Answered step by step

Verified Expert Solution

Question

1 Approved Answer

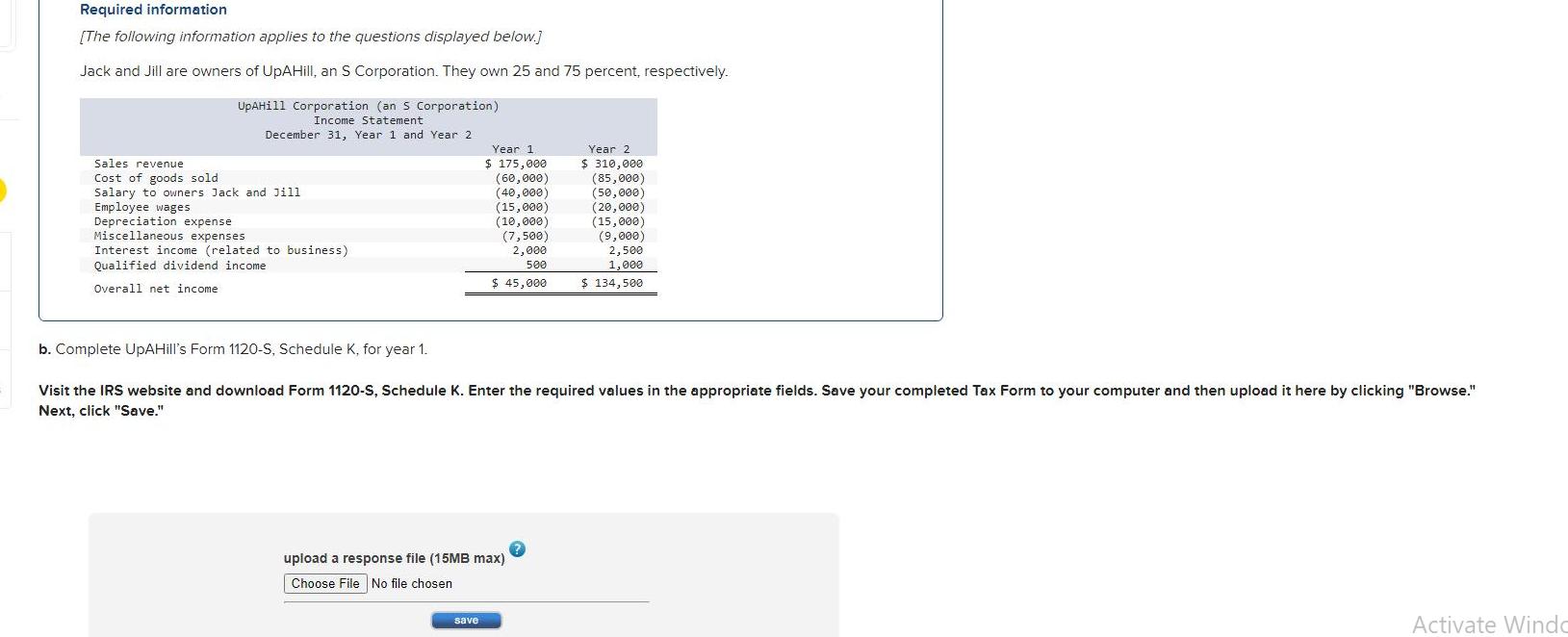

Need help completing form 1120- schedule k Required information [The following information applies to the questions displayed below.] Jack and Jill are owners of UpAHill,

- Need help completing form 1120- schedule k

Required information [The following information applies to the questions displayed below.] Jack and Jill are owners of UpAHill, an S Corporation. They own 25 and 75 percent, respectively. UpAHill Corporation (an S Corporation) Income Statement December 31, Year 1 and Year 20 Sales revenue Cost of goods sold Salary to owners Jack and Jill Employee wages Depreciation expense Miscellaneous expenses Interest income (related to business) Qualified dividend income Overall net income Year 1 $ 175,000 (60,000) (40,000) (15,000) (10,000) (7,500) 2,000 500 $ 45,000 upload a response file (15MB max) Choose File No file chosen save Year 2 $ 310,000 (85,000) (50,000) (20,000) b. Complete UpAHill's Form 1120-S, Schedule K, for year 1. Visit the IRS website and download Form 1120-S, Schedule K. Enter the required values in the appropriate fields. Save your completed Tax Form to your computer and then upload it here by clicking "Browse." Next, click "Save." (15,000) (9,000) 2,500 1,000 $ 134,500 Activate Windo

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Solution b 1 Ordinary ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started