Answered step by step

Verified Expert Solution

Question

1 Approved Answer

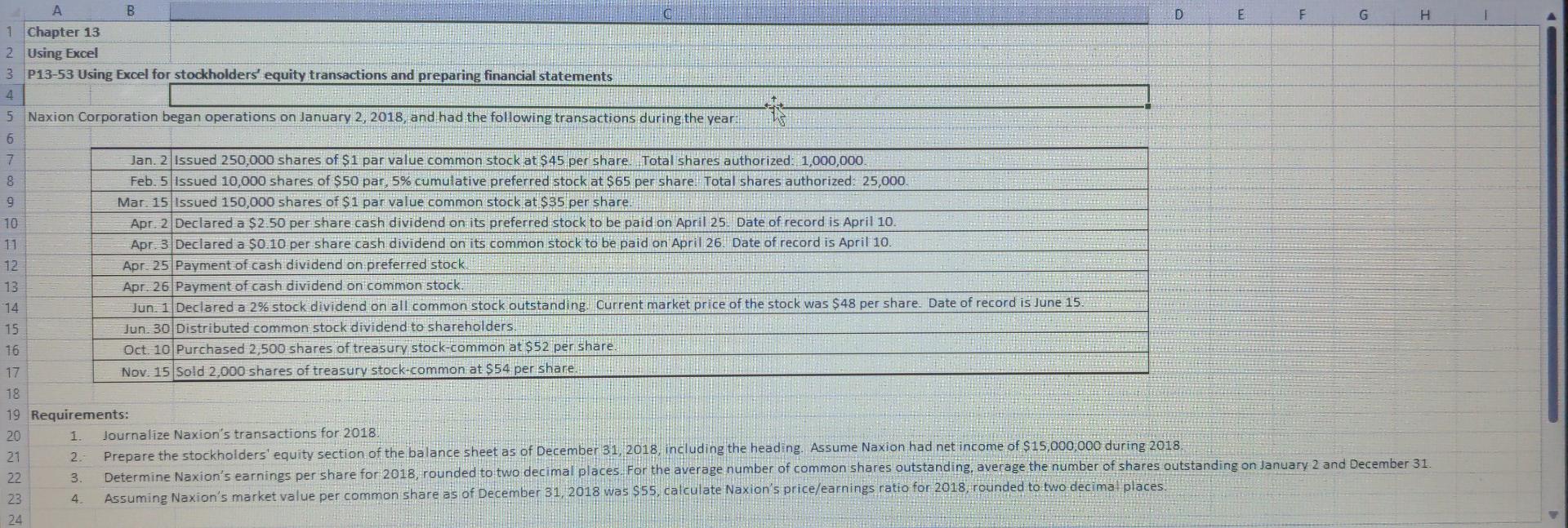

need help completing these Excel sheets blue cells need filled with relevant references E 1 A B D F G H 1 Chapter 13 2

need help completing these Excel sheets blue cells need filled with relevant references

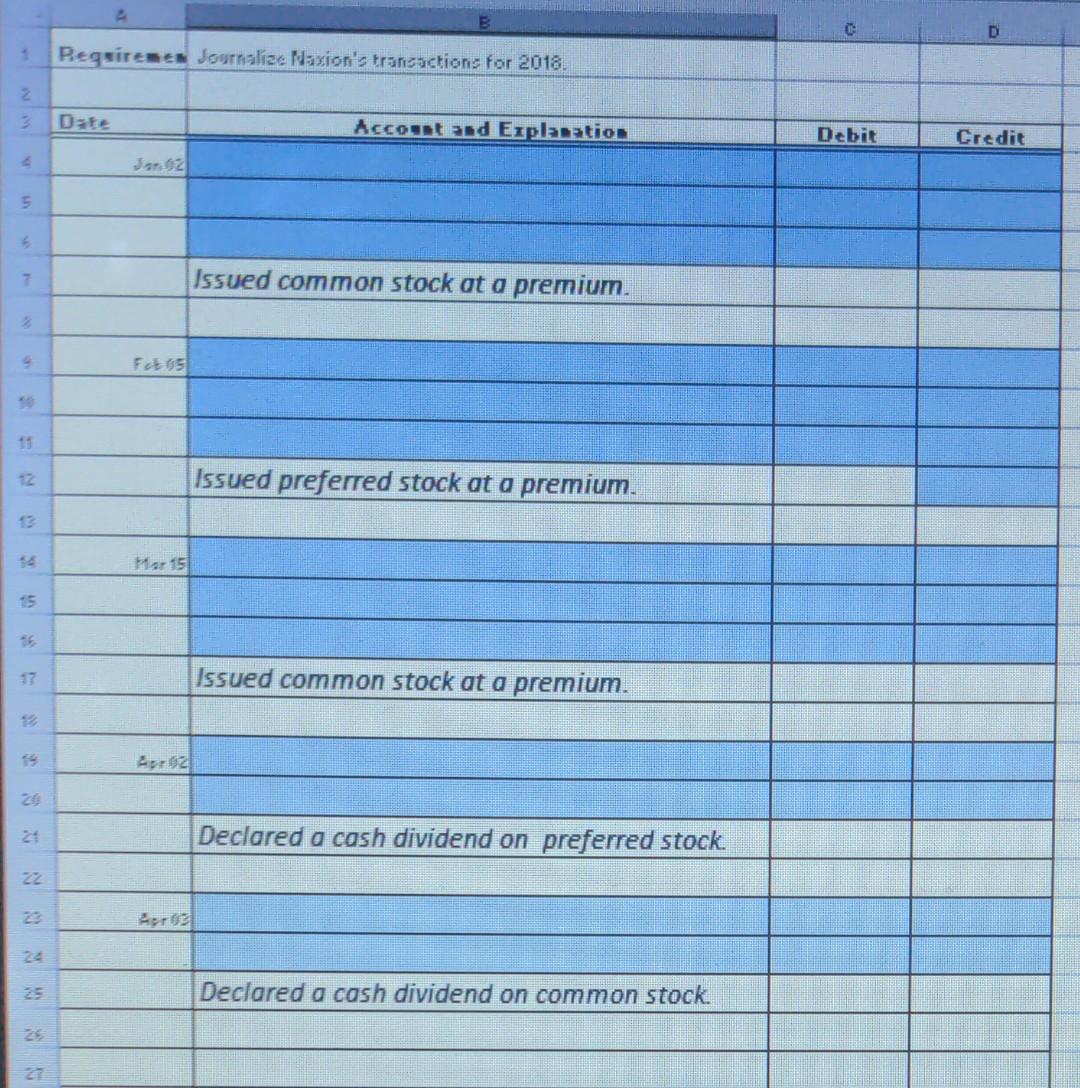

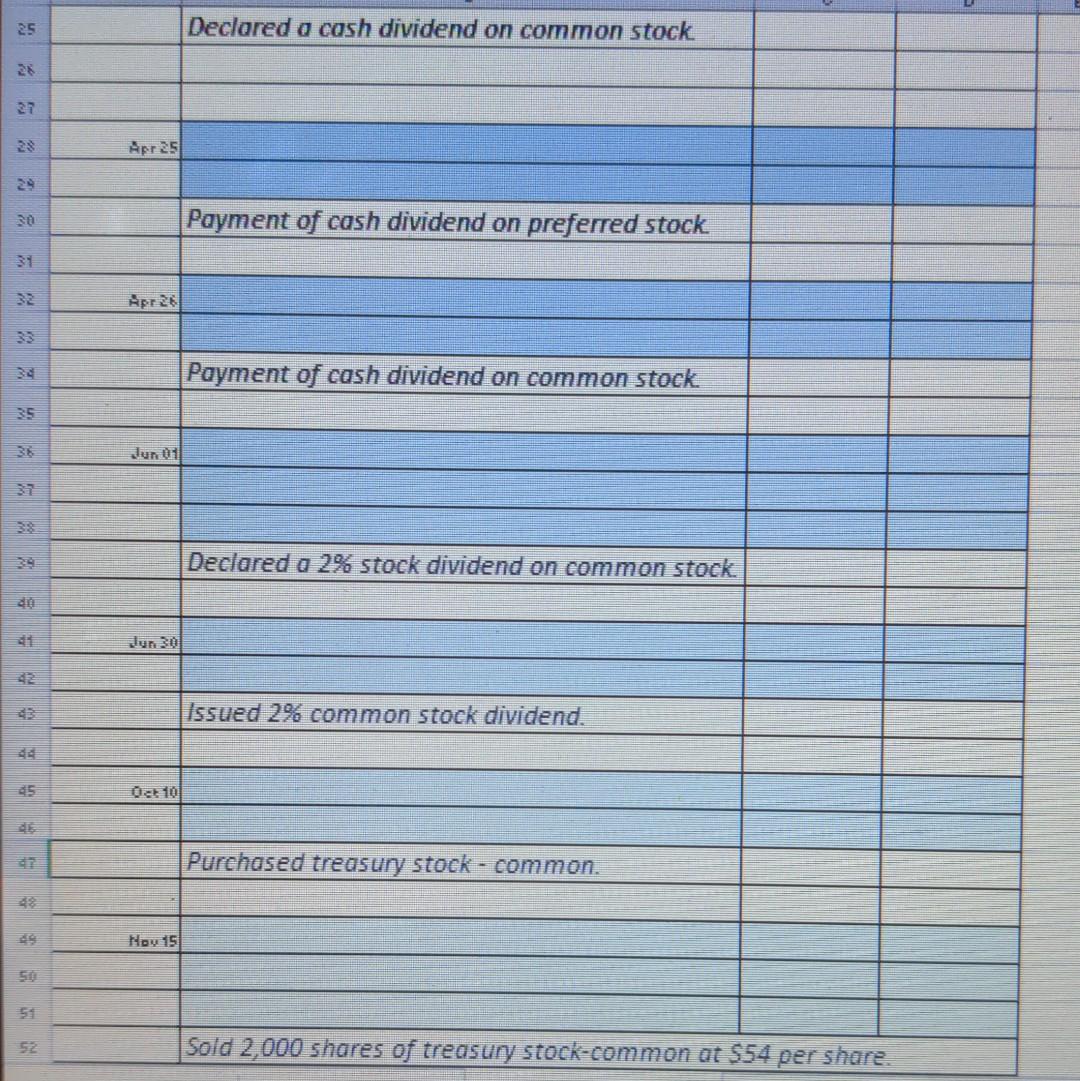

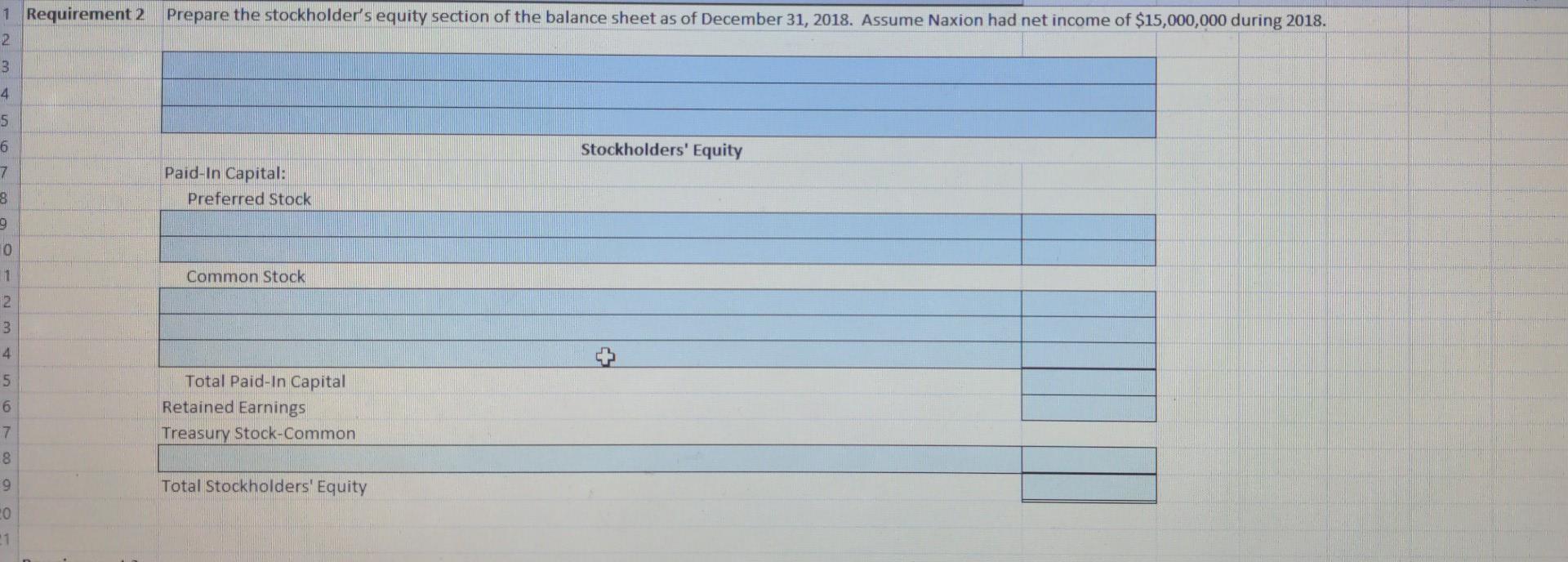

E 1 A B D F G H 1 Chapter 13 2 Using Excel 3 P13-53 Using Excel for stockholders' equity transactions and preparing financial statements 4 5 Naxion Corporation began operations on January 2, 2018, and had the following transactions during the year: 6 7 Jan. 2 Issued 250,000 shares of $1 par value common stock at $45 per share. Total shares authorized: 1,000,000 8 Feb. 5 Issued 10,000 shares of $50 par, 5% cumulative preferred stock at $65 per share. Total shares authorized: 25,000. 9 Mar. 15 Issued 150,000 shares of $1 par value common stock at $35 per share. 10 Apt. 2 Declared a $2.50 per share cash dividend on its preferred stock to be paid on April 25. Date of record is April 10. 11 Apr. 3 Declared a $0.10 per share cash dividend on its common stock to be paid on April 26. Date of record is April 10. 12 Apr. 25 Payment of cash dividend on preferred stock 13 Apr. 26 Payment of cash dividend on common stock. 14 Jun. 1 Declared a 2% stock dividend on all common stock outstanding. Current market price of the stock was $48 per share. Date of record is June 15. 15 Jun. 30 Distributed common stock dividend to shareholders. 16 Oct. 10 Purchased 2,500 shares of treasury stock-common at $52 per share. 17 Nov. 15 Sold 2,000 shares of treasury stock.common at $54 per share. 18 19 Requirements: 20 1. Journalize Naxion's transactions for 2018. 21 2. Prepare the stockholders' equity section of the balance sheet as of December 31, 2018, including the heading. Assume Naxion had net income of $15,000,000 during 2018, 22 3 Determine Naxion's earnings per share for 2018, rounded to two decimal places. For the average number of common shares outstanding, average the number of shares outstanding on January 2 and December 31 23 4 Assuming Naxion's market value per common share as of December 31, 2018 was $55, calculate Naxion's price/earnings ratio for 2018, rounded to two decimal places. 24 B c D 1 Pegsirenes Journalize Nasion's transactions for 2018. 2 3 Date Accout and Enplanation Debit Credit Jan 2 5 Issued common stock at a premium. Fotos 12 Issued preferred stock at a premium. Mar 15 17 Issued common stock at a premium. Apr2 26 21 Declared a cash dividend on preferred stock N NS 22 Azr02 NN Declared a cash dividend on common stock S 27 25 Declared a cash dividend on common stock Apr 25 29 30 Payment of cash dividend on preferred stock Payment of cash dividend on common stock Jun 01 Declared a 2% stock dividend on common stock Jun 30 Issued 2% common stock dividend. 3:49:9:6 $ Purchased treasury stock - common. Nov 15 52 Sold 2,000 shares of treasury stock-common at $54 per share Prepare the stockholder's equity section of the balance sheet as of December 31, 2018. Assume Naxion had net income of $15,000,000 during 2018. 1 Requirement 2 2 3 4 5 6 Stockholders' Equity 7 Paid-In Capital: Preferred Stock 8 9 10 1 2 3 4 Common Stock 5 6 Total Paid-In Capital Retained Earnings Treasury Stock-Common 7 8 9 Total Stockholders' Equity CO 1 21 Requirement 3 Determine Naxion's earnings per share for 2018, rounded to two decimal places. For the average number of common shares outstanding, average the number of shares outstanding on January 2 and December 31. 22 23 24 Formula Answer 25 26 27 Requirement 4 Assuming Naxion's market value per common share as of December 31, 2018 was $55, calculate Naxion's 28 price/earnings ratio for 2018, rounded to two decimal places. 29 30 Formula Answer 31 32Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

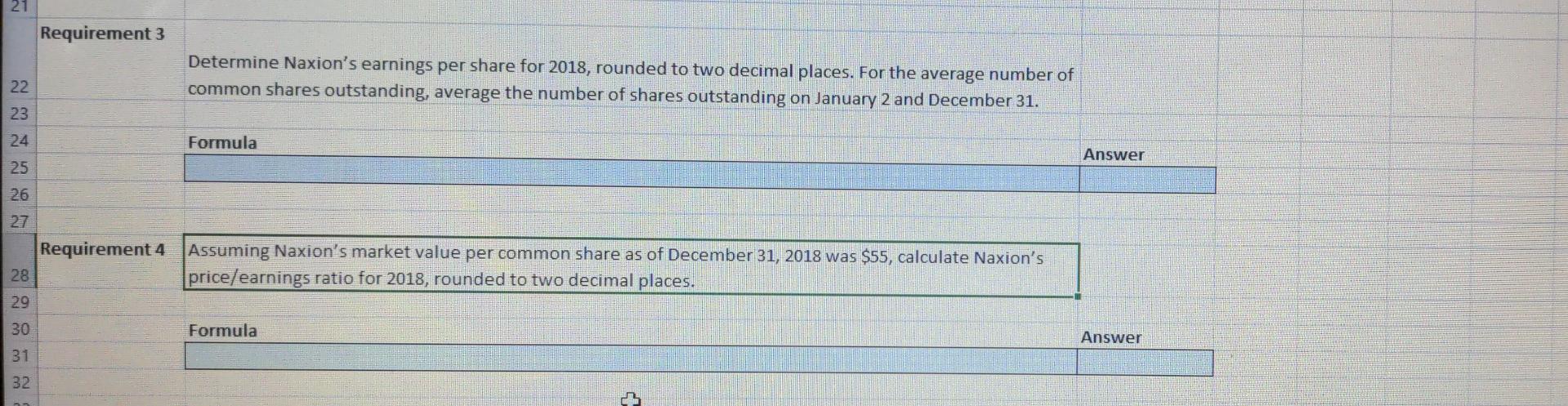

Get Started