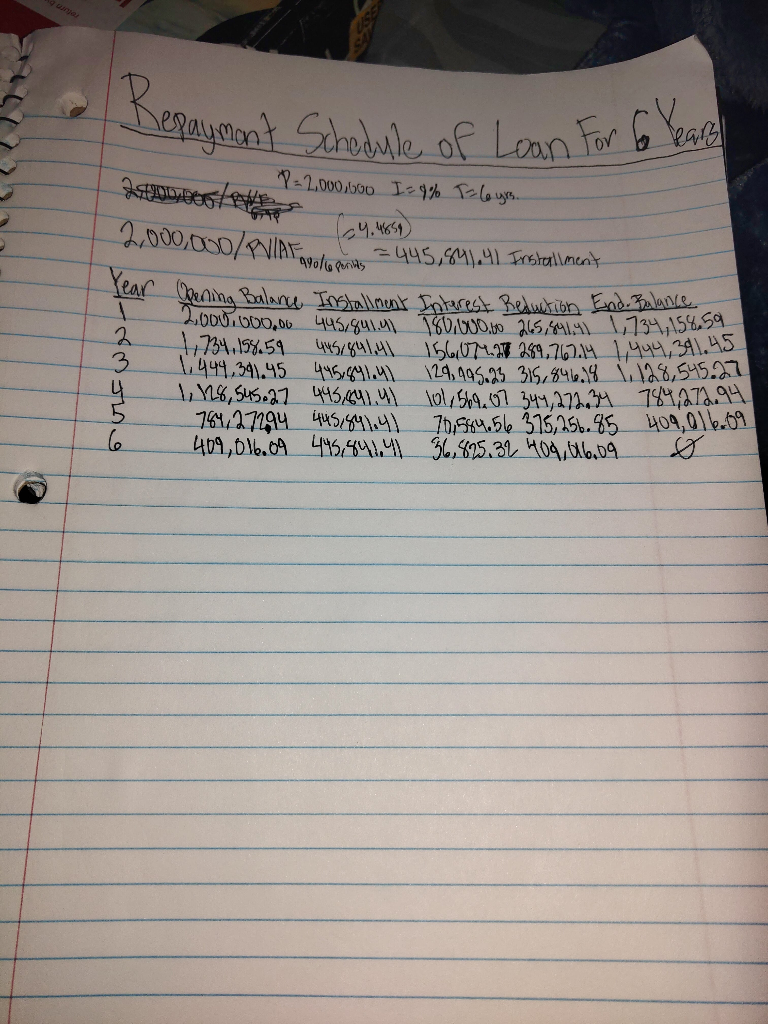

Your company has negotiated the purchase of some land, a building, equipment, and vehicles for $2,000,000. The appraised values of these assets is as follows: 1,000,000 550,000 630,000 120,000 2,300,000 Land Building Equipment Vehicles total There are two choices to finance the acquisition of these assets: one, would be to obtain an installment loan from City National Bank at 9.0% for 6 years (compounded annually). The other choice would be to issue non-cumulative, $125 par value, 10% preferred stock. Required: Compute the values of the acquired assets based on the appraised values and prepare the resulting journal entry. Compute the payment on the loan and prepare the repayment schedule. Prepare a written analysis of the two financing options (at least one page), discussing the advantages and disadvantages of each. Finally, provide your recommendation, based on the advantages and disadvantages mentioned in your analysis. Be specific, and be sure to show all work. F of Apem Assus Baild Venicles 300 0002000/000 05 Lan hundng 6,5 gan aken Lap pmnh de RS 2.90,000 Long Ain lan 1.465 34,15%51-445 1 49.29.95 1,1265 1507 4x5g4IMI \24,495.25 3/5,84118 Your company has negotiated the purchase of some land, a building, equipment, and vehicles for $2,000,000. The appraised values of these assets is as follows: 1,000,000 550,000 630,000 120,000 2,300,000 Land Building Equipment Vehicles total There are two choices to finance the acquisition of these assets: one, would be to obtain an installment loan from City National Bank at 9.0% for 6 years (compounded annually). The other choice would be to issue non-cumulative, $125 par value, 10% preferred stock. Required: Compute the values of the acquired assets based on the appraised values and prepare the resulting journal entry. Compute the payment on the loan and prepare the repayment schedule. Prepare a written analysis of the two financing options (at least one page), discussing the advantages and disadvantages of each. Finally, provide your recommendation, based on the advantages and disadvantages mentioned in your analysis. Be specific, and be sure to show all work. F of Apem Assus Baild Venicles 300 0002000/000 05 Lan hundng 6,5 gan aken Lap pmnh de RS 2.90,000 Long Ain lan 1.465 34,15%51-445 1 49.29.95 1,1265 1507 4x5g4IMI \24,495.25 3/5,84118Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started